How many stocks should you own in your investment portfolio? What is the right level of diversification? Whilst it would be nice to have one straight forward answer, the answer depends on your situation.

Firstly, if you’re like the majority of people and are risk averse then you will want to own a large number of stocks to spread your risk. But if you’re a risk-seeker and therefore have a preference for risk, then you will want fewer stocks.

The fewer stocks you own, the more likely you are to earn superior returns; but you have a far greater risk of losing a lot of money.

It’s generally considered that between 20-30 stocks is the optimal number to minimise what’s known as unsystematic risk, but starting with a bare minimum of 6 stocks that you intend to build up to around 20 would be OK. However, for the majority of individual investors we don’t think buying individual stocks is a good idea.

How many stocks should a Beginner/Novice/Lazy Investor buy?

Zero/None/Zilch! If you’re a beginner then you should probably avoid investing directly into stocks altogether. Instead beginners should invest in Funds and we would suggest low cost Exchange Traded Funds (ETFs).

By taking this approach you are likely to minimise risk and yet still have excellent market returns. A fund we like for this type of investor is the Vanguard Lifestrategy family of funds, which itself invests in Vanguard Funds and ETFs giving you diversification over thousands of stocks across the world at crazy low fees.

Moderately Active Investor?

This is where things get a little more interesting and we suggest you use a Core and Satellite strategy to investing. This is essentially where the bulk of your portfolio consists of passive ETFs – This is the Core.

Then you invest in a few individual stocks, which make up the Satellites. The aim of the satellites is to outperform the market.

We think that the core should make up about 75% of your overall portfolio and will simply track the market. The remaining 25% are your satellites and could be invested in between 5-10 stocks (you don’t need so many stocks in this portfolio because your ETFs provide adequate diversification). Your stocks could be either equally weighted or weighted in favour of your best stocks.

What are Money Unshackled doing?

Andy’s current stock market portfolio is about 40% in Funds and 60% in individual stocks, which is made up of about 16 different stocks – it’s a position that he’s slowly de-risking by moving more towards the model mentioned above by only mainly investing new money into Funds, and reducing the number of stocks over time.

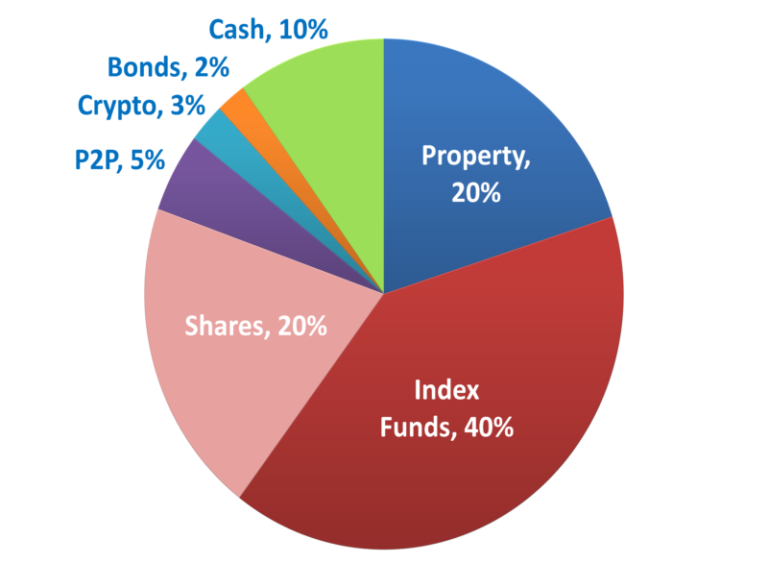

But the Stock Market is just part of a well rounded investment strategy. Below is an example of what we think is a good place to be with your portfolio as a whole – A good balance of Stocks, Funds, Property, and smaller amounts of liquid and speculative assets:

Less is More with stocks

The reason we suggest only 5-10 stocks (or 20-30 if you don’t use Funds) is because any more and you cannot manage them properly. Unless you’re a full-time investor, managing more is too time-consuming and you simply cannot analyse each investment in enough detail. We want our investments to be passive!

Too many stocks will create a closet tracker – By this we mean you essentially just track the market by holding far too many – What’s the point? You might as well just invest in an ETF, which is far easier to manage and cheaper to set-up.

How many stocks should an expert buy?

Let’s be honest, are you really an expert? A common reason for underperformance is overconfidence in your ability. For almost all investors it would be wiser to take on one of the previously mentioned approaches.

There are a lot of self-proclaimed investment experts on YouTube and we seem to be amongst the few who promote passive index investing instead. They sell a get rich quick dream, whilst we sell an achievable path of wealth creation.

An “expert” might want to invest in 20 stocks and no ETFs. They may still want to invest in actively managed funds to access certain markets where even they know nothing about, like emerging nations.

Their favourite stocks will likely be small-cap stocks, which are considered more risky but give a greater chance of superior returns.

How to invest if you’re Rich or Poor?

This all depends on your attitude to risk and capacity for loss. If you’re wealthy, you probably have a higher capacity for loss BUT you still want to preserve your wealth – There is no need to take on excessive risk.

In this case you might want to minimise risk by investing in a large number of stocks – more exciting than Index Funds! But not too many, or you track the market. Then move on to Funds.

If you’re poor, you probably have a low capacity for loss and therefore cannot take on much risk. In this case a well-diversified Exchange Traded Funds approach would be best.

Rich or poor, novice or old-hand, with ETFs you can’t go wrong.