Hey guys! Today we’ll be looking at the many different ways to invest in gold, as well as the reasons why you should.

We’ll look at the parallels that gold has with cryptocurrencies, and we’ll explain the great advantages of holding gold physically, as well as the dangers that holders of gold need to be aware of.

We’ll ask whether gold should really be thought of an investment, or should it be considered as an insurance product against disaster.

And finally, we’ll look at the expected returns of gold. Let’s check it out!

The world’s largest online investment gold service, BullionVault, have a special offer for gold lovers. Everyone who opens a BullionVault account with this offer link will receive 4 grams of silver for FREE, and will find their online account preloaded with a small amount of cash to let you try buying and selling for free.

Alternatively Watch The YouTube Video > > >

How Do You Invest In Gold?

There are lots of ways to own gold that on the face of it seem to be different ways of essentially doing the same thing.

- You can own gold bullion physically and take delivery of it at home.

- You can store physical gold in a managed vault, like the BullionVault service above.

- You can buy a gold ETC.

- You can own gold derivatives, which have the added benefit of being able to apply leverage.

- Or another way that some people choose to loosely track the gold price is to own shares of gold mining companies.

Gold enthusiasts or gold bugs as they’re often known will say that there is only one way to own gold, and that is to take physical delivery. They would say that if you don’t hold the gold, you don’t own the gold.

People who physically hold their own gold are using gold for its primary function, as a store of wealth that can’t be magicked out of existence by the banking system or stolen by a computer hacker or corrupt government. No other method of owning gold provides this protection.

But physical holdings of gold are not as popular as synthetic holdings, also known as gold derivatives, or paper gold, whose values fluctuate in price in line with the real price of gold. There is vastly more synthetic gold on the market than the actual amount of real gold in the world: 50 times as much, by some estimates.

Paper gold has its uses in the global economy, helping the flow of transactions between investment banks and letting them bet on future gold prices. But does it provide you with the full benefits of owning physical gold?

Holding Gold Physically

Imagine the world’s digital economy imploded, and there was a run on gold with people wanting to take physical delivery of their assets.

At least 49 out of 50 people presumably wouldn’t get any, as they only held paper gold. People who can actually touch their gold bullion have a significant advantage in this scenario.

However, there is a security risk in holding gold physically. You either need an expensive safe – or a combination of a garden, a spade, and a treasure map.

There is every chance that your gold might be stolen and insuring it may be difficult. But this may be a risk worth taking if your gold only constitutes part of your total net worth.

The solution in the interim may be to buy physical gold but have a specialist company hold it for you in a vault, with the option to take physical delivery of it in the future if you so wished.

Using BullionVault as an example, you can do exactly this, building your gold reserves up regularly, just like you would any other investment. You can even set up a direct debit monthly to make the process automatic.

You can even hedge your bets further by storing your precious metals in a vault in renowned jurisdictions such as Switzerland or Singapore, so the British government wouldn’t be able to confiscate it in times of crisis.

This isn’t such a crazy idea. It’s happened before in the US in 1933, when a law came in banning private citizens from holding gold, which stayed in effect right up until 1974.

Coins vs Bars

Gold coins can also come with an added antique value, due to the engravings on them. Historic gold Sovereigns have been known to command premiums of 35 per cent over and above their contemporary gold value.

This is of little benefit to you if you are both buying and selling at inflated prices, but it should be factored into the price you should trade at. Gold bars meanwhile hold little historic or traditional value and are traded exclusively for their gold content.

Certain gold coins also have the tax advantage of being exempt from Capital Gains Tax. This is only if they are considered legal tender in the UK and includes gold Sovereigns and gold Britannias amongst others. But all gold coins have a big disadvantage versus gold bullion bars, and this is a much higher bid/offer spread.

The bid/offer spread is the difference between the buy price and the sell price – it’s effectively a cost of trading. Because coins are smaller and less commonly traded in bulk than bars, their spreads can run above 10%. That’s an instant 10% loss on the day that you buy. Whereas the spreads on gold bars can be around 0.2%. Gold bars are therefore likely to be the better investment of the two.

Gold Exchange-Traded Commodities (ETCs)

ETCs are like ETFs, but for commodities. They are traded on a stock exchange and can be bought on the majority of stock market investment platforms. They come in 2 types: synthetic and physical.

Synthetic gold ETCs use futures or options contracts to replicate the gold price. While we don’t use synthetic gold ETCs, we do use gold futures elsewhere in our spread betting strategy – more details here.

But when it comes to ETCs, we prefer the physical type. Physical gold ETCs have some similarities with the service offered by companies like BullionVault, whereby your investment is in physical gold, stored in a vault, with every penny of your investment matched to a real piece of metal.

You get the same advantages from market movements in the gold price, but the great disadvantage of an ETC versus a gold storage service is not having the option to take physical delivery of the gold. As such, you might not be protected if the digital economy gets hacked or if there’s a financial or political crisis.

With a service like BullionVault you own the gold, but with an ETC, you own the fund, which owns the gold. Small difference, but it could have a large impact during Armageddon!

If you are looking at gold ETCs, you’ll note they are all in different currencies. A top tip is to get one priced in GBP, as it will avoid any FX fees charged by your investment platform.

Why Gold Is A Good Inflation Hedge

Gold provides such good protection against inflation over the long term primarily because nobody’s making any more of it.

While the Bank of England and the US Fed run the printing presses on full to pump cash into their flagging economies, nobody is producing any more precious metals. They have to be mined, at great expense, and there is a limited supply of the stuff on planet Earth.

Gold preserves its purchasing power for long periods of time. When measured against gold, the prices of commodities such as oil are relatively stable over history; but it’s not the case for fiat currencies like the US dollar, with the dollar inflating by over 5,000% against gold in the last 70 years.

But gold didn’t get more expensive: rather, the value of paper money has depreciated significantly over time. The major economies of the world are still locked in a downward spiral of currency devaluations in their efforts to stimulate growth. Meanwhile, gold stands as stable as it has for thousands of years.

Gold As An Insurance Product

Owning gold is like holding an insurance product. If the stock market goes belly-up, or if there’s a banking crisis, or a political crisis, you may be glad you own gold. Historically, gold is an excellent hedge against a falling stock market.

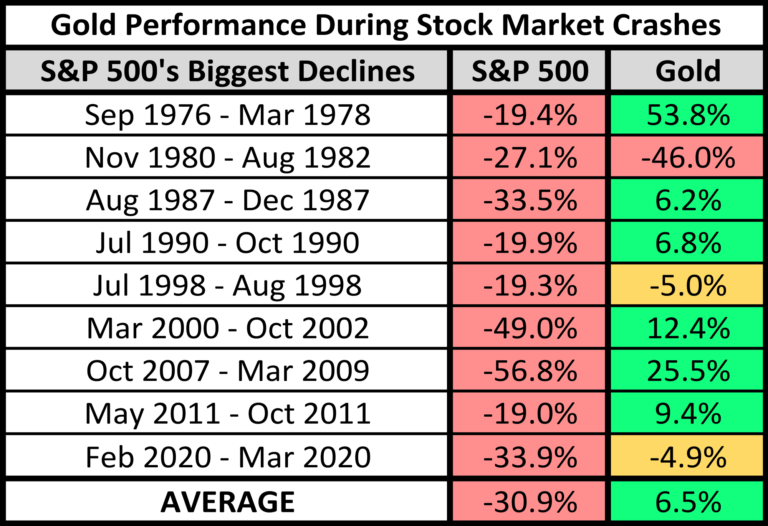

This chart shows how gold has moved during the last 9 stock market crashes. The majority of the time, and overall, gold went up, shown in green. Twice it fell by less than stocks did: also a good result. Gold’s only significant selloff – 46% in the early 1980’s – occurred just after its biggest bull market in modern history.

Gold is therefore a little different to other investments, and common cries of “well it’s not a productive asset” are perhaps misguided.

You don’t hold gold for its dividends – it has none. You hold gold because when the chickens come home to roost in the economy or the stock market, you can hope for a big pay-out from gold. You also hold gold because it’s a great store of wealth.

Why Gold Has Always Been The Best Store Of Wealth

Gold is amongst the oldest of investment assets, in the sense that it was once literally money. Gold has some very special qualities that have kept it in demand for thousands of years as a store of wealth.

First up, it doesn’t decay. Unlike corn, furs, or bits of paper, gold will last forever. Secondly, it is easily divisible into standard units, or grams.

Thirdly, gold is portable. One small coin may have been worth several cows back in the day, but it’s easier to carry a coin around with you than a herd of cattle.

And finally, gold has a limited supply, and is why things like pebbles and rocks could never become a mainstream currency. It is this limited supply that sets gold apart from government cash, which is theoretically infinite.

Crypto As Digital Gold

Crypto also shares some characteristics in common with physical gold. Though there’s nothing stopping new cryptos from popping up all the time – and they do – most individual cryptos like Bitcoin have a finite supply, meaning only so much can ever be in existence. Like gold bullion, central banks can’t print more of it.

As such, crypto has come to be seen as an alternative hedge against inflation, sharing the role traditionally dominated by the precious metals.

And also like gold, you can spend your crypto anywhere in the world. There are no borders when it comes to gold, and now crypto has come along to claim the same role of international currency.

As investments, cryptocurrencies have been hoovering up money from the economy over the last couple of years that may otherwise have flooded into gold during these times of inflation and quantitative easing.

But given the volatility of cryptos like Bitcoin, the next big crash in the crypto markets may remind investors that if they’re looking for a STABLE long-term inflation hedge, gold has always been the answer in the past.

Gold Returns

Gold has an average 5.8% per annum return going back 70 years, but there have been periods during that time where gold has exploded. Over the last 20 years, the average annual return has been 10.0%, in part due to large scale money-printing around the world.

The price of gold lagged throughout 2021, despite inflationary worries, we think due to the crypto craze.

We would have expected with all the talk of inflation right now to have seen a gold price BOOM during the pandemic if it had followed the usual pattern of its history. The next major gold boom may happen if crypto starts to lose some of its shine.

Will you be expanding your portfolio to include gold? Join the conversation in the comments below, and remember to grab your free silver from BullionVault and try their service for free.

Written by Ben

Featured image credit: Momentum Ronnarong/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: