Dave Ramsey is an American radio show host, author and businessman. If you’ve ever been on YouTube before and looked up anything remotely related to money, no doubt you have come across him. He has 1.4 million subscribers and is seen as a personal financial expert.

His advice is generally good and certainly entertaining. For those that have never seen it, it is essentially a radio show where financially inept people call up and get shouted at for running up huge amounts of unnecessary debt and in return he quickly tells them what they need to do to solve their money problems.

As one of the main guys in the personal finance space, Dave Ramsey has a lot of support but he also gets his fair share of criticism as does anyone who achieves success.

For anyone outside of the US, a major problem with YouTube and the Internet for that that matter is that much of the information that we are fed is based on a different market that is often unsuitable.

Here in the UK if you do a Google search or regularly watch your favourite money YouTube channels the information that is regularly served is US specific and so is either irrelevant for the UK market or worse extremely dangerous should you follow it.

This is really concerning, which is one of the reasons why we started our own YouTube channel.

In this article, we’re going to talk about some of the key areas where Dave Ramsey is wrong from a UK perspective. Let’s check it out…

Editors note: Don’t forget to check the Offers Page and grab free shares worth up to £200 plus £50/£75 cash backs when you open new investment accounts through the affiliate links there!

YouTube Video > > >

Cut Up Your Credit Cards?

Dave Ramsey pretty much hates all forms of debt but utterly detests Credit Cards. He promotes the use of cash and claims that the use of credit cards, even when paying off and avoiding interest, encourages consumers to spend more.

The problem we have with this is that it assumes you are useless with money, which is probably a fair assessment for many people and those people should follow his advice.

The argument goes that credit cards create frictionless spending, so it’s far too easy to spend more.

But as you are probably actively seeking content on the subject of money then we will assume that you are better than the average person when it comes to managing money. Personally, we try to spend everything on Credit cards for a variety of reasons.

One of those reasons came to save me recently when Thomas Cook spectacularly collapsed leaving 1000’s of customers out of pocket. I could have been one of those customers, but thankfully I paid by credit card as we have always encouraged you to do.

We have no idea if the US has a similar credit card scheme but here in the UK, we have what’s known as section 75 protection, meaning that I was refunded by my credit card issuer.

Anybody who paid by cash or debit card would have lost everything.

Credit Cards can also come with many other benefits such as fee free spending abroad and lengthy interest free periods. Bear in mind that not all credit cards are created equal, so absolutely do ensure that your card is not a card from hell.

Pay Down your Student Loans?

No, No, No. His baby step 2 of paying down all debt including student loans does not apply to UK student debt.

In fact, in most cases it would categorically be bad advice. UK graduates should not follow his advice here!

This is because UK student debt is structured in a way that it’s not really debt – more like a graduate tax.

After all what other debt gets wiped after 20 odd years even if you haven’t paid a penny? We have a dedicated video on whether to pay off your student loans early, check that out on the YouTube channel.

In the US however, our understanding is that student debts attract punitive interest rates like any other debt and should therefore be repaid. Whereas in the UK the interest rate on student loans is largely irrelevant as it’s your earnings that dictate what you pay back.

If you choose to overpay then you are probably throwing thousands of pounds down the drain, which could have gone towards your house, your business, your retirement or whatever you value most. Please, please, please research this before making overpayments.

Pay Down your House Mortgage?

Another one of Dave’s baby steps is to pay off your home early. In our opinion we don’t think this should be a priority of yours depending on your age.

Certainly, the younger you are the lower down the pecking order this should be for a number of reasons.

A strong positive cash flow can give you the breathing room to grow your earnings further by starting a business or even a side hustle.

However, should you instead decide to plough all available money into overpaying your mortgage then you are in danger of a significant emergency derailing your plans.

We don’t think your life goals should be to plod along and live a mediocre life. When you’re sitting on a large cash pile you have the freedom to chase dreams and make a difference and ultimately live a more fulfilling life.

Of course, this depends on your age and attitude to risk. As you get older paying down the house is probably a good shout.

But if you are young don’t settle for mediocre. And right now, interest rates are really, really low.

In his book, Total Money Makeover, Dave argues that the tax deductible does not compensate you for the large interest payment to the bank. In the UK we don’t even get this tax-deductible expense, so it would be even worse for us here in the UK.

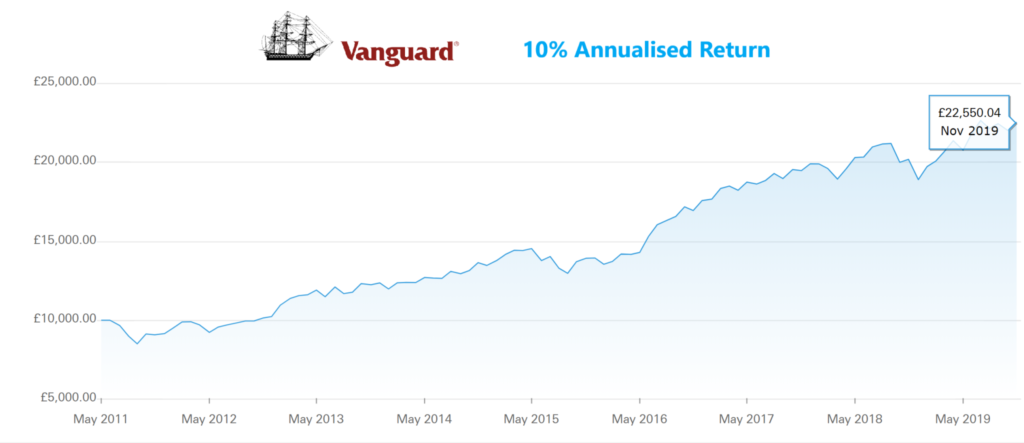

But critically, Dave does not seem to consider the opportunity cost of paying down your house.

On a £200k mortgage, instead of paying that down that money could instead be invested to easily generate additional income in excess of £10,000 per year – just by investing in a simple stock market fund. That’s £10,000 profit after tax!

Just imagine how that could compound over a few years and what difference that would make to your life.

Invest using Actively Managed Mutual Funds?

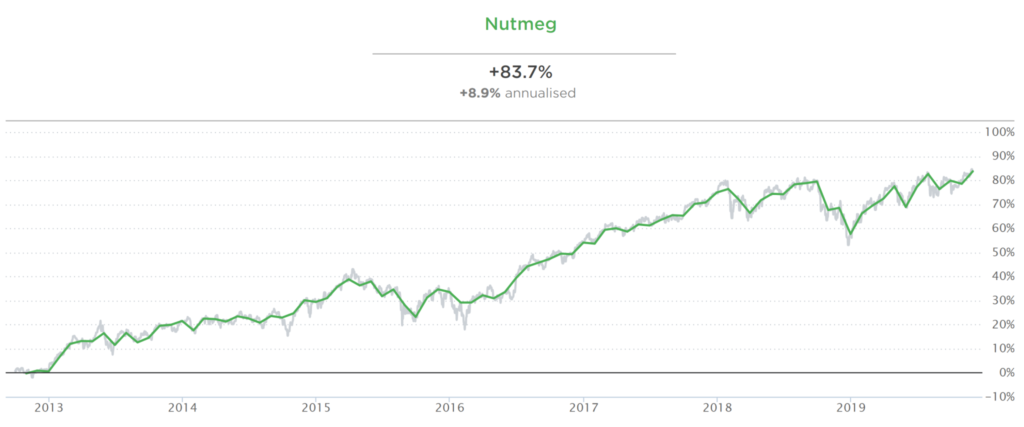

Once you’ve made the decision to begin investing you need to decide on how exactly you will invest. Dave recommends that you simply pick 4 actively managed mutual funds and you will receive 12% returns per year.

He even suggests that you pick these mutual funds based on their past record over at least a few years – if only it was that simple!

The problem with using past performance as a means to pick investments is the false assumption that yesterday’s winners will continue to be tomorrow’s winners. If it was that simple, we’d all be multi-millionaires.

It’s also highly unlikely that a portfolio consisting of mutual funds will give you an annual compounded growth rate of 12%. It’s definitely not the average despite what he says.

It’s not impossible but would be a stretch even if you chose particularly high risks funds.

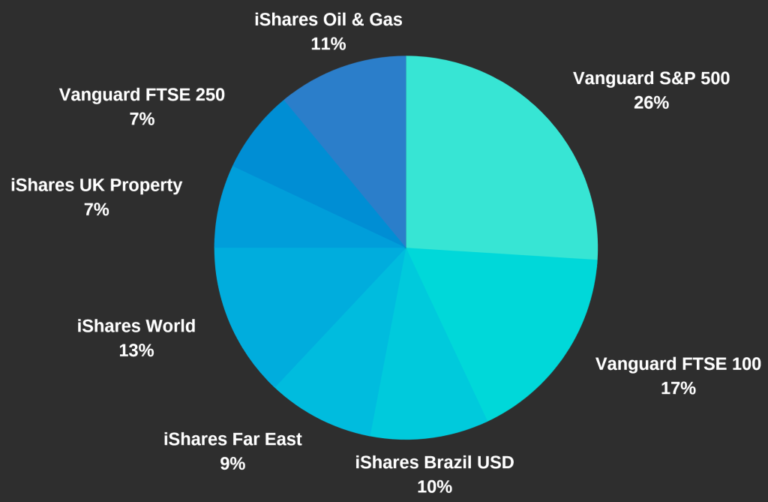

Our final objection is with using mutual funds as the basis of your portfolio. It is well known that actively managed funds tend to underperform due to excessive fees and portfolio churn.

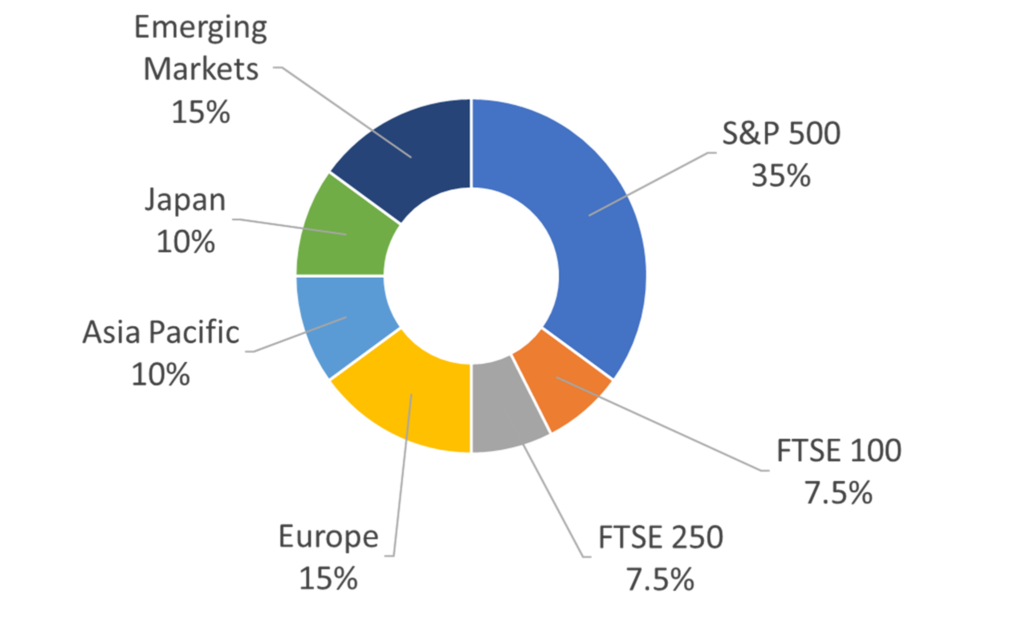

We believe the core of your portfolio should be built around low cost index trackers like ETFs. For us this would ideally track the world market and would not be overly exposed to your home country’s stock market.

Saving For Retirement

Dave suggests saving 15% of your gross household income into retirement accounts. For American’s this will be into 401(k)s and Roth IRAs. It’s safe to assume the UK equivalent of the 401k would be your company pension scheme.

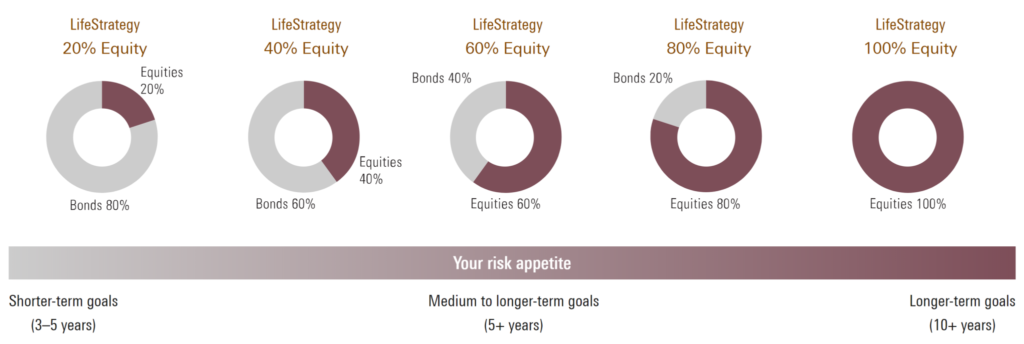

We’re not going to be overly critical of retirement saving as it’s always a good idea to have a plan B but should it be your main goal?

In the UK we have the amazing ISA or Individual Savings Account, which gives us tax-free investments that can be accessed at any age. This gives us another weapon in our arsenal that our friends across the pond don’t have.

Going into a full retirement strategy goes beyond the scope of this article but we thought we should point out that advice meant for the US market may not be suitable for investors elsewhere.

Another fantastic feature of the ISA is that any income you take from it does not form part of your taxable earnings. It’s taxable on the way in but not on the way out.

We have both always paid into company pensions to whatever the maximum our company would match, but any excess would go towards other ways to save and grow wealth including ISA’s and property.

Don’t blindly follow the advice from the US financial gurus.

What do you think of Dave Ramsey and other financial gurus? Let us know in the comments section.