We all need to look out for a number of threats or evils when it comes to investing. If you don’t, whatever small amount of money you have will be stolen, pilfered, and swiped, and slowly moved from your pocket to someone else’s.

In this post, we’re going to look at the enemies of investing, what you need to look out for, and some of the things you can do so you’re less likely to be a victim of these wrongs. Let’s check it out…

Fees

Fees are a constant drag on your investment performance, and if not given the attention they deserve, they will chip away at your little pot until there’s barely anything left, whilst at the same time making the finance industry rich as the money is siphoned from your pocket into theirs.

The good news is that fees across the industry have been coming down and this trend looks set to continue. With that said, here are some of the nasty charges that you can minimise with a little research and forward planning.

Platform Charge

Most investment platforms will charge you a fee just to hold your investments. Some charge a percentage based on your investment pot and others charge a fixed fee. Whichever you opt for we suggest you never pay more than an effective 0.25%.

Today, there is no need to pay any more than this – thankfully a surge of new investment apps such as Trading 212, Freetrade and Stake have entered the fight by introducing zero platform fees.

Trading Fees & FX Fees

Trading fees are some of the worst charges because they often prevent you from building and rebalancing your desired portfolio, and therefore impacting on your investing behaviour in your effort to avoid them. FX fees are similar and will usually slice away at your money whenever you trade and receive dividends.

While the more comprehensive platforms are allowing these fees to run rampant – often charging 1.5% FX fees and around £10 per trade – the new commission-free trading apps have eliminated them or significantly reduced them.

There’s a hell of lot more fees that investors should be aware of but that is a full article in itself and we have a lot of other stuff to cover in this post.

Other major fees you want to watch like a hawk are transfer-out fees, the Bid/Offer spread when trading, a fund’s OCF, a fund’s internal transaction fees and advice fees.

If you need help in picking the best investment platform that’s right for you, we’ve gone ahead and done all the hard work for you. See the Best Investment Platforms page for the top picks.

Taxes

To put it nicely, taxes are a thorn in any investors side. If we described them accurately, no doubt we would be banned from Google for obscene profanity.

On the plus side, in the UK we have some quite generous accounts that allow us to avoid the worst of it on smaller investment pots – such as ISAs and SIPPs – but there are still some god-awful taxes that are effectively stealing what is rightfully yours.

First let us clarify our stance on taxes. We are pro taxes when they are levied as a reasonable percentage on real profits. What we despise are taxes that are incurred on transactions, cash flows, and real losses. For example, stamp duty on UK stocks is 0.5%. Why? The investor has not made any profit and yet the government feels it is okay to take a slice.

The irony is that UK investors can invest in many foreign stocks with zero upfront tax, incentivising UK investors to forgo UK stocks and trade international stocks instead.

Income tax on dividends is another tax that really grinds our gears. When a dividend is paid, the value of a company falls by the value of the dividend paid. Therefore, no wealth has been created for the investor; but the tax man wants a piece. This also encourages some companies to seek other ways to increase shareholder wealth, so affects behaviour.

This leads us to the sickening dividend withholding tax imposed by many foreign countries. For example, France will deduct 30% from any dividend paid by French stocks to UK investors. Remember, a dividend is not real profit.

As an investor you have limited means to reduce taxes but there are still some weapons in your arsenal. Use ISAs and SIPPs where you can. You may want to avoid certain countries entirely if they have punishing withholding taxes and/or transaction taxes.

Synthetic ETFs are a potential way of reducing withholding tax but not all synthetic ETFs successfully achieve this from our research. If you’re interested in learning more about synthetic ETFs, then search our YouTube channel page as we have a few videos on the subject.

Moreover, spread betting is another way to avoid tax but probably not something you want to do until you’ve maxed out your ISA. Don’t forget the goal should never be to solely minimise tax if it lowers overall return. The most important thing is to maximise profits after the deduction of tax.

What worries us is that nobody ever talks about the impact that these taxes have on long-term returns. It is widely recognised that stocks have returned 8% per year over many decades, but we’ve never seen any study or heard anyone talk about the returns that an investor can expect after the deduction of fees and taxes.

Say an investor invested a lump sum of 10 grand over 30 years believing he was earning 8% annually. The final pot would be a not too shabby £100.6k. But in reality, the fees and taxes could take that 8% down to 5% maybe. At that rate of return the final pot would just be £43.2k – almost 60% smaller than what it should have been.

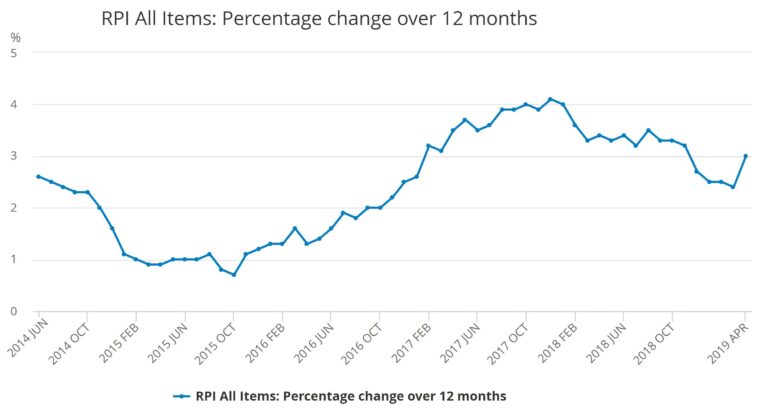

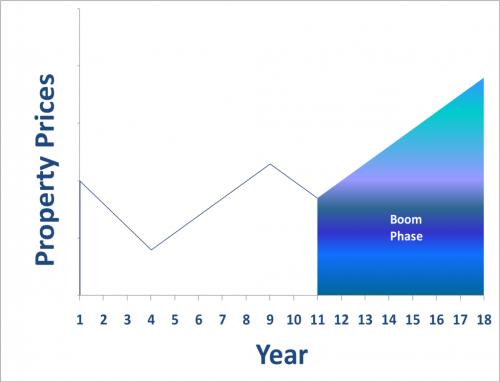

Inflation

Most people would never have thought that inflation is a tax, but it really is. Tax is usually collected but in the case of inflation it is an invisible hidden levy on your wealth. The reason that inflation can be labelled as a hidden tax is because the government indirectly controls it.

They can increase the money supply seemingly at will, as demonstrated by the money printing to fight Covid, and before that the credit crunch. They can raise and lower interest rates, and they can stimulate or slow down the economy through government expenditure, known as fiscal policy.

Raising inflation brings money into the government purse because it reduces the value of government debt. It works like this: they raise inflation; the assets of investors get hammered; and government debt goes down. It is a transfer of wealth from us to the Treasury – a hidden tax – to help pay for the national debt.

To carry on the example from earlier: if we assume inflation on average is 3%, that will take our investor’s real return from 5% down to 2%. That £10k investment would now only grow to £18k over the same time frame. It now doesn’t seem like such a great return, especially considering the time it took and the amount of risk that the investor had to take.

Our tip to all investors and savers is to start considering your returns after the effect of inflation. This is known as the real return. Too many people only ever look at nominal returns.

This means if you’re one of the majority of people in the UK who only saves money in a bank account, then you need to start investing. According to finder.com, only about 3% of people in the UK were subscribed to a stocks & shares ISA account in 2019. That is a shockingly low figure.

We conclude from that, that the majority of people in the UK are getting rinsed by inflation. Further, that 3% of people using S&S ISAs will include people who are investing in investment products that are producing dismal returns, like bonds. Vanguard’s Global Bond Index Fund has returned on average just 3.5% annually for the last 10 years – barely beating inflation.

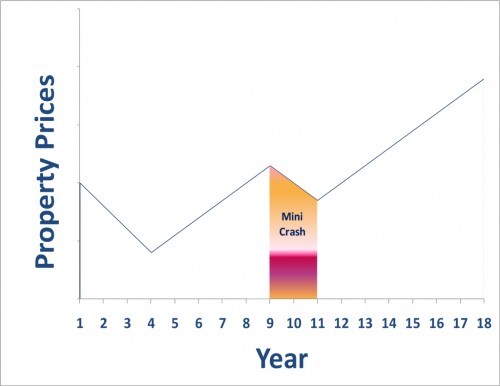

Recently we’ve been asked a few times to comment on the rumoured changes to capital gains tax. The rumours are that the capital gains tax threshold will be lowered, and the rate increased – a double whammy. Whether this directly affects you or not, let’s be clear – if this change happens it’s totally unjust and unreasonable.

Capital gains tax does not make concessions for inflation. A property owner may be sitting on a large nominal return, say for example if the property value moved from £200,000 to £400,000 over 25 years. But the real return over that time frame is likely to just be inflationary and so no real gain to their wealth was made. And yet, they will be expected to pay a high level of capital gains tax when they sell up.

These sorts of policies are often vote winners but only because most people don’t understand the difference between nominal and real profits – in fact most people and even most politicians have probably never even heard of these terms.

Bad Advice

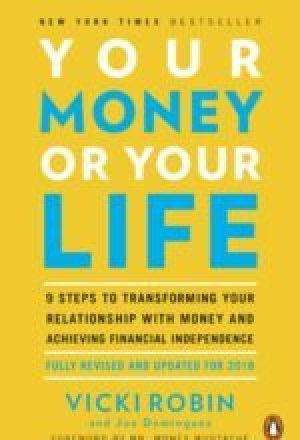

If all those threats to your wealth wasn’t enough, then bad investment advice will surely make your investment stack topple over like a game of Jenga. You will get bad advice when it’s free, and even when you pay for it.

When Ben (MU Co-founder) was 16, he went to his bank seeking to invest a small sum of money. It was a disaster, and he lost half of it – and to top it off he committed a cardinal sin and sold it at the bottom in panic. Whilst technically he had been speaking to a qualified financial advisor, in reality this advisor was just a salesman for the bank. We’re sure they did well enough out of the fees. Learn from Ben’s mistake and make sure you know who you are taking advice from.

Even the most honest advisor is likely to underperform the market, as the hit your portfolio takes from their fees is likely to offset any edge they can provide over just using passive index-tracking funds.

A financial advisor usually gets paid a percentage of the size of the pot they manage for you. This means they are incentivized to have your assets in investments that they can manage themselves, like funds. They’re not going to encourage you to invest in things like Buy-To-Let property or physical gold bullion as they can’t charge you for it. Remember, there’s usually a conflict of interest with any advice you get.

Groupthink

The next great investment evil is groupthink. This will likely impact your own decision making and even the actions from paid-for advice, whether that’s financial advisors or fund managers. Fund managers will invest in line with everyone else, so they will loosely track the performance benchmark and avoid looking foolish.

Groupthink also impacts every decision you make. Debt is bad. Pay down your mortgage as fast as possible. Stocks are risky. Stocks are overpriced. Interest rates can’t fall any further.

Some of these may be true but make your own decisions. People are taught what to think, not how to think.

We’ve also found, and this doesn’t just apply to investing, that the best, cheapest, and most suitable products are not always the most popular or well known. Cheap products don’t tend to have the marketing budget to reach a wide enough audience.

It’s why you see so many adverts for CFD brokers. In most cases these are not platforms that beginner investors should be using, but because CFD brokers often rinse their customers in fees they have large profits to fund more advertising to rope in the next unknowing victim.

What other evils do investors need to be aware of? Let us know in the comments below.

Also check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: