Whether you’re hoping to retire young or at state retirement age, where is the best place to invest for retirement? If you’ve never considered retirement planning properly before or just want to verify your retirement strategy, then this is the blog post for you.

We’re first going to consider what retirement means to you – because it means different things to different people – and then looking at the 5 main vehicles for saving for retirement, including an overview of each one and the cheapest platform to use.

We’ll then look at what makes a good retirement portfolio and finish up with some model portfolios.

Many of the investment platforms we’re about to mention just so happen to be offering free stocks, free money, or discounts when you use the links provided by us. So, before signing up, do check the Money Unshackled Offers Page.

Examples include 6 months free with Nutmeg, or a £50 welcome bonus with InvestEngine, a free stock with Freetrade worth up to £200, plus many more.

Alternatively Watch The YouTube Video > > >

What Is Retirement To You?

Almost everyone considers retirement to be when you stop working at old age – most people are fixated on age 65. Whenever we tell people we want to be retired asap, more times than not they respond by saying, “Don’t wish your life away”.

To them retirement is something that can only be achieved when your best years are behind you and probably when the government dictates it with the state pension.

We’re here to tell you that your retirement can be anything you want it to be, from sailing around the world from age 25 onwards right through to the traditional armchair at 65.

The more you deviate from the so-called norm, the harder it will be of course, but with dedication you can set your own path. You can do so much better than conforming to societal norms.

No matter what age you’re planning to retire, you will need an investment pot that produces an income from the day you stop working to the day you die.

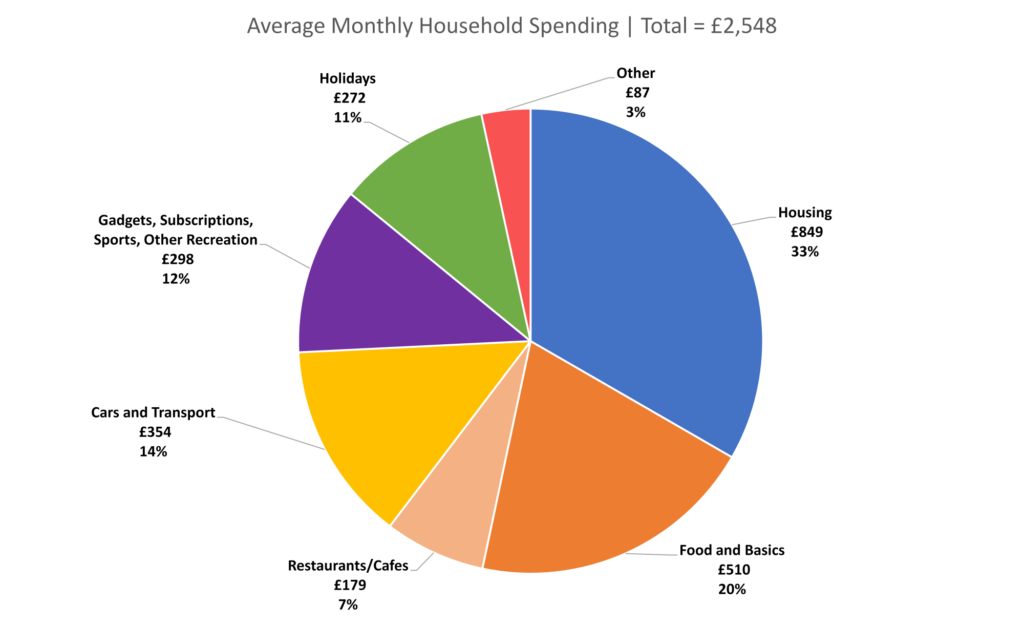

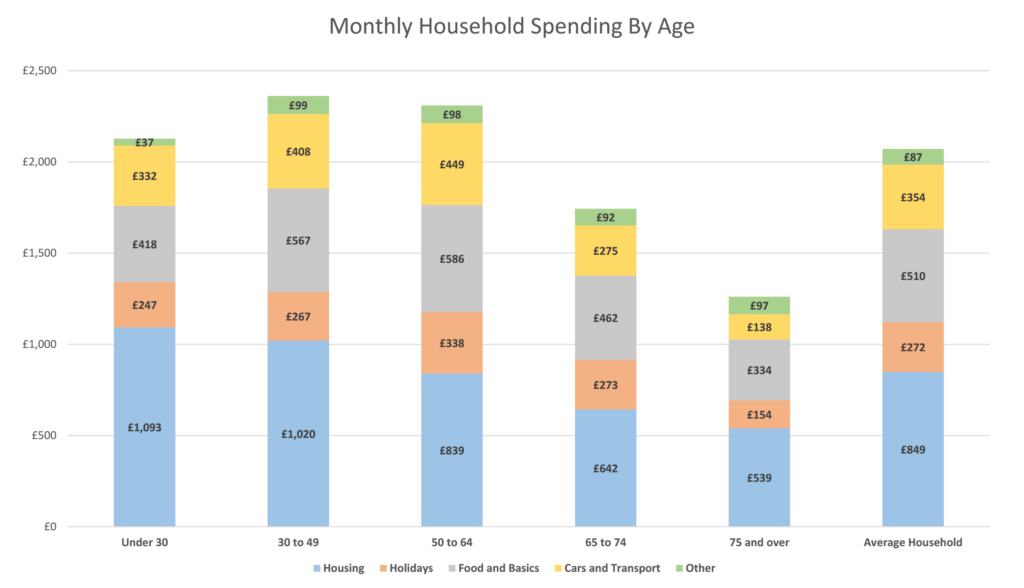

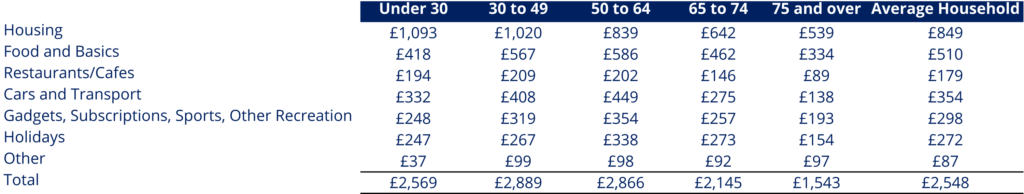

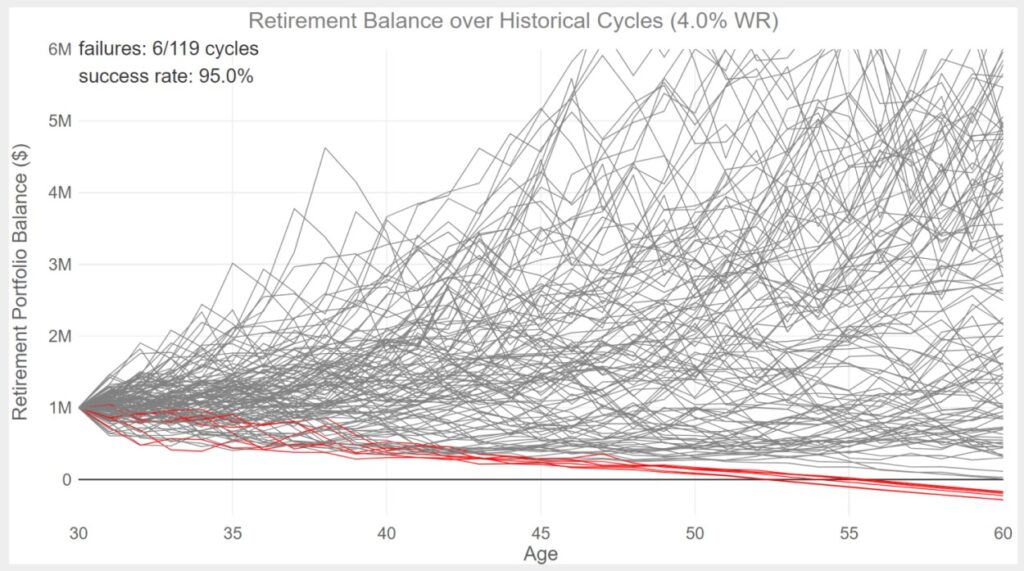

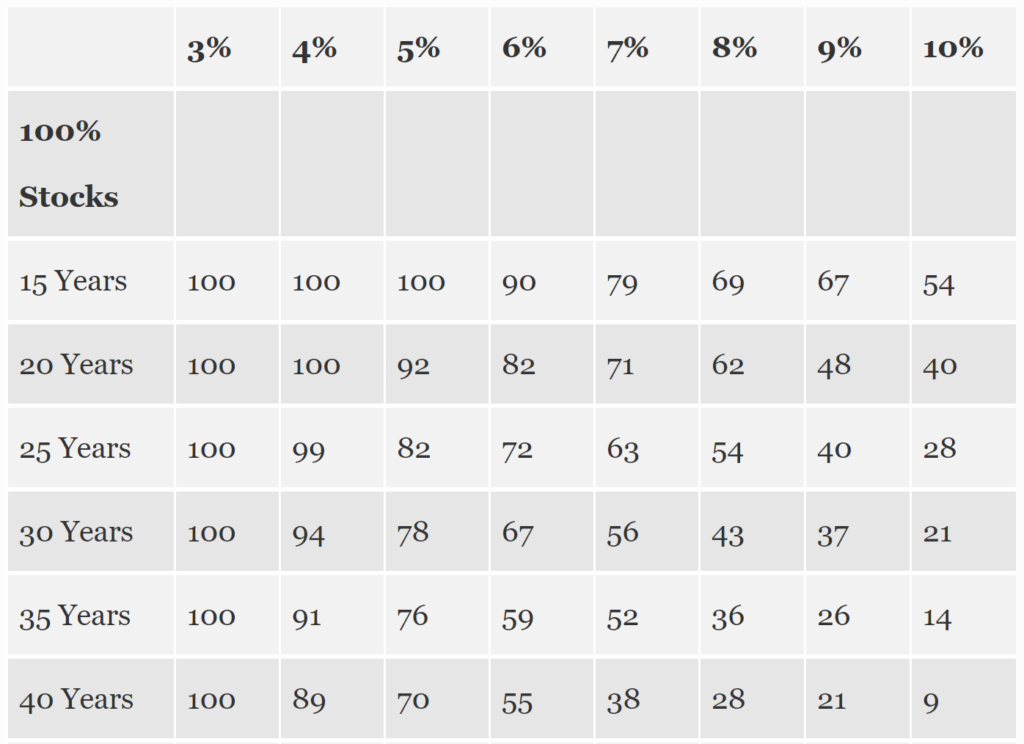

First and foremost, you need to know how big that investment pot needs to be. Work out your expected living costs in retirement and divide it by 4% to give you your required pot size. 4% is generally what is accepted as a safe withdrawal rate.

Check out our other YouTube videos and blog posts as we go into this quite a lot, so we won’t repeat it here. You can lower the percentage if you want to err on the side of caution.

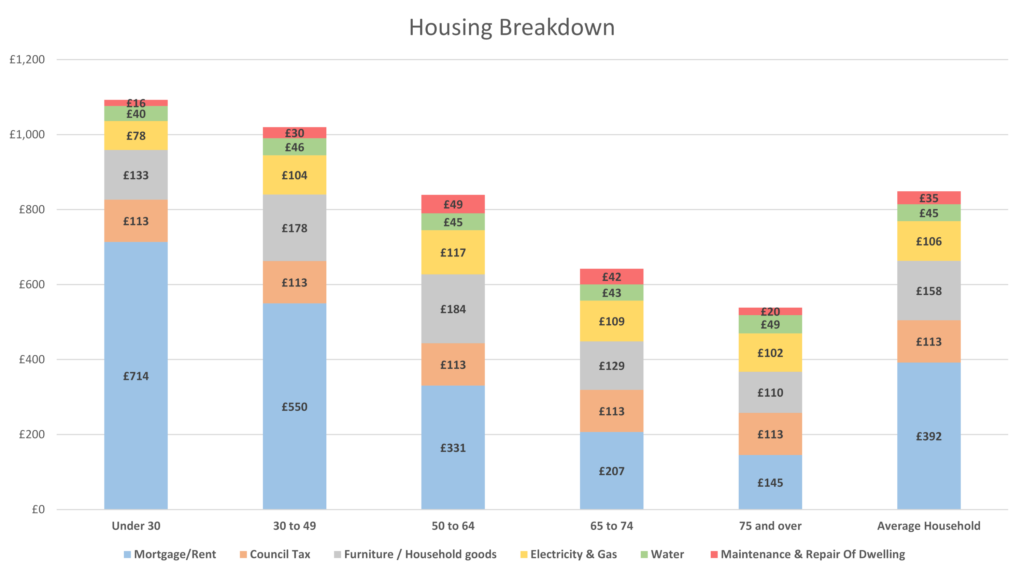

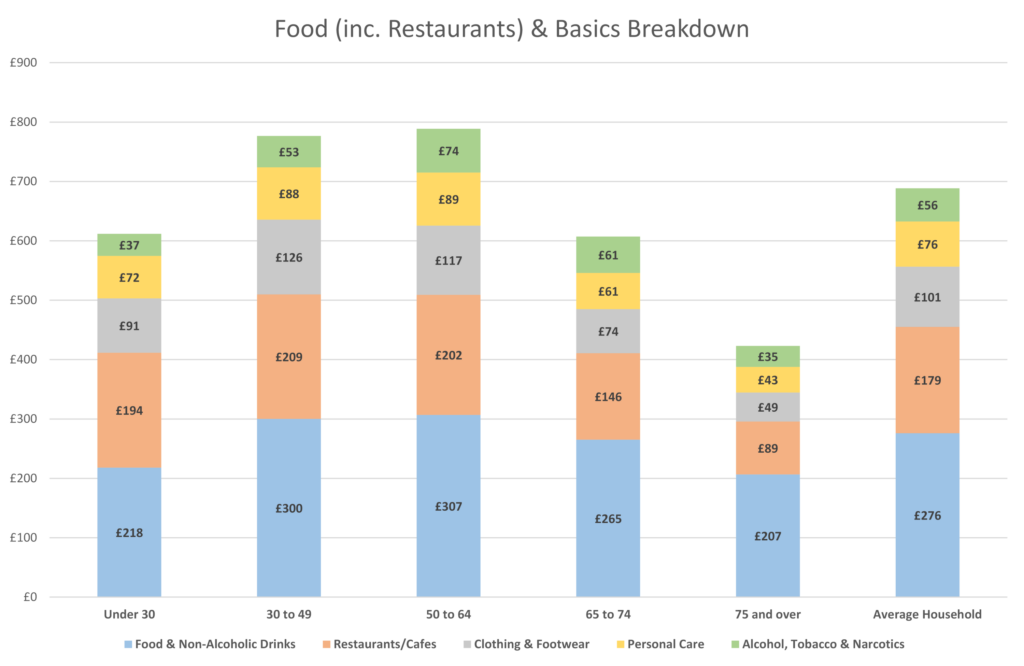

Don’t forget that your expected living costs in retirement might be much lower than they are today. You will have possibly paid down a mortgage, there will be no further need to save for retirement, and maybe the cost of raising children will be in the past.

We’ve built an awesome tool, that will help you determine when you can retire. It’s worth checking that out and coming back to it every so often to monitor progress.

State Pension – Don’t Count On It?

If you’re planning to retire at state pension age, you can also factor that in. The full new State Pension is over £9,000 a year, so could slash your required investment pot.

Check out this video & article if you want to learn more about what State Pension you’ll get.

Our word of warning is that the State Pension probably shouldn’t be relied on, especially for younger generations. Due to the dire state of the UK’s national finances, we expect some sort of means-testing to eventually come into play.

We personally plan as if it won’t be there and hope that it is – and if it is it’s a great little bonus!

If you’re planning to retire young, then obviously you wouldn’t be eligible for the State Pension for potentially decades anyway.

Vehicles For Saving For Retirement

Broadly speaking there are 5 main vehicles that can be used to save for retirement – and when we say save, we actually mean invest.

You cannot save long-term in cash, which includes savings accounts, cash ISAs, Premium Bonds, and so on. Cash has negative returns after inflation. You will have to accept a degree of risk in order to build up an investment pot that is big enough to pay for your retirement.

You should use as many of the following 5 vehicles as necessary. A good retirement plan will likely use most of them and perhaps all.

#1 – Workplace Pension

If you’re an employee or wage slave as we half-jokingly call them your employer must offer a workplace pension where they match your contributions up to a certain percentage. Take advantage of this to the max as it’s essentially free money.

You won’t be able to access this until at least age 55 – and it’s likely to be 58 according to the Government’s current policy. Even for freedom fighters aiming to retire young we would encourage you to fully utilise this, as you can cleverly manage your other retirement vehicles to live on until your pension accounts kick in. Although, we wouldn’t bother paying any more that what your employer will match as there are better alternatives, which we’re about to see.

The downside of pensions is that when you eventually draw an income from them, the amount taken will form part of your taxable earnings.

#2 – Self Invested Personal Pension (SIPP)

This account is very similar to a workplace pension. It will have the same tax benefits and the same access rules –being that your money is locked away until your late 50s.

SIPPs give you a great deal of control over what you invest in. Moreover, SIPPs can be much cheaper than workplace pension schemes if you choose your platform and investments carefully.

SIPPs are great for consolidating old workplace pensions into one convenient place. People now have an average of 11 different jobs during their career, and will often be enrolled into a new pension at each workplace – an absolute nightmare to keep track of.

Before consolidating your pensions though do check if there are any exit fees and/or safe-guarded benefits that you might lose by transferring – most modern workplace pensions will not.

We personally both have SIPPs, which we used to consolidate old workplace pensions, but are not currently adding more money to them as we’re focussing on accessible retirement strategies.

Whatever you pay into a SIPP or a workplace pension will get tax relief. Tax relief is paid on your pension contributions at the highest rate of income tax you pay. So:

- Basic-rate taxpayers get 20% pension tax relief.

- Higher-rate taxpayers can claim 40% pension tax relief.

- Additional-rate taxpayers can claim 45% pension tax relief.

We’d love to do a full run down of the best SIPPs, but time is short, so instead check out the best SIPPs page here.

In summary, for most people Vanguard is likely to be the cheapest, but AJ Bell Youinvest isn’t far behind and gives a significantly wider investment range to choose from.

Freetrade have just launched a SIPP but strangely it’s not as competitively priced as their other accounts. There’s a fixed monthly cost of £10 – barely noticeable on larger pots of perhaps over £50k but not great for smaller retirement pots.

Nutmeg is our favourite robo-advisor SIPP. Their ‘Fixed Allocation’ portfolios cost just 0.45% plus fund fees, and we think this is ideal for anyone who wants an expert to choose their portfolio for them.

#3 – Stocks & Shares ISA

This account type is a beast and is likely to be the main investment vehicle used by those seeking early retirement.

You can currently deposit £20k every year and it’s very tax efficient. We’ve refrained from calling it tax-free because there are some minor taxes you might still have to pay, such as stamp duty and dividend withholding taxes.

The Stocks & Shares ISA is so powerful because you will never have to pay any capital gains or UK dividend tax no matter how large your ISA grows.

Secondly, there are no access limitations. You can literally withdraw whenever and as much as you want, and your withdrawals do not count as taxable income – so, you can probably see why we love Stocks & Shares ISAs so much!

Again, we’d love to do a full run down of the best Stocks & Shares ISAs, but for completeness instead check out the best ISAs page, found here. In summary and only broadly speaking, Interactive Investor is very good for pots over £50k who want choice. AJ Bell Youinvest is an all-round cheap platform with account fees of just 0.25% on funds.

Commission-free platforms include Trading 212 and Freetrade, and for those who want it managed for them, newcomer InvestEngine is an incredibly cheap robo-advisor.

Check out our Stocks & Shares ISA comparison page here for a thorough comparison.

#4 – Stocks & Shares Lifetime ISA (LISA)

This account is surprisingly not talked about that often but could be better than a SIPP for some people. With Lifetime ISAs you get a 25% government top-up on your contributions, similar to what a basic rate taxpayer gets on a SIPP, but just like other ISAs they never incur any further income tax.

Therefore, for basic-rate taxpayers a Lifetime ISA is likely to be financially better than a pension. However, higher-rate taxpayers are probably better off with pensions due to the higher tax reliefs.

Some downsides to the Lifetime ISA include a low contribution limit – you can only deposit £4k a year and this eats into your £20k ISA total allowance.

Secondly, you can’t access the money until age 60, without penalty. This makes it similar to a pension but insanely your Lifetime ISA savings will impact on any welfare benefits you might be entitled to, as the DWP factor Lifetime Isa savings into Universal Credit calculations. For this reason, we would tread carefully using LISA’s.

So, which is the best Lifetime ISA? Unfortunately, there is barely any platform choice. AJ Bell Youinvest is among the cheapest at 0.25% on funds, and Nutmeg is the cheapest robo-advisor that we’ve seen offering LISA’s.

We’ve not yet built a Lifetime ISA comparison page but it’s in the pipeline, so do check back if you’re thinking of opening a LISA.

#5 – BTL Property

BTL property is perhaps the most lucrative investment available to normal working people due to mortgage leverage. The returns can be enormous but there are also a lot of downsides.

Unlike stock market investing you can’t really invest and manage property while you’re taking your morning number two.

The drawbacks include unexpected bills, late paying or non-paying tenants, problem tenants, regulations, organising maintenance with tradespeople, tax complexities, your time involvement, and lots more. If you are able to take all of this on, then absolutely consider property investing.

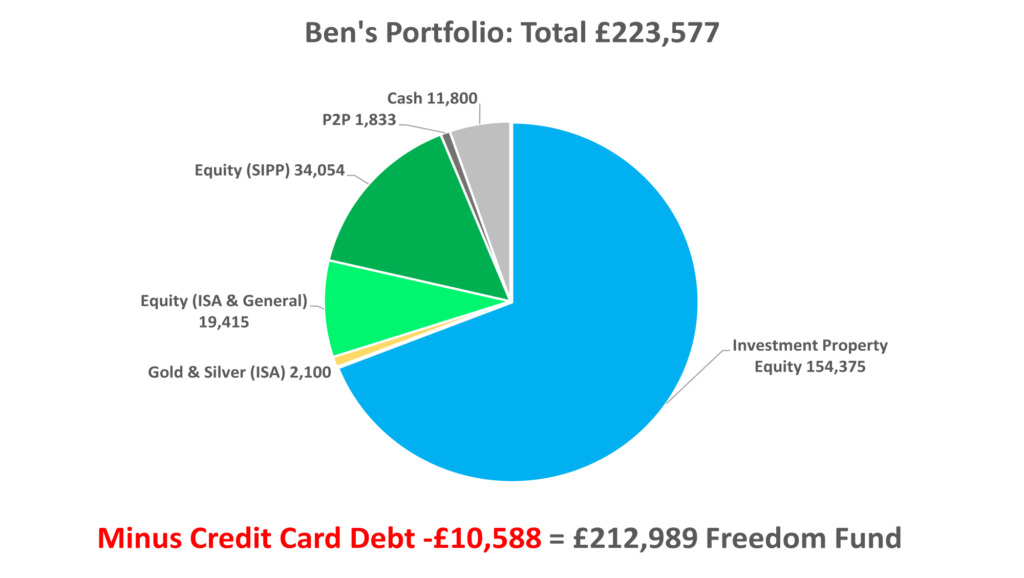

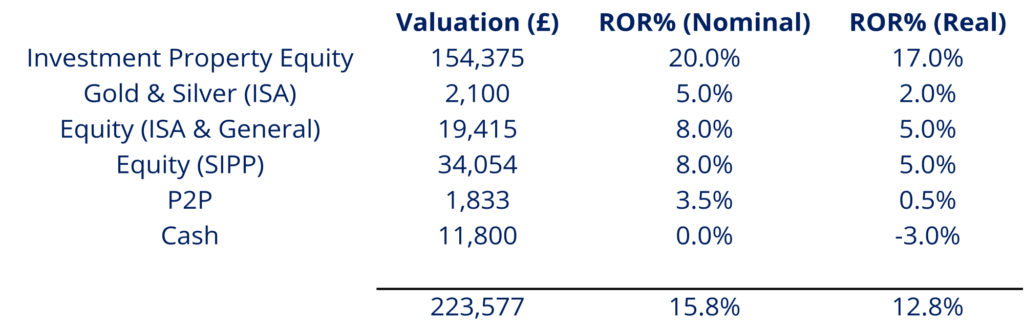

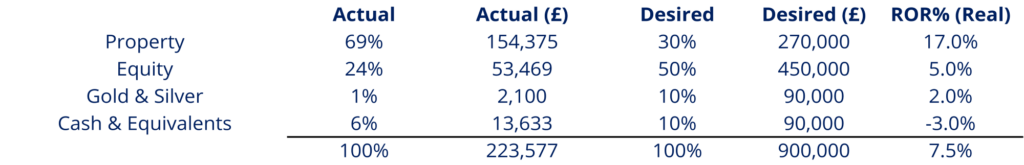

The bulk of Ben’s (MU co-founder) retirement pot is in BTL property and his annual ROI has been around 20% – you can’t get that very easily in the stock market.

What Makes A Good Portfolio?

Other than the last point on property, all of the best vehicles for saving for retirement are geared towards stock market investing.

If you choose a robo-advisor you won’t need to concern yourself with this but for those going down the do-it-yourself investing route, we think a good portfolio should possess the following characteristics:

- Simple – You should have a clear understanding of what you are investing in and keep the number of assets you own at a manageable level. Complexity means higher costs.

- Low Cost – Fees matter. Keep them as low as possible. That also means don’t trade frequently as this is a guaranteed way to let fees spiral.

- Tax Efficient – Tax is an unwelcome evil. Use all the weapons in your arsenal to minimise it or even eliminate it. Remember it’s the after-tax return that’s most important.

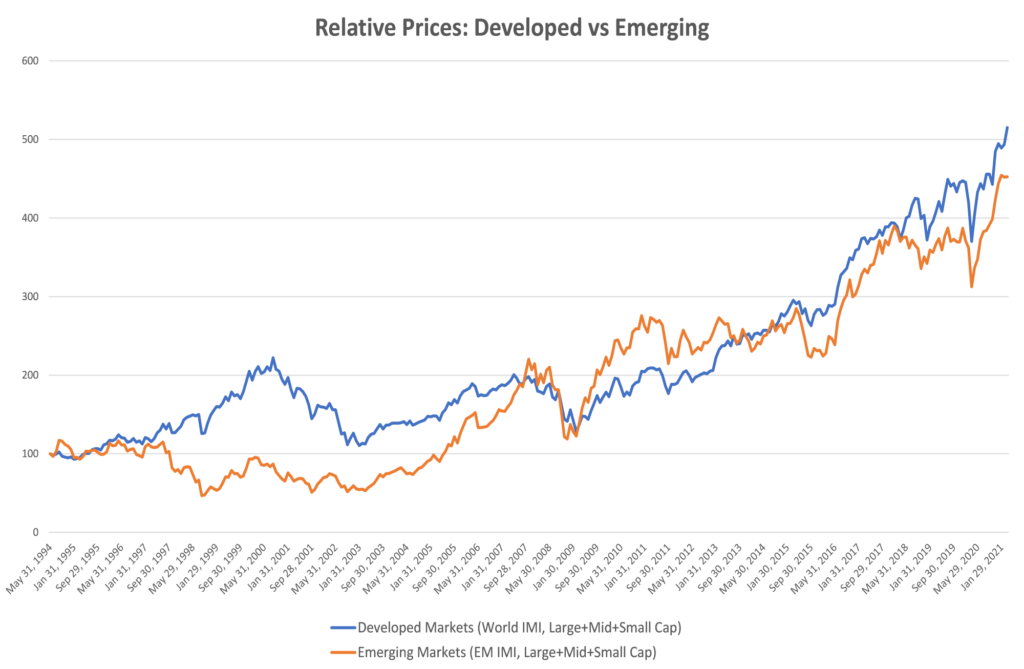

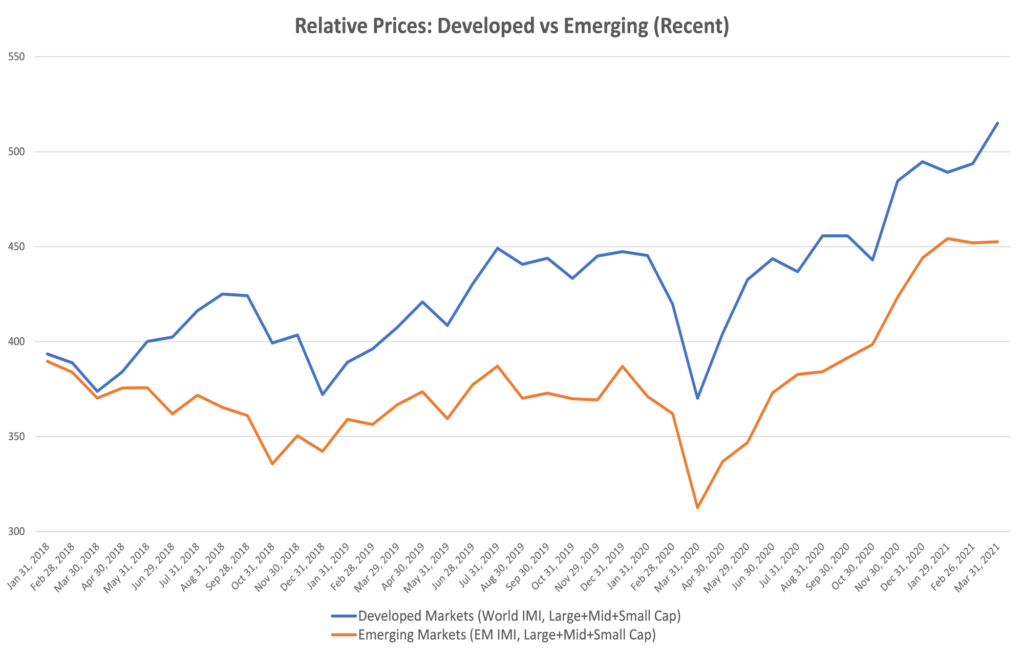

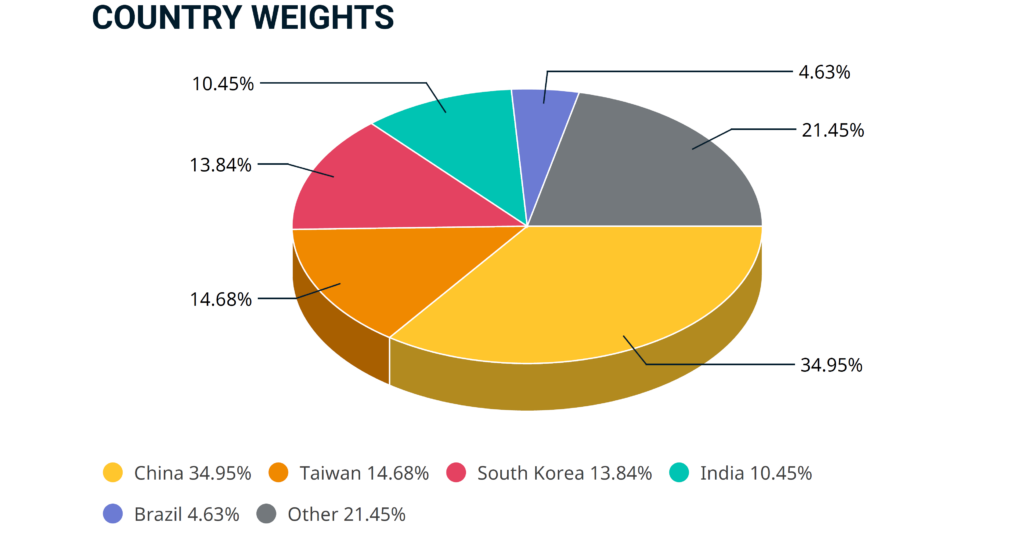

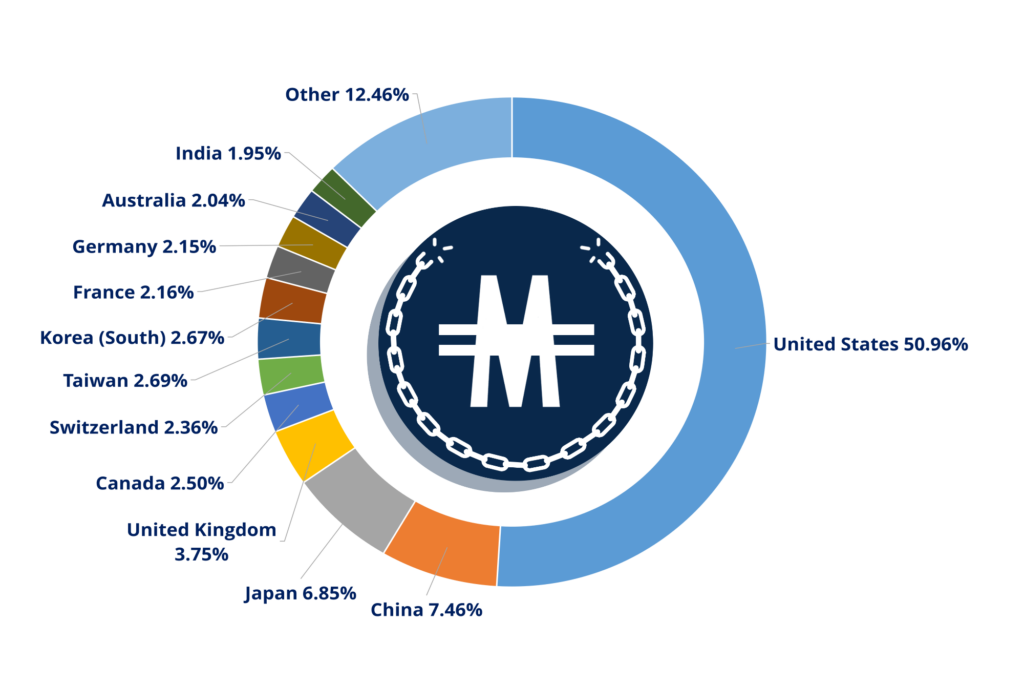

- Diversified – Ideally globally and across multiple asset classes. The younger you are the more you can lean towards high-risk assets such as equity funds.

- Passive – Active investing incurs lots of fees and is on average unlikely to provide superior returns. Investing passively in an index allows you to invest with conviction. Being free from doubt means you won’t tamper with the portfolio, which usually only damages returns.

Model Portfolios

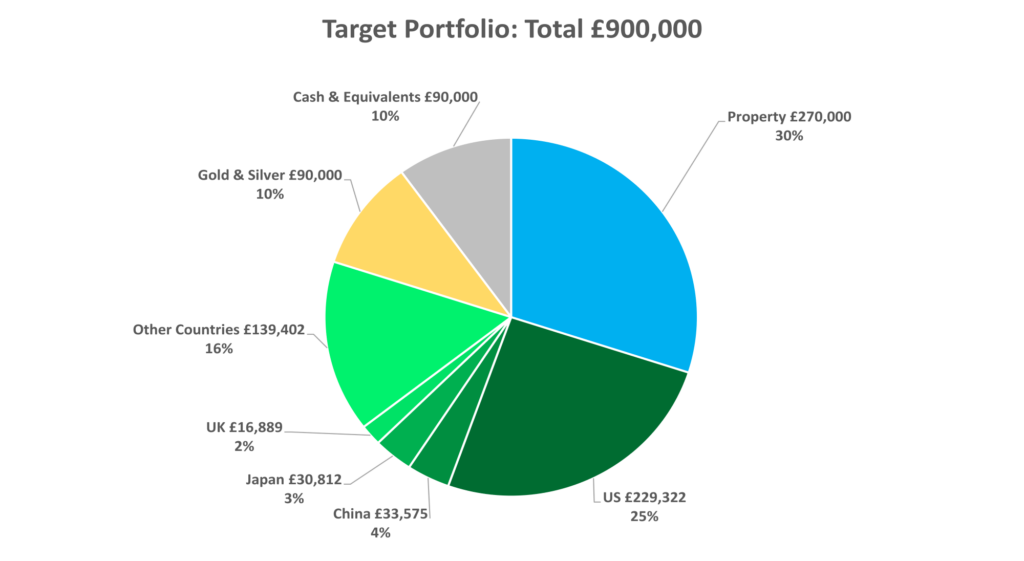

Following the characteristics just outlined, our ideal portfolio is what we’re calling the Money Unshackled Ultimate Portfolio.

It contains a developed world ETF, a developed world small cap ETF, an emerging market ETF, some gold and silver, and on top we would also hold some cash.

- Invesco MSCI World ETF (MXWS)

- iShares MSCI World Small Cap ETF (WLDS)

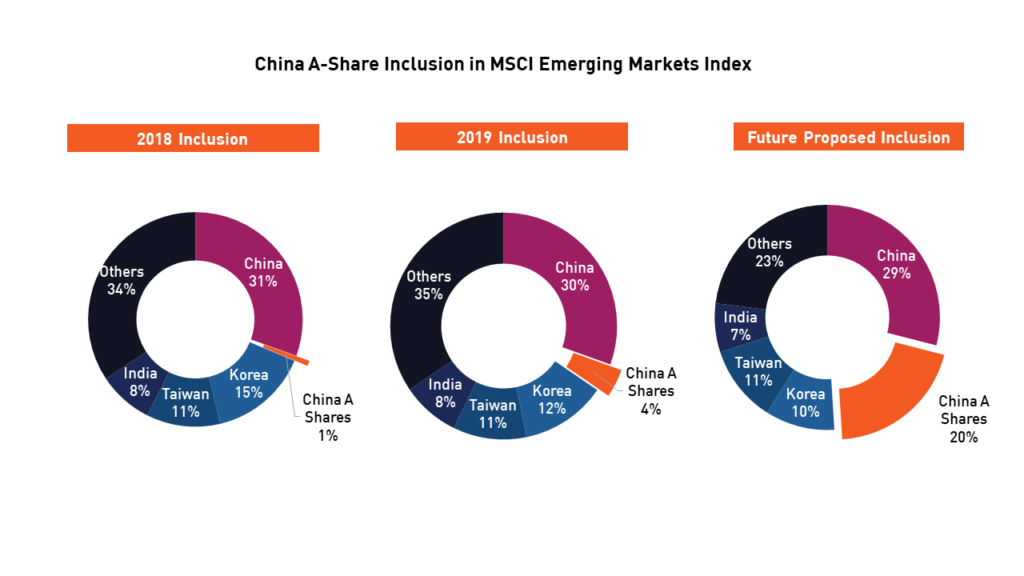

- iShares Core MSCI Emerging Markets IMI ETF (EMIM)

- iShares Physical Gold ETC (SGLN)

- iShares Physical Silver ETC (SSLN)

We have a dedicated video and article covering this portfolio in more detail, found here for those interested.

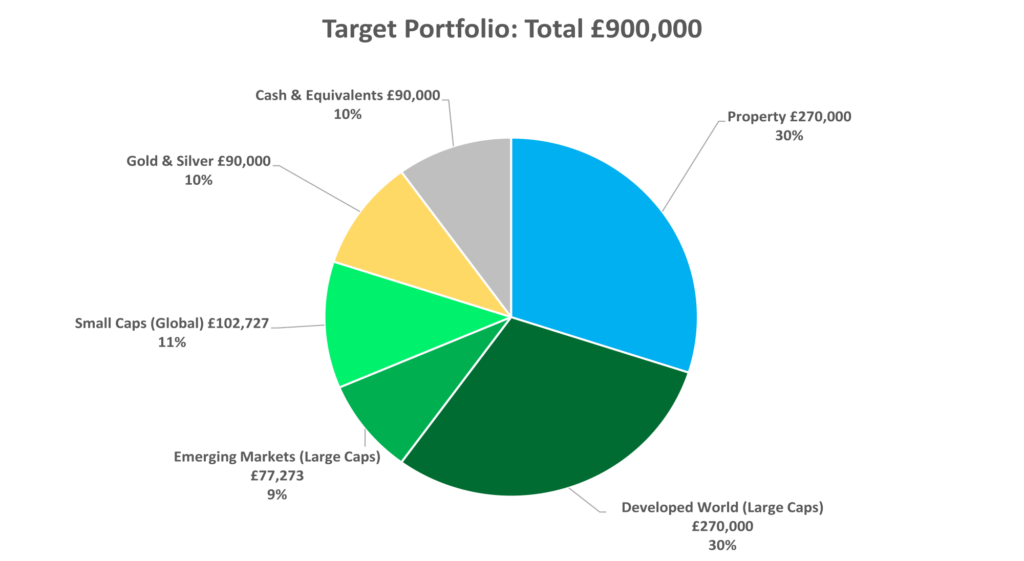

A second portfolio we like is what we’re calling the Money Unshackled Vanguard Portfolio. This one’s based on two Vanguard ETFs covering the developed world and the emerging markets. This ETF combo works out cheaper than the popular single Vanguard All-world ETF and gives you some control over allocation between geographies.

If you like gold and silver, you could easily tack on those as well but there are no Vanguard ETFs for these. We suggest the iShares gold and silver ETFs.

- Vanguard FTSE Developed World ETF (VHVG)

- Vanguard FTSE Emerging Markets ETF (VFEG)

- iShares Physical Gold ETC (SGLN)

- iShares Physical Silver ETC (SSLN)

In addition to any ETF-based investment portfolios like the ones mentioned we also like to invest in P2P lending for the fixed income it provides, and Ben likes property for growth and regular cash flow.

What vehicles are you using to save for retirement and why? Join the conversation in the comments below.

Written by Andy

Featured image credit: Khakimullin Aleksandr/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: