Many beginner investors are keen to start investing because of the easy money that can be made. And rightly so! Those who have watched our videos before will know that it is far better to put your money to work than to work hard yourself.

Without exception the only way to make serious money is to invest. Look at any rich list and you will see a bunch of people who made significant sums in some form of investing – most commonly from stocks and property.

Unfortunately to start investing without educating yourself is a recipe for disaster – You WILL lose money. It’s imperative that you not only learn how to invest but also learn from your mistakes. Better yet, learn from other people’s mistakes, so you don’t make them yourself.

Warren Buffett has 2 rules:

- Rule No. 1: Never lose money.

- Rule No. 2: Never forget rule No. 1!

Editors note: Don’t forget to check the Offers Page and grab FREE shares worth up to £200, plus £50/£75 CASH-BACK when you open new investment accounts through the sign-up links there.

YouTube Video > > >

Investing mistakes will cost you money but why is it so important not to lose money? Some of you might be thinking that it’s okay to lose money because eventually stock markets will recover, and you’ll get your money back and more.

Let’s demonstrate this mathematically:

Say you invest £10,000 and lose 50%. How much does it need to grow to get back to square one? 50% maybe? Wrong!

To grow your remaining £5,000 back to £10,000 would require 100% investment return just to get back to where you started. The more you lose the bigger the investment return that is required to recover.

Some people are even tempted to buy stocks that have crashed by say 90% because they think that it was once worth so much more.

Imagine if you owned one of these stocks and you are unfortunate enough to see it crash by 90% and have held whilst you lost all your money. To get your money back it would now need to grow by 900% – nothing short of a miracle!

Now that we’ve demonstrated why it’s so critical NOT to make mistakes, we’re now going to look at the Top 10 investing mistakes beginners make in the stock market…

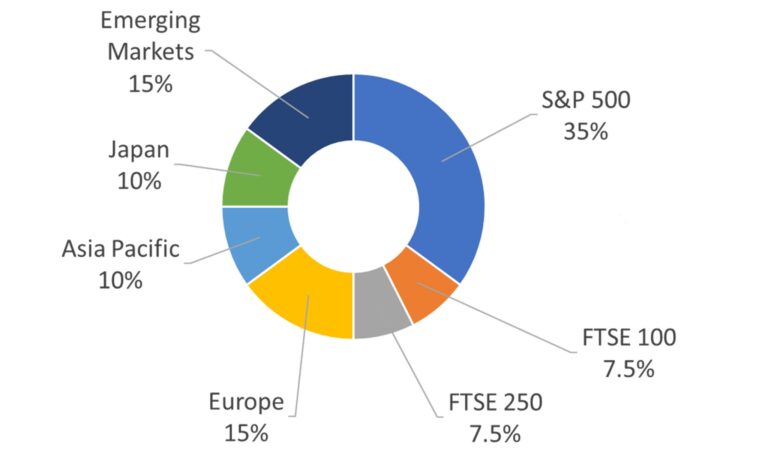

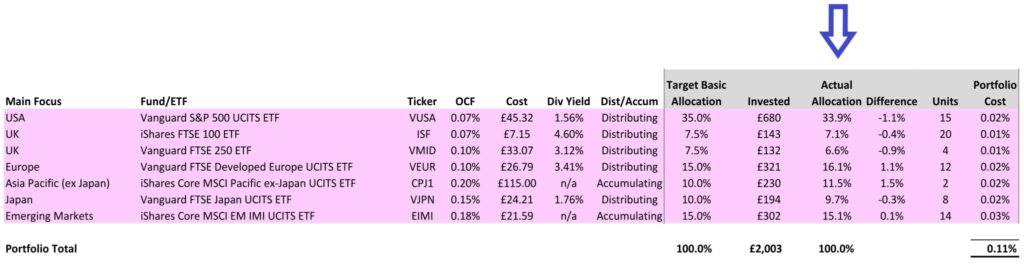

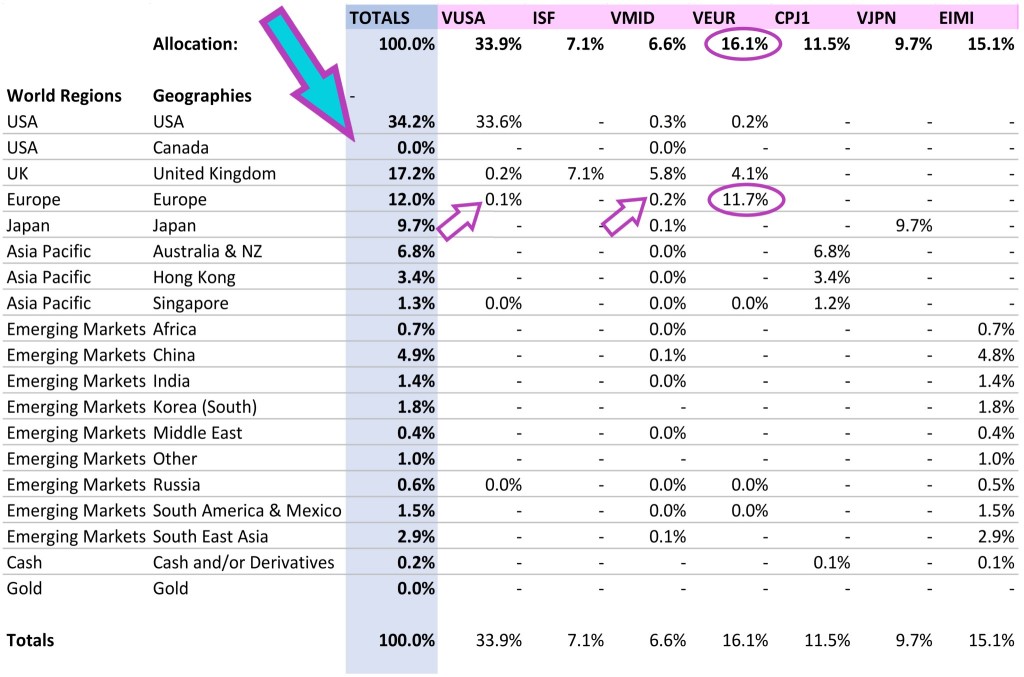

Mistake Number 1 – Not Diversifying

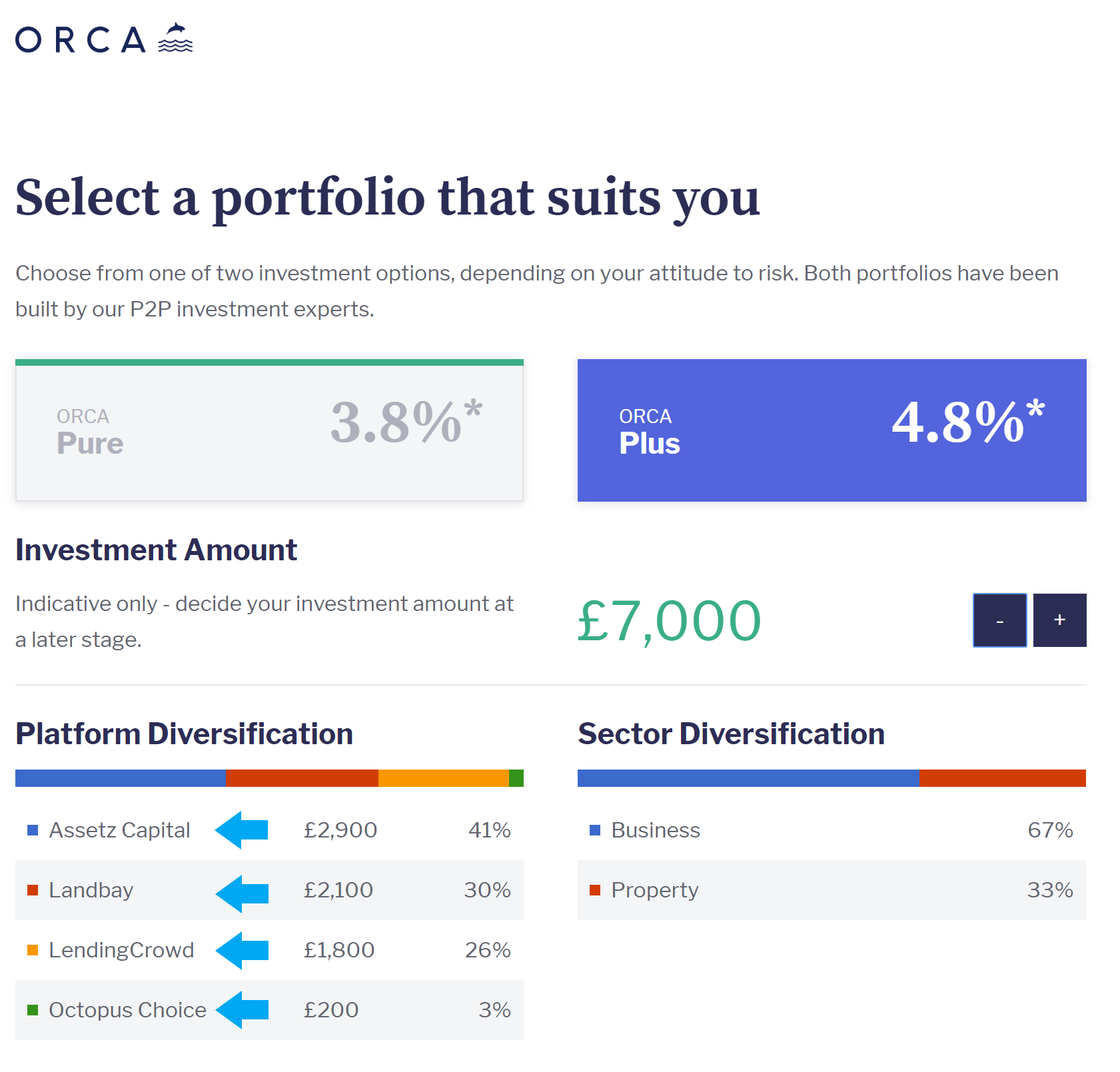

Diversification is absolutely essential to protect and grow your wealth. Beginners often fail to diversify due to lack of money, lack of knowledge or over-confidence in their ability.

These days lack of money is no excuse as ready-made diversification is easily achievable through the purchase of a Fund or ETF.

Unfortunately, many beginners dislike funds and are drawn into the excitement of picking stocks but in doing so, they almost never achieve the diversification that is so vitally important.

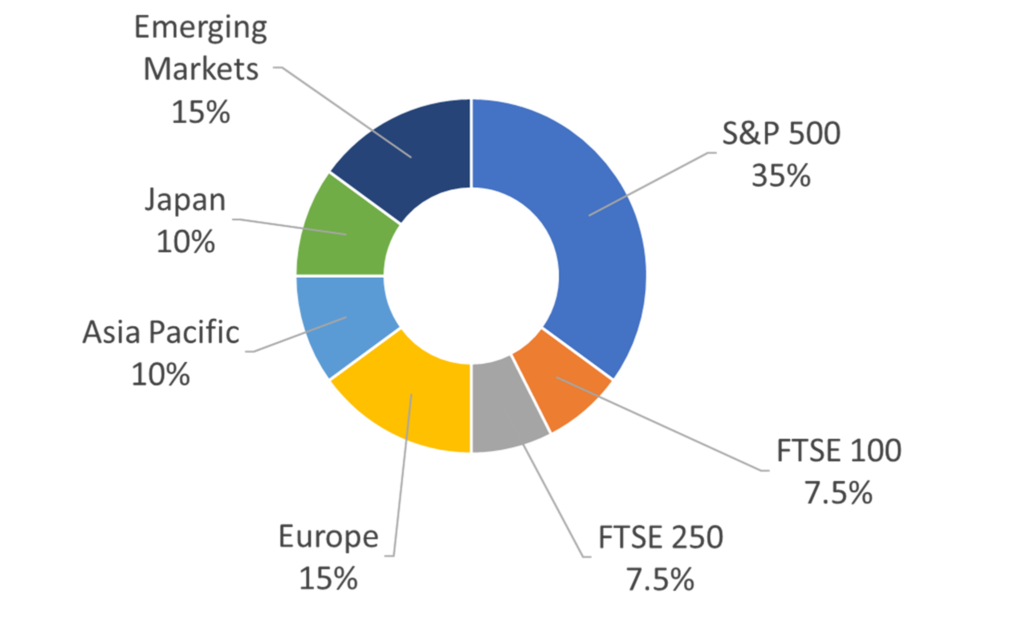

Lack of knowledge often leads to an investor believing they are diversified but the reality suggests otherwise. For example, a UK investor may rather foolishly only be invested in UK stocks. If the UK suffers a downturn, that investor will soon realise they had not diversified properly.

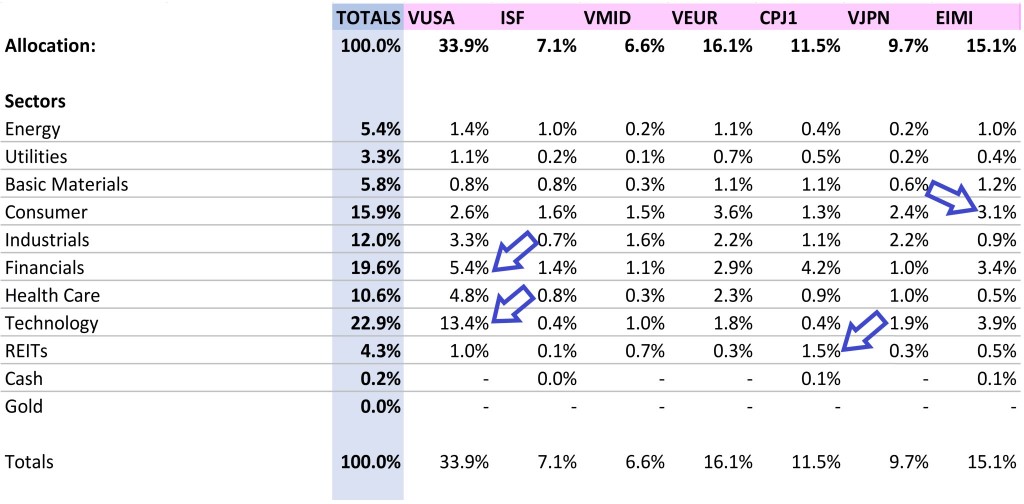

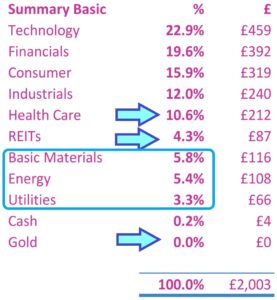

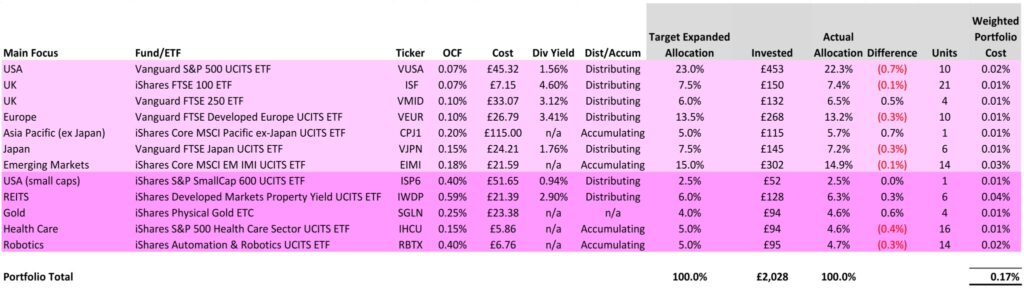

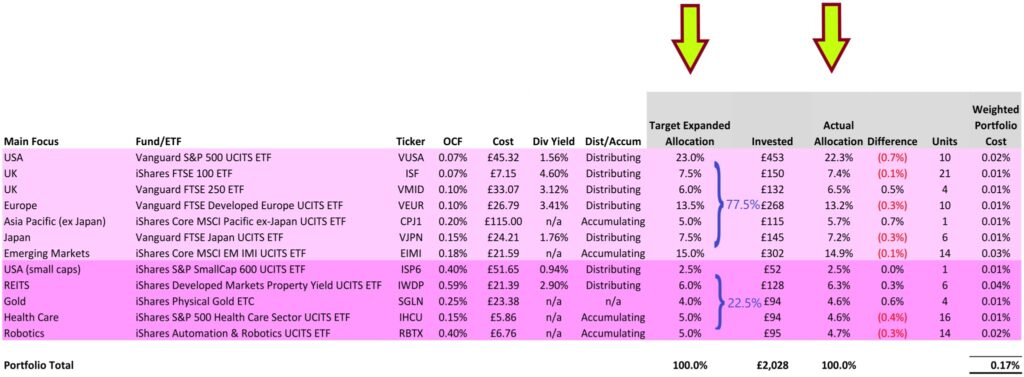

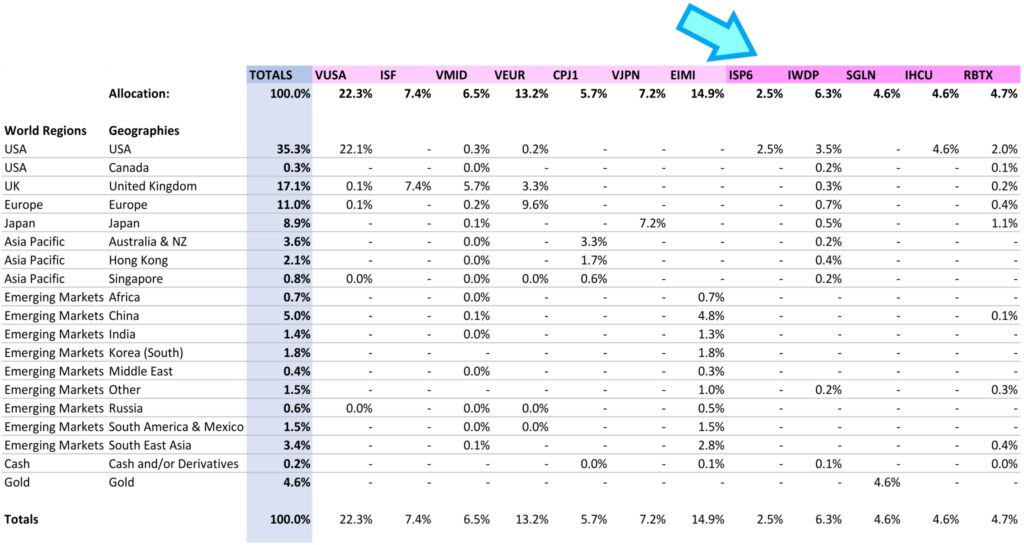

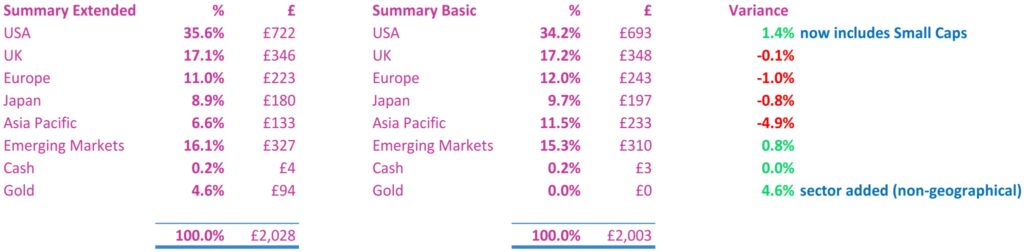

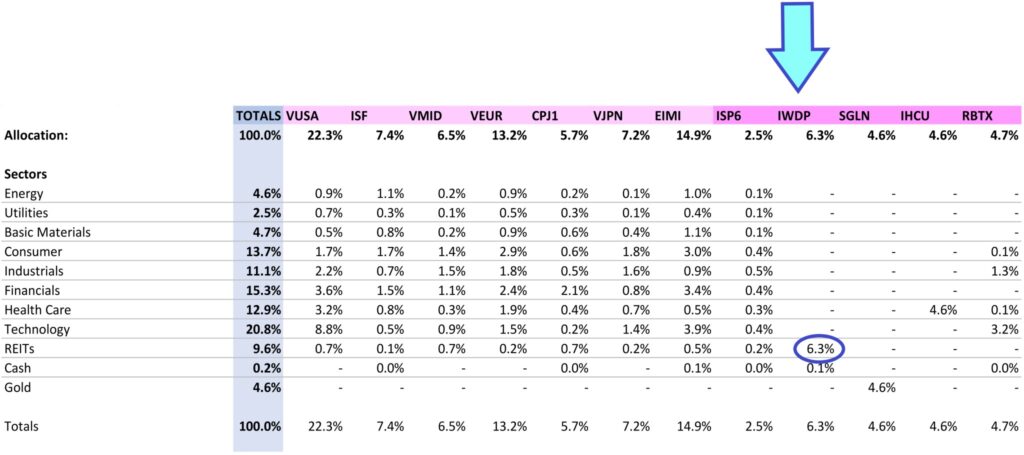

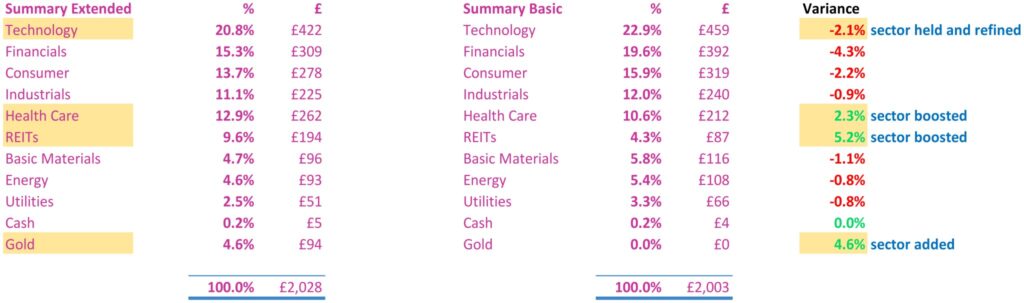

True diversification is across different geographies, asset classes, sectors, and stocks. Diversification doesn’t just protect against losses though – it boosts the chances of you achieving the investment returns that are expected.

I’ve personally made this mistake myself. For years I was overly exposed to the UK and I failed to get the enough exposure to the essential US market.

As a result, I missed out on some tremendous growth. Whatever the reason, lack of TRUE diversification is likely to hurt you.

Mistake Number 2 – Copying Other People

Everyone’s situation is different, which is why a Regulated Financial Advisor must first assess your unique situation before giving advice. This fact is often overlooked though when it comes to beginners who just want to copy someone.

We are often get asked what investment platform we use or what we invest in. There’s nothing wrong with these questions per se, but these questions terrify us because it is clear that most of those who are asking are going to blindly follow whatever we say. Our situation is different to yours and yours is different to the next guy.

It’s much better to understand the reasons why we do something rather than just what we do. For example, if you only have a few thousand pounds to your name it’s not useful knowing which investment platform we use because we are not in the same financial position.

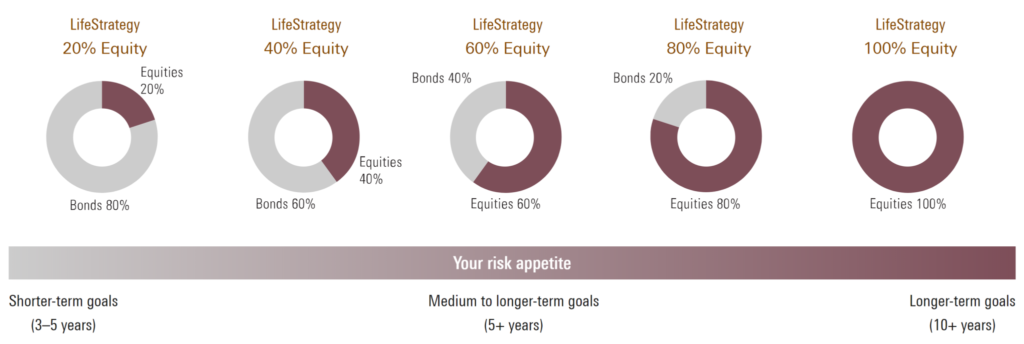

Or if you are approaching old age retirement, it would potentially be dangerous to blindly follow our investment strategy because we are probably willing to take on more risk than you are.

Long story short – Don’t blindly follow other people, but understand why they do something.

Mistake Number 3 – CFD Trading

We covered this in a recent video about Avoiding CFD Trading, which is certainly worth checking out (see below).

Essentially, due to high fees and leverage 82% of CFD clients lose money, so beginners should pretty much always avoid this type of investing.

Unfortunately, these CFD brokers have large marketing budgets and have some really enticing adverts which lures noobie investors to their peril.

Beginners often come across these brokers first and wrongly think this is investing in the traditional sense – it isn’t. Best to avoid them and learn how to invest on a proper investment platform first.

YouTube Video > > >

Mistake Number 4 – Holding Losers and Selling Winners

Many investors sell their best performing stocks to realise the gain, despite the stock still having potential for growth.

But worse still, many people are unable to sell a loser. Preferring to hold until total collapse of the share price. There is too much emotion in the investment, and they make all the wrong choices.

Even if the Loser slowly recovers, how long have you had to wait and what did you miss out on? Many investors incorrectly believe that what goes down will go back up. This is a misconception and is often not the case.

Mistake Number 5 – Buying High and Selling Low

Everyone knows what they should do – Buy low, sell high. But people tend to do the opposite, and this is not a contradiction of the previous mistake.

When stocks crash, they become fearful and sell and likewise they buy when everyone else is, when the price is highest. The best thing you can do is ride out any crashes and perhaps buy more if the prices are cheap.

Mistake Number 6 – Trading Too Frequently

Novice investors incur substantial fees by trading too frequently. Usually they are trying to make short term gains or are just bored and therefore often come out worse due to high fees.

Consider this, you have the trading fees to buy and then to sell, you have stamp duty and you have the bid/offer spread. In case you don’t know, you can’t actually buy at the stated share price.

There is something called a bid/offer spread, which is the difference between the buy and the sell price. This bid/offer spread, and stamp duty on UK shares are unavoidable even on “free” investing platforms. Our point; trading frequently is too costly.

Mistake Number 7 – Over Confidence

Some people think they are better than everyone else. Why some people think they can put in no investment appraisal and yet still outperform the market is beyond us.

We’re not saying you can’t beat the market because you can, but many beginners think they can pretty much just take a wild punt and outperform the professionals.

We regularly get asked about timing the market or whether a certain stock looks good. We love to talk about anything to do with investing but the reason we do better than most is not because of awesome skills but because we avoid these mistakes.

Mistake Number 8 – Not Starting or Starting Too Late

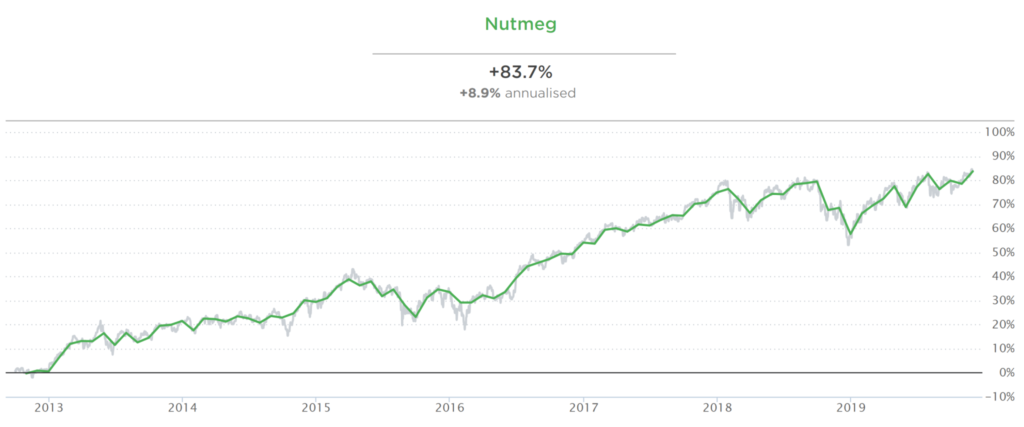

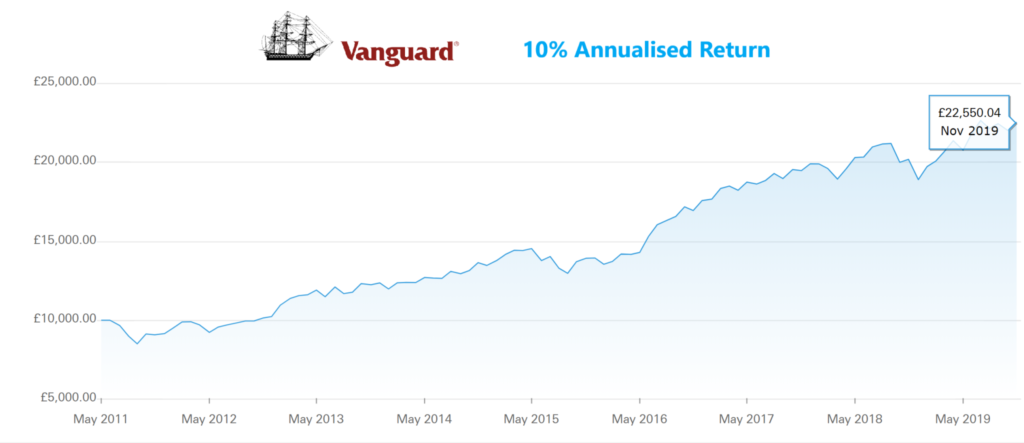

Investing works best when it has time to work its magic. The true power of compounding takes years. We’ve heard every single possible excuse why people don’t invest. All too often people prioritise short term gratification over their long-term future.

£10,000 invested for 35 years earning 8% will be worth £148,000. £10,000 invested for just 10 years earning 8% will be worth just £21,600.

Don’t wait to invest; Invest and wait!

Many people don’t start because they think their tiny sum of money isn’t worth investing. They fail to realise that the best way to learn is when their pot is small. If they save a large amount first, then they will be too fearful to start investing because they have a lot more to lose.

Mistake Number 9 – Short Term Horizon

The ability to sell shares at any point, what we refer to as liquidity, often leads to people thinking they can invest for the short term. But in reality, prices are so volatile in the short term that it’s way too risky.

Some short-term traders may make money, BUT you will almost certainly do better with long-term investing. This being for at least 5 years, and better yet 10 plus.

Mistake Number 10 – Buying Last Year’s Winners

People have a tendency to review the historical record and assume that it will repeat. Sometimes it might, but it might not.

When making an investment decision you need to look at the future and not just the past. If it was as simple as looking at history, we would all be millionaires.

What investing mistakes did you make or are still making? Let us know in the comments section!

Written by Andy