Normally we like to focus on topics that enhance your financial life; how to invest, what not to waste money on, important finance news, and the like. But today we need to have a good old moan about certain things in the money space that are really annoying us right now.

If it frustrates you too, let us know in the comments below. Or otherwise tell us to stop whinging and to get back to telling you the finance news. We’ll be moaning about investing, YouTube, the media, politics, tax, and people. Now, let’s check it out…

Alternatively Watch The YouTube Video > > >

Investing

First off, we need to moan about crypto, meme stocks, and lucky stock picks. We don’t have a problem with these things per se, but more precisely what winds us right up are the lucky sods that make a quick win – on what is essentially a gamble – and then think they’re investing gods.

Meanwhile the rest of us – who are investing in a more calculated, and some would say, boring, fashion – have to spend years and decades growing our investments at a snail’s pace. Then of course we all look stupid when we’re only getting, say 10% growth a year, while some of those who took a reckless punt are laughing all the way to the bank.

Bitcoin really started to gain traction and widespread attention in 2017. It started that year hovering around the $1,000 mark and by the end of 2021, it was priced around $50,000 – a 50-fold increase.

Somebody could easily have turned a 10 grand investment into 500 grand – a lifechanging sum of money. The internet is awash with people who rode that gravy train, and an entire community of crypto “experts” has popped up on YouTube claiming to have rewritten the investing rulebook.

Perhaps a little more common are those who started investing in Bitcoin when it was hovering around $15,000 at the tail end of 2017 and you, like us, probably have some friends who did this. If they continue to hold to this day, this is still an epic return of 3.3 times in just a few years. Quite frankly, this makes those of us who invest in conventional index trackers look like idiots.

There is a danger here that we’re wrongfully describing incredible investors as lucky. Serious Bitcoin investors will argue that it was obvious, and that Bitcoin will continue to surge ever higher. However, we have yet to meet anyone who can put together a compelling case for Bitcoin at its current price, and we see no reason why the price couldn’t have gone the other way. Seriously, what is Bitcoin worth? All we tend to hear are soundbites like, “invest in Bitcoin”, “Bitcoin is the new gold”, or “Bitcoin is my retirement”.

While we see potential uses in Bitcoin and crypto in general, we have no idea how anyone can put a value on them, so how can we justify investing serious money into this asset class? Honestly, we would not be surprised if it either went up 10-fold from here or collapsed 10-fold.

On a related note, we get frustrated at the quantity of social media influencers on places like here on YouTube that are relentlessly plugging crypto, no matter the coin.

Even respectable YouTube stars like Graham Stephan who initially talked about real estate, and has 3.6 million subscribers on his main channel, seem to be ruthlessly knocking out video after video about crypto.

The infamous YouTube algorithm rewards videos that get clicks, and there’s no doubt about it that clickbait ‘get rich quick’ style videos are hugely popular. Meanwhile YouTube channels that focus more on “boring” but tried and tested methods of investing into stock-market index funds and property are sadly far less popular.

If you want to make a quick £1,000 after Christmas, or even more if you continue, give Matched Betting a go. It’s not betting, and it’s not investing either – in fact, it’s a logical, step-by-step process of scooping up the cash bonuses offered by bookies.

We’ve got introductory guides here, but in short you subscribe to one of the Matched Betting services and they serve you all the offers and walk you through it. We have discounted offers for both Oddsmonkey and Profit Accumulator on our Matched Betting page.

The Lying And Sensationalising Media

Something that really has got to stop is the constant negativity from the media. And much of the media are so lazy now in their reporting that they just stick a few tweets in their articles and try to pass the negative opinions of 3 random people or celebrities as if it’s the opinion of the masses.

But what annoys us the most about the media is the constant sensationalising, headline-grabbing news stories. They spread fear because negativity sells. This obviously applies to all aspects of the news, but it seems to be very prevalent in the financial space.

Take this recent headline from the Mirror as a typical example, “Bank of England HIKES interest rates to 0.25% as inflation jumps to 10-year high”.

The fear mongering in that headline is full-on supercharged – trying to terrify anyone who has debt like a mortgage and also those who are worried about the rising cost of living. Nobody on planet earth considers an interest rate increase from 0.1% to 0.25% as a “hike” – honestly, you’ll barely notice it.

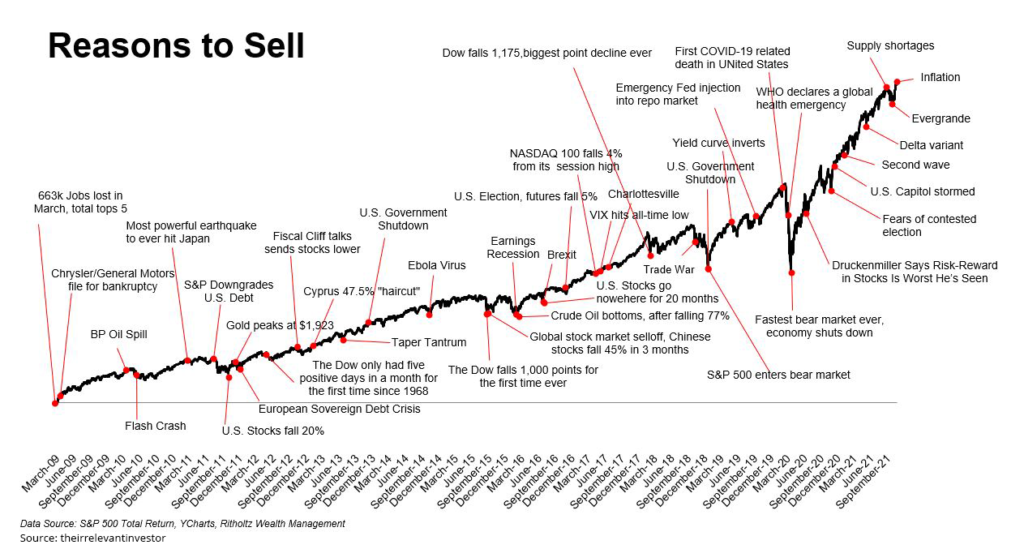

For investors, this negativity is a minefield that needs to be avoided at all costs. If you paid close attention to the news, you’d never invest, because there’s always a reason to sell and sit out of the market.

This chart is an updated version of one we have shown before. It’s littered with negativity that the media would have been hysterically reporting at the time, and it shows how the S&P 500 responded – it continued to storm ahead. Remember Brexit? Well, some people may have thought it was the end of the world, but this is what the market thought. It simply didn’t care!

Don’t even get us started on how Covid has been reported these past 2 years. The thing with statistics is you can spin almost any story from the same set of data – both positive and negative, but the media obviously choose the latter.

Every death these days seems to go down as “dying with Covid”. A blind 112-year-old, driving dunk and stoned, drove off a cliff, whilst having a heart attack. But his autopsy showed that as well as having no head, he had contracted Omicron. Add him to the “died with Covid” statistics!

Negative news was bringing Ben (MU co-founder) down so much that at one point he stopped watching the news entirely. But as a finance YouTube channel, it’s our job to cut through all that noise to bring you the news that matters, so he has reluctantly started tuning in again, so you don’t have to. You’re welcome.

Politics & Taxation

We’re sick to death of the government. They’re either raising taxes, banning stuff, or taking away our freedoms. We’re very much pro-freedom as you might have guessed based on our slogan ‘Investing For Freedom’, which you might have seen during our video intros on YouTube.

Both of our goals in life are to build up big enough Freedom funds, so we’re free to live the life we want. But if the government continues to keep overreaching, and forcing their will on the people, no amount of money will ever be enough to achieve true freedom.

Much of the stuff that the government bans doesn’t even directly affect us but it sickens us that other people lose the right to enjoy whatever it was that was banned. One such example in the finance space, was the banning of crypto derivatives by the FCA. Another was preventing investors from having more than 10% of their net worth in P2P Lending.

We’re all for laws to guide positive behaviour and protect people but outright bans – to put it bluntly – pisses us off.

Here’s one that probably affects everyone and the economy in a big way – antiquated Sunday trading laws. Most people are too busy slaving a full-time job during the week to go shopping and probably save Saturday for a little bit of well-earned fun.

You finally get a chance to head to the shops on Sunday evening to do a big food shop but remember the silly law that prevents shops over a certain size from opening for more than 6 hours, so you’re out of luck. You’re forced to go and overpay at a far smaller shop, which has less choice.

As for taxes, we’re in favour of making them as low as possible, to encourage economic growth and make Britain the world’s choice for investment. But both major parties in the UK, despite their rhetoric, are pro high taxes, which is why The Institute for Fiscal Studies (IFS) said the chancellor was on track to lift the UK’s tax burden to the highest sustained level in peacetime.

It’s not just the amount of tax that is the problem though, it’s the fact that the tax system is ludicrously complicated and imposed on certain aspects of life that it has no right to, such as on death.

Inheritance tax is 40% after some relatively small tax-free allowances. Every person should have the right to pass on most of their wealth, which they probably spent a lifetime earning, without having almost half of it siphoned off by the sticky fingers of the government.

In a Guardian article published in 2015, they stated that the UK tax code was the longest in the world at 17,000 pages, which is considerably longer than Hong Kong’s, which at the time was 276 pages. Theirs is widely held by tax lawyers to be the most admirably efficient in the world.

Taxation.co.uk, said, “We can’t stress enough how important a nation’s system of tax is – societies are shaped by the way they are taxed. A large part of a nation’s destiny – whether its people will be prosperous or poor, free or subordinated, happy or depressed – is determined by its system of tax.”

They also said that the UK’s tax code is eight times longer (and considerably less readable) than the longest novel ever written.

Their taxes and regulations also punish aspiration and those who seek to better themselves. Landlords, for example, are having a tough time of it recently – after years of fiddling with the way property is taxed (in HMRC’s favour of course), property investors now face a rough decade of trying to make their properties “green”.

From installing car charging points outside houses (how do you do that on a terraced street?), to insulating lofts and wall cavity spaces, to replacing boilers with costly heat-pumps, at what point is the landlord meant to draw a decent profit? Landlords don’t take substantial financial risk to provide housing out of the goodness of their hearts. Soon, what will be their incentive to keep providing housing to renters?

People

The most annoying thing of all though could be people. People don’t fact check and believe everything they hear.

This meme always makes me laugh, “Don’t believe everything you read on the Internet just because there’s a picture with a quote next to it.” – Abraham Lincoln.

Just the other day, Ben was telling me about some revolutionary wisdom he had just read about. It was Warren Buffett’s three-step productivity strategy, which has been dubbed as the “25/5 Rule”. He was about to enact it in his own life, only to find out that it was complete nonsense and Buffett never even said it.

Also, people are prone to whinging a lot and then making preposterous suggestions that would never work in the real world. Hopefully we’ve not done any of that today.

I don’t help myself because I listen to talk show radio shows like LBC, where any idiot is given airtime when they ring up. One such ludicrous suggestion is that MPs should earn minimum wage, so they can see how difficult it is to live on. I’ve lost count how many times I’ve heard people say that MPs get paid too much.

Despite all the criticism MPs get for doing a poor job, if anything they don’t earn enough for what the job involves. FYI, the basic salary for an MP is about £82k.

One major reason why many MPs are so useless is because the wage is so low, compared to wages for the top jobs in the private sector. The right person for the job instead chooses to work as a director in a large business and often earns many hundreds of thousands of pounds, so why take a stressful job as an MP for relative peanuts?

For reference, the director general of the BBC earns a staggering £525,000 per year, which is about 3 times as much as the prime minister. Come on people, MPs are hardly making the big bucks. Do you really want drunk Dave from the pub running the country?

The same applies to company directors. We want the best people running our great companies, and they demand a very high wage.

Another thing that frustrates us is people whinging about wanting a higher wage for themselves and taking no action. We’ve even spelled out to friends and colleagues exactly what they need to do, and yet many years later they’re still doing the same job for the same pay and still moaning.

As a minimum, these people simply need to inform their manager that they want more money. Your boss isn’t psychic, so probably doesn’t even know you’re unhappy – or it’s easier to ignore if you don’t raise the issue.

What’s annoying you right now? Have a moan in the comments below.

Written by Andy

Featured image credit: altanaka/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: