Whether you’re an aspiring first-time-buyer or are already on the housing ladder, it pays to know what the best mortgage deposit size is. That is, the optimal amount of cash to stump up upfront to buy a house.

Getting it right can make your house deposit one of the best investments you’ll ever make; and getting it wrong by overpaying can leave you much worse off than if you’d just put that money into your pension or ISA instead.

Not only that, but the range of possible mortgage types on the market can be totally overwhelming. Do you choose a lifetime tracker mortgage, or maybe a 3-year fixed? Should you get one with arrangement fees if it means the interest rate is lower? Is there an advantage to getting a 10-year term instead of a 30-year term?

In this post, we’ll be answering all of your mortgage questions, plus we’ll cover stuff you’ve never even thought to ask.

By the end, you should know what type of mortgage you need, and be confident that you’re making the right financial decision for you. Let’s check it out!

Are you wanting to buy a property to run as a Buy-To-Let investment, but don’t know where to start? Check out the Find Me A Property page, our property sourcing service finding the right property for your investment needs.

Investors have the option of having the whole process of sourcing, buying, and renting to tenants run for you, making the entire process as passive as it can get but still producing excellent investment returns of potentially 20%+.

Alternatively Watch The YouTube Video > > >

What’s The Best Deposit Size?

For you the answer might be as simple as “whatever is the smallest amount I can get away with”, which with some lenders is 5%. We’re going to show soon just how big a mistake a 5% deposit is financially, if you can afford to put more down.

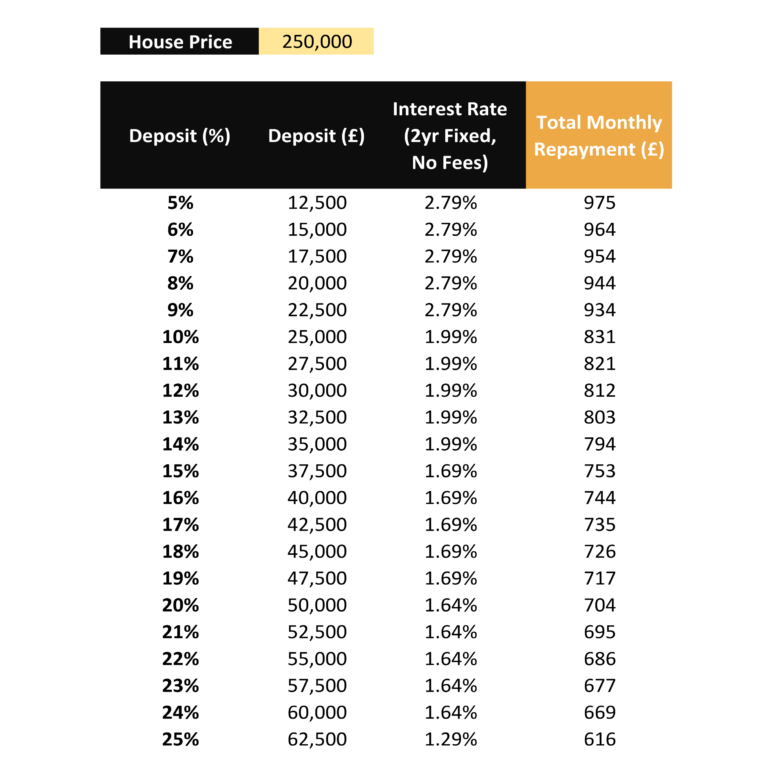

Assuming you can afford to pay a deposit exceeding 5%, let’s kick off by looking at the monthly repayments in the 5%-25% deposit size range:

The table shows the possible deposit sizes, the interest rates you’d be charged on the most popular products as of November 2021, and the money that would come out of your bank account each month, which includes interest and capital repayments – all on a hypothetical house worth £250,000, the UK’s average house price.

Comparing the monthly repayments are as far as most people get when deciding on a deposit size. They notice that a higher deposit means lower monthly repayments. There’s a quite a difference between 5% and 25%, with 25% deposits paying over a third less each month. So higher is better, right?

Not necessarily. For one thing, finding an extra £2,500 seems a lot of extra money to have to save up just to reduce your monthly bills by £10 (as in the case of moving from a 10% to an 11% deposit). And looking at the monthly repayments is far too simplistic a way to choose the optimal deposit size. Here’s what we’d do instead.

You need to think about your deposit as an investment and calculate the different rates of return for each deposit size in terms of how much mortgage interest it saves you from having to pay. It might then be obvious that chucking an extra £10k into your house deposit is not worth it financially.

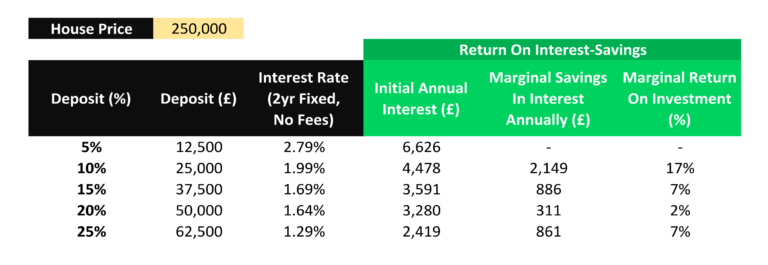

This table below looks at the marginal advantage of increasing your deposit size by 5% from one level to the next, in terms of Return On Investment. The interest rates that banks charge you move down in steps of 5% deposit sizes, so it makes sense to choose a deposit size in 5% increments.

A 10% deposit can get a 1.99% interest rate on a no-fee 2yr fixed rate mortgage. That’s a lot smaller than the best available rate on deposits between 5% and 9%, which is 2.79%. On a £250,000 house you’d save £2.1k in interest in Year 1 with a 10% deposit versus a 5% one. That is a 17% marginal rate of return on the extra £12,500 required.

A 17% return makes this likely to be the best investment you’ll ever make. If you can afford a 10% deposit, it’s therefore a no brainer. If you go higher than this to a 15% deposit, the extra £12,500 required will earn you a 7% return.

You might think it’s not worth the struggle to find an additional 5% deposit for a 7% marginal return on investment when you can get higher than this in the stock market. But remember – this is a guaranteed return.

Our workings show that a 20% deposit is not a good decision – you’d be better off stopping at 15%, since a marginal 2% return can definitely be beaten by almost any other type of investment. But what about somewhere in between like a 16% deposit?

Going for 16% instead of 15% only saves you interest on the additional deposit money – so a tiddly 1.69%, the same as the interest rate. Whereas choosing 15% instead of 14% has a huge difference, because it brings down the interest charged on the entire borrowed amount from 1.99% to 1.69%.

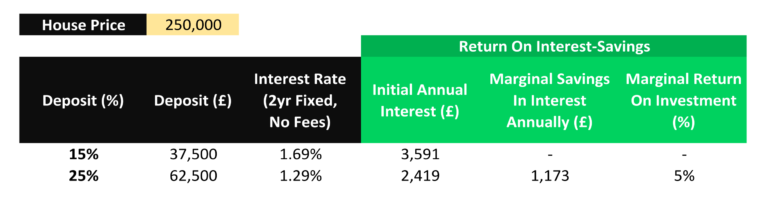

A 20% deposit is a bad decision based on these interest rates, but 25% looks ok. The decision must therefore be between a 15% and a 25% deposit. If we compare the 2, the marginal return on investment from the extra deposit money is 5%:

But is it worth saving up an extra £25,000 just to get a 5% return on it, when you can get better by investing that capital elsewhere?

For example, that £25,000 could be invested into a Buy-To-Let property, that might make you a 20% annual return. Your money is still invested in the property market, just a different set of bricks to ones you’re living in.

Our overall conclusion is that it’s worth going for either a 10% or a 15% deposit on your home, but no higher – and nothing in-between!

Current homeowners should be aware that you can retrospectively reduce the deposit size in your mortgage when you next rearrange your mortgage deal – often called equity release. Read more here. It might make financial sense to free up cash that’s not really helping you save much interest and reset your equity to 15%.

You should carry this exercise out yourself on your own specific mortgage options, as our example looked at just one type of mortgage, a 2-year fixed. Let’s next look at the different types of mortgages you can choose from.

Fixed, Variable Or Tracker?

This is the first thing you’ll need to choose and will depend on your attitude to risk. Fixed rate mortgages lock in an interest rate for typically 2-15 years and are the most popular mortgage type.

After this you can easily swap provider to another deal, or else fall onto what’s called the Standard Variable Rate – a bad idea, since it’s typically very expensive.

With fixed rate mortgages you know what amount you’ll be paying each month, which is good for budgeting, and also means you won’t be hit if the Bank of England raises interest rates because yours are locked-in. However, the interest rate you pay is typically higher than the other options, since you need to pay for the lower risk.

In theory, variable mortgages are meant to have lower initial interest rates than fixed mortgages, but often they don’t – here’s a fixed and a variable that both charge the same.

Variable mortgages are higher risk than fixed, since the bank can change the interest rate as they like. A more transparent alternative to variable mortgages are tracker mortgages, which are still variable but vary strictly in line with the Bank Of England base rates, as opposed to the whims of your mortgage lender.

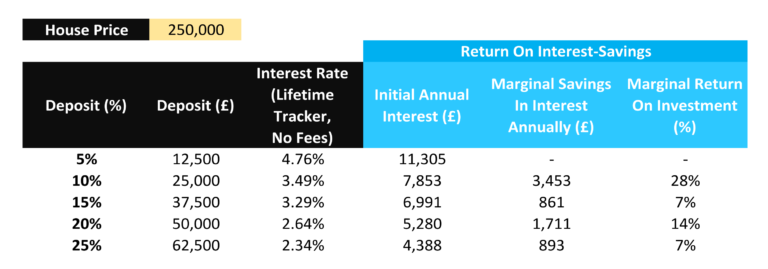

Tracker mortgages can be agreed for a period of time, say 2-5 years, and there are even lifetime tracker mortgages available. A lifetime tracker locks in your interest rate above the base rate for the entire life of your mortgage, usually without Early Repayment Charges. They can be more expensive though as you get so much flexibility.

Early Repayment Charges are large fees imposed on you if you want to change your mortgage deal within an introductory period. Examples of when you might need to do this are an unplanned house sale, or if you want to release equity.

We also did the deposit size test on lifetime tracker mortgages and found that the interest rates were so high at the lower deposit levels that it made sense to go for a 20% or 25% deposit size:

How Long Should I Lock-In For Initially?

Most mortgages come with an initial term between 2 and 15 years. Using a fixed rate mortgage as an example, a 2-year fixed would lock-in an interest rate for 2 years, after which you’d be advised to rearrange your mortgage deal. But is it better to go for a short fix, or a long fix?

Short fixes of 2 years are better for those with an investor’s mindset, since the interest rates are lower due to the extra risk you take on by not knowing what interest rates will be like in 2 years’ time when you come to remortgage.

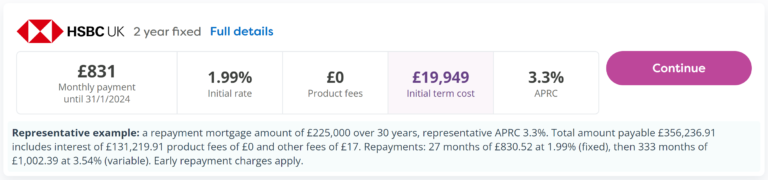

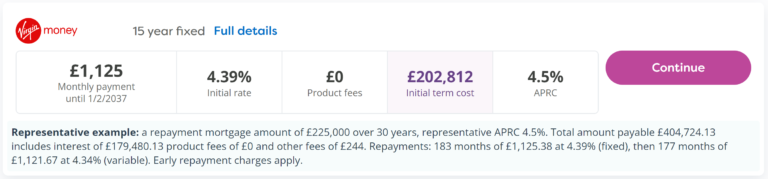

Here’s screenshots of a 2-year fix and a 15-year fix, each with a 10% deposit. The 15 year fix will cost you an extra £53,000 over the term, assuming rates stay the same – though rates likely will increase over the next 15 years:

Short fixes also mean you’re less likely to come foul of an Early Repayment Charge, as you can more easily work around life’s little surprises in a 2-year window.

I’d like to release a little equity from my house right now by switching provider, but I can’t without incurring a huge penalty because I’m locked into a 5-year fixed term.

Repayment Or Interest Only?

Most mortgages on residential homes are repayment mortgages, and you don’t really have a choice in this except in special financial circumstances.

Interest-only are usually reserved for those in financial difficulty as an interim measure, or for the very wealthy with an approved future repayment plan in place. This is totally different to the situation with Buy-To-Let mortgages for investors, for which interest-only is the norm.

Repayment means you effectively make 2 payments a month, usually grouped together into one amount. One payment is the interest payment, determined by your interest rate. The other is to pay down the loan, determined by the length of the mortgage term.

Interest-only literally means you only make the interest payment – you do not pay off the loan.

Fees Or No Fees?

You’ll notice as you skim through price comparison sites that it’s a mixed bag of mortgages that charge either some product fees or none.

These are one-off mortgage arrangement fees, that are charged each time you arrange or rearrange your mortgage, which might be every couple of years if you choose to do 2-year fixed terms, for example.

You usually have the option of either paying them when you sign the deal or adding them onto the mortgage loan and dealing with them later.

This second option means you pay interest on the fees over the term of your mortgage, but the value of the fees themselves will depreciate against inflation over the decades, which may more or less offset the additional interest paid. On this logic, we would tend to add the fees to the loan.

What about those products that charge zero fees? Are they better?

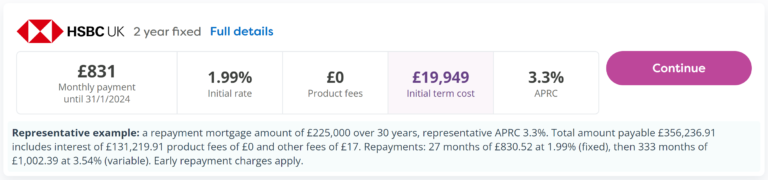

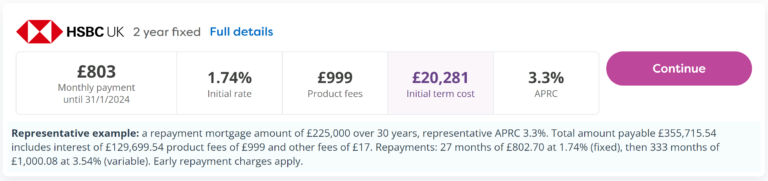

Well, the ones that don’t charge fees tend to have a higher interest rate to compensate, so what you really need to look at is the total cost in the initial fixed period. Here, the one with the higher interest rate and zero fees has the lowest overall cost in the initial term:

How Long Should The Mortgage Term Be?

Many providers now allow you to take out a mortgage over 40 years. This is significantly longer than what used to be available. 25-year mortgages used to be the norm. But is there an advantage to a longer mortgage term? Or is it better to set the term short, so you pay your mortgage off quicker?

It’s much better to go long. Taking a short term of say 10-years ties your hands, meaning you have to pay huge monthly payments or risk defaulting on your mortgage. While a long term means you can still make large overpayments if you choose to, but you don’t have to.

Many lenders charge you if you make overpayments of more than 10% of your initial mortgage balance, but that means you could get away with making overpayments of 10% for the first 10 years of a 40 year mortgage, fully paying off the loan and incurring no fees.

Therefore, it’s better to get a long-term mortgage, reduce your mandatory monthly payments, and overpay if you want to. But don’t feel the need to overpay!

Realise that a mortgage is amongst the cheapest and most manageable debt you will ever have, and approaching it with an investor’s mindset reveals how it might be better to put your excess cash instead into other, more profitable assets, like buy-to-let investing.

What type of mortgage do you think is best? Join the conversation in the comments below!

Written by Ben

Featured image credit: fasphotographic/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: