When you’re several years or even decades away from your financial freedom goals, your mind turns to crazy ideas to speed up the process. Could you just sell up the house, ditch the mortgage, buy a caravan, and declare yourself financially free? Thoughts like this have surely crossed your mind if you’re pursuing financial independence but are still years away from retirement.

After all, a holiday home at a beautiful caravan park by the sea might cost £60,000 to buy – that’s a damn sight cheaper than any house made of bricks, other than in the most deprived of areas.

You wouldn’t want to live in a cheap, run-down 1-bed flat in a horrible area for the rest of your days. But maybe a static caravan in a gated community wouldn’t be such a bad way to live, for the same upfront price.

Or maybe you’d like to tour the world in a mobile home? Is that much cheaper than owning a house?

If you could drive down the most significant cost of living – housing – while still enjoying life, that would be a great way to reach retirement earlier.

In this article we’re looking at the real costs of doing exactly this; whether it’s a feasible early-retirement solution; and how many years it can knock off your working career. By the end you’ll know whether this early-retirement strategy lifestyle is right for you.

Alternatively Watch The YouTube Video > > >

The Dream

The dream for many in the financial independence community is to retire young, or at the least, earlier than the state pension age.

The dream will usually involve travel, or spending your days on the beach, or just escaping the hustle and bustle of city life. Why not do that right now by buying a cliff-top static caravan overlooking the sea, or a motor home to drive around Europe in?

If it means you’re not having to pay a big mortgage each month and you get to see more of the world, it sounds on paper like an exciting (if radical) route to financial freedom.

Stated in financial independence language, it feels like it should allow you to reduce your required retirement pot size, and hence the number of years until you can retire – perhaps right down to today.

Retiring Earlier

We’ve built a handy early retirement, or FIRE calculator, here, that you can use to work out how many years away you are from retirement; and crucially, how big your investments need to be to get you there.

That’s how big in £s your retirement portfolio needs to be to allow you to live fully off the income that those investments provide.

To kick start your own investment journey, check out the deals on the Offers page which include a free £50 cash bonus when you open an investment account with InvestEngine or Loanpad, or free stocks when you open accounts with Freetrade or Trading212, plus a bunch of other stuff. Our investment guides will help you to choose the right platform or pension provider for you.

As an example, the required portfolio size for my family to retire early is £900,000, which should allow us to withdraw an income of £36,000 a year using a 4% withdrawal rate.

But that’s based on the assumption that we’ll continue to live in a house worth £300k at today’s value of money in our early retirement. If we could make a trade-off of living space for a reduction in living cost, maybe that retirement pot size could be a lot smaller, and we could start living our best lives sooner.

Static Caravans

Let’s kick off with the actual costs involved in rebooting your life in a static caravan overlooking the sea in the UK. This involves living at a holiday park in a holiday home like this one, with on-site facilities typically including a shop, a pub and kids’ clubs, in a community of like-minded people.

Is it cheaper than running the average UK home? You’d better hope so, since you’ve got just a tiny fraction of the floorspace!

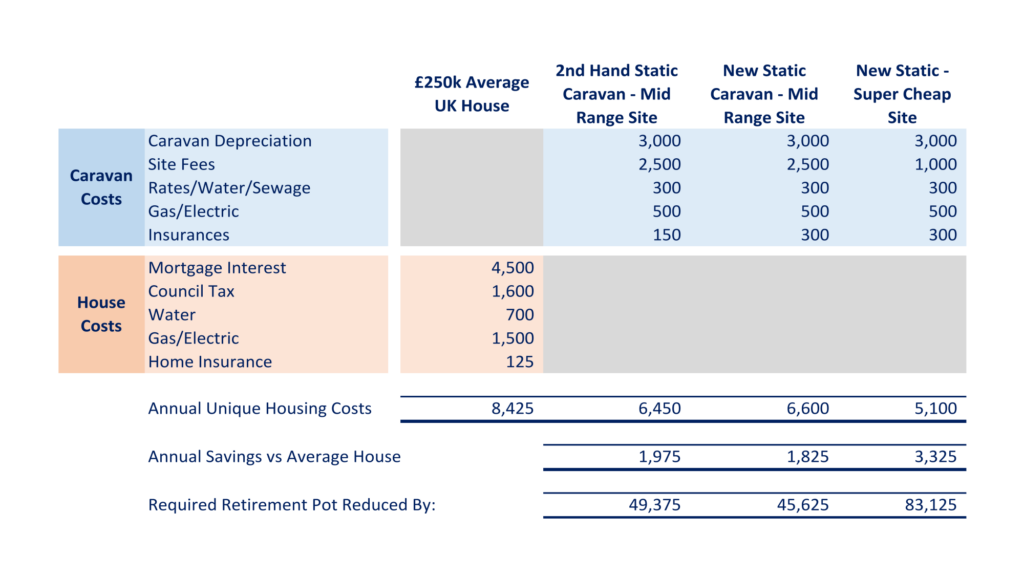

Yes, it IS cheaper, but not by as much as you might expect:

Let’s kick off with the actual costs involved in rebooting your life in a static caravan overlooking the sea in the UK. This involves living at a holiday park in a holiday home like this one, with on-site facilities typically including a shop, a pub and kids’ clubs, in a community of like-minded people.

Is it cheaper than running the average UK home? You’d better hope so, since you’ve got just a tiny fraction of the floorspace!

Yes, it IS cheaper, but not by as much as you might expect:

The standalone costs of running a £250k average house are around £8,400 a year by our estimates – this excludes ever-present costs like internet, which you’ll be buying regardless of where you’re based. The saving you’d make by moving to a static caravan might just be a couple of grand a year.

If you look at the split of the costs, the big ones are caravan depreciation, and site fees. A big problem is that caravans have a life of around 20 years, before they depreciate down to nothing.

They are made of plastic, wood and sheet-metal, and are not built to last forever like a house is.

Surprisingly, there’s not a great deal of difference between buying new or buying second hand – an average second hand one might cost £30k and last you 10 years, while an average new one might cost £60k and last you 20 years – either way, it costs you about the same, as a yearly average.

The site fees really sting you, with even a mid-range site costing £2,500 a year. You could cut these fees to £1,000 a year if you were happy to pretty much live in a field with no facilities other than your gas, electricity, and water.

If you went down the static caravan route to retire faster, you might shave up to £83k off your required portfolio size.

Not exactly life-changing, but – (a) you do get to retire a little sooner, and (b) if you wanted to live like you were on a permanent holiday now, this ticks that box.

The Max and Paddy Option

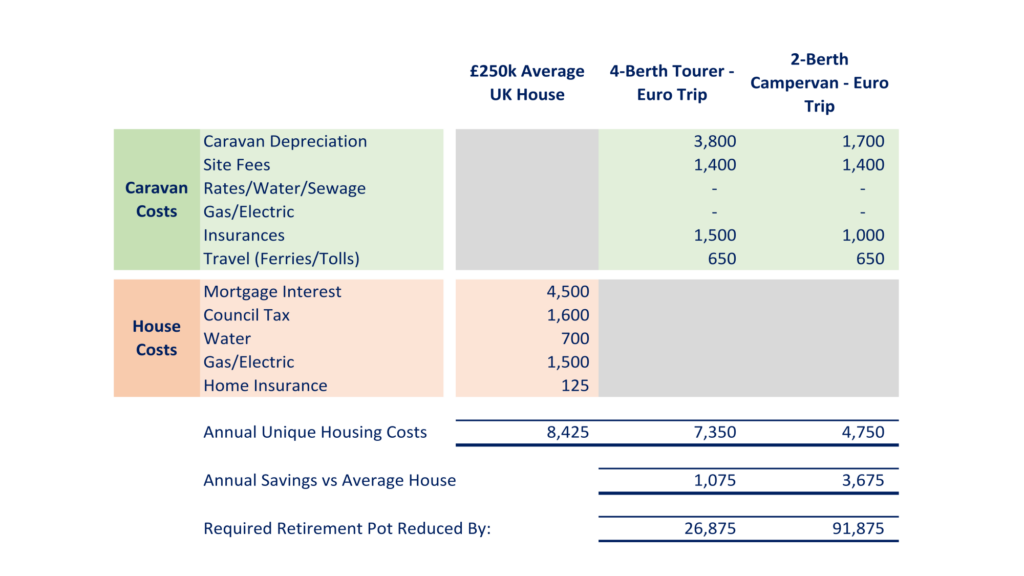

Statics are expensive, no doubt. But motor homes and campervans ought to be a lot cheaper, as they’re smaller and your standard of living is far less luxurious.

But as this is a life on the road, it may only appeal to a certain brand of financial freedom fighter who pictures their early retirement being one of travel and exploring the world.

Here’s a couple of options – a decent 4-Berth tourer, and a little 2-Berth campervan, both making use of campsites around Europe:

This lifestyle would fit someone who was able to work remotely from their laptop.

The tourer works out as a more expensive lifestyle than the static caravans, and just a little cheaper than owning an average house. The little campervan saves you the most money, reducing your required retirement pot size by £92k.

What’s obvious from these numbers so far is that taking the radical step of selling your home to live a cheap life in a caravan isn’t all that realistic financially.

It’s not the extreme early retirement shortcut that we had hoped it would be.

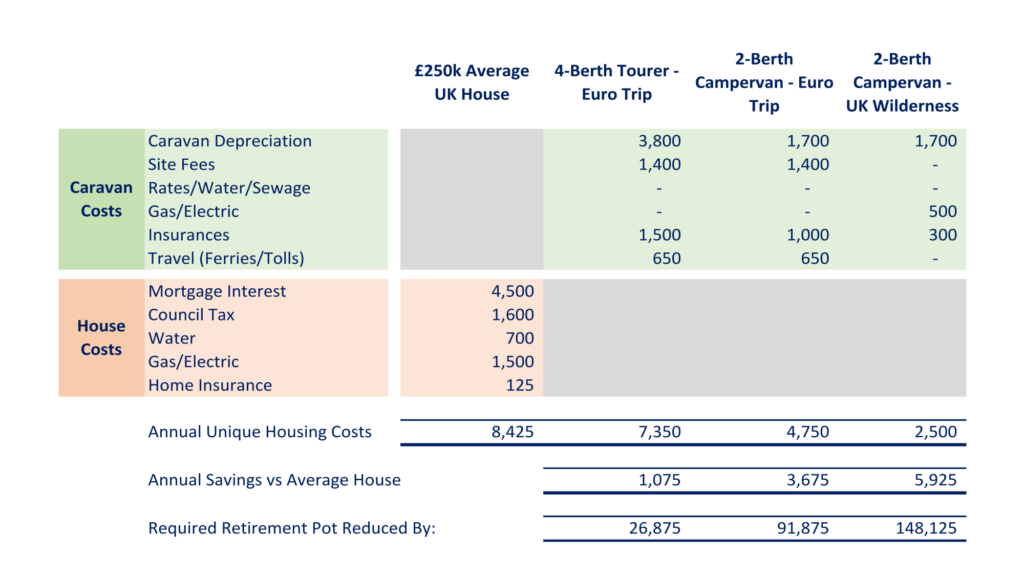

It CAN Be Done Cheaper

The site fees are the real killer, and could be avoided if you really wanted to make this lifestyle change work.

In the UK, campervans are allowed to park at the side of most roads overnight, and you’re allowed to sleep in them. If you’re travelling in England and Wales, there are still places that you can go wild camping, such as the Lake District and parts of Dartmoor. You’d have to source your own gas, and presumably use public washrooms.

But this could shave nearly £150k off your required retirement pot size (3rd column):

If this was the lifestyle you wanted to live in retirement, you might only need £300k or less in total to draw a very basic income, so this saving is significant.

You could also go really cheap and live in a knackered old caravan in the wilderness or even on an old canal boat for just a couple of grand upfront cost, with no site fees.

For the static caravan enthusiasts, make sure you pick a site that allows you to rent your caravan out to tourists. You could make back a few grand a year by renting it out while you go on your holidays elsewhere.

Other Things To Consider

While you own a house, you’re on the property ladder, and your property is likely going up in value. Not only that, but if you have a mortgage, you’re getting leveraged growth on your equity due to the mortgage debt.

If you have a 10% deposit in the house and a 90% mortgage, and if property prices go up by 10% one year, your equity just went up 100% (which is the 10% rise in house prices divided by the 10% deposit).

If you own a caravan instead, your money has likely been either (a) used to buy the caravan, (b) sat pointlessly in a bank account, or (c) invested without leverage in somewhere like the stock market.

You could of course keep your property and rent it out to someone else to cover all the bills, while you move into a caravan. This could be the best of both worlds.

You should also consider that the cost of saving up to buy replacement caravans never stops, while at some point the mortgage interest payments would stop on a house, once your mortgage is paid off.

These advantages of property are difficult to quantify and depend on your own circumstances. But this next point is pretty universal: UK winters suck!

If you really wanted to go down the caravan route, just remember how cold it can get in January, sat in a glorified shed on a cliff top.

A Nice Holiday… But A Retirement Hack?

Having a second home at a caravan park is a nice way to spend the summer if you can afford it – but it’s probably not worth having one as your main residence as an early-retirement hack.

That said, if you’re up for this lifestyle one day in the future when you’re actually retired, it’s good to know that it is a slightly cheaper way to live and you can still factor this annual living expense reduction into your retirement plans.

Or if you’re at the point now that you could declare yourself financially free with a caravan, then the benefits of staying on the property ladder might no longer interest you – you’re free, so it’s mission accomplished.

Alternative Early-Retirement Living Arrangements

Let’s face it, the reason you might be even considering living in a caravan is because housing is so damn expensive in the UK! Here’s a few other ways we can think of that get a similar result in terms of speeding up your early retirement date:

#1 – Move Abroad

If you’re willing to live in a caravan, then you’re probably willing to do just about anything to retire early. So why not move abroad to somewhere super cheap?

Places like Thailand and Spain are great places to stretch your money to the max. Obvious hurdles to overcome are the language barrier, and being far away from family and friends.

This lifestyle is suited to someone who can work remotely from anywhere, which as this last year or two has shown, is perfectly possible for most office jobs.

If you can work for your company from your bedroom during lockdown whilst getting paid in British pounds, you can also do the same work from a cocktail bar in Thailand and be paid in British pounds. With the cost-of-living difference, you could live like a king.

#2 – Co-Habit

This one is all about getting someone else to pay towards your mortgage, or splitting the cost of a place that you rent with friends. You could rent out a room in a house you own, or you could group together with friends to buy or rent a house together.

You could even convert a house that you buy into a duplex – two entirely separated homes within one building. This should add enormous value to the property, and means you can rent out half the building to a tenant for a regular income.

#3– Just Downsize A Little

It doesn’t have to be all-or-nothing. You could downsize your home a little, or maybe move to a cheaper city.

If you can save even a few hundred extra pounds a month on your mortgage and bills, that could go a long way towards reaching your early retirement goals faster.

Is downsizing to a nice static caravan or mobile home something you’d ever consider, or something you’ve already thought about? Join the conversation in the comments below!

Written by Ben

Featured image credit: Duncan Cuthbertson/Shutterstock.com

Static Caravan image credit: gbellphotos/Shutterstock.com

Campervan image credit: Andrey Armyagov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: