In previous articles we’ve looked at retiring really young, and there were two themes that were evident:

1) You had to save and invest an enormous amount of money; and

2) Pensions were of little use because they cannot be accessed until your mid to late 50s.

However, if you are willing to retire a little later, such as in your 50s, pensions are an incredibly powerful tool for building up a huge investment pot that can provide you an income for the rest of your life. What’s more, if you’re aware of smart strategies – the kind that we’ll introduce you to today – then you can in effect access your pension pot early.

In this post we’re looking at how you can retire with a £1 million pension at age 50, in today’s value of money. We’ll cover how much you need to save, the benefits of starting as early as possible, some strategies at your disposal, and more. Let’s check it out…

If you’re going to do the following strategy properly, at some point you’re likely going to need to use a SIPP. We’ve compared them all and handpicked our favourites. Check out the Best SIPPs page for guidance.

Alternatively Watch The YouTube Video > > >

Do You Really Need A £1 Million Pension?

How much retirement pot you really need is dictated by your desired income. The more income you want, the bigger the pot required!

Which.co.uk spoke to thousands of their members and they published some really interesting figures on how much money you need in retirement, whether you’re living alone or in a couple.

Couples would need just £18,000 for the essentials, £26,000 for a comfortable income and £41,000 for a luxury lifestyle. The comfortable lifestyle covers all the basic areas of expenditure and some luxuries, such as European holidays, hobbies and eating out. The luxury lifestyle includes all this plus more, such as long-haul trips and a new car every five years.

If you don’t mind popping your clogs and having nothing left to leave to your family, friends or favourite charity, then you’ll be able to drawdown on that pension much faster than someone who doesn’t want to deplete the pension pot. If your goal is to retire at 50, as per the title of this article, you might want to consider trying to maintain the value of your pension for as long as possible.

A good rule of thumb is to use the 4% safe withdrawal rate. We won’t cover it today because we’ve covered it a lot previously but in theory you would need a pension pot of £1,025,000 to achieve that £41,000 per year luxury lifestyle for a couple.

The pension lifetime allowance for most people is £1,073,100 in the tax year 2021/22. Up until the allowance limit, pensions are a very tax-efficient way to save for retirement. Past this mark, they start to become inefficient as the government start hitting you with hefty tax charges.

If you’re hoping to hit that £1m pension and you’re in a couple, you should definitely consider splitting it across the pair of you so you’re less likely to fall foul of the lifetime allowance from further growth, but at the same time you also need to consider the most tax efficient way to save.

How Much Do You Need To Save To Get To The £1 Million Mark?

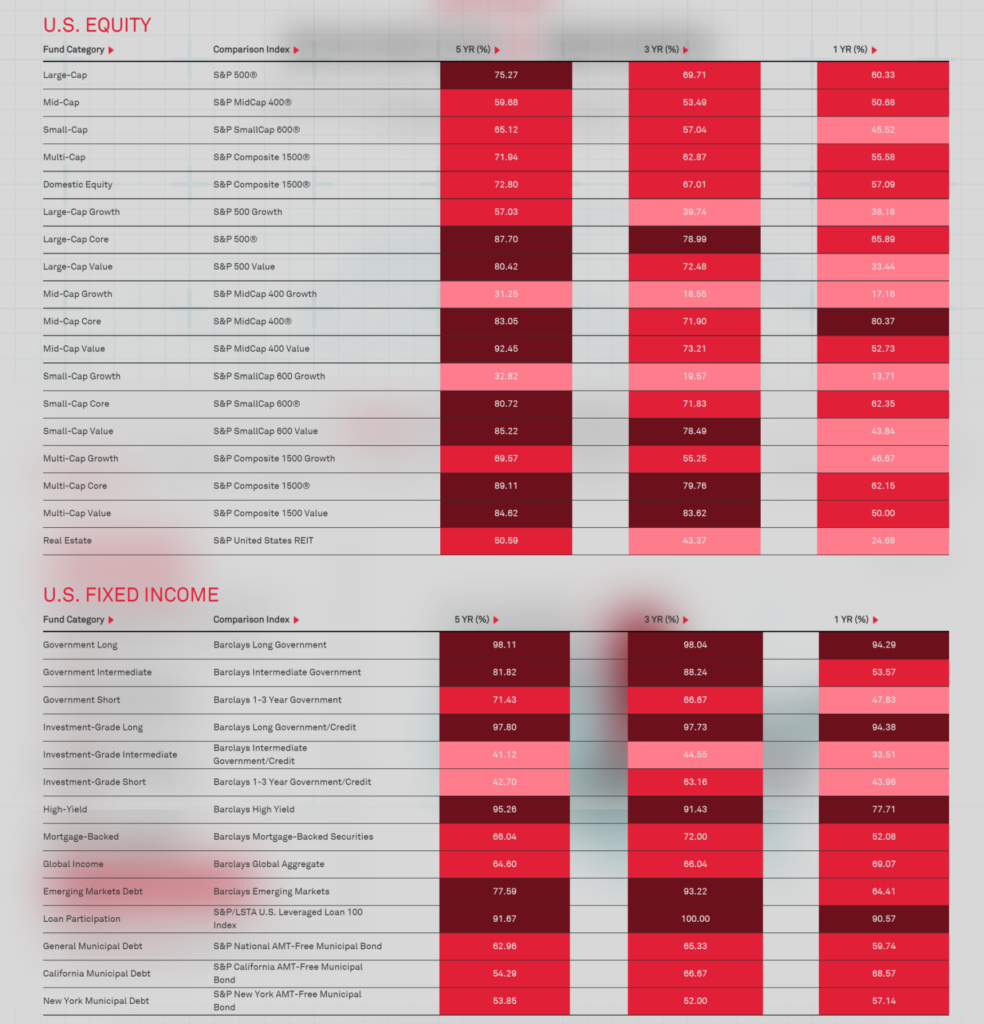

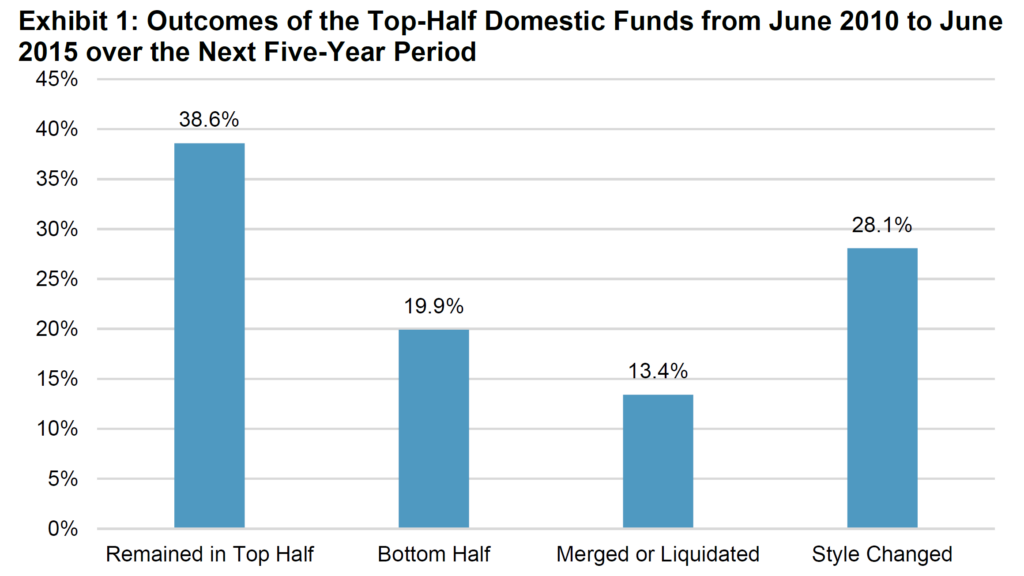

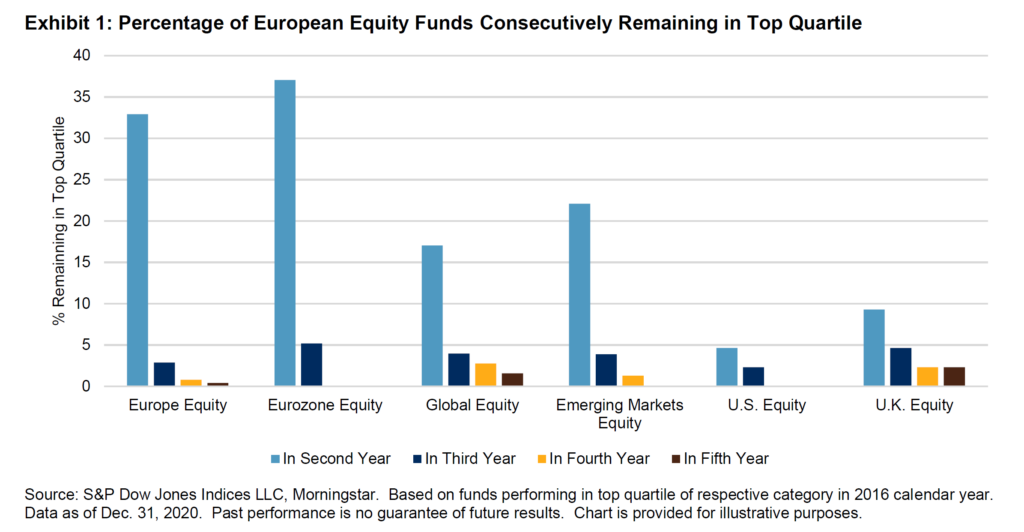

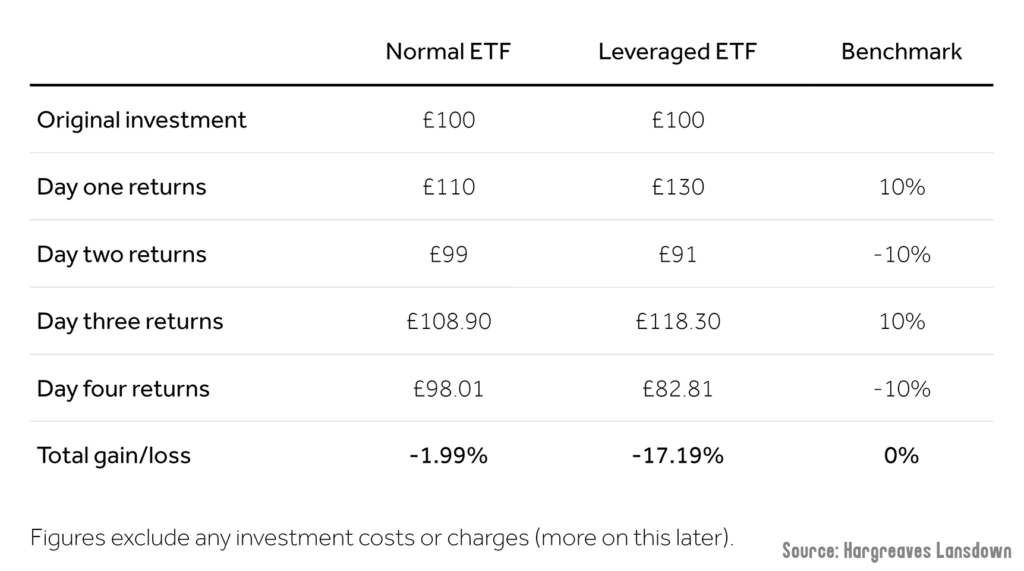

For all the following figures, we’ve used a 5% real rate of return. We always assume that market returns will be 8% based on history and then deduct 3% for estimated annual inflation and investment fees.

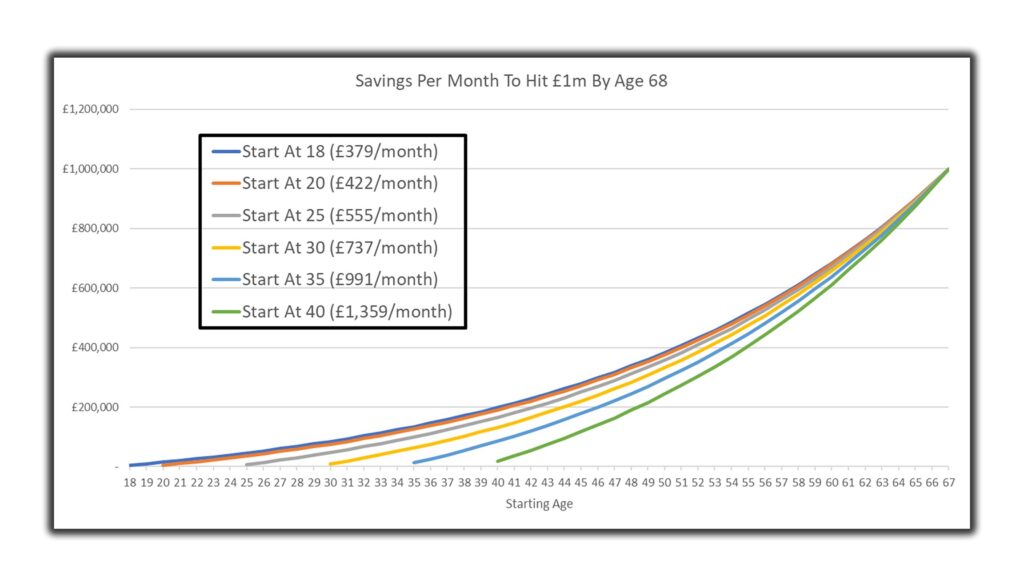

Let’s first look at what you need to save, assuming that you’re going to save into a pension until you hit state retirement age at 68.

The amount you need to save per month depends on your age. As you can see in this chart the younger you are your required savings per month are far lower than if you start later in life. If you’re 25 you will only need to save today’s equivalent of £555 per month. But if you start at 40 you will need to save almost triple at £1,359.

We’d say that for anyone under 30 who wants to be a millionaire it is absolutely within their reach. 30-year-olds only need to save £737 per month. In fact, we’d even say that if you’re 40 you can still quite easily become a pension millionaire despite the seemingly higher savings rates required.

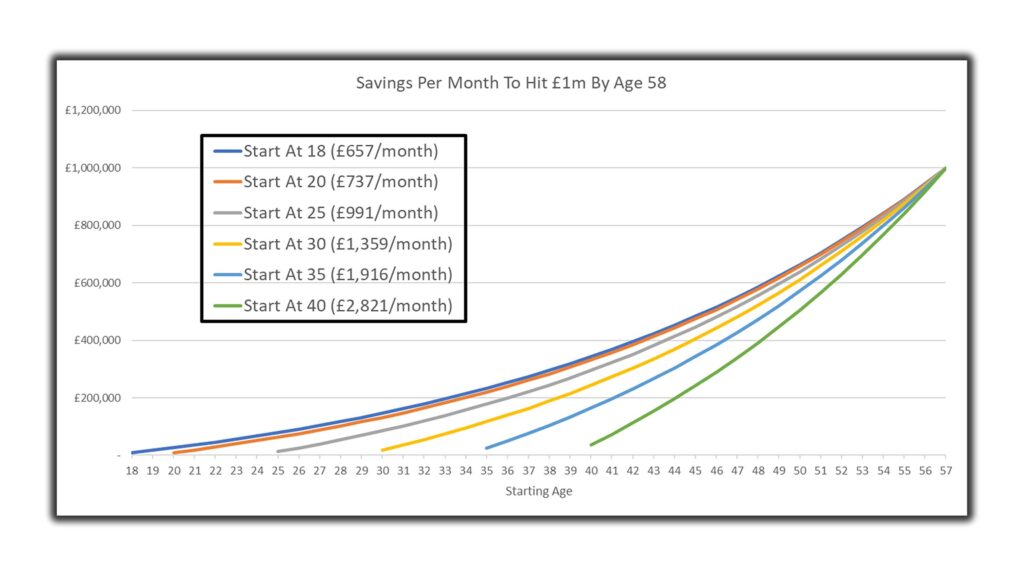

You can access your private pension before the state pension age, so let’s recalculate as if you want to access as early as possible. The current minimum pension age for taking benefits from a private pension is age 55. This is expected to increase over time. For this example, we’ll go with 58, which is probably most likely for those currently in their 30s and younger.

The required savings per month is noticeably higher than when the target date was 68. We have 10 years less to contribute and 10 years less of compounding returns. The later you start the harder it gets, like before, but every year later is so much harder. This is based on 58. Doing it by 50 is probably going to be a Herculean task. Let’s take a look…

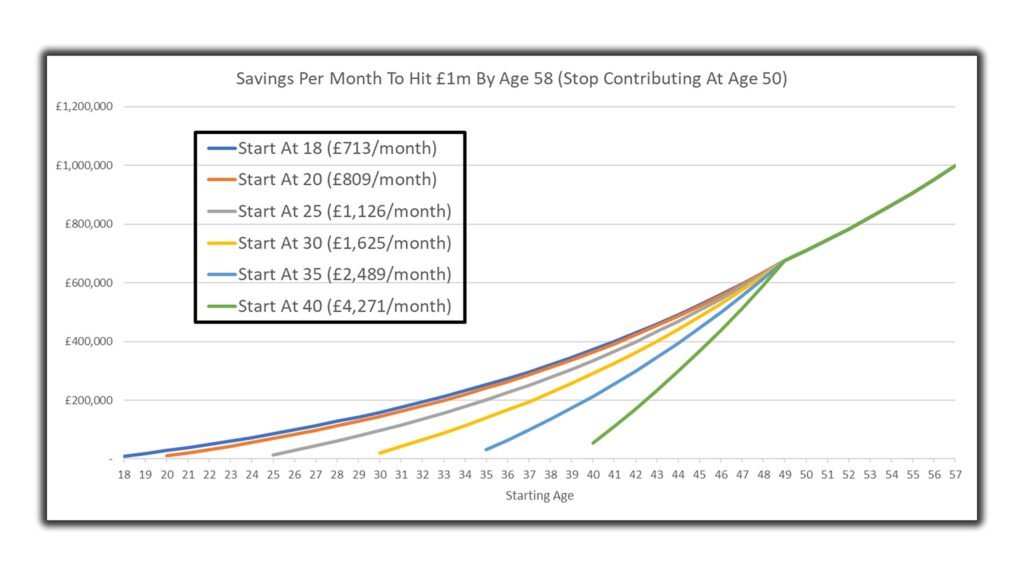

This chart looks different to the other charts because you can’t actually access the money in the pension at 50. So, although you will stop contributing at 50, the pension pot will continue to grow until 58, hence why all the lines come together at 50.

What might surprise you is that the savings per month for the younger ages are not that different to those required for retiring at 58. At that point growth is far more important for compounding than the relatively low contributions.

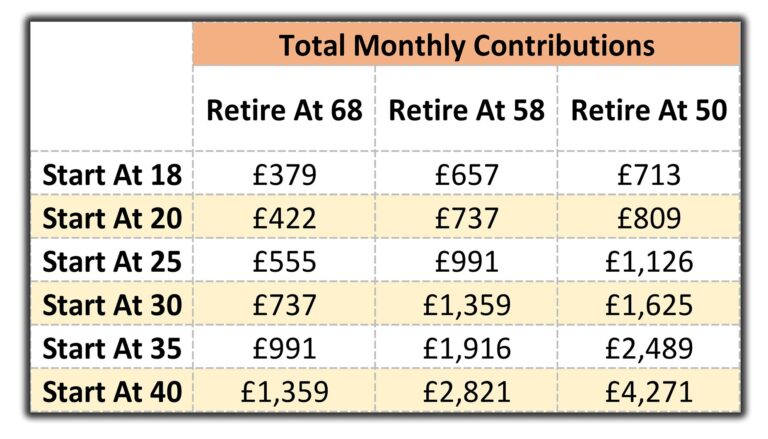

Let’s look at all the figures together to more easily see how they compare. The later you start investing would make getting to £1m a very difficult task indeed. But for those who are currently 30, retiring by 50 looks very doable as you only need to save £1,625 per month.

I imagine that some of you are screaming expletives at us right now because unless you’re on the younger end of that scale some of those numbers are beginning to appear ridiculous. Well let’s take a look at how those numbers can be drastically cut down.

Taking An Axe To The Required Savings

All the numbers we’ve seen so far are the total contributions. The beauty of pensions is that thankfully you don’t need to pay all this yourself. You will get employer contributions and tax-relief, which can be enormous.

There’s also a smart hack that some companies use to avoid National Insurance (NI) called ‘salary sacrifice’, which saves you a bucket load of money. You can then make further contributions to your pension with the tax saved.

Better still, some companies who operate a salary sacrifice scheme will also pass on their employers NI savings of 13.8% to your pension pot too.

All in, this will be an effective boost of 83.8% for higher-rate taxpayers on top of whatever you put in. For lower-rate taxpayers it works out at a still impressive 53.8%.

If that wasn’t enough, if you have outstanding student debt, using salary sacrifice to increase pension contributions lowers the amount you need to pay back each month. This would further increase those figures to 98.8% for higher-rate taxpayers and 65.1% for lower-rate taxpayers.

For the purpose of the rest of the article we’ll assume you have no student debt and so don’t benefit from avoiding that.

Also, some companies don’t offer a salary sacrifice scheme simply because they’ve never heard of it. There’s no harm in asking and perhaps educating them why they should introduce salary sacrifice.

How Much Do You Really Need To Save To Get To The £1 Million Mark?

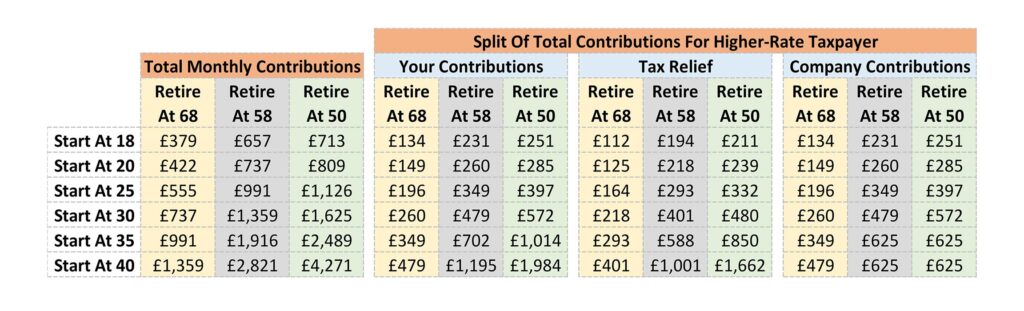

This is what both a higher-rate taxpayer and their employer will contribute to their pension, plus the tax relief they will receive, in order to hit that £1m pension. In this first example shown we’ve assumed a salary of £75,000 and 10% matched employer contributions.

Most companies will pay less than 10% but there are also many who do respect their employees and pay this or even more. If you’re serious about building a £1m pension, then it might be in your interest to seek a good employer out.

That 10% matched limit is why the company contributions are frozen at £625 for some of the ages. It means that you will have to pay in more yourself to compensate for lower company contributions. Hence at 35, to retire at 50, you will pay in £1,014 per month but only receive £625 from your company. Of course, if you earn more or have higher matched contributions your company will pay more than this, meaning you yourself can pay less.

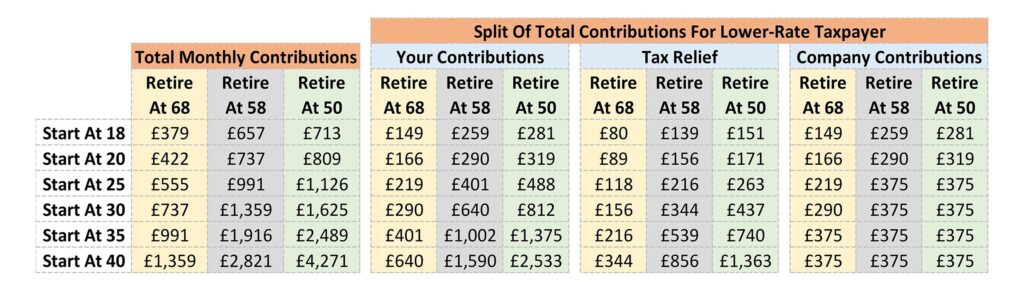

Let’s look at what a lower-rate taxpayer earning £45,000 would have to save. As you can see the lower salary means the employer contributions are capped at £375 per month causing you to have to contribute more yourself. At 30 you would only have to save £812 a month to retire at 50 with a pot that would soon grow to £1m. For those age 40, the required monthly savings are a tall order, requiring £2,533 per month. This can be slashed for those willing to work until 58 and later.

How To Access Your Pension at 50?

As we mentioned earlier you cannot access a private pension until probably 58 in normal circumstances.

Our first lifehack is to take out debt at your chosen retirement age of 50, most likely mortgage debt as it’s very cheap, to fund your lifestyle until you reach the pension age of 58. When you can finally access the pension, you can take a 25% tax-free lump sum, which you could use to pay down the debt should you wish. If you did manage to build a £1m pension that’s a tax-free lump sum of £250,000.

If you had remortgaged your property and extracted £250,000 at age 50, that would give you £31,250 each year to live on. This could be supplemented with any other savings or investments that you hold outside of a pension, such as an ISA.

Our second lifehack also involves using debt smartly, but in the early years of pension building.

The irony of investing is that it’s far preferable to inject lots of money in the early years rather than later, in order to produce better compounding. But inevitably, your salary will be lower in the early years and your pension pot will be small, meaning it’s only in the later years that your pot grows to a size that the compounding starts making an impact.

Why not flip that on its head? By taking on a large amount of low interest debt in your twenties or thirties and investing it into your pension, you can then watch as your pension snowballs over the years from strong compounding returns.

Preferably the debt will be long term, cheap mortgage borrowings like the first hack, so you can defer paying it back for 2 or 3 decades, as before.

Other Key Tips

#1 – Consolidate Old Pensions

Most people will have several jobs or more during their lifetime and accumulate multiple pensions. This not only makes them a pain in the butt to manage but also many of them will be expensive and underperforming.

In many cases it’s worth consolidating them into one easy to manage, low-cost SIPP. Before doing this do your research and perhaps speak to a financial advisor if you’re unsure.

#2 – Partial Transfer Your Existing Workplace Pension

Following on from the last point, it might be worthwhile partially transferring your existing workplace pension into a SIPP if your existing pension is costly or badly run. Many workplace pensions have poor investment options and are likely to not be invested according to your risk profile and goals.

We’re suggesting a partial transfer because otherwise your employer will likely stop contributing, which you want to avoid. Before doing a partial transfer make sure your existing pension provider allows this.

#3 – Ramp Up The Risk

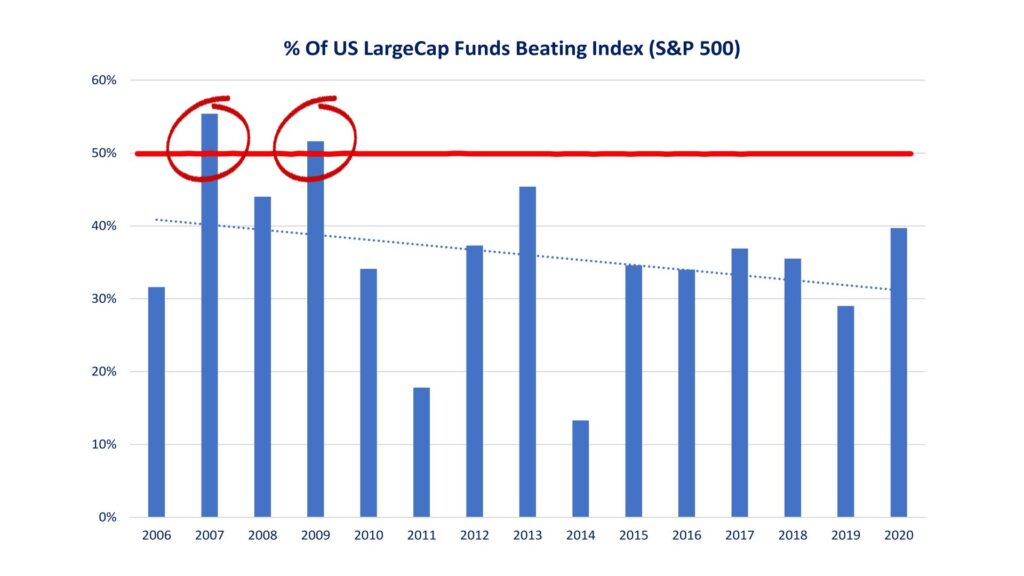

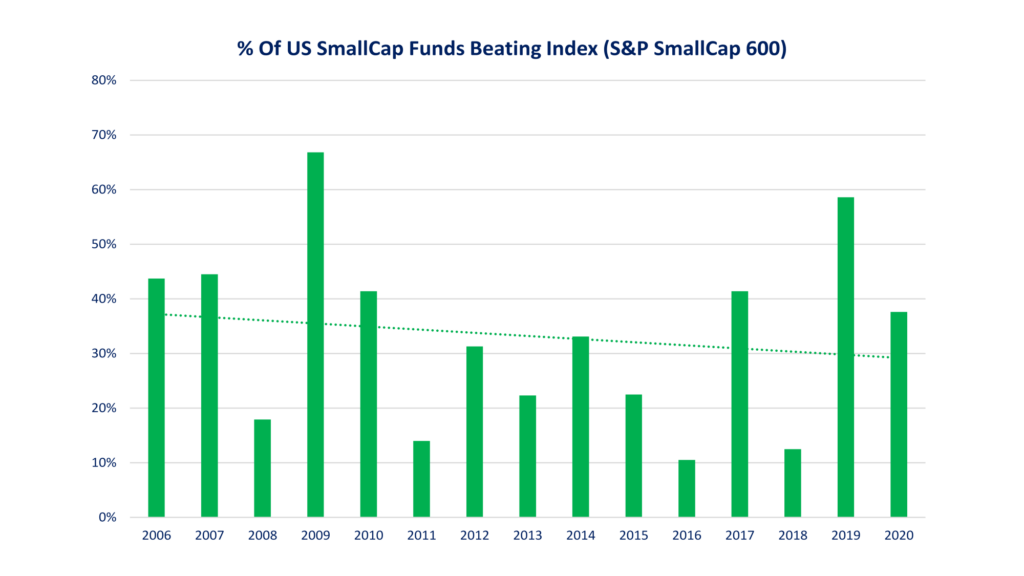

Generally, the higher the risk, the higher the potential reward. To build a £1m pension is no mean feat and will require great returns. In this video we think we’ve been quite conservative using just 5% real returns, and if you increase risk, we think there is a good possibility that you will get returns exceeding this.

#4 – Use Your Spouse’s Pension Too

If you’re fortunate enough to have a spouse who has a good workplace pension too, then take full advantage of this. You’ll get even more employer contributions and will now have two salaries to make quick work of those required savings rates.

Also, on your own you will likely eventually breach your pension lifetime allowance if you have a pot already worth £1m at age 58 as it will continue to grow. If that was spread across two people’s allowances, that is much better.

#5 – Don’t Neglect Your ISA

Pensions are incredible, but Stocks & Shares ISAs are also extremely powerful in their own right. Together they can be used to balance tax efficiency and accessibility. Check out this article and video next to learn how they can be strategically used together to retire early.

Were you surprised by just how little of your own money is required to become a pension millionaire? What’s your retirement strategy? Join the conversation in the comments below.

Written by Andy

Featured image credit: Rus Limon/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: