We spend a lot of time looking at ways to become financially free and retire early should we wish. We regularly look at ways to slash unnecessary spending, boost income, invest better, reduce taxes, implement early retirement strategies and more.

And today we’re looking at an in-depth review of the current batch of retirees to see if we can learn anything that will help our own finances and retirement preparations.

Standard Life Aberdeen, an investment company, have surveyed 2,000 UK adults who were either due to retire in the next 12 months, or had retired in the past 12 months.

The report they’ve published is a treasure trove of information looking into the minds and finances of those retiring. In this video we’re going to share with you all the key points, so we can learn from those who’ve done it. Let’s check it out…

And don’t forget: we have hundreds of pounds worth of offers, like free stocks with Trading 212 and Freetrade, plus many more, up for grabs on the Offers Page.

Alternatively Watch The YouTube Video > > >

Redefining Retirement

Only a few a years ago, before 2011, employers used to be able to force workers to retire at 65 (known as the Default Retirement Age). A few years later saw the most radical changes to private pensions for a generation, as everyone was given more choice in how they take their private pensions – previously they were almost always forced to buy an annuity.

These, plus many other factors have contributed to the changes to what it means to be retired.

We’d say there used to be a perception that retirees were sitting around and waiting to die – let’s not forget that it wasn’t that long ago when they were frequently called old age pensioners, which isn’t the most flattering of terms.

According to the Standard Life Aberdeen report, there is a noticeably growing trend towards flexible retirement and continuing to work in SOME capacity.

56% of the 2021 retirees don’t plan to give up work altogether, and 27% will work part time to support themselves. It’s not clear whether they are doing this out of necessity, but we suspect that many want to work a little.

We’ve long said that work is not the problem. It’s the number of hours of forced labour that you have to endure every week that’s the issue. It leaves no spare time to relax and enjoy yourself, but working on your own terms is a very different story.

If we apply this logic to our own early retirement plans, then maybe we don’t need to build such a large freedom fund after all. Maybe we should be looking to partial FIRE instead. FIRE stands for Financial Independence Retire Early.

Back to the report, 6% of the retirees want to set up their own business and 45% are looking forward to learning new skills. We can totally relate to this having ourselves always wanted to start a business, and the fact that these retirees now have more time and far less financial risk should they fail, means they can finally do what they always wanted.

What Does It Mean To Retire In 2021?

The average age of the retirees in the survey was 60. Three quarters were married or in a relationship, and the rest were not.

The average value of their pension pots is £366,000, which in our opinion seems a very good haul considering most people are very lax when it comes to retirement planning. Worryingly though, a third have less than £100,000, which has no chance of lasting for any meaningful amount of time.

On average, the retirees plan to spend £21,000 per year in retirement, so £100,000 for sure wouldn’t go far. £21,000 is almost £10,000 less than the average UK household income. Presumably as the average age is 60 most of them will own their home outright, so don’t have the largest household monthly expense to worry about.

So, what does it mean to retire? The quintessential meaning is “spending time doing what I want”. That sounds like freedom to us and that is also exactly how we describe it.

44% see retirement as giving up work completely and 30% see retirement as never setting an alarm again – now that sounds good. And 19% plan to do charity work or volunteering.

We think it’s fair to say that retirement is about living life on your terms. No more doing soul-destroying work for a boss and job you hate, no more commuting in darkness bumper to bumper, and no more losing friends and relationships due to lack of time.

Will Their Pension Be Enough?

Ok, so far, we’ve mostly looked at the positive side of retiring but is all that affordable?

We’ve seen that the average planned spending is £21,000 a year, and according to Standard Life Aberdeen retirees would need around £390,000 in savings to retire at 60 on top of their future State Pension income, to cover their expenses over the course of a 30-year retirement.

Presumably that’s based on holding most of their investments in low risk, low return assets such as bonds and on running the pot down to zero, which differs from what we need in the FIRE community who might need our pots to last 50 years or more.

So, they need £390,000 but the average as we’ve seen was just £366,000, meaning some of them are in serious trouble. We can’t imagine what it might feel like to be 80 and broke.

The report says, two thirds of the retirees risk running out of money in retirement based on the average spend of £21k a year. It was a similar dire story no matter where they live in the UK.

We hate to say this as ambassadors of financial freedom but some of them – like the ones with only a hundred grand – should probably struggle on working a few more years. Every extra year worked is more time contributing to your retirement fund, more time for it to grow, and less time withdrawing from it. This might be easier said than done as things always seem to get harder when success is in touching distance.

For the rest of them, and assuming they’re invested in lacklustre assets, they just need to accept more investment risk to reduce the chances of them outlasting their money.

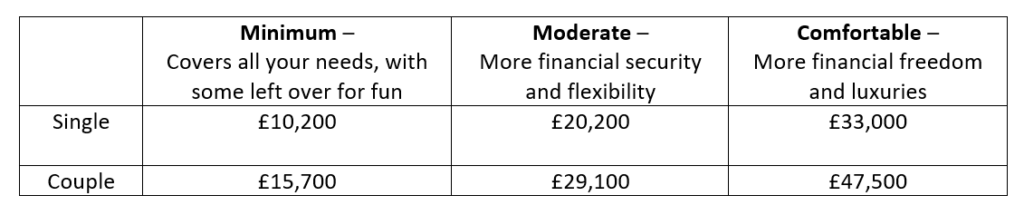

These are the estimates of what someone today might need at different levels of retirement as quoted in the report:

The minimum looks to be impossible, and we wouldn’t wish this on our worst enemy. How anyone can live off £850 a month in the UK is a mystery to us.

What’s being considered a moderate retirement is £20,200 a year for a single person. We might just about agree with this, but it really depends on whether the retiree owns their home.

The current state pension is just over £9,000 a year, so goes part of the way to covering their essential bills but that still leaves a lot that needs to be covered by their own savings. Disturbingly, 1 in 20 plan to rely the state pension alone.

Do They Feel Financially Confident?

37% are worried about not having enough money to last throughout retirement. And we think they’re right to worry.

As we’ve seen, most of them have not collected enough nuts for winter. Most of you reading this post still have potentially decades to correct this. Personally, worrying about money is one thing that we don’t want eating away at us, so we’ll certainly be aiming to overprepare.

48% plan to reduce their spending habits to support themselves in retirement. We don’t think this is as easy as they might think it is. Free time is often spent, literally. While you’re at work you probably aren’t spending much money, but when your diaries clear you will likely be out spending more – a lot more.

27% will work part time to support themselves in retirement and 21% plan to sell their property or downsize to fund retirement. We think downsizing is a great way of freeing up some money if needed. As the kids will have hopefully flown the nest, you don’t need to have all that capital tied up in a 5-bed castle if there’s just 2 of you.

Sources Of Income

The report only briefly covers this, so we don’t get that much insight. Almost one in five retirees say they plan to rely on one form of income. Not surprisingly pension pots are without a doubt the most popular option. We put this down to a few reasons:

- The government push pensions as the main retirement vehicle. This is truer today than it’s ever been with policies like auto-enrolment.

- Most people have a lack of financial discipline, so any money available in accessible accounts such as ISAs or savings accounts is probably spent on cars, holidays and house extensions long before retirement approaches.

- Most people never consider establishing multiple sources of income. Throughout their lives they’ve only ever had one – usually from a job, and so having one in retirement is normal to them.

If you watch our YouTube channel or read these blog posts regularly, you’ll know we always encourage having multiple streams of income.

How To Know If You’re Financially Ready?

The report gives some good advice about how to calculate when you’re ready to retire and it’s essentially the same as what we say here at Money Unshackled. Although, one major exception is everything they say is geared towards the retiree getting financial advice. Whereas we think most people are fully capable of running their own finances if they are prepared to do some research.

The 3 steps are:

- Estimate your annual cost of living. Take what you spend now and make some adjustments for the things you will no longer have – goodbye expensive slave unforms and commuting costs, and hello new costs like world cruises, or maybe more likely care costs.

- Calculate how much you have. Check all your pensions, ISAs, savings, and insurance products, and don’t forget to check what state pension you’re entitled to. You might even have the potential for an inheritance.

- Plan your estimated income. Here they encourage you to check out online calculators or speak to an advisor. If you’re hoping to retire young as WE do, we suggest you read up on the 4% safe withdrawal rate, which we’ve covered on our website and YouTube channel numerous times before.

What Are They Most Excited About?

The 3 things they’re looking forward to most are all forms of freedom:

- The freedom to have their own schedule.

- Simply not having to work.

- Spending more time with their family and friends.

Who Gets Retirement Advice?

Before we read the figures from the report our perception was that most people feel overwhelmed with investing and managing their personal finances, so when it comes to a big life event like retirement, they think a financial advisor can do it better.

The report found that 40% of soon-to-be retirees have already sought financial advice and 16% say it’s on their to-do list. Only 44% don’t intend to get advice at all.

Before the internet, learning about investing or anything for that matter was much harder, so professional advice was probably a good idea. Nowadays, you could spend a little of your time and learn everything you need to know and probably do it better yourself.

55% of the retirees research their options online, 30% ask friends and family for advice, and 23% get support and information from their employer. Just be careful getting advice from friends and family. It might be the blind leading the blind.

Words of Wisdom

And finally, is there anything we can learn from last year’s retirees? Their words of wisdom include:

- “Theres a whole new happier world out there.” – we knew this all along.

- “Factor in a little bit more [money] for the unexpected items” – sound advice for retirement and through life.

- “Have a plan B” – again, invaluable advice. That’s why we aim for multiple streams of income.

- “Have projects to keep you busy” – this one really is important. Make sure you have a plan as boredom really is a killer.

What are your retirement plans? Join the conversation in the comments below.

Written by Andy

Featured image credit: Timofey Zadvornov/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: