Here we’ve set out to prove that anyone can go from £0 of savings to financially free in just 10 years.

You don’t need a killer business idea, you don’t need to work 60-hour weeks juggling a job and a side hustle. All you need to do is accept and adapt to the new world order of money and debt that we’ve found ourselves in since the 2008 crash, and make the appropriate moves, like you would pieces on a chessboard.

But unlike chess with its infinite possible actions, this 10-year plan to financial freedom is laid out for you in this article step-by-step.

Thousands of ordinary people are doing this already and the basic ingredients are simple assets and good debt. No luck or beating the market necessary!

FYI: don’t forget to check out the hundreds of pounds worth of offers on the Offers page, including a £50 cash bonus when you open an investing account with InvestEngine. It’s free money, check it out!

Also, a word of caution: nothing in this article is advice, and investing with debt should only be done if you feel you can do it sensibly. All we can say is that following the steps here has transformed my own wealth drastically for the better.

Alternatively Watch The YouTube Video > > >

The Changing Financial Landscape

The financial truths that held for previous generations rarely hold true for future ones.

For instance, it used to be the case that bank savings accounts would pay you interest of over 5%, so a moderate return could be achieved with zero risk.

But the reality we find ourselves in as investors going into the 2020s is one of super low interest rates, seemingly endless inflation in asset prices, and governments and central banks the world over printing more and more currency like it was toilet paper.

As government debt has shot up to facilitate this, they have tied the fates of entire nations to global interest rates.

According to ThisIsMoney, if the interest the UK government had to pay on its debt rose by even 1 percent, this would add £21billion per year to the cost of financing the UK debt burden – making the cost around double what it is right now.

It’s unthinkable that governments and central banks around the world, most of whom are in similar positions, would allow interest rates to return to pre-2008 levels. Low interest rates are here to stay.

Even if they wanted to somehow counter rising inflation, we believe governments and central banks would first choose to pull OTHER levers before they would significantly raise interest rates: such as raising income tax, controls on wage growth, and decreasing the money supply.

Alongside low interest payments, the real value of any debt you hold falls away over time due to inflation – a £500 debt taken out 30 years ago might have seemed a fortune at the time to most people, but £500 today isn’t much money at all.

In this new world, investors who leverage low interest debt to buy assets with can thrive.

You have to roll with the punches, and to get rich today, the path of least resistance is to pick up all this low interest debt that’s lying around and use it to buy some sweet assets with.

The Basis Of The 10 Year Plan

This isn’t some zany get-rich-quick scheme, or some gamble on crypto – this is a logical, financially realistic 10-year plan to amass enough investment assets by taking advantage of low interest debt that you can be financially free from having to work another day to pay the bills.

The easiest way to invest using debt is to secure the debt against the very assets that you’re buying: like how a mortgage is secured against a property. The valuable asset is what gives the bank the confidence to lend you a lot of money. Property fits debt like a hand to a glove.

Unfortunately, this doesn’t work as well with stocks, as we’ve yet to find a bank that will lend you money to buy stocks with. But imagine if a bank did come out with an equivalent of an interest-only mortgage product for buying stock index funds? Maybe one day.

Over the centuries the property market has evolved to provide the borrower with additional perks, which include equity release.

This tool is available to everybody, but most people are too scared to use it because they have inherited the previous generation’s fear of mortgages, born out of decades of high interest rates.

Equity Release

When you are outside of a fixed term on your mortgage (or if you are mortgage free), you can renegotiate your mortgage agreement to withdraw some of your built-up equity out of your house and replace it with more mortgage debt.

As an example, a £200k home with an 80% Loan To Value of £40k equity to £160k mortgage might be reset to a 90% Loan To Value of £20k equity to £180k mortgage. That £20k difference would go into your bank account.

Equity release shouldn’t be feared unless you are financially illiterate or financially irresponsible, in that you would spend the cash on treats instead of investment assets. Instead, it should be welcomed as perhaps the single best opportunity available to any homeowner to become a millionaire in their lifetime.

That’s because it removes the need to have to first save up money from your wage-slave day job over many months or years to buy cash flowing assets with. We can think of few other ways to immediately get hold of 5 or 6 figure lump sums of cash to invest with without having to do any work!

The 10 Year Plan

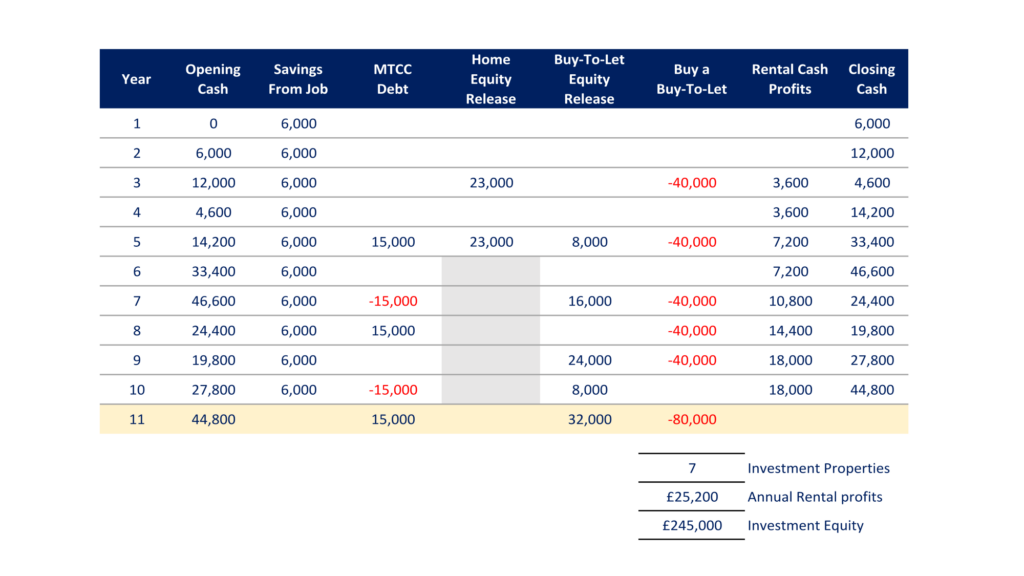

For this next section we’re going to lay out an example 10-year plan that you can adapt to your own situation. The numbers are given at today’s value of money.

It assumes you have just bought your first home, worth £200,000, and have £0 of savings left after the purchase. From this baseline you can focus on building your financial freedom fund.

In Years 1 & 2, not much happens other than squirreling away £500 a month from your soul-crushing day job. But hang in there – things are about to scale pretty quickly.

At the start of Year 3, after your 2-year fixed term mortgage period has become open for renegotiation of terms, you do just that and extract £23k from the house.

£23k is based on monthly equity repayments of £400 over 2 years (which excludes the interest), a 4% annual growth in property prices, and resetting the Loan To Value to 90%.

You buy your first Buy-To-Let (BTL) property in Year 3, worth £140,000 – which costs you £40,000 with a 25% deposit plus stamp duty and buying fees.

Because this happens at the start of Year 3, you can record a full year of rental profits at £300 a month, being rental income minus mortgage interest, tax, and other costs of renting.

Year 4 is just as boring as Years 1 & 2, except now you’re saving money from the rental as well as from your job. You’ve built a second income stream. Congratulations!

Year 5 gets fun. This year you get 3 more lump sums of cash into your bank account from low interest debt sources. The first is a Money Transfer Credit Card (or even a pair of such cards, if needed). They work like a 0% loan, transferring money from the credit card directly into your bank account.

I was carrying £15k on cards like this at the start of 2021, before paying off 1 of my 2 cards. You can pay 0% interest on these cards in the first 2 years – just remember to pay them off before that interest free period ends.

You also do your 2nd and final ever equity release from your home, which might net you something similar again to what you got the first time around. You’ve made the decision to let your mortgage pay down naturally thereafter, as it seems the most responsible course of action to you.

You also get to release equity from your first rental property, which you also took out a 2-year fixed deal on. 2-year fixes are the industry standard, and in our view are the most flexible for this style of investing.

You use the cash from your borrowings to buy your 2nd BTL property. Cash profits from your growing rental empire are double those of the previous year as a result.

In Year 6 you have little else to do other than drive to the office and back home again about 230 times. But note that your rental profits are now greater than what you’re able to diligently save from your 9-to-5.

At the start of Year 7 you sadly have to pay back the credit card debt – it’s not your money after all – but you can release equity from both of your rental properties.

You can afford to buy your 3rd BTL, and you do so. Your cash profits from your 3 BTLs bring home nearly £11,000 after tax this year.

In Year 8, there’s nothing stopping you from taking out more Money Transfer deals, since your record of repayments is squeaky clean. You use it, along with last year’s money carried forwards, to buy your 4th BTL at the start of the year.

This is about where I’m up to now in the plan, with 4 BTLs, though I’ve been able to move a bit more quickly.

In Year 9, you release equity from your first 3 rentals, and buy another one, bringing your BTL empire up to 5.

In Year 10, you pay back your credit cards, release a bit of equity from BTL #4, and have enough money left over at the end of Year 10 that a few weeks later you can also release equity from 4 rentals and can afford to buy 2 more.

After 10 years (and a few weeks), you have 7 rental properties paying out £25,000 a year, with the equity value of your investments at £245,000.

What does this mean for financial freedom? A £25,000 annual investment income may mean you no longer have to work.

A couple could both follow this plan and end up with a portfolio of 14 rentals bringing in £50,000 a year. Safe to say you’d be financially free at this point if you managed your expenses carefully.

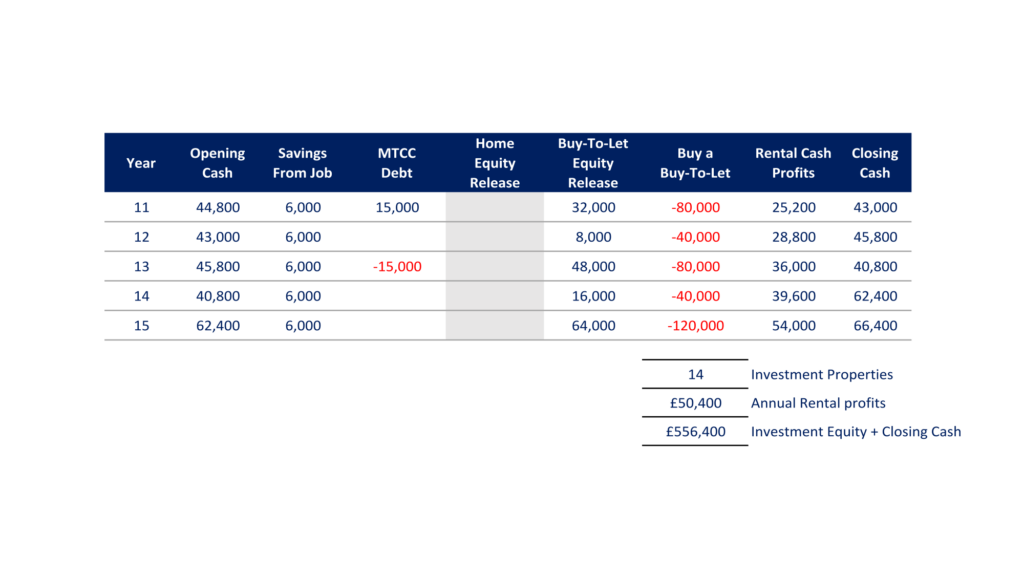

But you may have noticed that our little 10-Year plan started gathering quite some momentum as the years progressed. Couldn’t you just keep going a bit longer to get substantially more readies coming in?

Of course you could, and here’s how things might stand if you pushed on to Year 15. You could have 14 BTLs by then, pumping out £50k of annual rental profits. A couple might have 28 properties paying out £100k, all things being equal.

This person’s closing investment equity plus loose cash after 15 years is £556,000. You could even sell your rentals at this point and put the money you’ve made into passive stock market funds, kicking out over £20k a year at the 4% safe withdrawal rate. Less money, but less ongoing effort.

You’d just have to carefully navigate the capital gains tax rules, for which it might have been better to have set up your property empire as a limited company rather than in your own name.

But What If X Happened?

Here’s a quickfire round of common concerns we expect people to have with the plan, and our responses.

#1 – What If Property Prices Went Down?

Property prices could go down in some years, they could go up way more than 4% in others. We’ve used 4% to be conservative. History shows house price growth to far exceed this. Price movements could make the plan take longer or shorter than 10 years for you. But prices are likely to go UP overall based on history.

#2 – Can You Use Debt As A House Deposit?

When buying a residential property – such as your home that you live in – the banks will do checks to ensure you aren’t using other debt to get a mortgage with.

BTL mortgages in my experience do not do these stringent checks. I personally had thousands of pounds of money coming in from remortgages and credit cards on my bank statements when buying all of my Buy-To-Lets.

#3 – What If I Had A Problem Tenant?

Yes, this is a risk in the early years of property investing, which becomes less of a problem the more properties you own. Give your property portfolio to a good management agent to look after them for you, as they should have better processes to filter out the worst potential tenants before they become your problem.

#4 – What If I Lost My Job?

Holding all that debt can be a worry that would keep you up at night if you were to lose your job, but remember that all the BTL mortgages are attached to assets that pay you rent, which covers your many BTL mortgage payments whether you have a job or not.

And securing future mortgages and remortages doesn’t depend so much on you having a job once you own 4 or more rentals. At this point you are classed as a portfolio landlord, and it’s more important to the bank that you can prove income from your portfolio rather than a job.

These worries aside, the most likely scenario in our view is that you gradually get richer and richer exponentially, utilizing other people’s money to build an empire of assets valued far in excess of the value of the debt and setting you financially free.

What’s your view on using good debt to grow a freedom fund? Join the conversation in the comments below.

Written by Ben

Featured image credit: KamiPhotos/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday:

2 Comments

Is the buy to let mortgage in the example one that you pay capital off per month as well as interest? Just asking after a quick Google seemed to indicate most BTL mortgages were interest only?

No capital is paid off, the But To Let’s are on interest-only mortgages. The theory is that over the long-term, property prices increase but your mortgage amount stays the same, and so could be paid off more easily in the future. Unless that is, if you’re remortgaging it and withdrawing equity all the time! In which case, your long-term plan might be to just always have a mortgage on the properties and not pay them off (which might be ok if they’re cash-flowing assets). Ben

Comments are closed for this article!