Recently the FCA published a report into the behaviours of investors. The conclusion was that newer investors are at risk of causing themselves harm. There has been an enormous shift in the demographic of investors in recent years and significant changes to what they invest in.

Newer investors have been found to be drawn more towards high-risk investing, have less investing knowledge, or disregard the risks, and many appear not to be able to withstand significant losses.

This research by the FCA – highlighting the downsides of democratising investing – could lead to future restrictions. Should investors who may have zero knowledge be allowed to participate in something where there is serious financial risk? After all, you can’t just jump out of a plane without a skydiving instructor.

In this post we’re going to share with you the key findings of the FCA report.

If you’re new here, or even if you’re not – check out the cash bonuses and free stocks offers on the Offers Page.

Alternatively Watch The YouTube Video > > >

Who Are The FCA And What’s The Report About?

The report which we’re looking at today has been carried out by a market research agency on behalf of the FCA. The aim was to conduct an in-depth exploration of self-directed investors’ behaviours, attitudes and financial resilience.

A self-directed investor means anyone who is making their own investment decisions such as making their own trades without the help of a financial advisor.

Before we get in the findings of the report, let’s quickly take a look at who the FCA are for those who don’t know.

In their words, the FCA aim to make markets work well – for individuals, for business, large and small, and for the economy as a whole. They regulate thousands of businesses, and their objective is to protect consumers, protect financial markets, and promote competition.

Overall, we think the FCA do a fantastic job. They’re the reason we feel comfortable investing our hard-earned money with a variety of investment platforms. The platforms must abide by the rules laid out by the FCA – segregation of client assets being one example.

According to the report, there is evidence that some consumers are making or are led into making poor investment choices. In some instances, people are missing out on returns, and in other cases they are being led to invest in high-risk products.

The overall theme of the report is that new investors are taking excessive risk, which they may not be able to afford, potentially prompted in part by the accessibility offered by new investment apps. Let’s now take a look at the key findings.

Gamblers and Thinkers

The report categorised investors into 3 broad groups – ‘Having a Go’, ‘Thinking it Through’, and ‘The Gambler’.

They do go on to break those groups down further into sub-groups, which you can check out for yourself if you’re interested.

The ‘Having a Go’ group are newer or less experienced investors. They often look for shortcuts, which can include ‘hyped’ options that they’ve heard about, or consider well-known brands as safe investments such as tech companies.

The ‘Thinking it Through’ group are more experienced and may have a professional or academic background in maths, finance, economics or business. They feel they have high levels of knowledge and are very confident in their abilities.

And finally, ‘The Gambler’. This group see investing as similar to betting. They are attracted to short-term high-risk investments like FX and CFD’s.

It sounds like they’re referring to the crazy lot over at WallStreetBets who are pumping certain stocks and crypto and are going to the “moon.”

High Confidence Is Misplaced

Regardless of group, investors, particularly those who invest in high-risk investments, tend to have a high degree of confidence. However, their behaviours and beliefs indicate that this can be misplaced – basically if we read between the lines, most of them taking on excessive risk have no idea what they’re doing.

They have a total lack of awareness of the risk – 45% don’t see ‘losing some money’ as a potential risk. That’s crazy. We understand this to mean 45% of say bitcoin investors or GameStop investors don’t think they can lose any money. Maybe we need a proper crash to knock some reality into them.

Moreover, gut instinct is apparently hugely important in decision making across groups. This is not surprising. After all, real research is hard work and it’s human nature to look for shortcuts.

Investing Is Now More Diverse

The report says that a more diverse audience appears to be getting involved in self-directed investing, potentially promoted by the accessibility offered by new investment apps.

It seems that investing before was predominantly white, older men, in professional occupations. But now there is a clear trend towards younger, more gender balanced, more BAME, and lower skilled workers taking up investing.

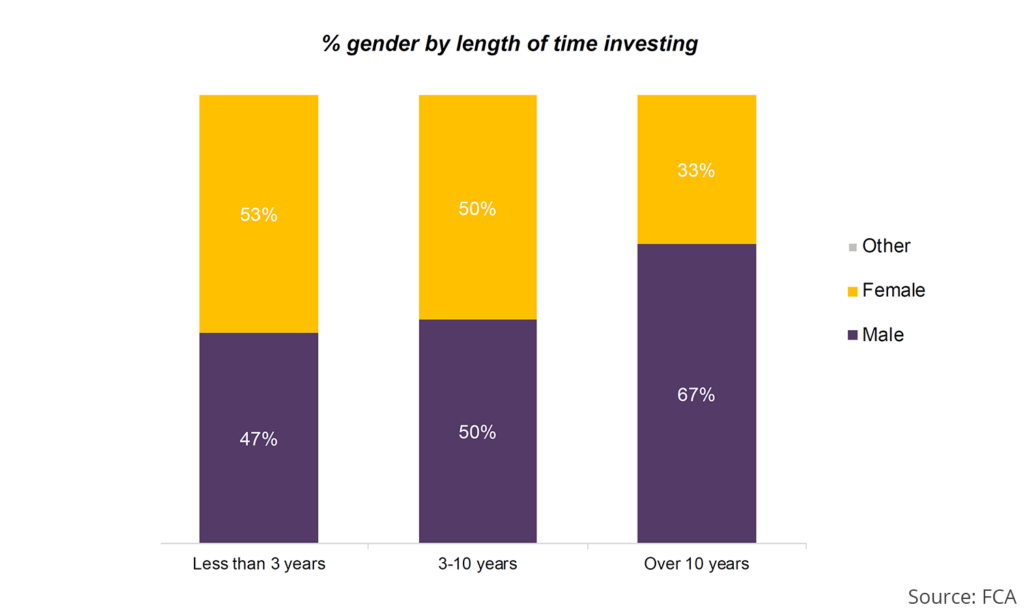

This chart shows how investors based on length of time investing has transitioned from mostly men at 67% to now slightly more women.

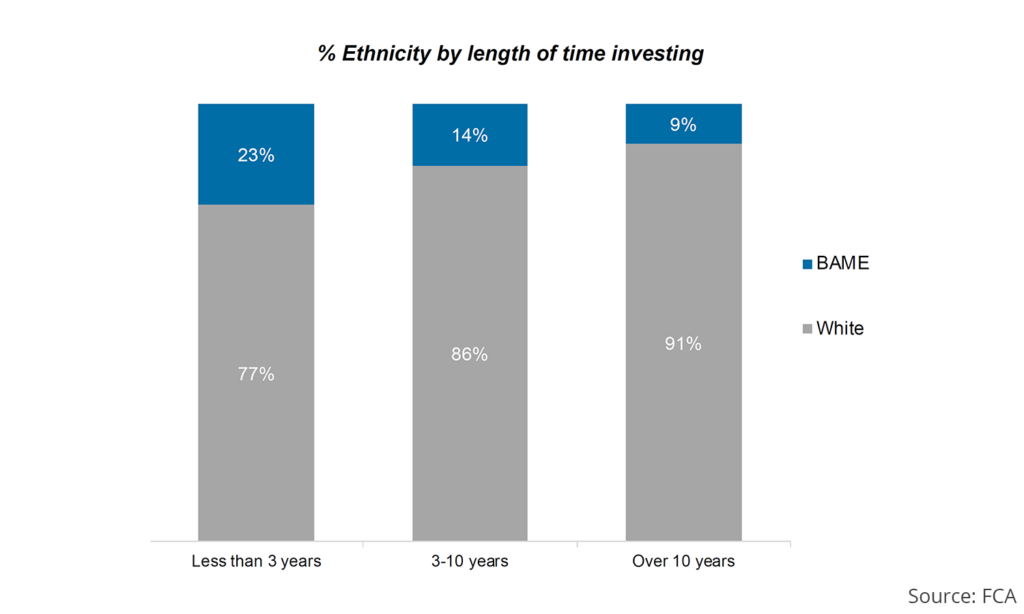

This chart shows that investing was previously a white person’s game but has clearly become more even amongst newer investors, which is great to see. The UKs white population is 87%, so if anything, 77% of new investors being white is actually underrepresenting that demographic.

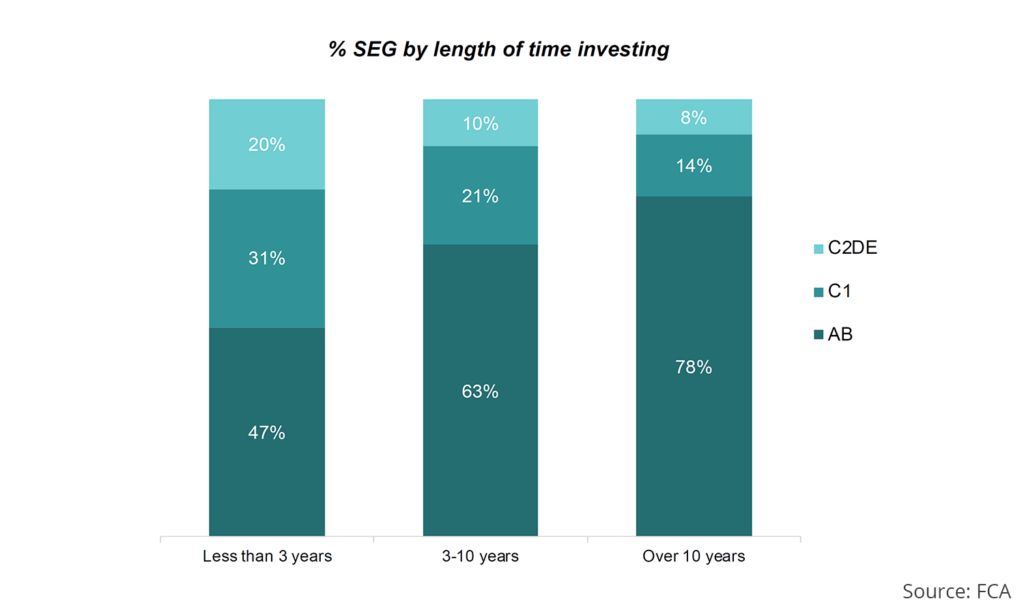

This chart is looking at investing across the social grades. As you can see the dark green bars, representing high level professional jobs, has decreased proportionally among new investors. There has been a big proportional increase in more junior workers, and skilled manual workers investing.

That’s the way it should be. New investment apps and the internet are largely to thank for this.

New Investment Apps Are Taking Over

Newer investors are drawn more towards new investment apps, that are commission-free and very heavily advertised online and on TV. Talking of commission free apps how about a shameless plug?

Freetrade are giving new customers a free stock worth up to £200 when you sign up and deposit at least £1 when you use our link. This offer and others like it can be found on the MU Offers Page.

Back to the report, 51% of those who have been investing themselves for less than three years, use, or were considering using, a newer platform, versus just 39% of those investing for more than three years. We think this is obvious. New customers are always more likely to research the cheapest product, whereas existing customers may be more reluctant of going through the upheaval of moving platforms.

When new platforms are innovating more and simultaneously slashing costs, of course they will attract more customers than the so-called heritage platforms. The report says that the rise of new investment apps, such as Trading 212, FreeTrade and Crowdcube, have significantly reduced the barriers to entry.

Likewise, apps like Moneybox, which round up spending and invests the ‘change’ offer an easy, passive and low effort route into investing. Apps like these are great, but kind of backup the FCA’s grumble about investing being open to anyone, regardless of their knowledge or capacity for risk.

This quote particularly stood out to us, “I started looking at investment websites like Vanguard, but I felt completely out of my depth, almost like I didn’t belong there. Apps like Trading 212 are really easy to use – the accessibility really catered to me and they even have demo accounts to try it out first.”

In our opinion Vanguard is probably the easiest investing website to use and potentially the safest, considering it only offers a few solid low-cost index trackers. If you can’t get to grips with Vanguard, then we have no idea how they understand Trading 212 with the complex instruments such as CFDs that it offers and much wider investment range.

A simple user interface doesn’t make the available investments any easier to understand.

Investors Now Get Information Online

There has been a major shift to online sources of information. Investors now have direct access to the opinions of trusted experts at their fingertips such as Warren Buffet, Martin Lewis and Money Unshackled.

Okay, you caught us – they didn’t quite name us alongside the big boys but maybe one day.

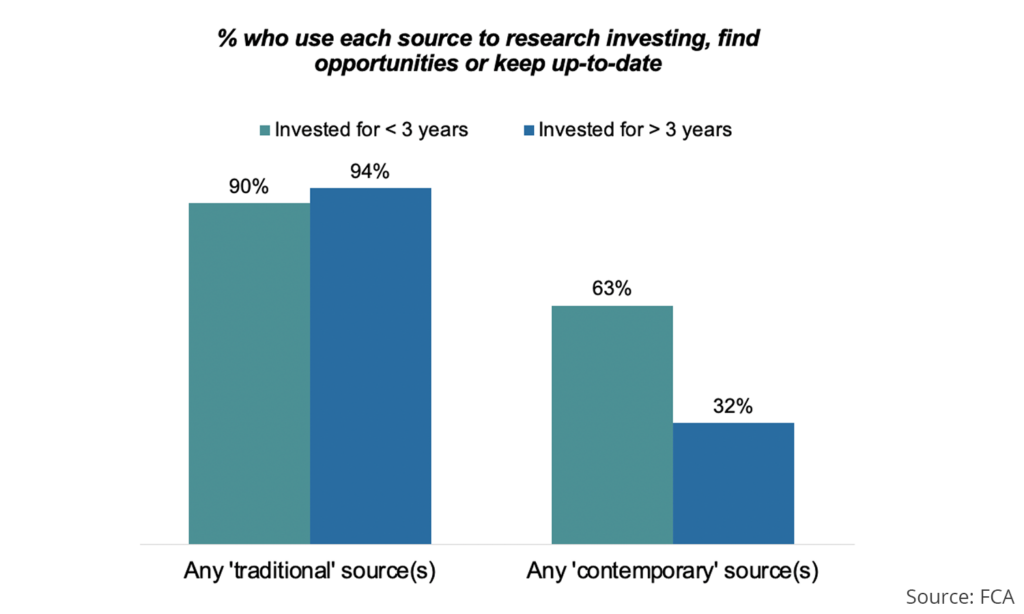

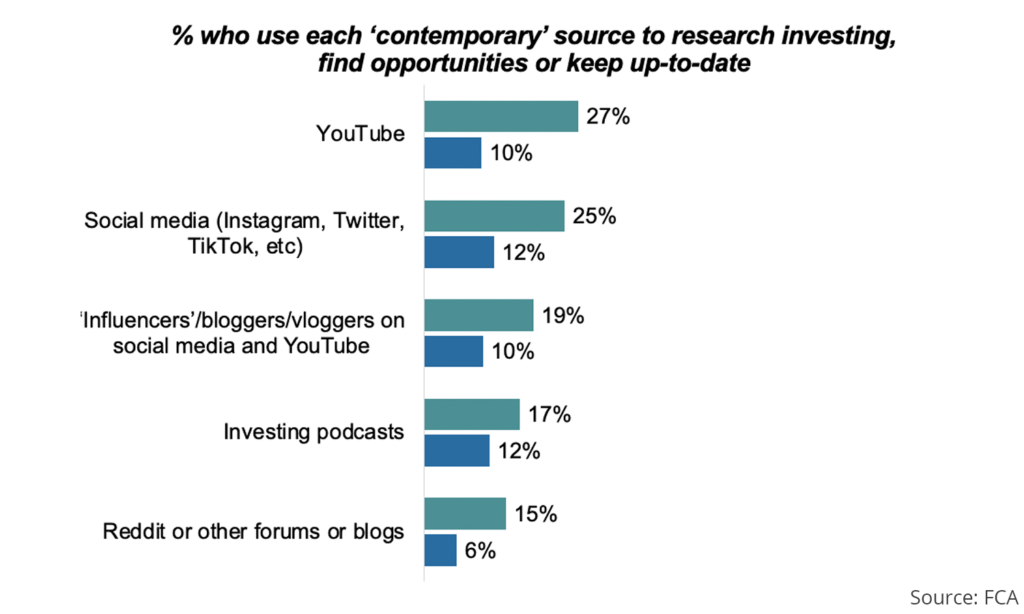

While traditional sources of information are still very popular no matter the experience of the investor, new investors are overwhelmingly looking towards contemporary sources, which includes YouTube, Instagram, podcasts and so on. 63% of new investors use these contemporary sources of info compared to just 32% for those who have been investing for over 3 years.

YouTube looks to be the most popular source of contemporary information with 27% of new investors using it, followed by social media at 25%, and Influencers are not far behind at 19%.

We don’t know how Influencers differ from the first 2 but surveys always have weird stuff in.

One finding that stood out to us was the identification that investors often come across investment opportunities during the course of their day-to-day lives, rather than specifically researching them.

Algorithms, such as what you get on YouTube and other social media, can create a perception of ‘buzz’ around a topic. YouTube knows that WE like investing, so when something like GameStop was making headlines, our YouTube recommendations feeds were full of this nonsense. You’ve probably seen something similar on yours. Right now, it’s crazy hype about Crypto.

Noobs Taking On Increased Risk

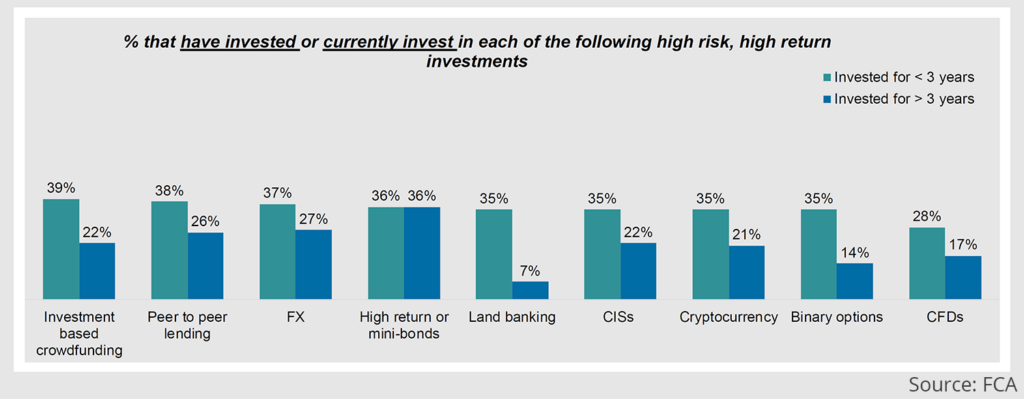

The report says that new investors are jumping straight into high-risk investment types more quickly than those who have been investing for longer.

This chart shows that clearly. Here we have many of the so-called high-risk investments and the percentage of investors who currently invest in each. The green bars represent new investors, and the blue bars represent those who have been investing over 3 years. For almost all of the high-risk investment types, noobs are overwhelmingly involved in them.

No Emergency Fund

To top it all off, these risk takers have also been found to be more at risk from a financial hit. 59% claim that a significant loss would have a fundamental impact on their lifestyle, compared to 38% of those who have been investing for more than three years.

The risk-takers do not have a cash buffer to fall back on and are more likely to be under financial pressure in their day-to-lives. Some of those surveyed even talked about ‘dipping back into’ investments when short of cash as if they these investments were like a bank account.

Money Unshackled’s View

Most of the findings in the FCA report probably shouldn’t come as any surprise. We’ve all seen how popular commission-free investment platforms have become and we put this surge of popularity down to falling costs of investing and much better information.

In years gone by, it was near impossible for the ordinary person to invest, so it is likely that some demand was there, but it was just going unmet.

There was also a lack of information, which is now widely available for free such as right here on YouTube. This new information is of no lower quality than what so-called experts would give you. It’s been proven that “experts” on average underperform the market.

Financial advisors are mostly sharks – yes there might be some good ones out there, but how can you tell them apart from those who just want to take a slice of your money off the top to enrich themselves?

Further, it’s perhaps unusual for the FCA report to fail to mention low interest rates. We would have considered this to be a driving factor for ordinary people to start investing. Previously you could get 4-5% interest by just sticking your money in a safe savings account, so there was far less desire to invest. Today, there is no safe place to store money that gives a positive real return, so everybody has no choice but to invest.

Looking back at the high-risk investments chart again, we would like to know how they determine what a high risk, high return investment is. We’ve never considered ourselves to be excessive risktakers but notice they have included P2P Lending in the high-risk bucket.

We’ve been investing in P2P for years and certainly wouldn’t consider it high risk. Most P2P platforms take out collateral on loans and get director guarantees. Then you diversify across hundreds of loans, and possibly over multiple reputable P2P platforms. Plus, the FCA have rules that you shouldn’t invest more than 10% of your wealth in this asset class. That doesn’t seem overly risky at all.

We welcome guidelines and warnings, but we find restrictions like this a bit meddlesome as we’d personally rather have the choice, and there’s always the worry that they’ll go a step further and impose restrictions that stop normal people buying other assets like stocks.

They’ve also recently banned the sale of crypto-derivatives to retail consumers, which is why you won’t find any bitcoin ETFs in the UK.

On the back of this report, we expect that the FCA will eventually clamp down further on risky investments. How they do this is anyone’s guess, and we just have to hope that it won’t affect sensible level-headed investors.

Do you invest in any of the mentioned risky investments? If so, which ones and why? Join the conversation in the comments below.

Written by Andy

Featured image credit: Paulik/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday:

2 Comments

Interesting; in Canada bitcoin ETFs proliferate (BTCC), options are freely traded on them, and puts and calls are allowed in the Tax Free Savings Account, the Canadian analogue to the ISA.

It sounds as though the UK FSA are doing at least as good a job of infantilizing the British investor as they are at protecting him/her/them.

Sounds like Canada trusts their citizens to act in their own best interests? Cheers, Ben

Comments are closed for this article!