When you reach an investment milestone like £200k, it’s good to reflect on your achievements so far, but more important is to course-correct before your past mistakes become any more ingrained.

Normally, for investors who only invest via online investment platforms or from an app on their phone, fixing a portfolio can be as simple as clicking the sell and the buy buttons in the right order.

But if you hold illiquid assets this isn’t as easily done. You might even have the first-world problem of holding assets which have such high returns that you can’t justify selling them, even though your strategy has changed since you bought them.

In this post, I want to share with you the details of my Financial Freedom Fund, so you can get a feel of how someone might come to accumulate £200,000 in just 5 years starting from almost nothing, and also to arm you with my experience so you can replicate this milestone while avoiding my mistakes. Let’s check it out!

I first started investing in stocks and ETFs on Freetrade, and it is still one of the best places to invest and grow a wicked portfolio.

As the name suggests, Freetrade doesn’t charge any trading fees, making it perfect to experiment with different combinations of funds and stocks without feeling trapped by fees.

Also, Freetrade are giving away a free stock worth up to £200 to every new customer who opens an account with them and funds it with at least £1. The offer is only available when you use this link.

Alternatively Watch The YouTube Video > > >

My £200k Portfolio

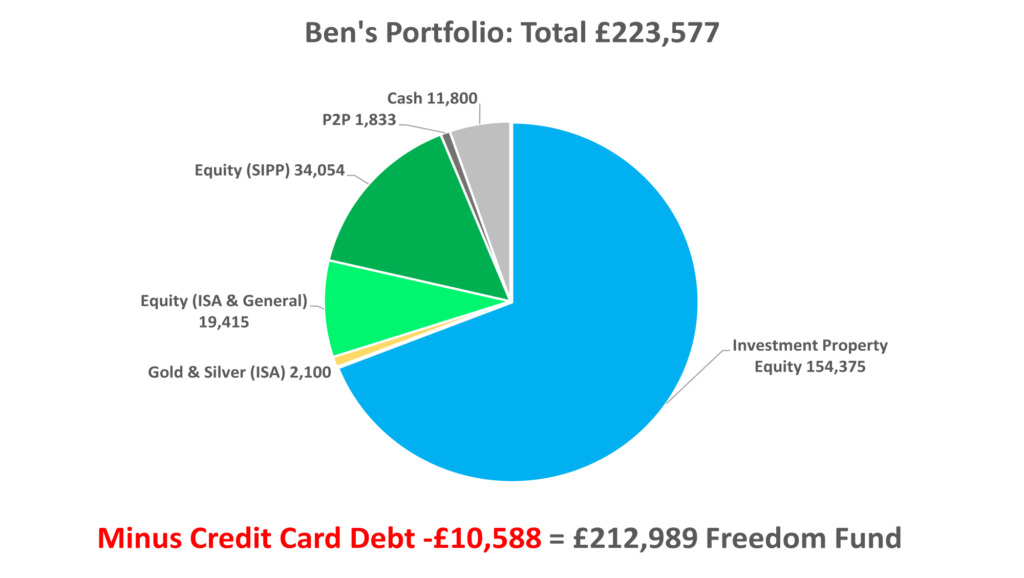

Let’s quickly look at the detail of this portfolio. Here’s the financial freedom part of my net worth, broken down. What should be glaringly obvious is that most of it is invested in Buy-To-Let property, specifically high cash-flowing terraced houses owned with mortgages, which were my first serious investments since committing to early retirement:

It’s this section of the portfolio that has seen the most capital growth, up by over 30% in the last year alone, and over 50% in total. It currently makes up 2/3rds of the pot.

I’ve consolidated most of my stocks and ETFs into a single Stocks & Shares ISA.

My old workplace pensions are likewise consolidated into a single SIPP. I might have regretted how small this slice is relative to other people in their early 30s… if not for the fact that I was purposefully diverting every penny I could from my wage into buying properties, which I saw as being of greater value.

There is also some small allocation to Peer-To-Peer Lending investments, and some commodities. And as we say at Money Unshackled, every portfolio needs a bit of cash.

There’s a red stain on the portfolio in that I partly financed the properties with 0% interest credit card debt.

Getting to £200k – Investing In Order Of Return

The original plan with this Freedom Fund was to invest my money in order of whatever assets could provide the greatest returns. I would worry about diversification later.

The answer for me lay in leveraged rental property.

My rentals give out pre-tax rental returns in the region of 11%, which is a higher return than the stock market, especially once leveraged annual capital gains of around 12% are added on as well.

My gamble of investing early on for maximum return rather than diversification has paid off so far – it provides a high second income AND incredible capital growth, and it has pushed the portfolio up to £200k in about 5 years. But it is now time to worry about diversifying.

Course Correction – Investing To Diversify

I got to £200k by leaning heavily on property, but I now need to focus on diversification. For the last year I have been ploughing all my investable money into the stock market, rather than hoarding it in cash ready for the next property.

A well-rounded portfolio should invest across multiple asset classes, but also many positions within each asset class.

As it stood, apart from some small-change, this portfolio held 4 assets – all being rental properties, and all serving the same demographic in similar locations to one another. It was NOT diversified.

Owning multiple rental properties offers some protection in case one tenant stops paying rent, but to be truly diversified you need to own the world – and that means owning stocks.

My small but growing equity portfolio contains 9,000 stocks, achieved by owning just 3 equity funds in my ISA and 2 in my SIPP, plus a smattering of individual stocks. There are also holdings in gold and silver.

The plan is for the allocations in the Stocks & Shares ISA and SIPP to grow over the years by drip feeding income into them monthly, until they catch up to the property slice.

Risk

If we look back at the portfolio, the portion invested in equities is what we would consider to be relatively safe and secure, due to good diversification and liquidity. The part representing just 4 individual properties is at far greater risk.

If I had desperately needed cash during 2020, I may have struggled to sell a property to save my bacon. But if I’d owned more shares, I’d have been fine – though they may have dropped in value.

Likewise, in a downturn I could easily lose all 4 of my properties’ incomes if tenants could not pay rent, while the odds of all 9,000 of my stocks failing to perform would be very low indeed.

The risk in my portfolio is therefore much higher than someone who owned purely equities or a mix of equities and bonds, which is probably most investors. But are the returns on this portfolio proportionally high too?

Return On Investment

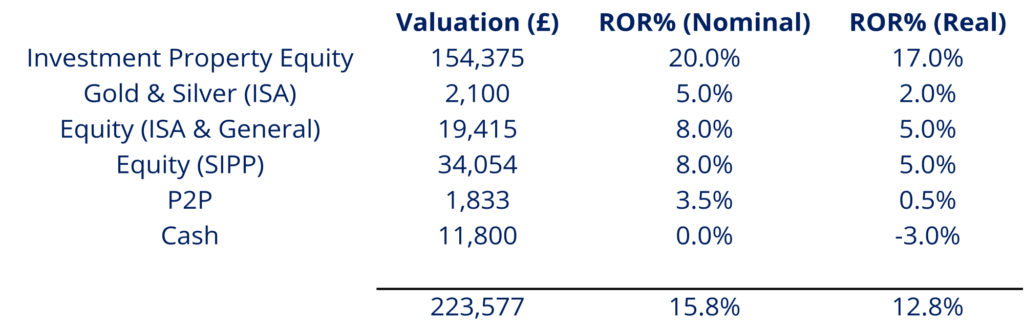

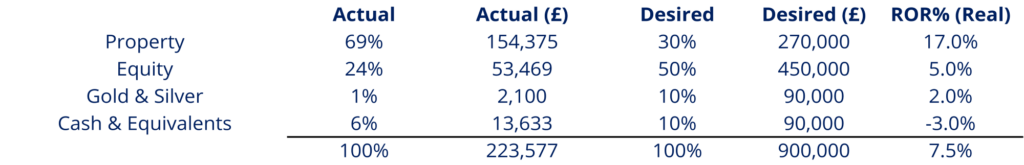

Here’s the expected future weighted average returns on this portfolio:

For property, the return is a mix of 8% after-tax rental profits that I’ve been achieving consistently, plus 12% expected capital growth on the equity.

A very brief explanation for why these 2 numbers are so high is because I’m leveraging my equity using a mortgage, so the returns get amplified because I only need to invest about a quarter of the house’s value.

After inflation that’s a 17% real return. The equities are expected to perform at historical market averages, while P2P and cash are assumed to continue at current levels of performance.

The weighted average real return of the portfolio overall is expected to be 12.8%.

This compares very favourably to a portfolio built using unleveraged assets such as stocks, and provided I continue to be fortunate and not succumb to the risks that low diversification brings, this asset mix should power me towards my Financial Freedom target at a fast pace.

The properties I already own should multiply on their own as well over the years, as I can extract equity from the growth to buy more properties with, which will lower the risk while increasing the returns.

If you take away one thing from this review, let it be that you too should consider getting some rental property in your own portfolio early on, for the boost to returns that it brings.

Effort

That said, why would anyone want to decrease their portfolio average return by diversifying away from property towards stocks? Part of the reason of course is risk. But also, you have to consider the effort involved.

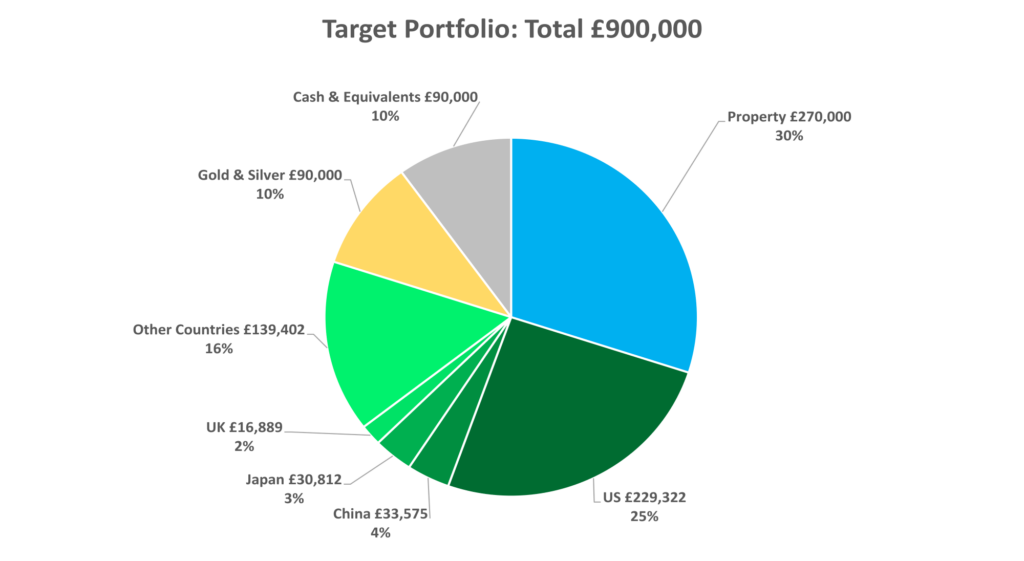

£200k is a good start but it needs to grow to around £900,000 to give me and my family the lifestyle we’d want in early retirement.

This is my household’s FIRE number – FIRE standing for Financial Independence, Retire Early.

To find out how big your pot needs to be to retire early, check out the Money Unshackled FIRE calculator. You can tweak the returns based on your own portfolio’s asset mix, and it will tell you when you can retire and what your FIRE number is.

You might be happy to put more effort into managing your investments upfront, if they give you a head start on your FIRE journey. It might just shave some years off your goal. But if you have other commitments, understandably you may not want the hassle long-term.

Right now, big percentage returns are important to me because I need all the help I can get to grow my pot fast. But once the pot is built, I could tolerate a lower percentage return in exchange for a higher return in pounds, by virtue of the pot being a lot bigger.

Owning rental property is many times more effort-intensive than investing in ETFs. Even with the use of property management agents, there’s still a fair bit of ongoing admin to do.

This all runs contrary to my desire to sit in a hammock staring into space from no later than the age of 40 onwards.

The Stocks Allocation

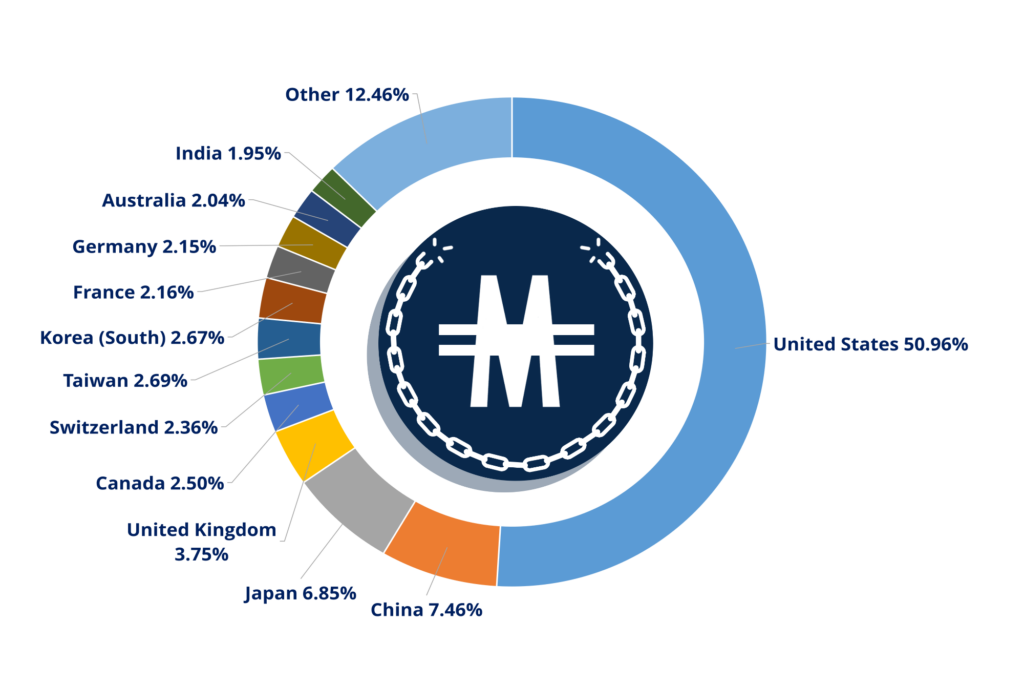

A portfolio based mostly around passive equity-based ETFs can be automated. If we dig into the equity section of this portfolio, this is predominantly made up of the Money Unshackled Ultimate Portfolio, covered in detail here.

Above is the split of the equities in the ISA by geography, and the portfolio covers the top 99% of market capitalisation in those countries. When this £200k portfolio grows into a £900k portfolio, the intention is that this component will be the largest chunk.

Money gets drip-fed into this section of the portfolio regularly and is automatically allocated into the pre-planned allocation of global funds. When I reach my FIRE date, I will simply drip-feed money OUT of it regularly instead.

That’s as complicated as investing needs to be.

The equity investments in the SIPP follow a similar idea of owning a diversified cross-section of the world, but with a slightly different set of funds.

A good strategy is to draw an increased income from the rest of your portfolio first when you FIRE, such as your ISA and properties, and access your SIPPs and other pensions from when you’re allowed to, which currently for our generation will likely be at 58.

Be sure to check out this article which shows you how to draw up a retirement income plan using a combination of ISAs and Pensions.

The Portfolio I’m Aiming For

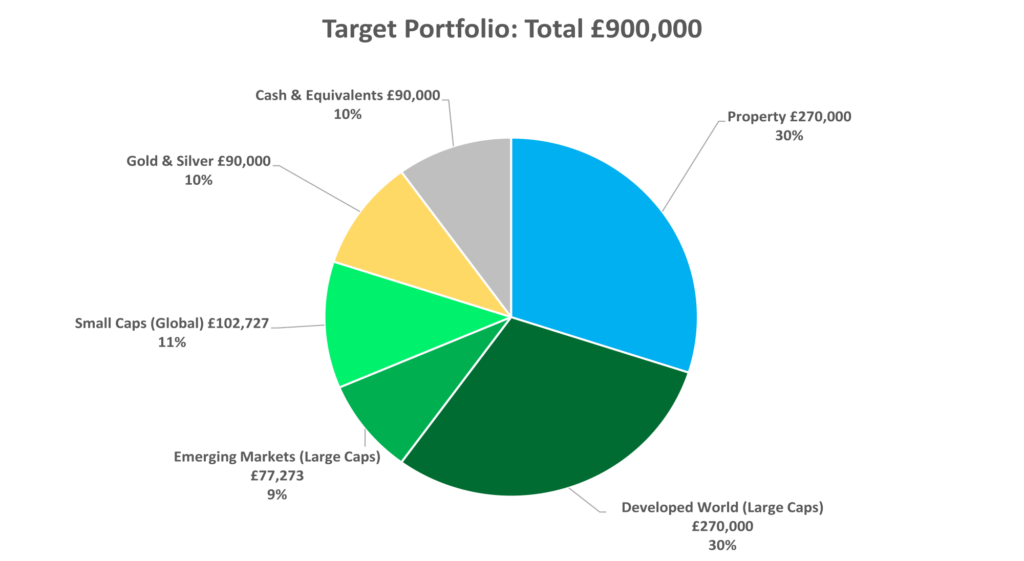

Seeing as I have already done the hard work of establishing a property portfolio, I’m happy to hold on to them for their high returns, and even add to them over time – I’d be happy at around 30% of the total pot:

My main task between now and my early retirement date is to plough money into the stock market, bulking up my ISAs and SIPPs to reflect the green and yellow portions of this pie. You can see the specific weightings of the top countries for the equities, with the US making up 25% of the pot, or half the equity.

Above is another way to look at the target equity split, showing off the small cap and emerging markets elements. With a full 20% invested in the emerging markets and small cap stocks, this is hardly a low-risk portfolio. But it will have a good balance of diversification, liquidity, and returns.

The expected real rate of return shifts from the current 12.8% to 7.5%, still far higher than a stocks-only portfolio which might average 5% after inflation.

Portfolio Financing

If you too like the idea of starting out with a higher risk strategy of targeting the highest rates of return first, it might help you to know that the way I got started with rental property was to optimise the use of good debt.

My first 2 rentals were paid for in part with money I had borrowed on 0% interest Money Transfer Credit Cards, but even MORE so by remortgaging my own home and extracting equity from it.

Much of this goes against the grain of what you are told you aren’t supposed to do, and this definitely shouldn’t be considered advice. But to get ahead in life, it’s worked for me to ignore the mainstream guidance.

What do you need to change in your portfolio, or are you happy with it as it is? Join the conversation in the comments below!

Written by Ben

Featured image credit: Vitalii Vodolazskyi/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: