Do you ever think you might be spending too much? We usually cover ways to boost your income and make money on this channel, but today we’re focusing on spending, and how your spending habits compare to the rest of the UK.

I’ve been thinking a lot about spending goals recently. Depending on your life goals, making sensible cuts can drastically change your quality of life for the better.

Saving an extra £500 a month might knock 15 years off an average person’s working life, according to our Retirement Calculator.

If you’re keen on clawing back some years of life, then it helps to compare your spending level to others’.

But maybe you’re happy with your level of spending and just want a nosey into your fellow countrymen’s finances. We’ve got you covered for that too!

Commission-free trading platform Stake are giving away a free US stock worth up to $100 to everyone who signs up via the link on the Money Unshackled Offers page, so be sure to check that out!

Alternatively Watch The YouTube Video > > >

The Data

The data in this video comes from the ONS, and covers the cost to households over the period April 2019 to March 2020 – i.e., the most recent period before the pandemic started messing with peoples’ lives.

These figures are therefore a representation of spending during normal times, which hopefully we’ll be heading back to soon! Famous last words…?

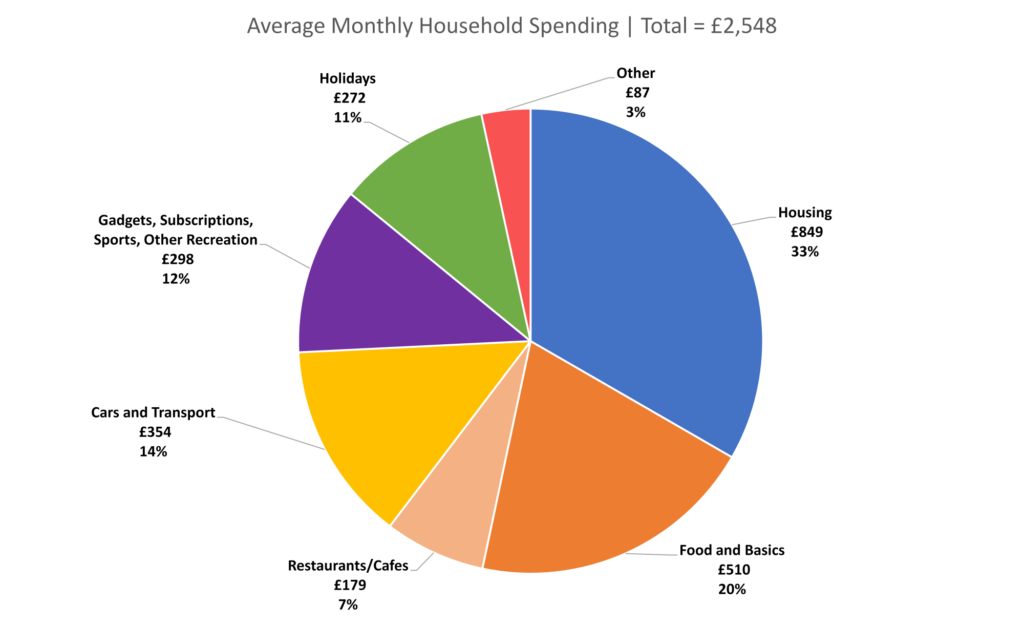

Average Monthly Household Spending

The average UK household spends £2,548 each month from their disposable income, which the ONS considers to be their take home pay. This is income after payroll taxes, student loan and pension contributions have been deducted. Spending does not include amounts saved or invested.

Here’s the breakdown by headline category:

By far the biggest expense at £849 a month is Housing, which includes rent and mortgage interest.

It doesn’t include mortgage capital repayments, as these are considered as investments in an asset and not a real expense, though if we were to include them, this figure would go up £122 to £971 a month.

Nor does it include so called “value added” home expenditure, such as extensions and new bathrooms and kitchens.

As it stands, housing is a third of the average household’s outgoings.

The next most significant chunk of money to hemorrhage out of your bank account each month is likely to be Food and other perishables – if we add eating-out into the mix, this makes up 27% of average outgoings, or £689 a month.

The next biggest cost is Cars and Transport, at £354 a month. Unlike houses, the ONS includes the cost of actually buying the car, as well as running costs – quite right too as cars depreciate to zero within a couple of decades while houses do not.

Also considered in here are non-car transport costs for those who take public transport.

Next up are gadgets, subscriptions, sports and other recreation which come to almost £300 a month. Then a monthly equivalent of annual holiday spend at £272 a month. And finally, £87 of miscellaneous.

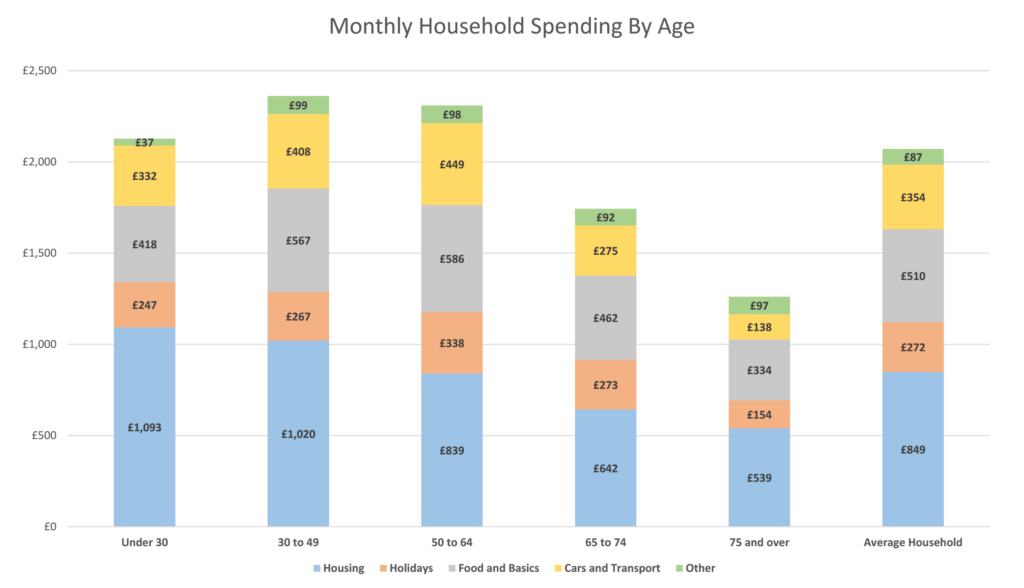

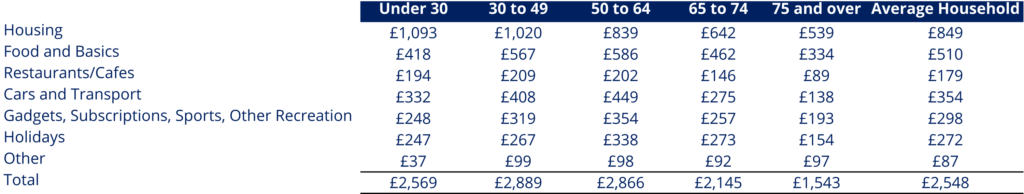

Let’s now look at these figures by age, to make it more relevant to you:

There’s quite a difference in spend as people age, with costs falling across the board the older you are.

Older people are more likely to have paid off the mortgage, become a 1-car household, and tend to have less spare cash to fritter on gadgets, restaurants and holidays.

If we look at this same data in a table instead, we can easily see that a 30- to 49-year-old is at the most expensive stage of their lives according to the stats, with spending on everything except housing up massively from their under 30s counterparts – lifestyle inflation in action! As they earn more, people tend to spend more too.

Annual Household Spending

Let’s now look at the same numbers but annualized. This allows us to demonstrate a psychological blind spot that we have long suspected was at play in reported savings figures, but can now confirm.

In a previous article, “What Percent Of Your Income Should You Invest For Financial Freedom”, we talked about how much the average person reports that they save, and the average for someone aged 30-49 was just under £3,000 a year.

Looking at the same data as above but annualized, this age group is spending about £34,700 a year. In the middle of this age range, the average household disposable income for 35- to 45-year-olds is just shy of £38,000, making for annual real household savings of about £3,300 a year. The average household contains 1.8 adults, so that’s £1,800 per person.

That’s 40% less than what people report they save! Which means they’re in fact spending a good chunk of what they consider to be savings.

Their mistake is that they are including their “delayed spendings” in their savings figures, probably without even realizing.

To us, this shows that people do not understand the difference between savings and delayed spendings, and that the average person is spending way more than they think they are.

Cutting Back – The Easy Wins

If you’re spending more than the average household at your age and want to do something to address that, you might be tempted to go for the low hanging fruit: subscriptions, holiday budget, coffees, day trips out and so on.

But as we’ve seen, these are unlikely to be a significant part of your total spend. And, your Netflix subscription and holiday plans are probably the things that help you get through the working week with your sanity intact.

Instead, to make the biggest impact on your monthly spending you might want to make just 3 simple changes.

The Big 3 Life Expenses

Looking back at the first chart, there are 3 obvious categories that arguably have the least impact on your overall daily happiness, and yet cost the most money: Housing, Food, and Cars. If you want to reduce your spending, these are the main areas to focus on.

Major Life Expense #1 – Housing

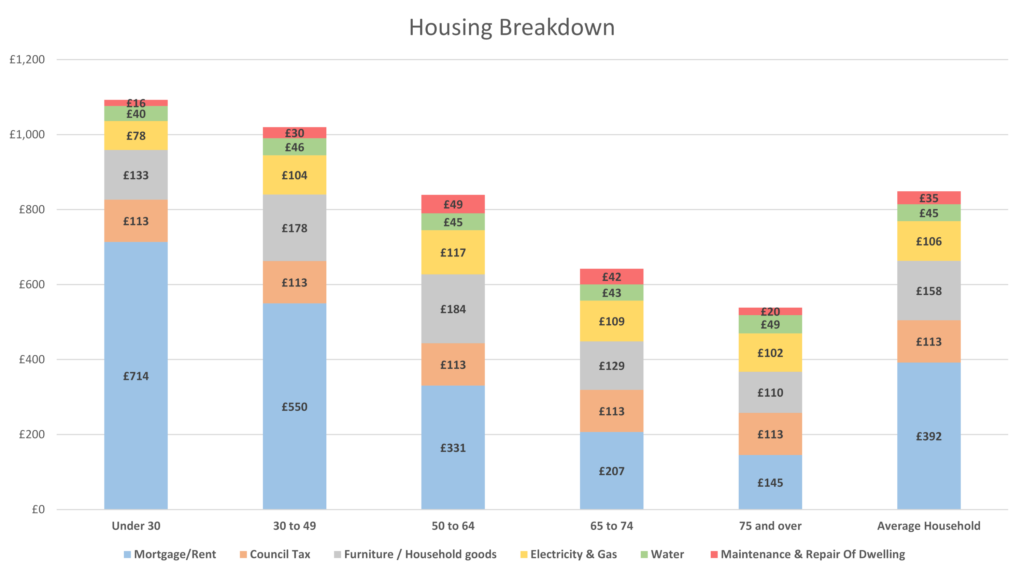

Housing is likely to be your biggest expense, and here’s the averages broken down by subcategory and age group:

For a 30-49 year old household it comes to over £1,000 a month.

If you’re thinking that this figure looks low at £550, remember that it doesn’t include mortgage capital repayments. Also, if your household is closer to 30 than 50 then your mortgage costs might be more like £700, as the people who’ve paid off their mortgages by 50 start dropping out of the dataset.

This average gas and electric bill is interesting – it shoots up for the over 30s, suggesting the presence of kids. My gas bill certainly took a beating once I had to run a full bath every night to clean spaghetti sauce out of my little girl’s hair.

And then when the kids leave home and people get older and retire, and so are in the house more often, we guess that they run the heating more.

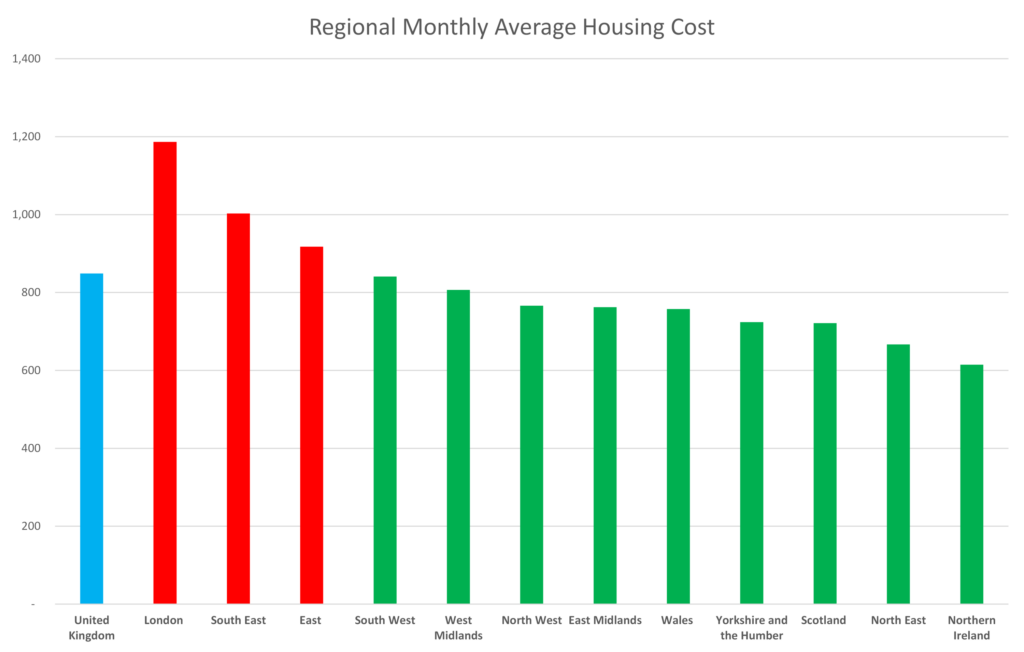

The cost of housing is not uniform though across the UK, as you may expect, and there are savings to found by upping sticks and moving somewhere less expensive.

While the UK average is £849 a month, the cost of housing is massively higher in London, the South East, and the East of England.

Every other region of the UK is below the national average, but if you’re looking for a saving of at least £100 above the average you could look to relocate to Yorkshire, Scotland, the North East or Northern Ireland.

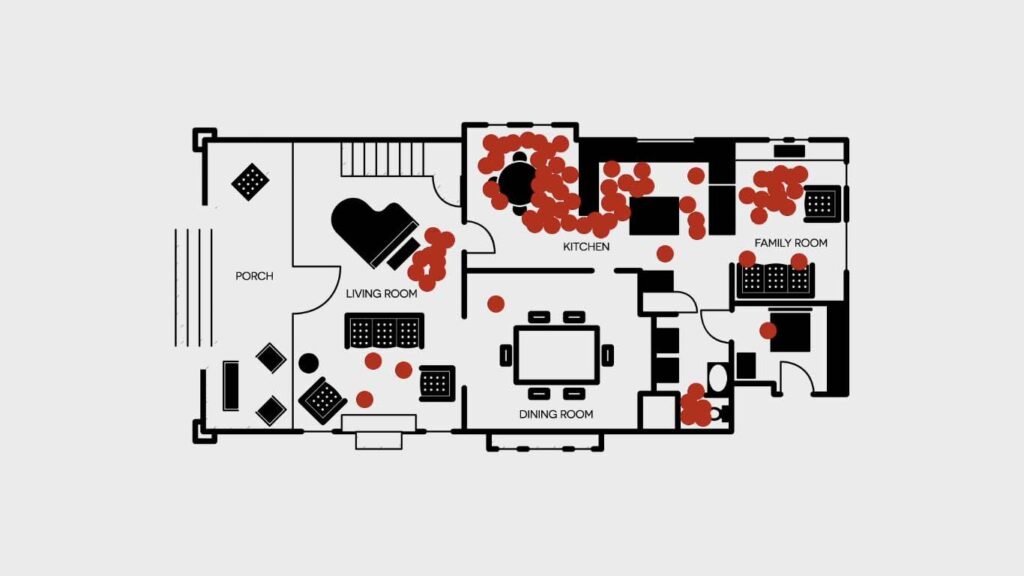

You might also choose to downsize to spend less. This image from Netflix documentary The Minimalists shows a heatmap of typical home use:

If you find yourself in a 4- or 5-bed house, ask yourself how much of that space you actually use. The cost savings on your housing spend from downsizing could be hundreds a month.

We all take it for granted that we should be able to afford a big 4-bed house in our 30s, but why is that? Is it worth buying a big castle, if you find yourself chained to a desk every day trying to pay it off?

One way to course-correct from having already bought a big house is househacking, or using your house to make money to offset those large housing costs.

This could take the form of renting out one or more bedrooms to lodgers, or it could be by extracting some of the equity you’ve built up in the property to use to invest in other properties or the stock market.

I myself have done both, previously renting out a room in my 4-bed house to a lodger for 18 months, and taking tens of thousands in equity out to buy rental properties with.

Major Life Expense #2 – Food

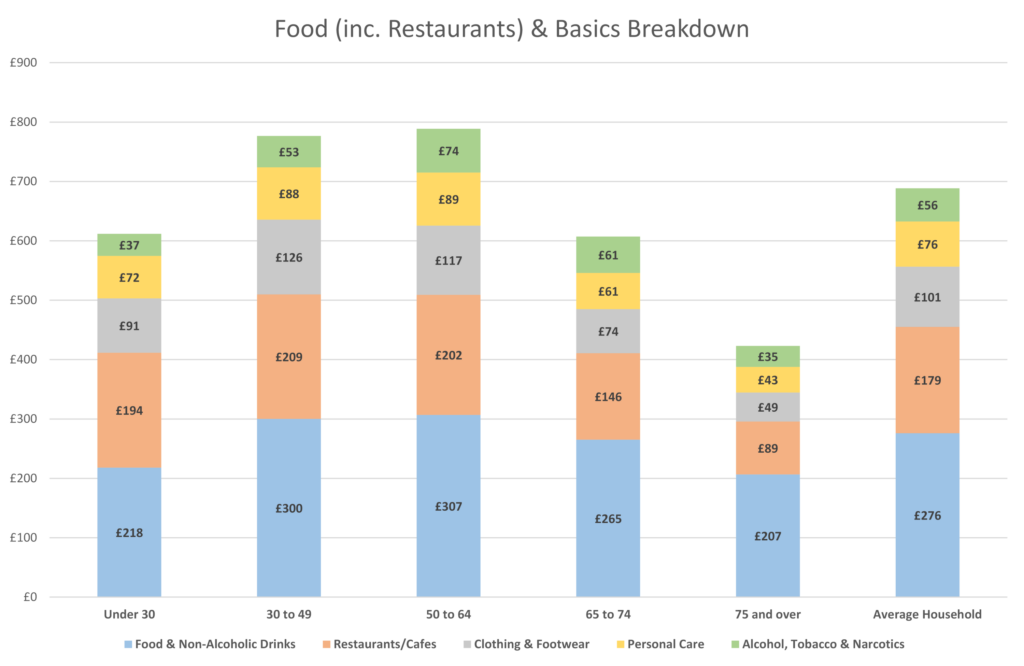

The next biggest cost area is Food and other basics, which includes all food and drink, clothing, footwear, hygiene products like toothpaste and shampoo, and tobacco:

It’s the Food and drinks part of this segment that should get your attention. The average 30-49 year old household spends £509 a month on food and non-alcoholic drinks, with 40% of this cost being from eating out.

How does your monthly restaurant and café bill compare with the average household? Is it an area you can cut back on without sacrificing happiness? Would swapping a Five Guys takeaway for a McDonalds make you significantly less happy?

If your goal is financial freedom like ours is, it’s worth noting that saving even an extra £100 a month could shave years off your working life – so it might not even be right to think of it as a sacrifice.

Maybe you could think of it as trading a night out now for a few extra weeks of financial freedom in the future?

Major Life Expense #3 – Cars and Transport

This one really is an easy win, if you’re used to buying new cars or taking out lease cars on a monthly payment, which is essentially the same thing in terms of money wasted.

According to the AA, the average new car will have lost 60% of its value after the first 3 years – 8% being lost in the first mile, according to edmunds.com.

Is a 3-year-old second-hand car materially worse than a new car? Not really, especially when it’s been cleaned, valeted and serviced prior to purchase.

A good car that’s well maintained can last 15 or 20 years, so why would you buy a new one every couple of years? Let some other sucker take the hit from depreciation, and buy second hand.

You might also consider the quantity of vehicles that you own. As I now work from home churning out blog posts and videos, my household no longer needs 2 cars. Moving to a 1 car household would save us £200-£300 a month, as we wouldn’t need to maintain, tax, insure or replace a second vehicle.

Thousands of households, possibly including your own, have moved to a ‘Working From Home’ situation during the pandemic, with many companies now coming out to say they won’t expect employees to come back into the office for more than a couple of days a week.

Are you splashing money up the wall each month by having 2 big lumps of metal sat idling outside your door for the majority of the week?

Missing Out On Compounding

As we’ve said throughout this video, our goals are early retirement and financial freedom. The route there involves increasing our incomes, but also decreasing our outgoings where we can.

Where we make savings, it’s always with happiness in mind – there’s no point being miserable just to save money.

If you have a similar goal in mind and worry that you are spending too much, then be reassured that any steps you do take to reduce your spending will have a double benefit.

First, any spending cuts you make can compound as extra additions to your investments over the years to bring your retirement date closer.

And second, any spending cuts that you can make and maintain into retirement will mean you need less money in your ISA and pension accounts in order to retire, because you’d need less investment income in retirement to cover your now lower outgoings.

These early retirement topics are covered more in these two articles (FIRE1 & FIRE2), so check them out if you haven’t already.

Finally, remember that savings cuts can only go so far. Sometimes it’s more realistic to make additional income. Check out this article next, for 3 awesome ways to make a few hundred extra quid each month and reach your financial freedom goals faster.

What’s your biggest downfall when it comes to your outgoings? Join the conversation in the comments below!

Written by Ben

Featured image credit: Art Stocker/Shutterstock.com

Also check out the MoneyUnshackled YouTube channel, with new videos released every Wednesday and Saturday: