If we want to become millionaires, then surely it makes a lot of sense to do what they do.

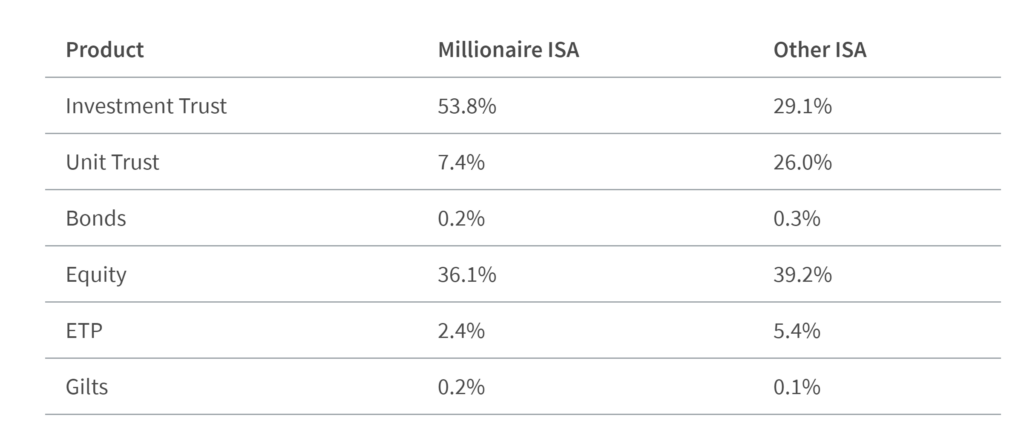

Recently we learnt that ISA millionaires invest overwhelmingly in investment trusts, which the average non-millionaire seldomly uses.

Armed with this knowledge, should we all be thinking about adding at least some investment trusts, or investment companies as they’re also known, into our portfolios?

And how much of your portfolio should you allocate to investment trusts?

If we’re following the well-trodden path of the ISA millionaires on Interactive Investor, then around 54% should be in investment trusts:

According to the Association of Investment Companies, who are the trade body for closed-ended investment companies, there are 391 of them to choose from.

So, this begs the question; which investment trusts should you be investing in?

Here we’ll explain what an investment trust is and the pros and cons of investing in them.

We’ll also look at the most popular investment companies that millionaires are buying, and crucially we’ll show you how you can research and analyse them for yourself!

The 5 Investment trusts in this article can all be found on Freetrade. If you’re looking for a new investment platform and are considering Freetrade, then make sure to grab your free stock worth up to £200 when using the link found on the Money Unshackled offers page.

Alternatively Watch The YouTube Video > > >

What Is An Investment Trust?

Investment trusts are collective investment funds, which allow investors to pool their money together.

In doing so, investors are able to invest in a range of assets, such as stocks, that otherwise may not be possible on their own. This pooled money will be managed by a professional who in theory should be able to provide better returns than an individual.

The name, investment trust, is somewhat misleading, given that it is not in fact a “trust” in the legal sense at all, but a separate legal company.

Investment trusts are ‘closed-ended’, meaning they have a fixed number of shares like other public companies such as Tesco or BP.

But instead of being involved in the buying, manufacturing, and sale of food or Oil, they specialise in the management of financial assets – usually other public companies.

The Investment trust model is well-tested having been around since the 1860s, whereas ETFs and OEICs have only been around since the 1990s.

But despite investment trusts’ long history, they are often regarded as the investment world’s best kept secret. This might be because investment platforms actively promote other types of funds, particularly OEICs, which feature in many of the best buy tables.

A sceptic might say that this reflects the fact that platforms can make more money if their clients buy and sell these other fund types.

Why Investment Trusts Kick Ass!

Investment trusts have a superior performance record compared to their better-known cousins – unit trusts and OEICs. But why might this be?

Investment trusts, unlike unit trusts and OEICs, can borrow money to invest, which when done right will magnify returns.

Another massive advantage over OEICs and Unit trusts is the fact that the investment manager of the investment trust can concentrate on generating returns, rather than have to worry about liquidity.

In other fund types, investors are able to withdraw money directly from the fund at any point, meaning they have to hold excess money to deal with the day-to-day withdrawals.

When this happens OEICs and unit trusts may be forced to sell some assets, at what could be knockdown prices, to deal with these unhelpful fund flows.

Investment trusts, however, are traded on an exchange. This means the shares are bought and sold just like any other company and doesn’t directly affect the daily operations of the investment trust.

Another benefit is they can also use derivative securities such as futures and options for investment purposes. These might be risky in the hands of an inexperienced investor but can be incredible tools to enhance or protect returns.

Investment trusts also have advantages when it comes to dividend payments, as they are able to retain 15% of the income they receive each year. In leaner years they can then dig into these reserves to maintain dividends.

According to the book “Investment Trusts Handbook 2021”, which is worth reading by the way, these advantages show up regularly in comparisons between the long-term performance of investment trusts and that of open-ended funds.

Where trusts and similar funds can be directly compared, trusts typically show up with superior performance records.

Where an investment trust and an open-ended fund with the same mandate are managed by the same individual, it is rare for the trust not to do better over the longer term.

What Are The Drawbacks?

As investment trusts trade on an exchange like other companies, their share price can and does deviate from the net asset value, which is the value of its underlying investments. This difference is known as the discount or premium.

This isn’t necessarily a bad thing and is in fact a characteristic that you should take full advantage of… but it does add more complexity and risk.

For example, the underlying investments could perform badly, and market sentiment could also decline, causing the discount to widen. This would be a double whammy!

Likewise, the opposite could happen. Underlying investments could do well, and market sentiment could improve, causing a double benefit to overall returns.

We personally see the option to use gearing as a positive but if the underlying investments do poorly, then gearing will amplify those losses. Though to be fair most investment trusts use gearing sparingly, and we’ll soon show you where to find this out.

The Management Problem

The biggest potential drawback of all could well be the management problem.

By buying into an actively managed fund, you are depending on one guy or a small team to deliver exceptional results.

But just look at what happened with Neil Woodford. When you pick an investment trust you could end up with one of these duds. Past performance doesn’t guarantee future results!

There is some very convincing evidence out there that says index investing, such as through an ETF, is the best way to invest, because it removes the human element of a fund manager.

Which Investment Trusts are Millionaires Buying?

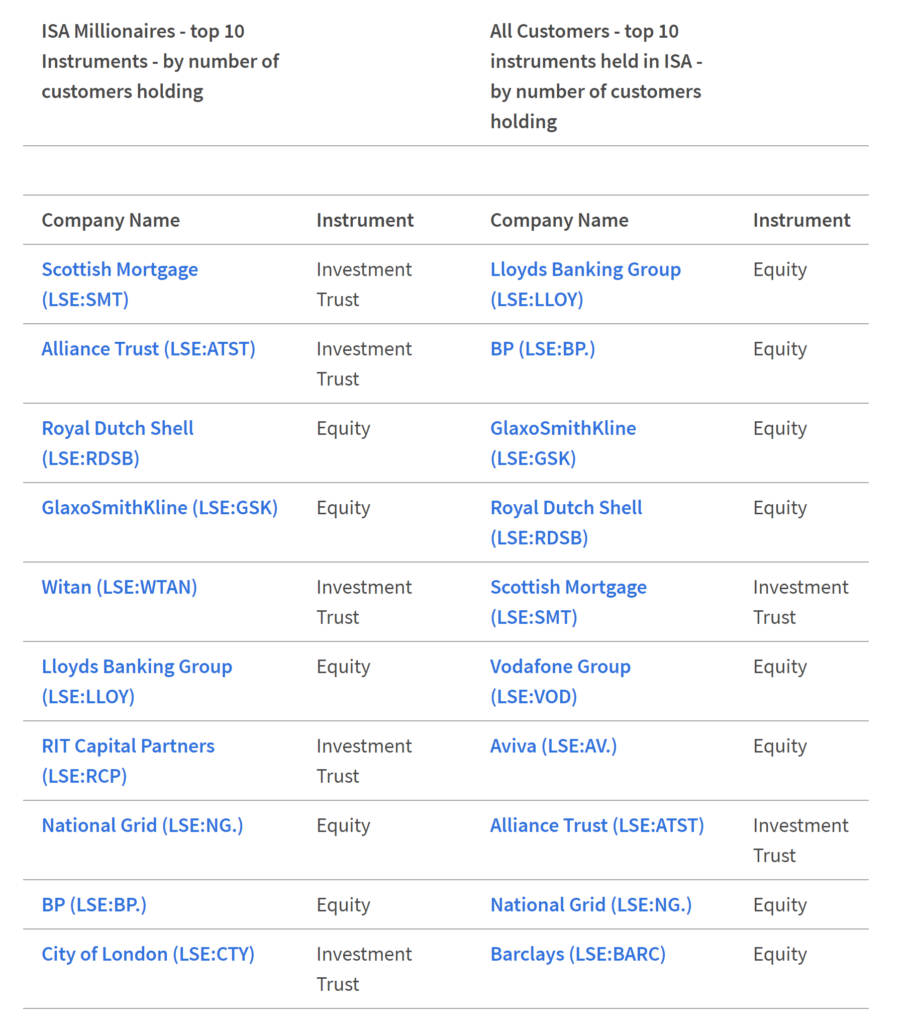

Interactive Investor shared the top 10 holdings for the ISA millionaires on their platform (see below). 5 of them were Investment trusts, with the most popular being Scottish Mortgage which we’ll explore shortly.

In second place was Alliance Trust, followed by Witan, then RIT Capital Partners, and finally City of London.

How To Research And Analyse Investment Trusts

Earlier we name dropped the Association of Investment Companies, and their website is in our view the single best place for information on investment trusts. But what’s better than a good site? A free good site. That’s right – the AIC site won’t cost you a thing to use.

Another useful site is trustnet.com but that’s got too many ads for our liking.

How To Navigate The AIC Website

On the AIC website, you’ll be able to search for a specific company from the homepage if you already know what you want to check out.

Alternatively, head over to ‘Find and compare investment companies’ at the top and click ‘compare companies’. On this page you’ll be able to look at all the investment trusts and view a wide range of data for each.

The “AIC sector” column gives you a rough idea of what they invest in.

Some of the things you might want to review include:

- What does the trust invest in?

- Who manages the trust and what is their past performance record?

- How has the trust performed?

- What is the dividend history?

- What is the yield?

- What is its dividend cover? This is based on its revenue reserves, which we talked about earlier.

- Compare it to other funds in the sector.

- Download and read the fact sheet and reports.

- Search the internet for news on the fund and the fund manager.

As with any investment the extent of your research will improve the likelihood of getting returns. Let’s take a quick look at Scottish Mortgage, which was the most popular trust amongst ISA millionaires.

Scottish Mortgage

Scottish Mortgage is the largest trust and has £18 billion of assets. Its 10-year total return is insane at 820%.

You have to wonder whether the millionaires own this trust because of their foresight or whether they are millionaires just because they happen to have been invested in this trust!

The management group is Baillie Gifford and it’s part of the ‘Global’ AIC sector.

The trust clearly doesn’t focus on paying dividends as it has a very low yield. The dividend cover ratio is a useful indicator of health if the trust is focussing on dividends.

This cover has allowed many trusts to continue paying out huge dividends even through the Covid pandemic.

It has a very low charge of just 0.36%. That’s lower than some ETFs! And the current gearing and the range of gearing over 3 years.

The interesting part is what the trust actually invests in. This trust is predominantly invested in the US and China at 47% and 26% respectively.

The US seems very expensive right now and there is always geopolitical risk with China, but evidently Baillie Gifford who are managing the trust are bullish about stocks in these regions.

The top holdings include huge positions in Tesla and Amazon, and a biotech company called Illumina. The top 10 make up 49% of the entire trust, so it is highly concentrated.

Out of the 96 holdings, 30 make up 78.1%, and interestingly the portfolio holds 50 private companies, which together account for 16.1% of the assets.

Is There An Easier Way?

Fans of this site will know we always try to maximise returns based on effort exerted on our end. Some might be call it laziness – we call it efficiency.

Anyway, picking the best investment trusts looks to be as difficult as picking winning stocks. The FTSE All-Share Equity Investment Trust Index kicks ass, so is there an ETF that simply tracks this?

Well, we couldn’t find one but if anyone knows differently then please let us know. Instead, we could effectively build our own or at least emulate something close to it.

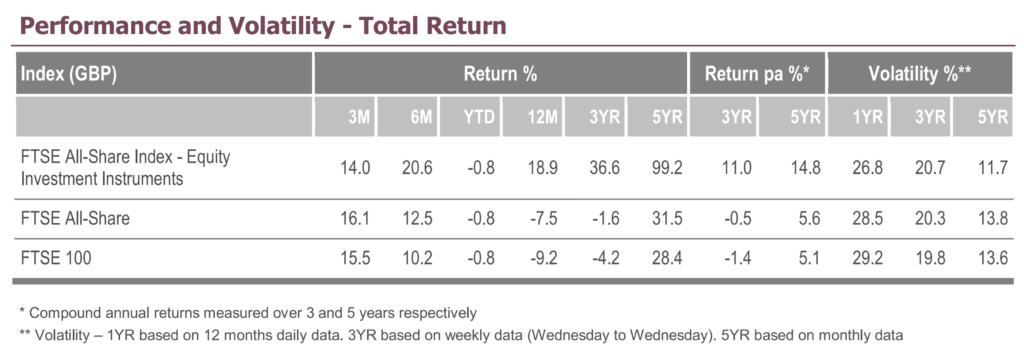

If you look at the fact sheet for the index (below), there you’ll find the top 10 constituents, which you could easily invest in yourself directly using a commission-free app. These 10 companies make up 31% of the weighting of the index, which is pretty good in the absence of an ETF.

How Has The Investment Trust Index Fared?

Over 5 years the FTSE All-Share Equity Investment Trust Index has returned 99%, which is an awesome 14.8% per year after fees:

To put that into context the Vanguard FTSE All-World ETF, VWRL, has returned 88%, which is 13.5% per year after fees.

So even though investment trusts will have higher fees, over the past 5 years these actively managed investment trusts have been the greater investment.

Don’t underestimate that seemingly small performance difference. It really adds up over time!

We don’t know anymore than you whether this story will continue into the next 5 years, but an annual performance difference of 1.3% would be enormous over the long-term due to compounding.

It could be worth hundreds of thousands of pounds over a course of an investing lifetime. That might explain why the ISA millionaires use them whereas ordinary investors do not.

Will you be adding investment trusts to your portfolio and how will you go about it? Let us know in the comments below.

Featured image credit: nednapa/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: