Surely everyone’s dream is to be an ISA millionaire – to have built up £1m in your ISA. Not only are you rich, but your income comes from a tax-shielded ISA – meaning you’ve opted out of the tax system for good. No more greedy HMRC groping around in your bank account!

Saving and investing enough money to become a millionaire is quite an achievement.

But these days, thanks to Individual Savings Accounts – known as ISAs – it is possible to build up £1million much more easily than it used to be, because there is no tax to pay on income or capital gains while you’re building your pot.

Despite this, shockingly few people have taken up the opportunity to have their income paid in tax-exempt dividends and capital gains.

You don’t need to be a high roller with a trust fund to be part of the elite ISA millionaire club.

In this article we’re going to show you how anyone can build up £1m in their ISA, on any budget.

But we’ll also show you how to do it quickly, we’ll address the roadblocks in your path, and tell you how to turbocharge your compound returns by cutting costs and doubling up your contributions.

And best of all, we’re going to look at the data on real-life ISA millionaires, and crucially, what they invested in to become ISA millionaires. It turns out they invest very differently to most investors!

Alternatively Watch The YouTube Video > > >

The Main Obstacle

The ISA is one of the most generous financial products in the world, so thumbs up to the UK government for this rare acknowledgement that saving for your future is a good thing.

But of course, they don’t make it easy.

You are only allowed to deposit a maximum of £20,000 a year into an ISA, and you can only deposit into one of each type per tax year – which runs from the 6th April to the 5th of April the following year.

£20,000 may sound a lot of money – but if your goal is to become an ISA millionaire, this is quite a hindrance.

In a previous video where we looked at official ISA statistics we learnt that a large number of people either use all of their annual allowance or barely use any.

Back to the £20k allowance, if we assumed zero returns, for instance by using a Cash ISA, then it would take 50 years to save £1m by depositing the maximum £20k each year.

But nobody in their right minds would attempt that. Luckily, Cash ISAs aren’t the only game in town.

Basic Timeline To ISA Millionaire Using A Stocks & Shares ISA

Stocks & Shares ISA investors could become millionaires in just 20 years based on historic returns for world stock markets, by making the maximum ISA contribution.

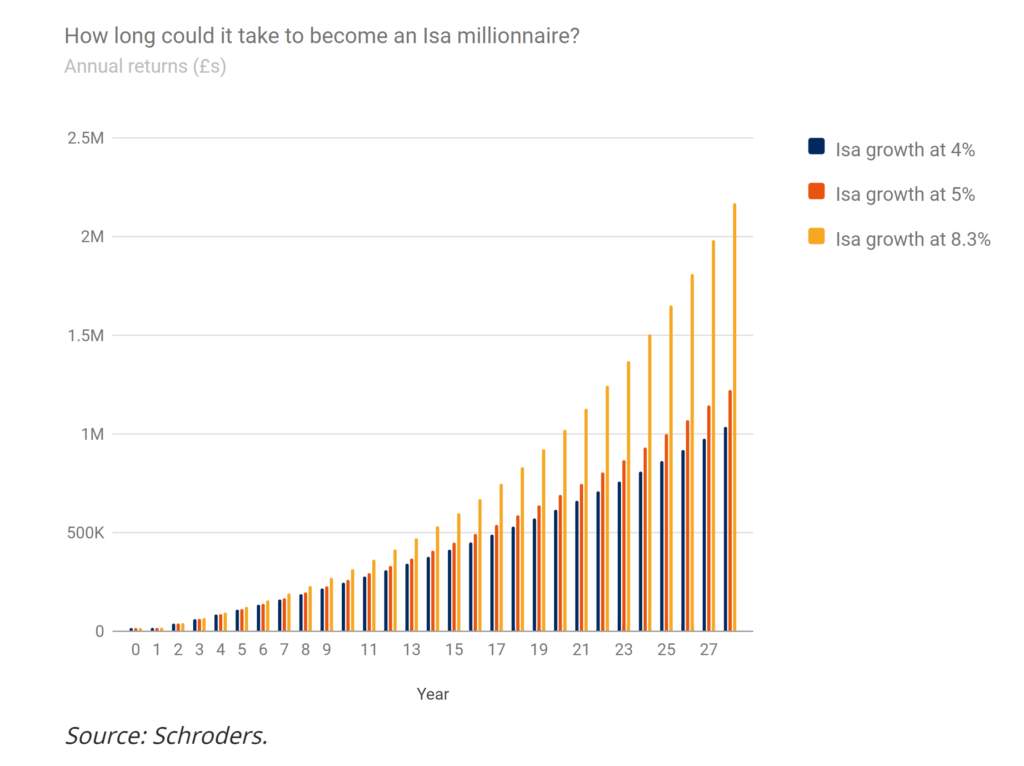

The below analysis from Schroders shows this nicely. ‘20 years’ is based on the average annual return of 8.3% that was achieved for the MSCI World Index over the 25-year period 1993-2018, with all dividends reinvested.

This is before inflation, so they also looked at a 5% real return, which would take 25 years, and a pessimistic 4% real return, which takes 28 years.

We almost take that 4% as a worst-case scenario, knowing what we do about the performance of the stock market over the last 100 years. It’s the best place to hold your money long-term, in our opinion.

Say you were able to start depositing £1,667 a month – £20k divided by 12 – at age 40. Not unrealistic if you work your way up the greasy pole in your career, or start a business.

That would make you an ISA millionaire in your 60s. And any contributions you make while you’re younger will drag that date significantly closer due to the power of compounding returns.

Also, it’s possible that a future government will raise the ISA limit further – after all, it’s been climbing since 1999 when the limit was only £7k.

Who’s to say you won’t be able to deposit £30k, or £40k in future years? Of course, it could just as likely be cut too, so it’s a good idea to use the current allowance in full while you can!

Keep Costs Low

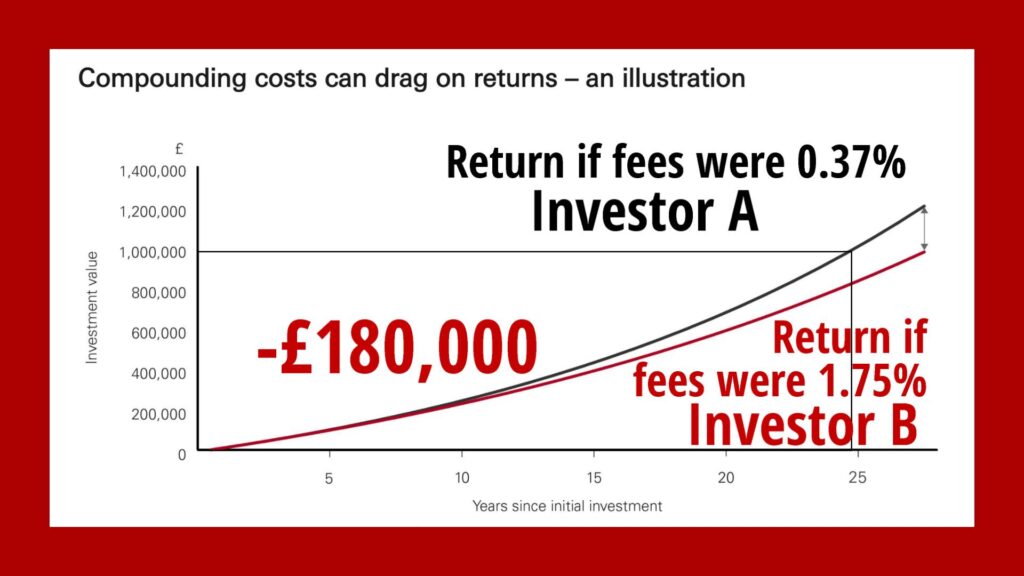

If you’re serious about being an ISA millionaire then you must keep your investing fees down. That’s because compounding works in reverse when it comes to your costs.

he below study by Vanguard shows the difference between investing the £20k maximum into your ISA each year at a 0.37% fee (which is Vanguard’s platform fee plus an average fund fee), and a hypothetical ISA with total fees of 1.75%.

Both these numbers sound small. But the difference on a 6% return meant that Investor A reaches millionaire status 3 years before Investor B, with Investor B being behind by around £180,000!

The moral? Get fees right from the start, and the journey will be a lot smoother.

Avoid Other Taxes

An ISA doesn’t protect you from all taxes, and you’ll want to minimise them all if you’re going to be an ISA millionaire.

If you’re investing in stocks from outside of the UK – which you probably should be if you want to be diversified and get the best returns – you’ll likely be getting stung by dividend withholding tax.

The US is a big culprit for this, and we estimate the drag on your returns from withholding tax to be around 0.3% – based on a 2% typical US dividend yield multiplied by the 0.15% tax.

We’ve found a way around this by packing your portfolio with synthetic ETFs – for more info on saving tax in this way, check out this article next.

Perfect Strategy vs Keeping It Simple

There’s getting there quickly as an experienced investor, and then there’s getting there at all regardless of your investing skills.

As we said, anyone can become an ISA millionaire – you don’t need to be interested in the nuts and bolts of investing.

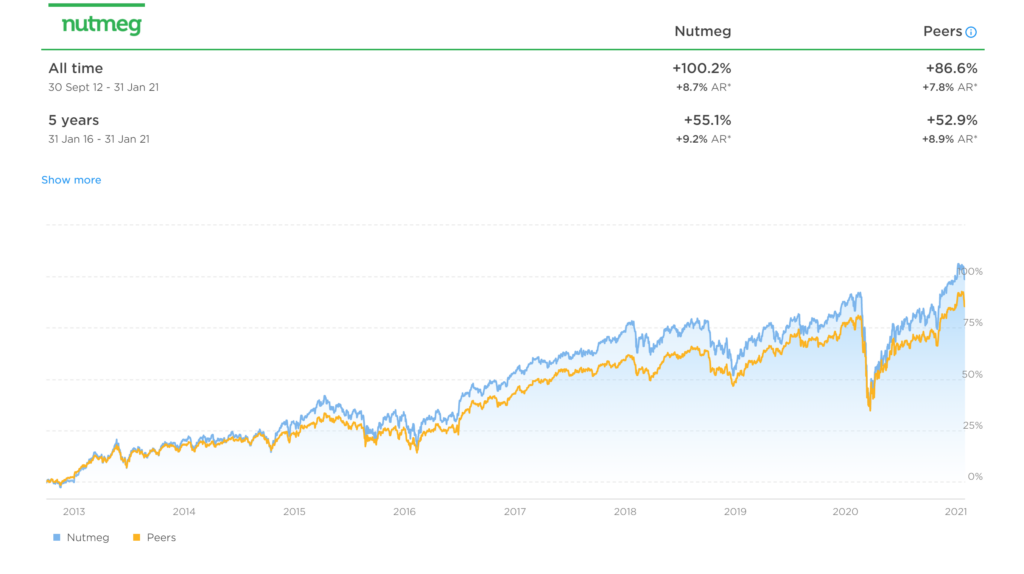

For this reason, opening a Stocks & Shares ISA on a robo investing app like Nutmeg might be best suited to the average person.

Nutmeg has a history of consistent high returns and they do it all for you, using globally diversified ETFs. You can literally open an account, set up your monthly deposit payment, and forget about it.

If you find your way to Nutmeg via the link on the Money Unshackled Offers page, your account fees will be reduced to zero for your first 6 months.

How Many ISA Millionaires Are There?

Research by the Telegraph in 2015 suggested there were only around 200 ISA millionaires. In 2018 they updated that number to 1,000.

As of February 2021, there are 731 ISA millionaires on the Interactive Investor platform alone (a third of which are women), so presumably the total number in the UK now runs into the several thousand. The average age of an ISA millionaire on Interactive Investor is 71.

Even though the number of ISA millionaires is increasing, it’s still shockingly low, though granted ISAs and their predecessors PEPs have only been around since 1987 – and deposit allowances were miniscule back then.

But with 1 million people using Interactive Investor, just 731 of them being ISA millionaires is a weak effort by the British public.

We believe achieving ISA millionaire status by age 71 is achievable for anyone due to compounding returns, as all you really need is patience, whatever your budget.

Really, getting there at age 71 should be your worst-case scenario, as you should be able to get there far earlier than this, now that ISA allowances are £20k.

Just think about this – you could have had a 50-year run at being an ISA millionaire by age 71, by saving only £380 a month, at an 8% average stock market return.

What Do ISA Millionaires Invest In?

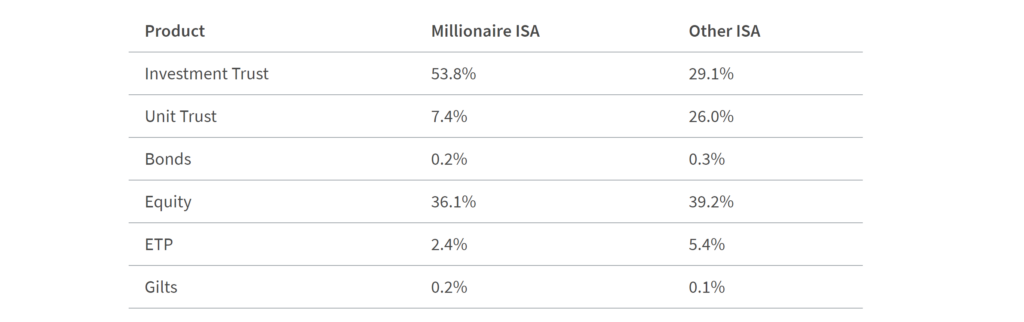

Sticking with Interactive Investor data – because they’re so open with it – here’s what the average ISA millionaire’s account looks like compared to an average user:

Interestingly, they invest quite differently to the average Joe, with 53.8% of their portfolios made up of Investment Trusts.

They don’t care about bonds, despite being the target audience in their 70s, nor do they bother much with ETFs (included in the ETP bucket), which are our bread and butter.

This is probably because ETFs are modern products and these investors are well into their retirements, and people tend to stick with what they know.

The top stocks among the ISA millionaires are Royal Dutch Shell and GlaxoSmithKline, and the top Investment Trusts are Alliance Trust and Scottish Mortgage:

But what is it about their love of Investment Trusts?

Investments Trusts are the oldest type of fund – around for over 150 years – so older investors will have grown up with them.

Investment Trusts have tended to outperform other fund types over the long term, but that’s not to say they’ll continue to do so in the future.

2020 saw the largest-ever outperformance of the FTSE All-Share by investment trusts, with the FTSE Equity Investment Instruments Index (FTSE EII) producing a total return for the year of 17.8% compared to a negative 9.8% for the FTSE All-Share.

Finally, their ability to borrow to enhance returns means they can give a portfolio a boost over the long term.

How ISA Millionaires Trade

Interactive Investor ISA millionaires make 24 trades in a year on average, compared to 9 for the average ISA customer.

And the average ISA millionaire has 28 stocks versus just 8 for the average ISA account, despite trading fees encouraging fewer holdings.

This somewhat goes against the ‘buy-and-hold’ philosophy and suggests a slightly more active approach might pay off.

That’s How Today’s Pensioners Did It – Should Our Generation Be Doing The Same?

Given your target is long-term growth, we agree that it’s worth avoiding bonds and sticking predominantly, if not exclusively, to equities.

By all means do this by using Investment Trusts, if you’re able to pick the winners from the losers.

But ETFs are so diverse, flexible and cheap that they will likely always form the core of our ISAs.

Want to invest in BioTech? Silver? Artificial Intelligence? China? There’s an ETF for pretty much every theme that you could want to invest in.

Double It Up With Your Spouse

Are you married? Couples get a £20,000 annual ISA allowance each, so between you, you could be saving £40,000 a year.

Recalculating the compounding based on £40k, £1m could be achieved in 14 years rather than 20 at that pace. That’s ISA millionaire status in just a over a decade from now.

Downside Of Being An ISA Millionaire – Inheritance Tax

We can’t think of many downsides to being an ISA millionaire, but the big one is what happens to your money on your deathbed.

In a pension, your wealth can get passed on tax-free to your heirs depending on the age you go. But an ISA is subject to inheritance tax.

So, the taxman catches up with you eventually – just when it’s no longer your problem.

But there are clever tax strategies to reduce or avoid IHT even with your ISA that you can look into later, so don’t let this put you off reaching for your dream.

The ISA Year End Is Coming!

The ISA year end is fast approaching – if you have £20k in cash, get it into a Stocks & Shares ISA now!

The annual allowance for how much can be put into an ISA cannot be carried over into future years, so for the current year’s allowance, it’s now or never.

And if you’re looking for the best Stocks & Shares ISA, check out our guide here next.

Are you planning on becoming an ISA millionaire? What are you investing in? Let us know in the comments below!

Feature image credit: Gustavo Frazao/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: