Warren Buffett needs no introduction. He has led the company Berkshire Hathaway for several decades now and turned it into a multinational conglomerate owning or having significant stakes in some of the biggest companies in the world. Today Berkshire is worth $577 billion.

Buffett is up there amongst the richest people in the world and he himself is estimated to be worth $95 billion. We don’t think we’d be out of place to call him the greatest investor on the planet.

He’s so good in fact that millions of investors hang on every word he says. We think you’d be hard pressed to find an investor that doesn’t at least pay attention when Buffett opens his mouth.

But despite all these incredible accolades does that mean you should try and emulate his success by doing what he does? Here we’re looking at 6 reasons why you shouldn’t invest like Warren Buffett!

It’s highly unlikely that Warren uses an investing platform, but you need one! If you need help choosing, then check out the Best Investment Platforms page.

We’ve handpicked some of our favourite places to invest and some are even giving away free stocks when you sign up.

Alternatively Watch The YouTube Video > > >

Buffett’s Investment Style

Many investors have tried to replicate his investing style or at least something that they think resembles it.

Buffett follows the value-based investing model. Essentially this where you only buy stocks in companies that exhibit solid fundamentals, strong earnings power, and the potential for continued growth.

But crucially, Value investing is an investment strategy that involves picking stocks that appear to be trading for less than their intrinsic value – basically trading less than what a stock is really worth.

He’s also famous for not investing in anything he doesn’t understand. This might mean he misses out on some big gains, but it also ensures that he doesn’t suffer significant losses such as when the dot-com bubble burst.

At the time most technology plays were new and unproven, causing Buffett to avoid these stocks.

Buffet favours companies that distribute profits to shareholders but perhaps hypocritically, Berkshire Hathaway does not pay dividends to its own shareholders.

Buffett feels that investing back into the business provides more long-term value to shareholders than paying them directly, because the company’s financial success rewards shareholders with increasing higher stock values.

While learning as much as you can from great investors like Buffett is certainly recommended, here’s why you shouldn’t try to invest like him yourself:

#1 – You Can’t Buy Entire Companies

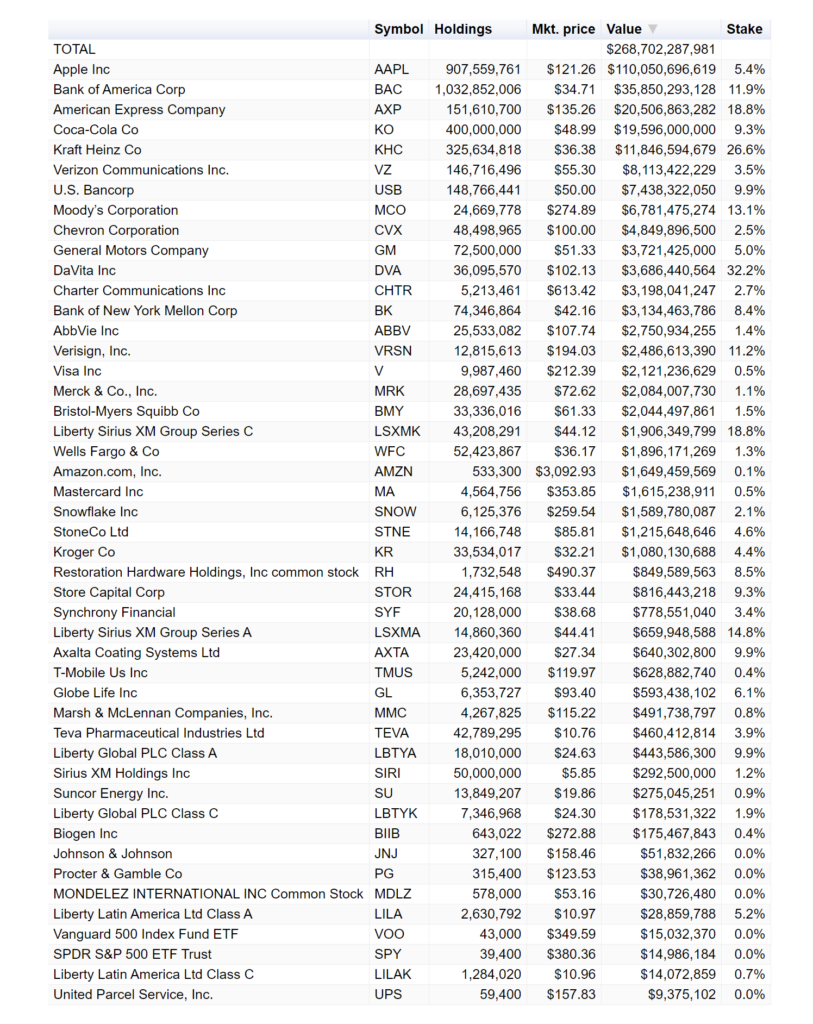

A lot of the attention on Berkshire is on its portfolio of public stocks that they own a percentage in. The big ones currently include the likes of Apple, Bank of America, American Express, and Coca-Cola.

This table produced by CNBC excellently breaks down all the publicly traded stocks that Buffett’s company currently has a stake in:

Notice that the total adds up to $268 bn. As we mentioned earlier the total value of Berkshire is $577 bn, which would suggest that Berkshire owns other companies worth hundreds of billions of dollars’ that are wholly owned and so are not included in this list.

One example of a wholly owned subsidiary is BNSF Railway, which is the largest freight railroad network in North America. That deal was completed in 2009 and was worth $44 billion, so presumably is worth a lot more today.

Another example is Precision Castparts Corp. This company became a subsidiary of Berkshire in 2016 in a $37 billion deal.

Owning companies in their entirety gives Buffett control over how the business is run. Although the subsidiaries get unparalleled autonomy, if performance is disappointing, Buffett could get involved.

Owning subsidiaries in full allows any excess cash to be redirected to the other parts of the Berkshire empire or to make new acquisitions.

Being able to take full ownership of companies gives Buffett advantages that you do not have.

#2 – You Don’t Have The Skills

That’s not meant to be a criticism. We’re comparing you with one of, if not the greatest investor of all time.

Anecdotally, we think the extent of most peoples’ investing efforts is to look at a share price chart and come to the conclusion that a stock is worth buying if the price is lower now that what it was in the past.

Perhaps some people go a bit further and look at earnings-per-share, the price earnings ratio, and the dividend yield. Not many people go further than this.

Have you ever looked at an annual report or other company filings, especially one from a US company? They are the longest and most boring documents that you can imagine.

No normal person in their right mind wants to read one of these. By the time you’ve finished reading next year’s report would have already been published.

And yet Buffett relishes the chance to flick through the pages. He has even said, and we paraphrase, “if you are invested in a business, it is your duty to know everything about its competition. Therefore, it’s not enough to just read the annual report of your business; you need to read all your competitors’ filings too”.

How did you learn to invest? Buffett was a student of Benjamin Graham, who is widely regarded as the father of value investing.

Most investors today have watched 5 minutes of Mad Money with Jim Cramer on CNBC and are following wallstreetbets on Reddit. That is the extent of their investing prowess.

#3 – You Don’t Need To Beat The Market

Buffett himself says the average investor should be tracking an index. This is a guy who has smashed the S&P 500 over several decades and yet he still encourages everyone else to track the market.

He believes this so vehemently that he has instructed the trustees of his estate to invest it in index funds after he’s gone.

In a 2014 letter to his shareholders Buffett said,

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund (I suggest Vanguard’s). I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions, or individuals—who employ high-fee managers.”

There is a great deal of evidence that shows that passive investing beats active investing after the high fees and taxes.

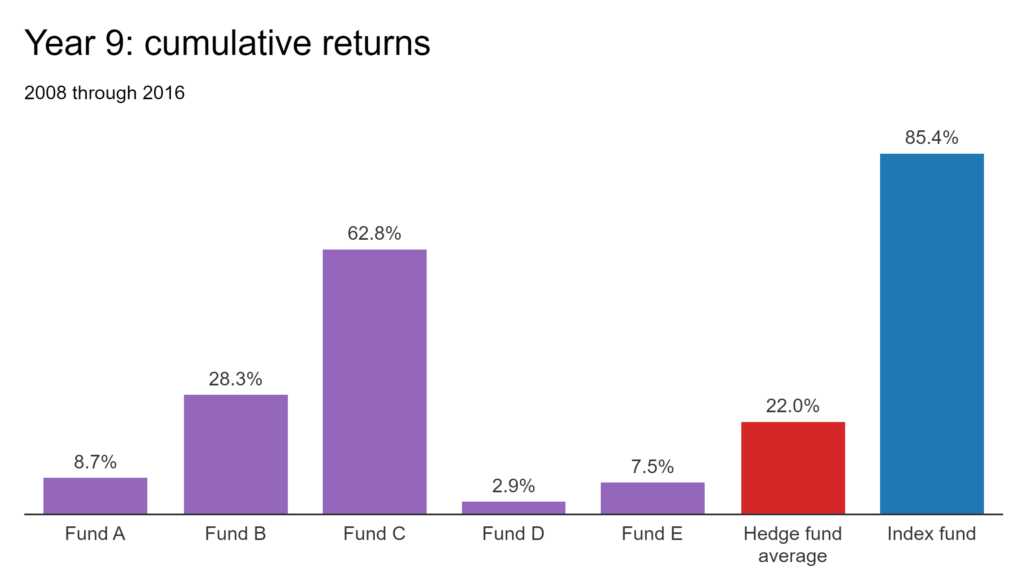

In 2008 Buffett made a $1m bet that an S&P 500 index fund would outperform a hand-picked portfolio of hedge funds over 10 years. In year 9 the hedge funds conceded after the S&P 500 had taken an unassailable lead:

What’s more, spending the time researching, analysing, and monitoring stocks is very time consuming when done properly.

A well-diversified portfolio is likely to have 20 or more stocks, so even if you have exceptional investing skills you still need to ask yourself whether picking stocks is worthwhile.

Let’s say you were managing your own portfolio that was valued at £100k. Most young people don’t even have this.

If you were to add 2% extra value to your returns over the index, that’s still only £2,000 a year. Your time would have been better spent increasing your income elsewhere and increasing your investing contributions.

#4 – He’s Not Saving For Retirement

Buffett is said to have the majority of his own personal wealth in Berkshire Hathaway, but he is not saving for retirement (because he’s already minted), and Berkshire is not a retirement fund.

Investing should always be personal because everyone’s situation is different, but with absolute certainty your situation is different to Buffett’s.

Most of us have to grow a portfolio during our working years and then the stash has to produce reliable income during our later years.

Broadly speaking, that means we can gear our investments towards high growth assets while we’re younger are forced to shift towards safer investments as we age.

Historically, during the retirement years the assets would need to pay an income but a reduction in trading fees may have lessened this need slightly, as you can gradually sell out of your growing positions instead.

Although we personally are not keen on bonds, you can understand why so many retirees feel comfortable holding these in their portfolios. They are nowhere near as volatile as stocks and help to preserve the capital value of the portfolio at the expense of lower expected returns.

Berkshire and Buffett have none of these concerns and can stick to the stock market.

#5 – He’s American, You’re Not

If you’re indeed American, you can ignore this but for the majority of our viewers who are British, your residence lowers your chances of success.

Most of the companies Buffett invests in are global but their roots and the majority of their revenues come from the US market.

When picking stocks, you have an advantage when you are familiar with the market they operate in. You can get a better feel for a company when you’re able to walk through the doors and experience it for yourself.

Also, you have to worry more about exchange rates than he does. Most of the profits his stocks make will be in dollars, which is exactly how he wants it.

For all of us in the UK, however, changes in the exchange rate can wipe out all of your returns or even amplify losses. We personally only see this as a short term-term worry, which is ironed out over the longer term, but many British investors are so concerned with this that they neglect their international holdings and choose to have too much UK bias.

However you choose to manage FX risk, this is a much smaller issue for Buffett!

Another problem us non-US investors have is dividend withholding tax. We get stung with a 15% tax on any dividends paid by US companies.

If you’re investing in US stocks that pay good dividends, Uncle Sam is going to take a slice off the top. Don’t underestimate the effect of small fees and taxes on the long-term performance of a portfolio.

#6 – You Can Invest In Small Companies

The first 5 reasons are all ways in which Buffett kicks your ass, the little guy, so let’s reverse that and look at 1 big area you can beat him in.

Buffett is managing hundreds of billions of dollars.

Although that sounds awesome, it comes with a major problem: There are not enough good companies out there trading at reasonable prices to invest in.

Unless the company is worth at least a few billion dollars, then it’s likely to be off limits for Berkshire because any purchase would likely result in owning the entire company. Owning too many tiny subsidiaries would clearly be too much of an administrative burden.

What’s more, even if a $50m stock doubled in value it would have a negligible effect on Berkshires profits, so it’s not worth their management time.

You on the other hand can literally invest in any public stock that’s available to you. This is awesome because it’s the smaller companies where the bargains can be found.

Large companies tend to be over analysed and are more likely to trade at their intrinsic value.

Small-cap stocks are more likely to go unnoticed and sometimes can trade at knockdown prices. It’s highly unlikely that you spot something in Apple’s product design or supply chain that a full-time analyst doesn’t already know.

But this is very possible when you look at your local chain of corner shops, which is floated on AIM!

Buffett’s inability to buy small companies puts Berkshire at a major disadvantage.

He told Berkshire’s investors not to expect the same type of returns the company has produced over the past 55 years.

What’s your investment style and why? Let us know in the comments below.

Featured image credit: Kent Sievers/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: