“Let me tell you something. There’s no nobility in poverty. I’ve been a poor man, and I’ve been a rich man. And I choose rich every f***ing time.” ~ Jordan Belfort: Wolf of Wall Street.

We hear you Jordan. We’re working our butts off towards financial freedom, but how can we measure whether we’re making that dream a reality? What needs to be done between now and that magical financial freedom date?

Everyone loves a good checklist – a set of actionable steps that can be ticked off once complete. With each small accomplishment you’re a step closer to achieving your wider goal.

That’s why we’ve compiled for you this checklist for financial freedom!

Alternatively Watch The YouTube Video > > >

Clear Your Bad Debt

Let’s keep this one brief as it’s the most overly preached rule in wealth building.

The borrower is slave to the lender. We’re not religious but this is a valuable lesson straight from the bible.

If you are indebted, then you have an obligation to the lender to pay it back, plus interest. Bad debt includes short-term loans, overdrafts and credit cards with a high interest rate.

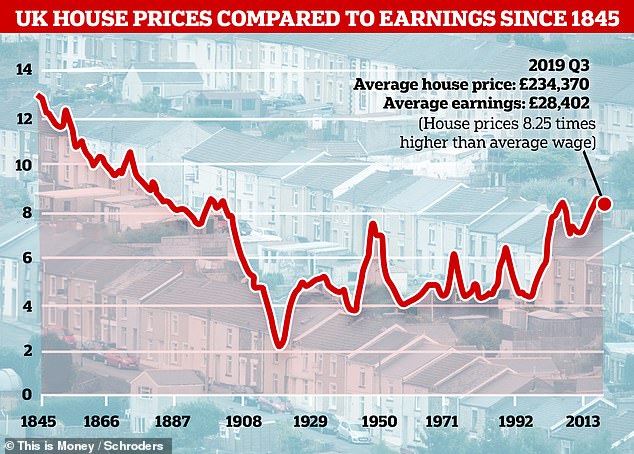

However, we draw the line at paying down all debt right now because GOOD debt is a tool that when used correctly can help to set you free. This is low interest, long term debt like mortgages and UK student loans.

We agree that the borrower is slave to the lender, but we also acknowledge that most people will be a slave to money until they become financially free, which sadly is at old age retirement for most people, as they are bailed out by state pensions.

We ourselves hope to become financially free in our 30s but until then we are money slaves.

Therefore, while we are enslaved, we will utilise good debt to help us achieve freedom faster. Good debt can be cleared later if you wish.

Checklist action point: if you’ve paid off all your bad debts, give yourself a tick!

Maximise Savings-Per-Month (SPM)

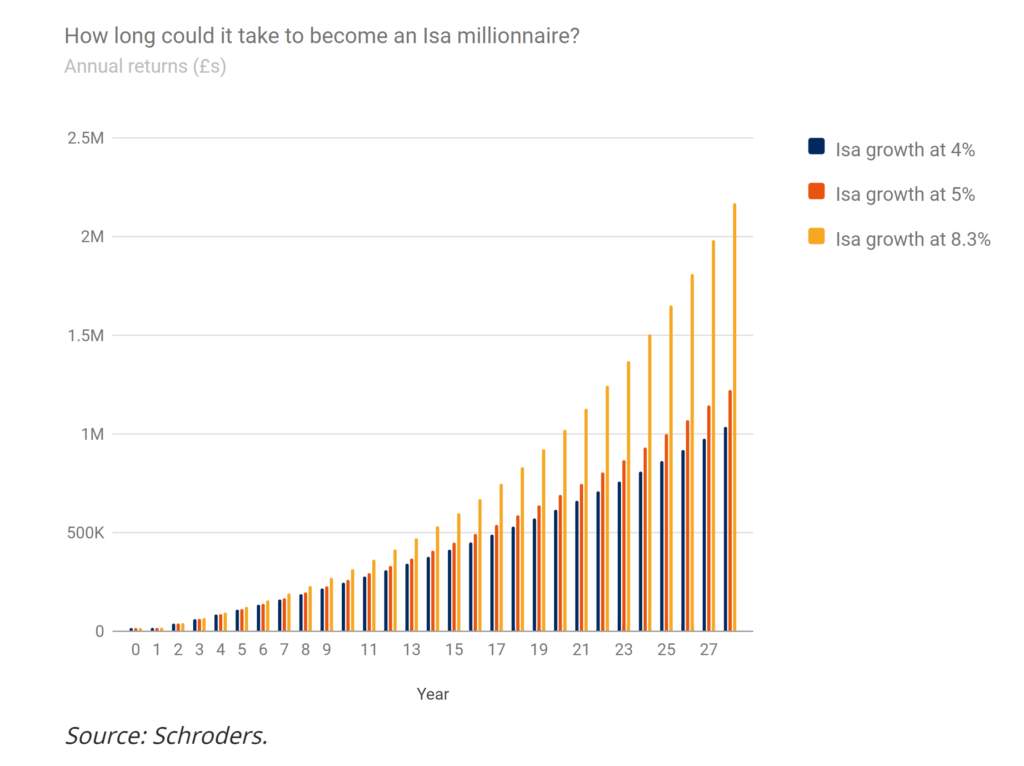

The most important aspect of wealth building for financial freedom is your savings-per-month. In the short to medium term the amount you can save is more important that your return on investment.

Your return on investment becomes the key factor later when your pot begins to swell. As an illustration, an 8% return on a £10k pot is just £800, but 8% on a £300k pot is £24k.

This goal can be broken down into multiple smaller goals, which can be ticked off as you progress:

- Save £100 a month.

- Save £300 a month.

- Save £800 a month.

- And so on…

If you’re happy that your level of SPMs will get you to your endgame, tick it off the list!

For most people who have predictable incomes from a job and if you’re budgeting correctly, then you should be able to save roughly the same amount each and every month.

If you’re wondering how on earth this can be achieved when you have things like Christmas or an annual holiday in some months, then you might get something from our Lazy Guide To Budgeting.

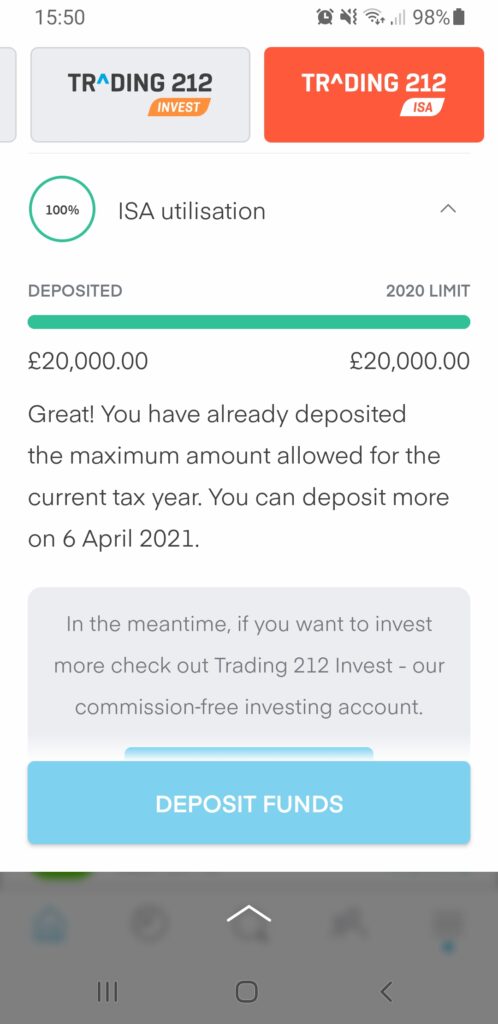

Although we call it savings-per-month, a more appropriate name would be investments-per-month. Any financial freedom or retirement money, or indeed any long-term savings, should be invested.

If you save in cash, you are likely never going to achieve freedom because inflation will decimate the pot.

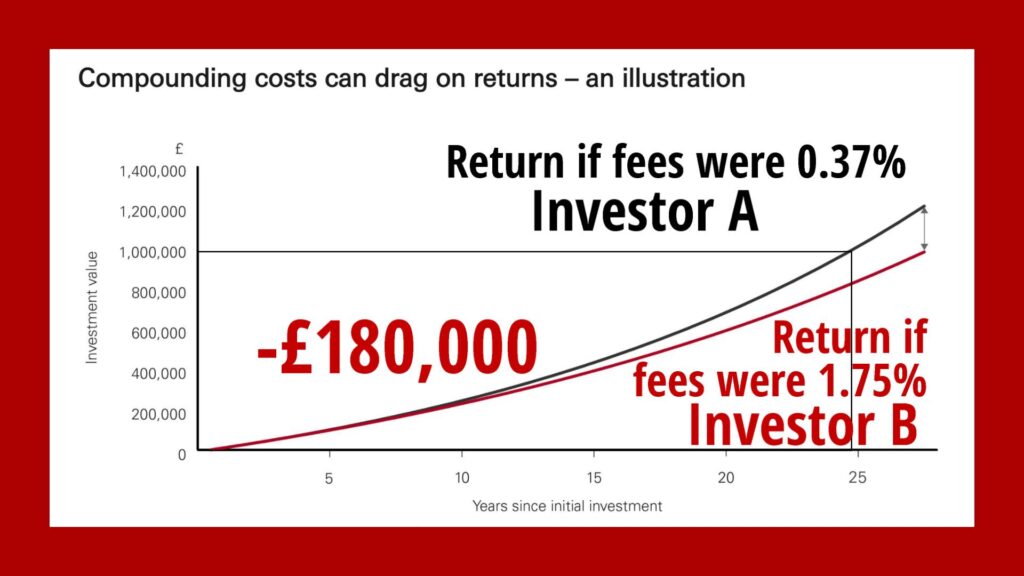

Secondly, it would be extremely difficult to build wealth based on your work alone. The compounding effect of money invested will supercharge your wealth building ability.

Master Investing

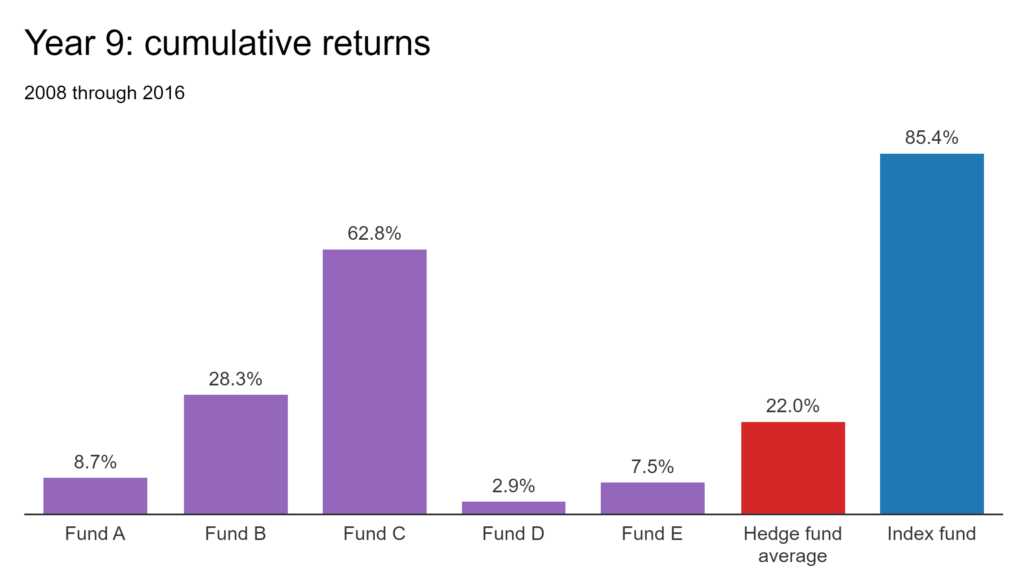

This leads us nicely into the next goal, which is to master investing. If you’re new to investing or don’t have any interest in the subject, then don’t worry. This might even be an advantage for you.

Constant meddling and trying to beat the market are usually the reasons why people suck at investing. We ourselves are aware of this and are conscious that our own involvement could damage us.

Hence why the vast majority of our investments follow our strict rules-based approach, which you can follow or use as inspiration.

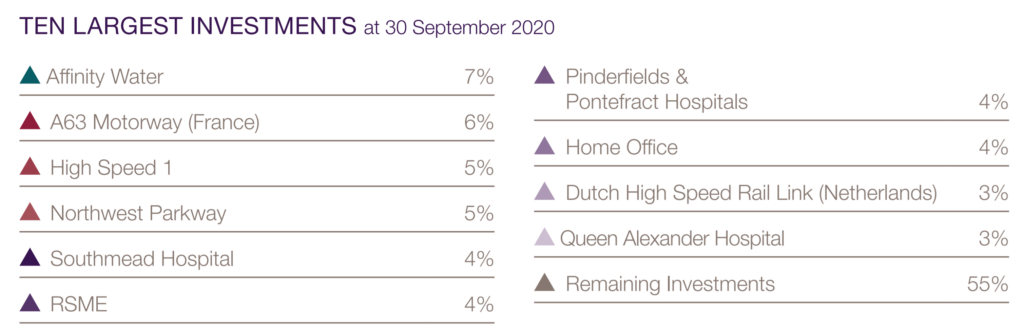

We both invest into what we call the Ultimate Portfolio.

It’s a portfolio consisting of 5 funds, getting positions in stocks from both developed and emerging economies, and also adds in smaller companies as they tend to grow faster.

The portfolio is finished off with some gold and silver to hedge against economic disaster.

We love this portfolio because it allows us to invest with conviction.

We don’t need to worry about short-term crashes in the market because it tracks a series of indexes that are essentially tracking global prosperity.

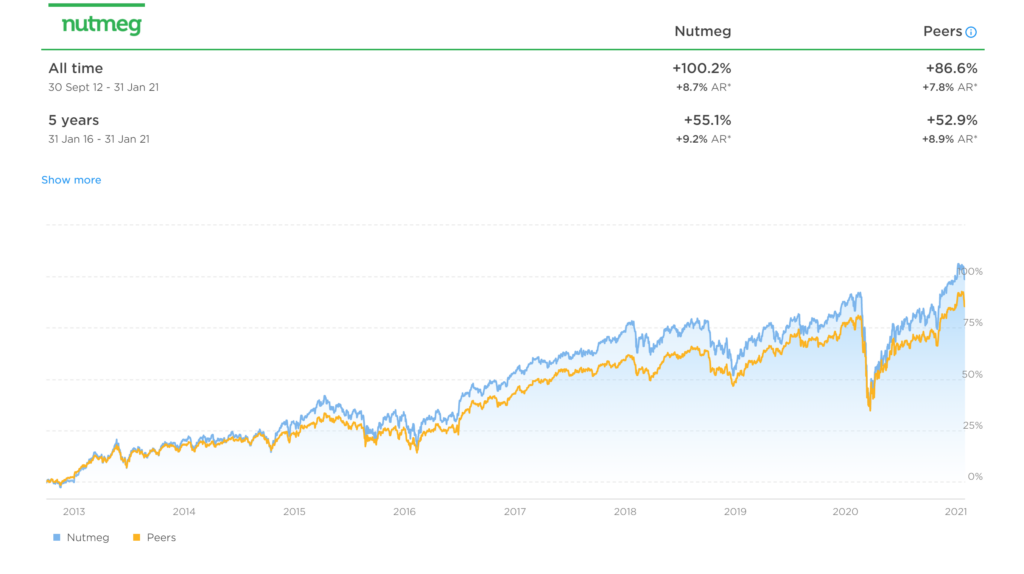

If mastering your own portfolio seems to be too daunting or you really can’t be bothered, then as an alternative check out robo-investing. Robo-investors quiz you and then build a suitable portfolio for you on your behalf.

One platform we’ve tried and tested and were really impressed with was Nutmeg. They even have a great welcome offer for customers who use our link. Use the link on the Money Unshackled Offers page and you’ll get 6 months with no management fees.

Whether you go down the robo-investing route or build your own portfolio, make sure you invest every month indiscriminately. It’s what’s known as pound cost averaging.

The idea is that by investing regularly, some months you will happen to buy when stock markets are expensive and other times you will happen to buy when they’re cheap.

By buying consistently, these highs and lows are averaged out.

And to tick this checkbox, you need to be able to say with conviction that you can ignore the news.

Every year there is a major event that screams “panic, sell your investments!”. But doing so would cost you dearly.

For as far back as the data goes, we have seen stock markets continue to climb upwards over the long-term. Selling and trying to time your re-entry is an awful idea.

Most people cannot do this and oftentimes they end up watching from the sidelines as everyone else gets rich around them.

Congratulations, you have now mastered investing. Check!

Hey, wait a minute, what about stocks? Stocks can be fun, and we do invest a little into individual stocks.

The problem with stocks is you could end up rich but equally you could end up poor.

We are confident that with index investing you will become rich one day, although of course there is no guarantee.

Insure Against Disaster

There’s probably a long time between now and your freedom date in which many things can go wrong. We know that insurance can feel like a waste of money but if the risk is too great, then insure against it.

That’s exactly what we’ve done. Ben (MU co-founder) has life insurance, which ensures his wife and child are okay if he was to die.

And Andy (MU co-founder) has income protection insurance that guarantees him an income if he is unable to do his job here at Money Unshackled. We see this as locking in your financial freedom today.

With insurance it’s best to speak to an expert and we’ve tried and tested Assured Futures who specialise in the field.

If you are considering insuring against disaster, check out our Lifestyle Insurance page and lock in your financial freedom. Peace of mind is a lot cheaper than you think.

Establish Multiple Streams Of Income

Ideally this would be to establish multiple streams of passive income. This should definitely be a longer-term goal but more imminently you need to establish any streams of income that you can.

Each income stream needs to be sizable enough that it makes a meaningful contribution to your monthly income.

Having 1 stream that provides 99% of your income and another just 1% doesn’t give you good enough diversification in your income sources.

Your first target for example might be to establish 2 income streams of at least £500 each.

One of these could be through Matched Betting, which can be easily done in your spare time to earn £500 or more. Here’s our simple guide on how to do this.

The next goal might be to establish 4 income streams of at least £600 each.

We have a built a business with over 20 income streams and counting, which ensures that the loss of any one stream wouldn’t put us on the streets.

Most people have one income source, which is their job. Having one source of income makes you a slave to your job master. They know that you are dependent on their crumbs and that is all you will ever get.

Do you have an adequate number of backup income streams? If so, check this one off the list!

Be Prepared For The Unexpected

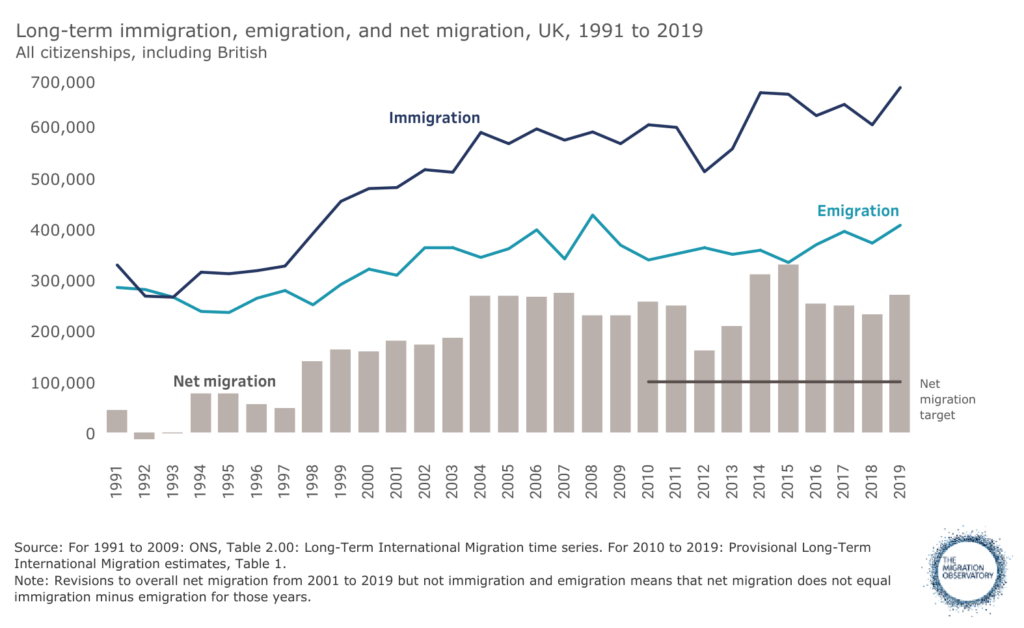

No matter how much you plan, life will throw some curveballs. Maybe an unexpected breakup will shatter your finances, or you underestimated the cost of having children, or maybe a contagious disease will devastate the economy.

Whether the next curveball is specific to you or a wider event, you need to be prepared for it.

You’ll never predict exactly what the next problem will be but if your finances are in good shape then you will survive it. In part this means you will have built up an emergency fund that will see you through.

If you’ve built up a substantial emergency fund that will see you through a few months of hardship, then feel free to tick this one off the list too.

Diversify Your Skills

If you do depend on one job, then you might also want to diversify your skillset. You need to work on improving your transferrable skills.

Today you might be a taxi driver by trade but when autonomous cars ultimately replace you, can you easily apply yourself to something else without taking a devastating and unexpected blow to your income?

The unexpected isn’t necessarily out of your control either. It could well be that you’ve been doing your well-paid but boring job for far too long and need to try something different.

Remember that financial freedom is likely years, even decades away. You’ll probably need extra skills to fall back on over that turbulent time horizon.

Tick this off your checklist if you’ve learnt something new and useful that can be drawn on in the future, like a second language or computer programming.

Having a diversified skillset means you don’t have to feel like you have to stay in a high stress job even if it means financial freedom is more quickly achievable.

Going from a lawyer to an entry level job as a website designer is likely to begin with a huge pay cut. Although in the short term this will harm your financial freedom plans, it’s better to do something you enjoy.

No matter how much you want financial freedom, if you’re waking up in bad mood for too many days in a row, then something needs to change.

It could well be that you’re trying to save too much per month. In which case, loosen up the budget and retire a little later than originally planned. At least you’ll have fun on the way.

What are your significant income streams? Let us know in the comments below.

Featured image credit: Pasuwan/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: