Should you buy Premium Bonds? Well, if you listen to your gran the answer will probably be yes, but if you listen to a mathematician who understands odds and median averages, then the answer is likely to be no.

We’ve been contemplating whether to do a post on Premium Bonds for a while now, and the reason we haven’t until now is because we always thought – who is silly enough to buy them?

But it turns out that Premium Bonds are owned by around 23 million people in the UK – that’s right, a third of the country! So, either there a lot of silly people in the UK, or we’re missing something.

In this post we’re going to look at Premium Bonds – what they are, the interest rate, who they’re for and who they’re not for, and everything else you need to know.

If by the end of this post you want to invest in the stock market instead, then check out the best Stocks and Shares ISAs here. Or alternatively, if you want experts to manage your investments, then Nutmeg is giving you the first 6 months without management fees when you use the link on the Money Unshackled offers page here.

What Are Premium Bonds?

The first thing that springs to mind when we think of bonds is a type of investment that pays interest. Usually at the end of a specified period you will get the face value of the bond back. In other words, they are essentially loans. The market value of a bond changes over time as it becomes more or less attractive to potential buyers, so if you decide to sell early you may get more or less than the face value.

However, Premium Bonds are different. The market value of a Premium Bond does not fluctuate, and you can cash it in at any time for the original value. Also, they don’t technically pay interest. Instead, each Premium Bond that you hold is entered into a monthly prize draw. And there you were, thinking this was a serious investment!

Premium Bonds are often referred to as a cross between a savings account and the lottery. It’s entirely possible to win a life-changing amount of money with them but we’ll soon look how likely (or should we say unlikely) this is. The difference with Premium Bonds is that unlike a traditional lottery, you never lose your stake, which is why Premium Bonds are often used as a savings account.

Where To Buy Premium Bonds?

Premium Bonds are issued by NS&I or the National Savings and Investments agency to call them by their full name. This is a government agency and can probably be best described as a ‘government savings bank’.

When you save with NS&I or buy their Premium Bonds, you are actually lending your money to the government.

The easiest way to buy Premium Bonds is directly on the NS&I website, and if you’ve found this article, we’ll assume you can search google and find it yourself. You can also buy over the phone and by post, but come on guys, who’s doing this in the 21st century?

What’s The Interest Rate (Prize Fund Rate)?

As of December 2020, the annual prize pool is 1.00%. If we consider a Premium Bond to be a type of Savings account, then this compares quite favourably. At time of writing, the best easy access online cash ISA on the market only pays just 0.4%.

1% might sound quite reasonable in today’s low interest environment but remember – this is an average pay out and you are likely to receive nothing.

When we consider that the odds of 1 Bond unit winning anything at all in any given month is 34,500 to 1, then Premium Bonds might not be as generous as first appear.

What we’re looking at here is the annual prizes over the last 12 years. Today, the average prize is more than other available cash savings on the market, but from our memory you could have often beaten those historical average prize amounts. So, perhaps Premium Bonds are more competitive now than they’ve ever been.

How Are The Prizes Distributed?

Okay, so the mean average is 1%, but because there are some very large prizes this means there is less money for the other prize winners. Arguably, the median average is a better indication of what return you will get.

The mean average is what you’re probably used to by the word “average”. In this case you would take the total prize pool and divide by the number of Premium Bonds in circulation. So, with a current annual prize pool of around £1bn and roughly 100bn Premium Bonds, this is where the 1% mean average comes from.

The median average, however, is calculated by ranking the 100bn bonds in order of the biggest win to the lowest and taking the middle one, to establish what pay out the average person would get. This results in an exactly zero return.

In other words, the average pay-out is 1% if you include the overnight millionaires, but probability wise you will end up with precisely nothing for each individual bond held – much like a lottery ticket.

The top prize is £1m and there are 2 winners every month. Sounds awesome and this seems to be the main selling point used to entice potential savers. We’re not saying that NS&I are deliberately trying to mislead people, but we couldn’t find any easily presented information on the odds of winning each prize pool.

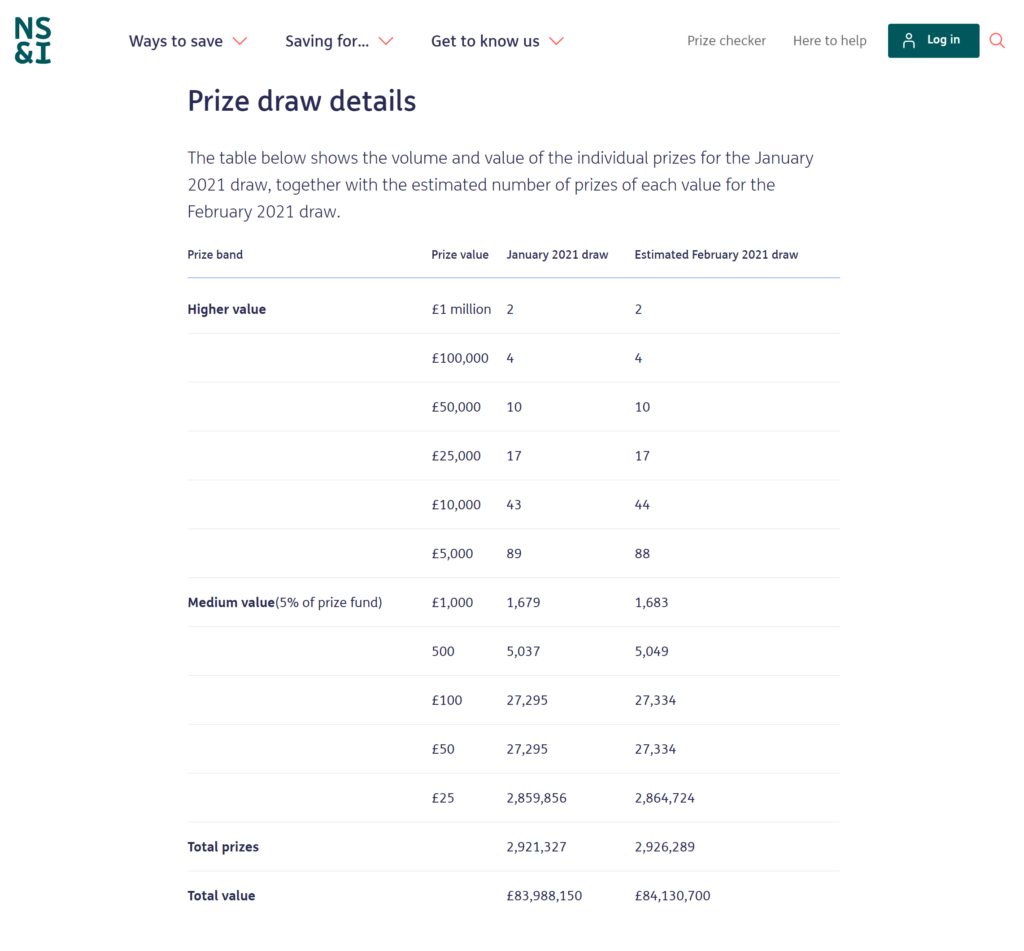

Instead, they present this, which makes it appear that the prize pool is huge and that there are lots of winners.

With almost 3 million individual Premium Bonds each winning £25 or more it looks very generous. However, without context this doesn’t really say much at all – given there are over 100,000 million bonds in circulation.

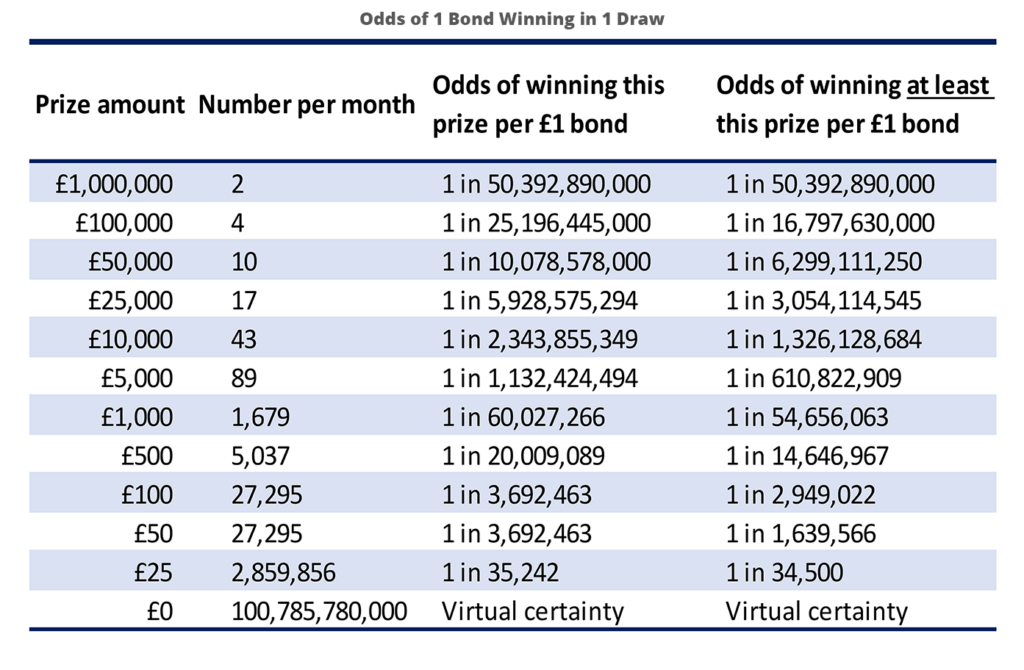

We decided to crunch the numbers to work out what the chances are of winning each prize.

The distribution of prizes changes slightly each month but for January 2021 the odds were as seen here.

What the table shows is the prize amounts and the number of pay-outs, with the lower prizes paid more frequently and the higher prizes increasingly rare. The next column shows the odds of winning this exact prize and the following column shows the odds of winning at least that amount.

The odds of winning the top £1m prize in a given month is 1 in over 50 Billion with a capital B. We both enjoy the occasional flutter, but to call this an outsider would be an understatement.

The next prize of £100k is paid out 4 times a month, and the odds of winning at least this amount still has astronomical odds of almost 17bn to 1. Even the odds of winning at least the lowest prize of £25 is unlikely with odds of 34,500 to 1.

What Are Your Odds Based On X Number Of Premium Bonds?

You won’t just own 1 Premium Bond. So, those probabilities are just the odds of 1 winning. You may own a few hundred or thousands. And there is a prize draw every month, so you will have multiple attempts to win.

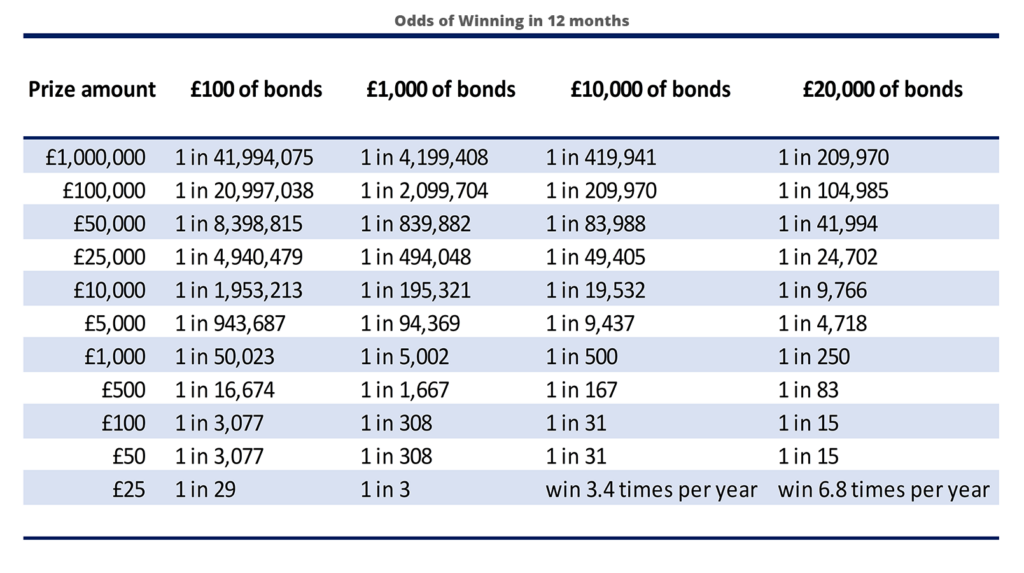

This table shows what the odds are of you winning each prize if you hold the Premium Bonds for 12 months and therefore enter 12 draws. We’ve done this for a range of different Savings amounts.

If you had £100 you would only have a 1 in 42 million chance of taking the top prize. Even if you own £20,000 worth of Premium Bonds your chances of winning any of the top prizes are still minute, but you do stand a very good chance of winning multiple small prizes.

Before buying this quantity of Premium Bonds you should first consider the likely better returns available from the stock market.

What You’ll Win With Average Luck

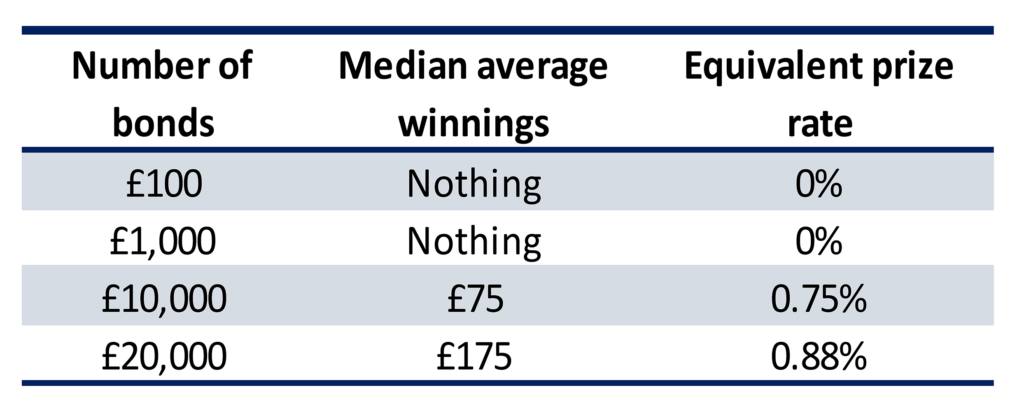

Up until now we’ve talked about the probability of a bond winning a prize, but what is the probable return for a person based on the number of bonds they own. The maths gets really complicated but fortunately money saving expert have hired some nerd to do it all for us.

Using the calculator on that site we can see that someone with £100 with average luck will earn nothing. Someone with £1,000 would also likely earn nothing. Someone with £10,000 would likely earn just £75, and someone with £20,000 would likely earn £175 (still less than 1%).

Basically, the more bonds you own, the more likely it is that your returns are closer to the reported “interest” rate – though most people will win less.

Other Need-To-Knows

The minimum you can buy is £25 and the maximum is £50,000. All prizes are tax-free, and your money is 100% guaranteed by the Treasury.

Back in the day its tax-free status used to be a major benefit, but with the introduction of ISAs and personal savings allowances, it is quite easy to avoid paying tax on savings anyway.

Just like cash savings, the rate of return on a Premium Bond is unlikely to beat inflation over the long term. Inflation may be below 1% right now due to the Corona pandemic but on average you can expect it to be around 2-3%, so you will lose money in real terms – unless you hit the jackpot of course.

The Lottery vs Premium Bonds

According to the National Lottery, the odds of winning the Lotto jackpot are 1 in over 45m. Compare this to the odds of 1 bond winning the top prize, which is over 50 billion to 1.

To be fair though, this isn’t a like-for-like comparison because you don’t lose your stake with Premium Bonds, and there is a prize draw every month. But you do lose the chance to invest that money for better returns elsewhere, which you could have then used to buy Lotto tickets with!

Who Are Premium Bonds Good For?

If you don’t mind playing the odds and are happy to maybe get nothing, then Premium Bonds are an alternative to a bank savings account, with the very slim outside chance of making you rich.

So Premium Bonds are good if you want a bit of fun and are getting next to nothing on your savings in interest anyway. It must be a nice feeling if you get one of the big prizes.

Premium Bond prizes are tax-free, so if you pay tax on your savings because you earn more than your personal savings allowance, then it makes sense to own Premium Bonds if you want the safety of cash savings.

And finally, Premium Bonds are really best suited to those with more savings, say £5,000 or more. The more you can save, the closer you will get to the advertised prize fund rate.

Who Shouldn’t Buy Premium Bonds?

Other than a bit of cash set aside for current spending and an emergency fund, most people should be investing their money in assets like stocks, property, precious metals, and so on.

Only through investing can you achieve a good rate of return that will not only beat inflation long-term but could make you very wealthy.

Check out this video next, which covers the basics of how best to invest at all levels of knowledge, from noob to expert.

Do you own Premium Bonds and if so why? Join the conversation in the comments below.

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: