Unless you’ve taken a day to sit down and really review your pension situation, your pension is almost certainly failing you.

In the UK most of us just trust our financial futures to our employer, and just assume that our workplace pensions are being well managed – and that’s if we’re trying to be sensible.

The less sensible among us will be trusting their futures to the state pension – which is like putting your trust in a tiger not to eat you.

But this video is aimed at those who want their private pensions to shine, to outperform the mundane, and to set you apart in your retirement from the majority who are just barely able to get by.

We’ll show you how to get your pension working for you: how to withdraw money from it before you’re retired, how to break free of mediocre returns, how to add investment property into your pension, and how to dodge tax to the max while staying within the law. Let’s check it out!

Alternatively Watch The YouTube Video > > >

What Normal People Do

Most people in the UK of working age contribute to a Defined Contribution workplace pension. As well as this, they will hold several other workplace pensions from past jobs, probably one from each.

A UK worker will change employer every five years on average, which means your average 40-year-old will have 4 pensions on the go; 3 of which are no longer contributed to.

We were a bit more trigger-happy with the job-quittings when we were in the workforce, and between the two of us we’d racked up 11 workplace pensions by age 32 – none of which were doing a great job for us!

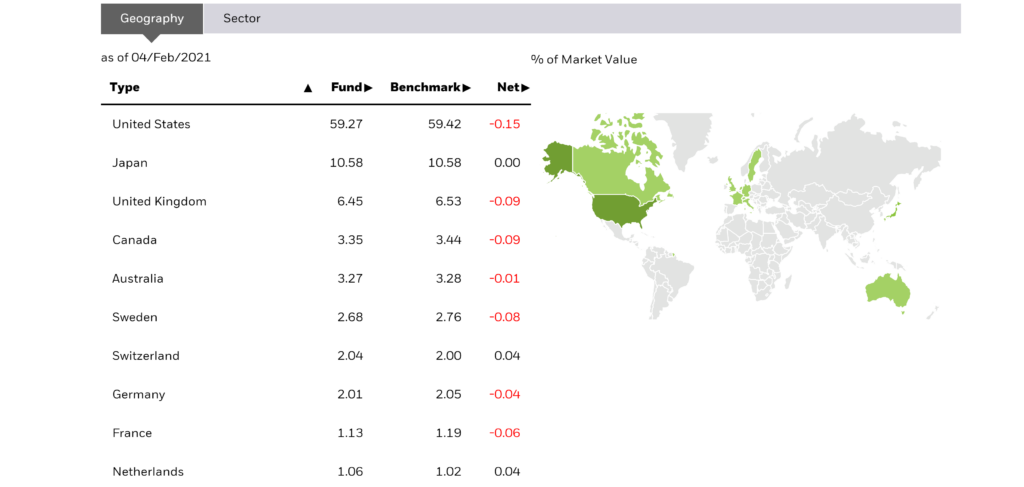

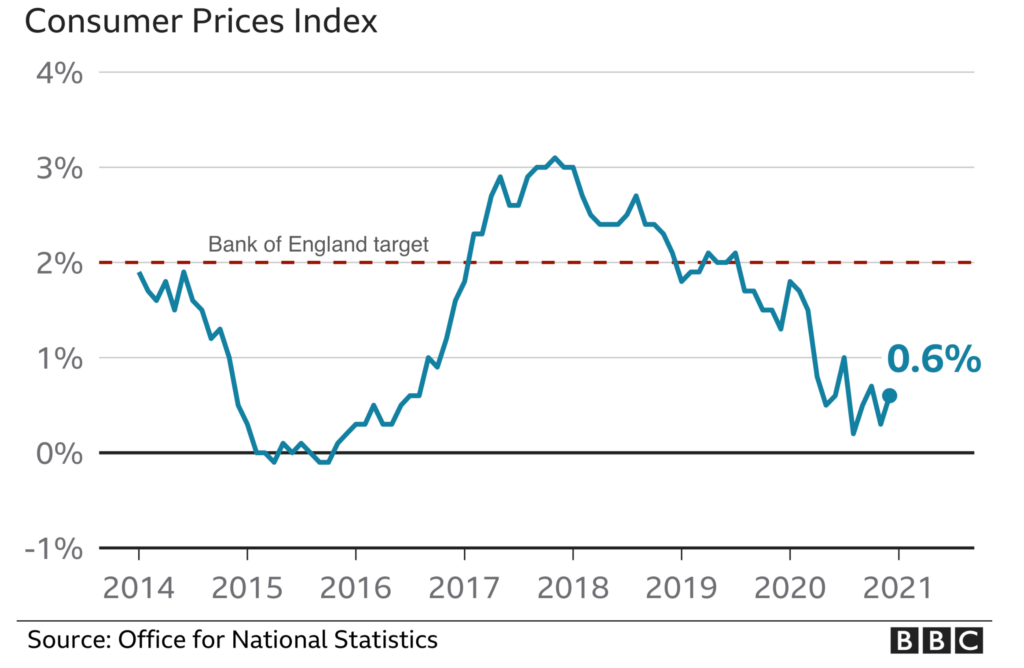

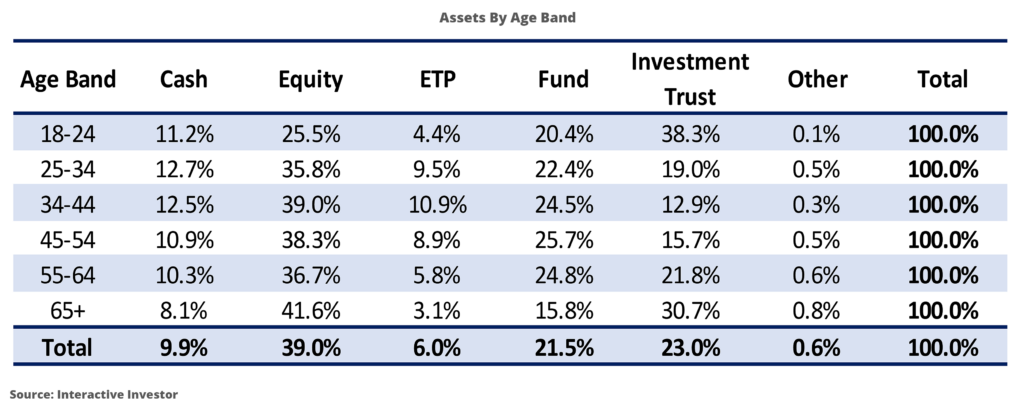

The problem with many workplace pensions in the UK is that they are UK biased. More than that, they are overly keen on low performing bonds.

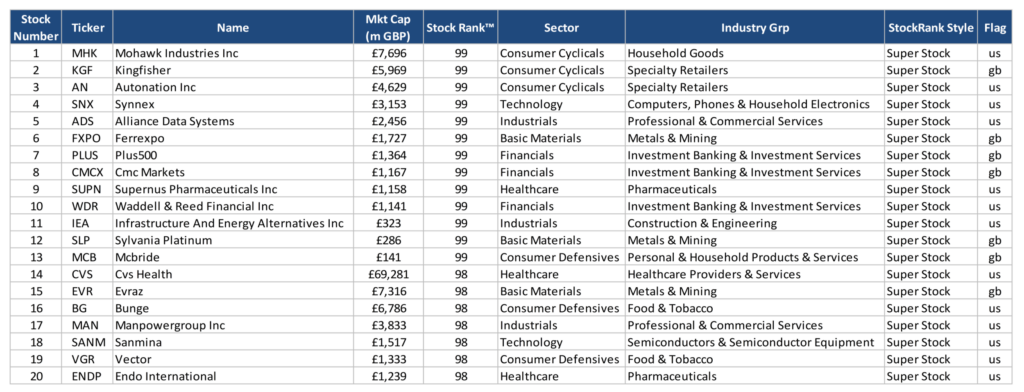

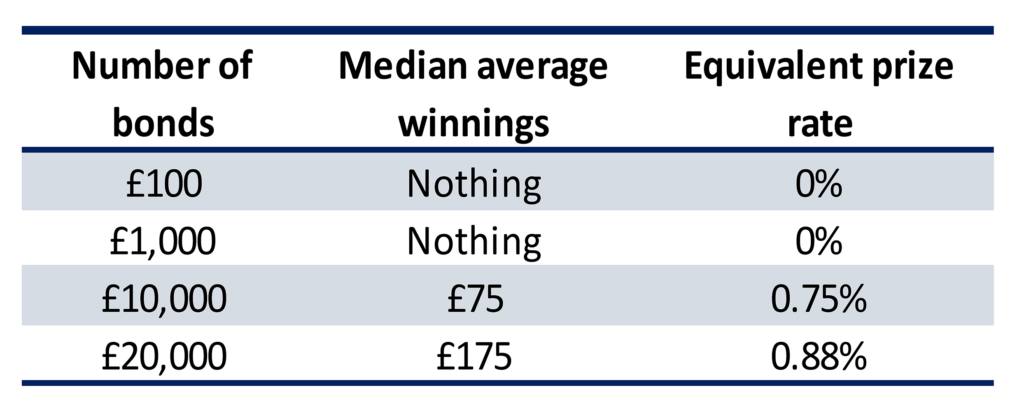

Above is the breakdown of one of my old workplace pensions. Around 30% of it is bonds. For a 30-year-old, that is far too unambitious.

Bonds can be useful for people approaching pension drawdown age. But for someone with 3 decades to go until that happens, it’s frankly laughable.

Also, 38% is in UK equities – notorious for its low returns in recent decades. Why is this pension not investing larger amounts in the USA, the world’s economic powerhouse?

The answer? Workplace pension funds are stuck in the past, still conforming to home bias from the days before global investing became cheap and accessible.

Impact Of Home Bias And Too Many Bonds

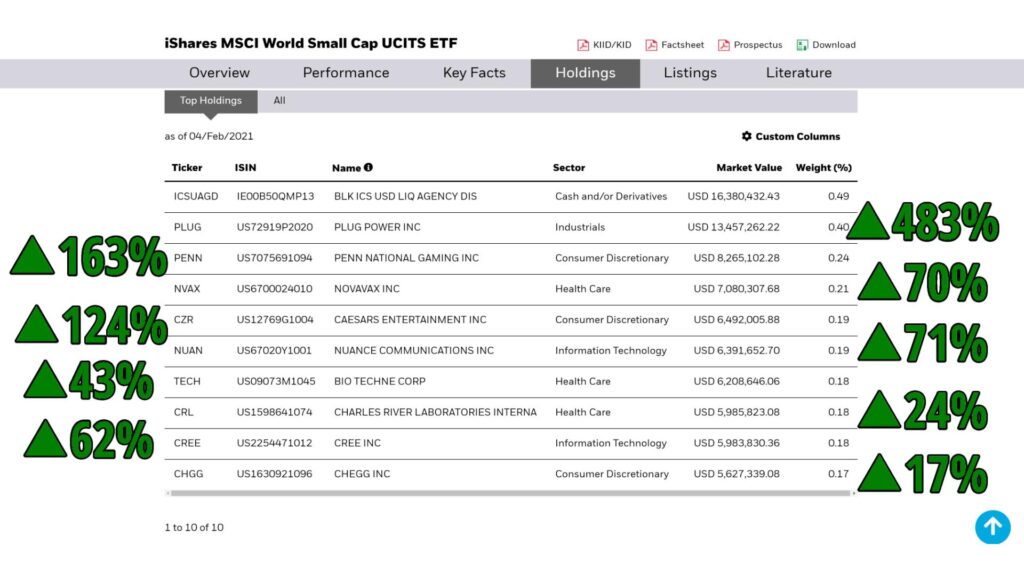

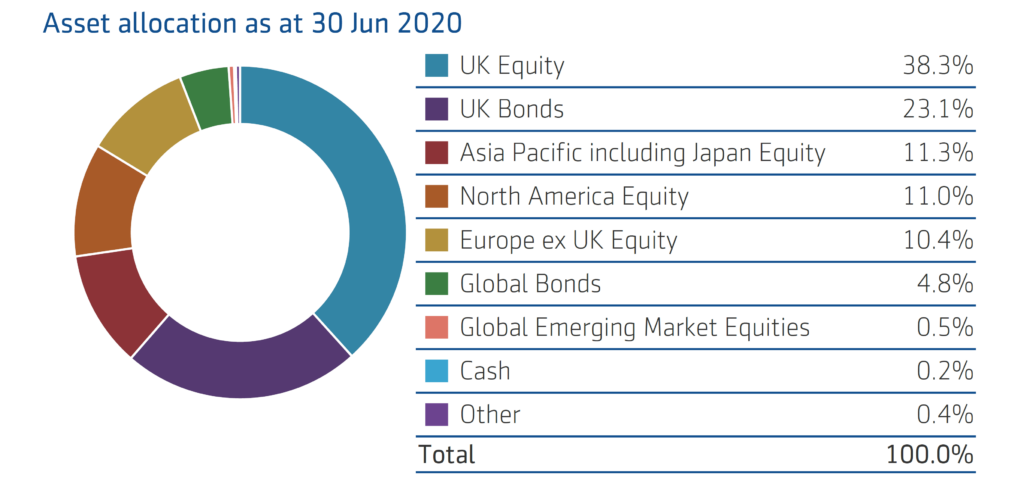

The presence of too much UK equity and bonds is clear from the returns. This Aegon pension returned 5.5% annually over 5 years, which is 30% total growth:

Over the same timeframe, a typical globally diversified equity fund – VWRL – returned 7.3% annually, which is 42% total growth. Lightyears ahead.

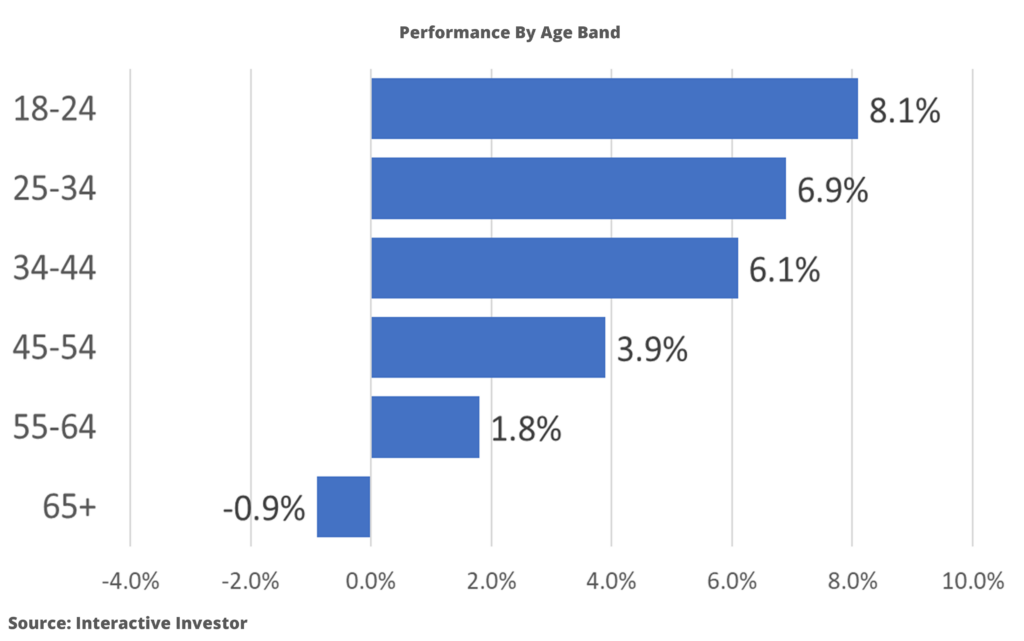

The problem with turning a blind eye to your pensions until you’re ready to retire is obvious – you’ve left it too late to make any necessary improvements.

The optimum time to get a grip on your pensions is the day you start your career – failing that, the next best time is today.

Finding out that your pension was invested in underperforming assets for the last 40 years at age 60 is not ideal. And yet this is what the majority will do.

Why Workplace Pensions Can Get Away With Poor Performance

They need to impress your employer – not you. And the wage-slave making the pensions decision for their company is unlikely to know much about investing.

A workplace pension provider could be chosen on the basis of sweet-talking the HR department better than the competition, rather than a proper long-term appraisal of their investment strategy.

What The Rich Do

Rich people don’t hold their futures in employee pension schemes. These schemes are too restrictive, with annoying rules that forbid you from accessing your own money until you’re at least 55.

Such rules don’t apply to the rich, nor to those aspiring to be rich who follow in their example.

They know better, and make use of a little-known type of pension called a Small Self-Administered Scheme pension, known as a SSAS.

SSAS Pensions – True Financial Freedom

A SSAS is a flexible pension usually for company directors of limited companies, managed by you (or by trustees that you appoint). Don’t let the ‘company directors’ part put you off – both Andy and I are company directors, as are many people who invest in property, as can be anyone who puts their mind to it.

We’ll come back to this point in a bit, but first let us tell you why you need to be aspiring towards having your future invested in this type of pension.

Once established, a SSAS pension can invest in all the normal assets such as stocks and shares, commodities, corporate bonds, and gilts – but it can also hold any investment property that you buy, and even shares in your own business.

It also gives you vast additional powers and opportunities, including getting your hands on your pension money whenever you need it, instead of in your late 50s like with other pensions.

Why You Should Have A SSAS Pension

#1 – Get Your Money When You Need It

You are allowed to make a loan of up to 50% of the value of your pension to your company for any use.

For example, you could use the funds in your pension to buy out part of your own company (i.e. giving you, the owner, a load of money). Alternatively, it could be structured as a loan to yourself.

Can you imagine dipping into your workplace pension at age 30? Well, you could, if your pension was a SSAS.

#2 – Invest In Property

As we touched on already, pensions don’t have to just invest in stocks and bonds – with a SSAS, you can use your pension cash to buy investment properties too.

One of our biggest annoyances with ISAs is that they can’t be used to buy properties (outright – we don’t mean REIT funds).

Well, a SSAS is an alternative tax-shielded product that you can do just that with, and still have some flexibility to access to your money at any age.

#3 – Very Tax Efficient

Contributions can be made by both you and your company – and because your company is probably you, this means tax loopholes!

SSAS pensions get the same basic tax benefits of other pension types, including:

- Pension contributions are deductible against tax;

- No income tax charge on investments;

- No capital gains tax on investments;

- A tax-free lump sum on retirement.

But SSAS pensions get extra tax benefits too:

- Commercial property can be bought by the SSAS and leased back to your company, which may have tax advantages (also possible in some SIPPs);

- Loans can be made to your business – the interest, which is effectively payable to yourself, could be tax deductible;

- You have greater control over accessing lump sums, which might have tax advantages over normal pensions.

#4 – Fees Are Fixed

Fees are typically charged on a fixed basis rather than the traditional percentage charges for most normal pensions, and is shared amongst the members.

The ones we’ve seen cost between £300-£1,000 a year, no matter the size of your pot. This is great for wealthy people – probably not great for smaller pots.

How To Qualify

You usually need to become a company director, which can be of your own limited trading company.

Becoming a company director is not difficult – setting up a company online takes a few minutes and costs just £12 to do on the UK government website.

SIPPs – For Getting Your Finances In Order Now

Being a director with a SSAS pension is something cool to aim for maybe in the future when you have large funds to take full advantage.

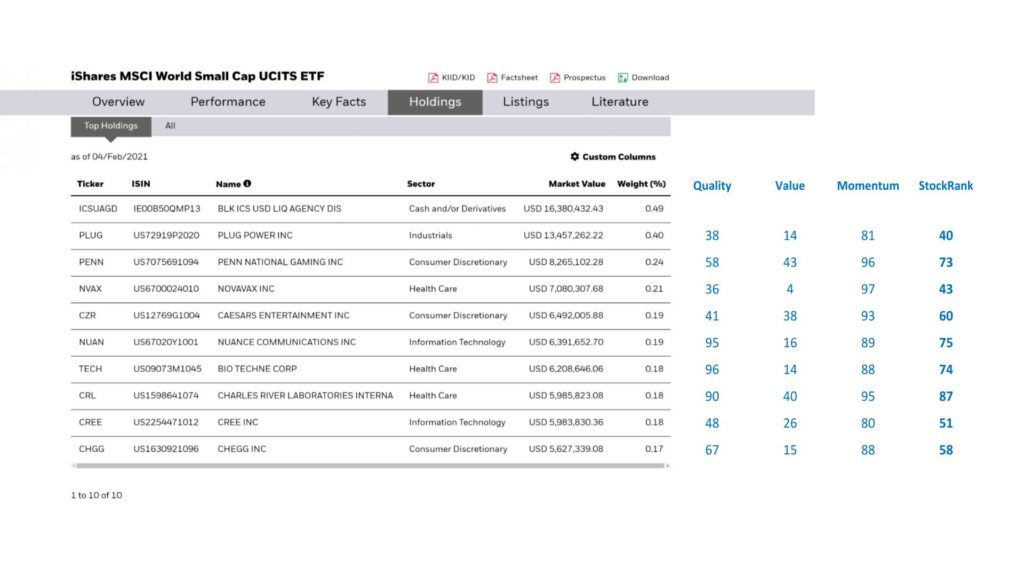

But to help you get there, a SIPP is the perfect pension product for taking back control of your future, today, that anyone can open.

A SIPP acts like a workplace pension, but has the following advantages:

- You can consolidate all previous workplace pensions into one SIPP which is under your control – what you invest in is completely your choice, not some pencil-pusher in HR;

- The returns are therefore likely to be much better if you choose a more sensible mix of assets;

- The fees are usually lower than what a workplace pension charges you.

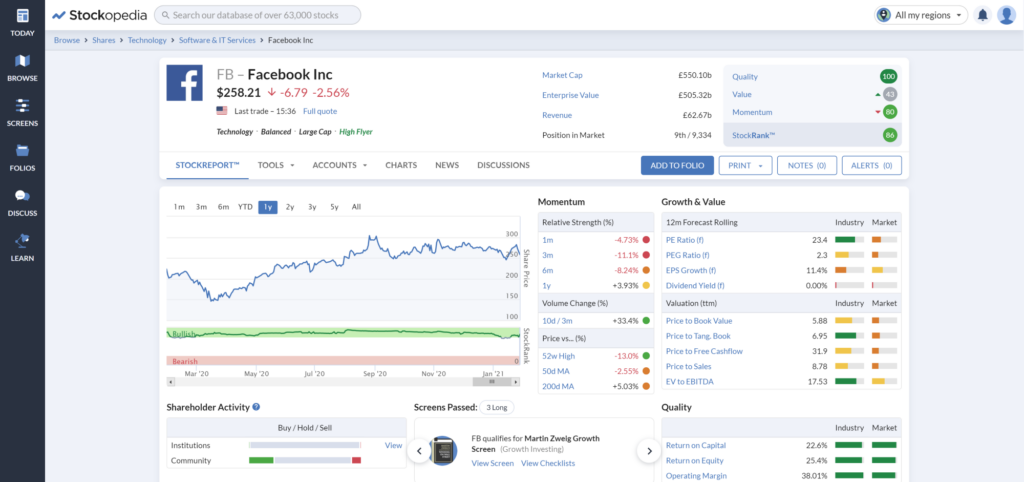

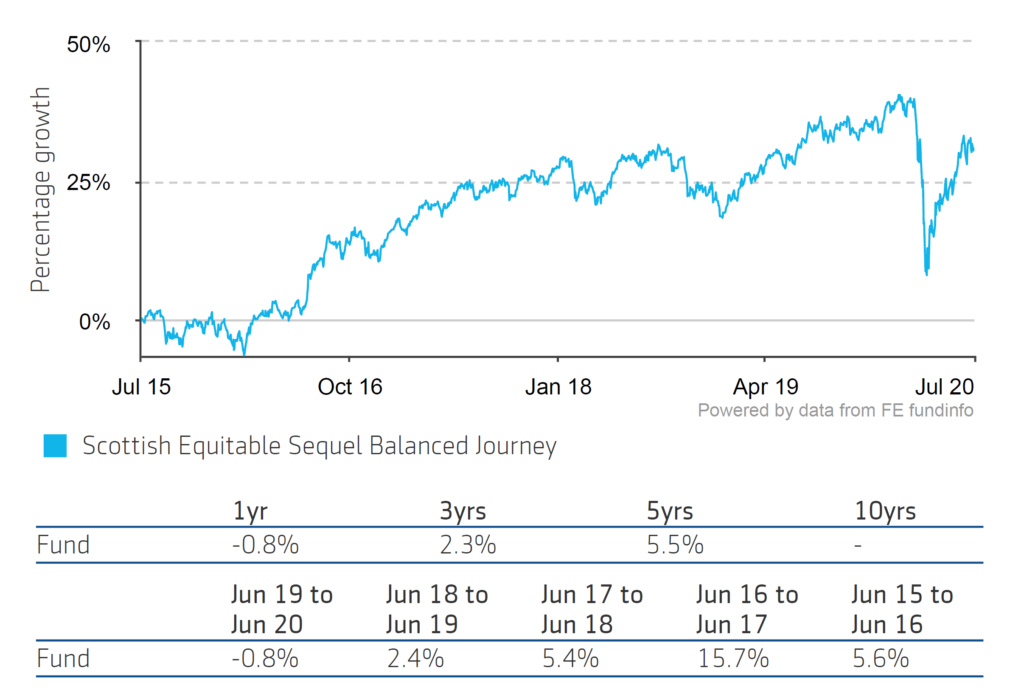

The simplest SIPP we’ve come across is run by Nutmeg. It’s also one of the highest performing against their peers. You can see here how it smashes the competition:

Over that same 5-year period as we discussed earlier, Nutmeg produced a 7.5% annualised return after fees, similar to the 7.3% we’d have expected from a global fund.

Nutmeg is a robo investing platform, offering ISAs and SIPPs. When you open one of these, you’ll be asked a series of questions, so that your portfolio is tailored to you.

Gone is the one-size-fits-all approach of the workplace pension, which tries to work for everyone, but ends up working for no-one.

You’ll also get 6 months without any fees if you find your way to Nutmeg via the link on the Money Unshackled Offers page. Check out the Nutmeg offer there if you want to open your own SIPP and get to grips with your pensions.

When A Workplace Pension SHOULD Be Used

There’s no doubt in our mind that a SIPP is preferable to an old workplace pension. But what about your current, active, workplace pension?

Your employer is probably matching your contributions to your current pension, in which case, that is a 100% return in year 1 and is free money which in most cases shouldn’t be turned down – regardless of how crappy the underlying investments may be.

For instance, I opened a SIPP for transferring my old workplace pensions into, which I’d accumulated from many previous jobs.

But I would always contribute into one current workplace pension, for the tax-free top-ups my employer would pay in alongside my own contributions.

ISAs

Finally, you should ask yourself, do I even need a pension?

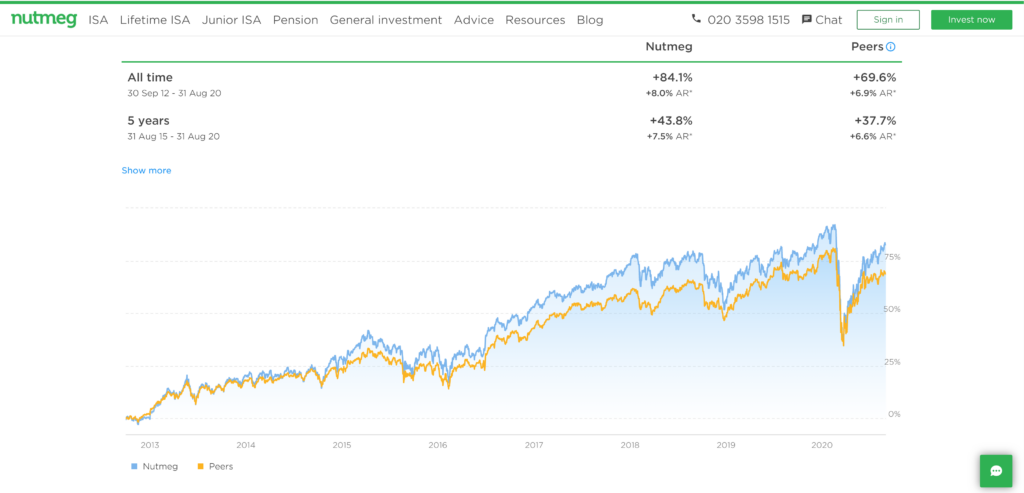

If you are able to set aside less than £20,000 a year, have no employer contributions, and are a basic rate taxpayer, then a Stocks and Shares ISA might be preferable to a pension.

You get similar tax benefits – the tax break comes when you draw from it, rather than during accumulation as with a pension, but it works out roughly the same in the end.

And you can retire whenever you feel ready – instead of a predetermined minimum age of 58.

As for us, we currently use SIPPs for our pensions, but as company directors we will be looking into transferring those into a SSAS as our wealth gets bigger.

But at least with our SIPPs, our investment returns are strong, our fees low, and our futures are in our hands.

What will you be doing with your pensions? Join the conversation in the comments below!

Featured image credit: Sauko Andrei/Shutterstock.com

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday: