In the UK, the government recognises age 68 as the age that it’s reasonable to retire. That’s the age you can draw the state pension from.

But we want to know what age people really retire at – and we want to help you work out if you’re on track to retire earlier than this, and by how much.

Your private pensions will allow you to access them up to 10 years before the state pension age.

But how many make it to retirement by even age 58? On this site we’re about having the freedom to retire as soon as possible.

Early retirement doesn’t have to mean sitting in front of the TV. It can be doing charity work; travelling the world; writing a book; or whatever floats your boat!

We’ve gathered together statistics from the UK and around the world to show you what age people are really retiring at – and therefore, what you might expect for yourself. We also touch on how to move this date forwards.

If you still need to consolidate all your old workplace pensions into one place, we’ve arranged for you the first 6 months without management fees when you open a self-invested personal pension with Nutmeg through the link on the Offers Page. The same deal applies for their ISA accounts as well!

Retirement Ages Around The World

First off, let’s look at how the UK compares to the rest of the world when it comes to real retirement age.

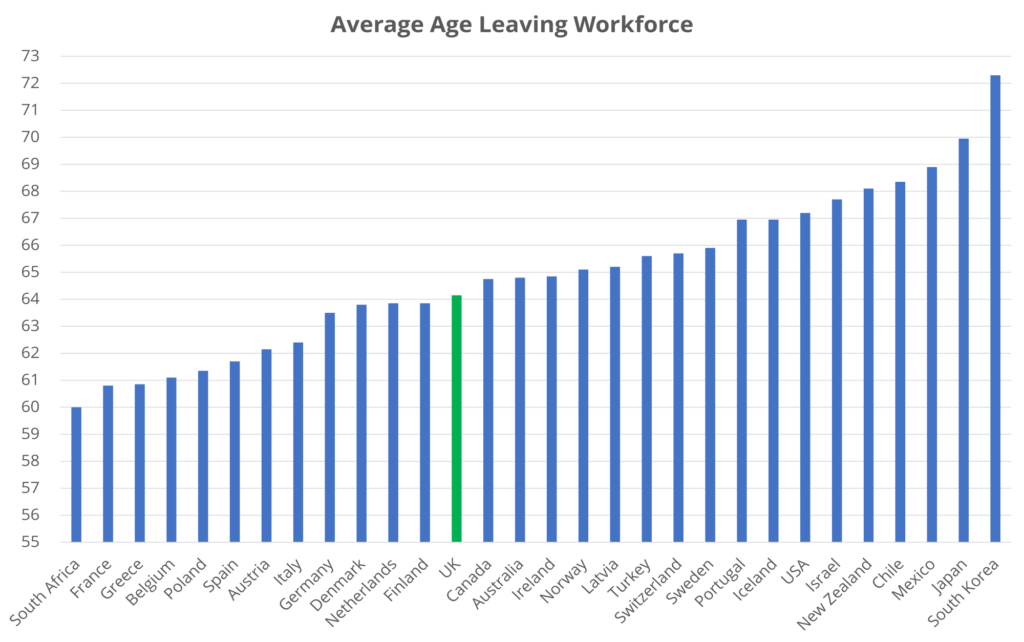

Here’s a chart showing the average age that citizens leave the workforce in various countries, using data from the OECD:

This is not the state retirement age. This is the real age that people decide to pack it in and put their feet up.

The UK has an average showing, hardly showering itself in early-retirement glory.

But a point in our favour is that, at a real retirement age of 64, we’re at least beating the official state pension age, which was 65 at the time this data was gathered in 2018.

Our neighbours in France are free from the age of 60, putting us to shame, while our friends in America feel the whip until age 67.

If you’re feeling bored at work, be grateful you don’t live in Japan or South Korea. These guys are slogging away until age 70 and beyond!

But this data shows a fixed point in time, as of a couple of years ago. What was the situation 10, 20 years ago and more? Is the UK getting better or worse?

Real Retirement Age: The UK

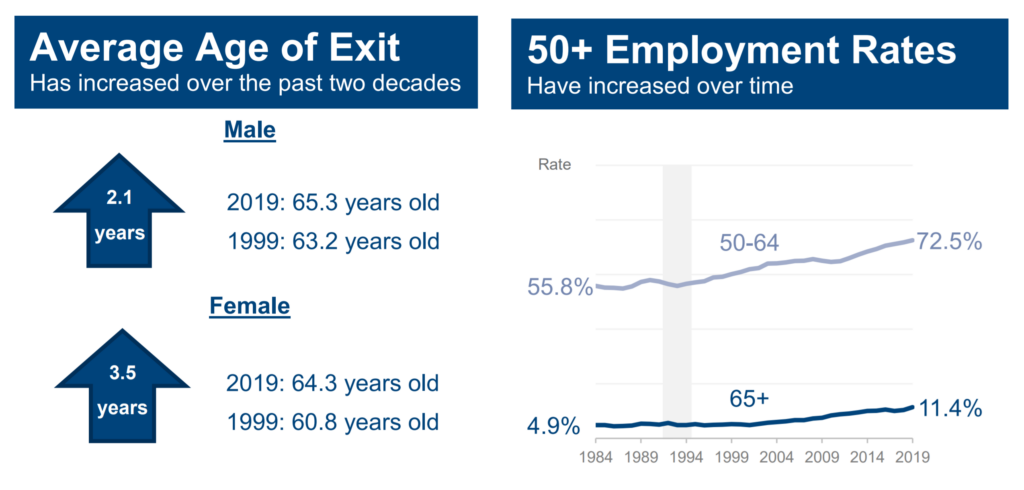

The Department for Work and Pensions released this info in 2019 showing that the age of leaving the workforce has gotten worse for men by 2.1 years over the past 2 decades, and worse for women by 3.5 years:

This second chart shows that around 60% of over 50s were in the workforce 35 years ago – now, 84% of the over 50s are having to work.

This is obviously a bad directional trend for younger generations looking forward to their own retirement. Will the average exit date continue to creep upwards?

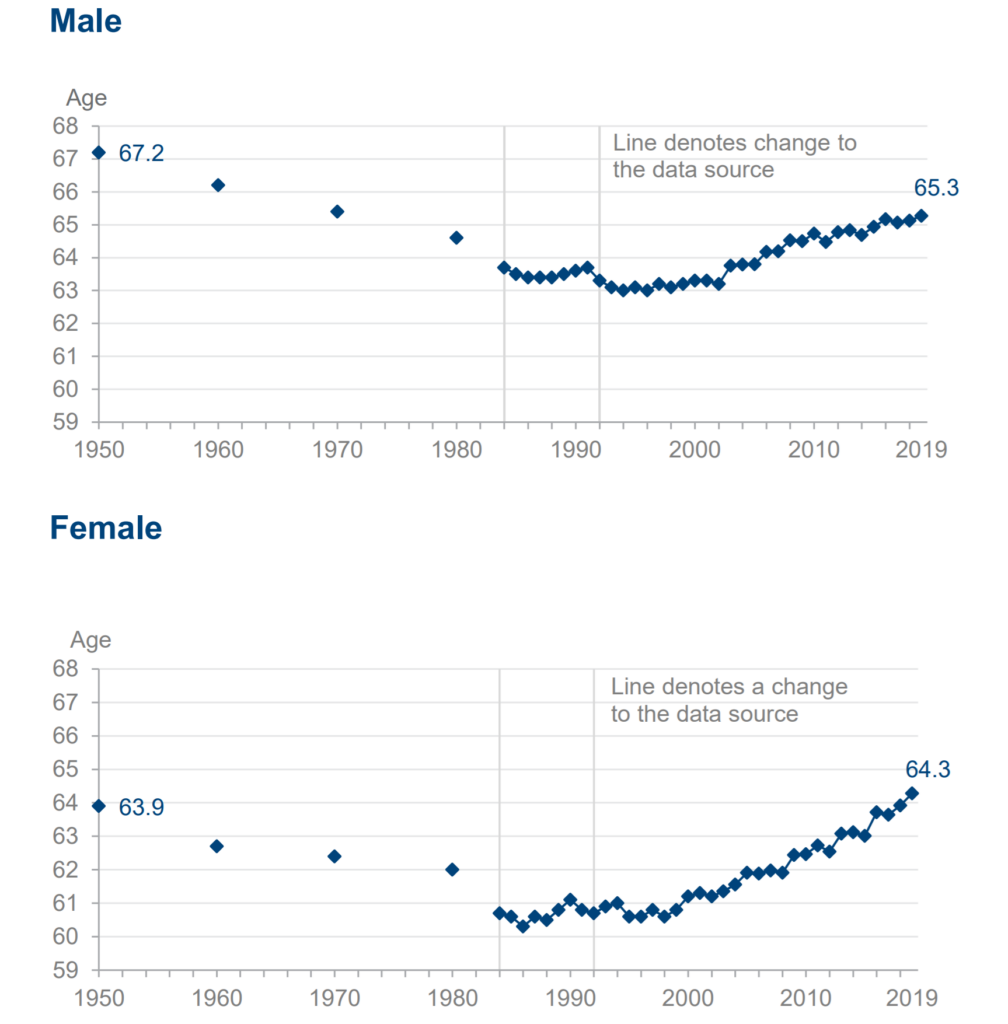

Here’s the age of exit for men and women in more detail:

Although the real retirement age has gotten much worse in the modern era, the period from the ‘50s to the ‘80s showed the opposite story.

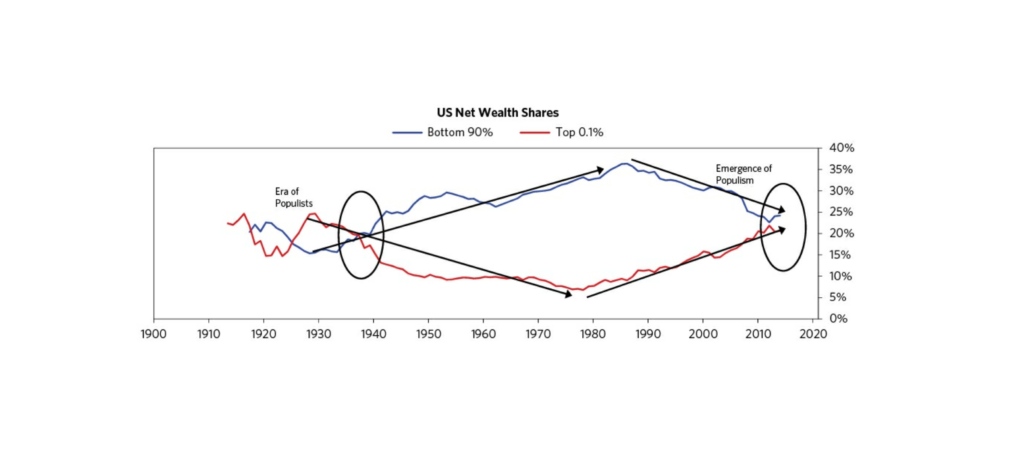

This reminds us of the trend in the wealth gap – shown here for the US, but the same story applies to the UK:

The same period from the 1950s to the 1980s showed the wealth of the bottom 90% (i.e. most people) increasing to a larger percent of the nation’s total. Since the 1980s, inequality has been on the rise, and the wealth gap versus the top 0.1% has been growing.

The story of this graph is that inequality has been reversed before, after a period of political shake up – and can happen again. We’d expect average people to be able to retire sooner if this happened.

Maybe People Are Waiting Too Long To Retire

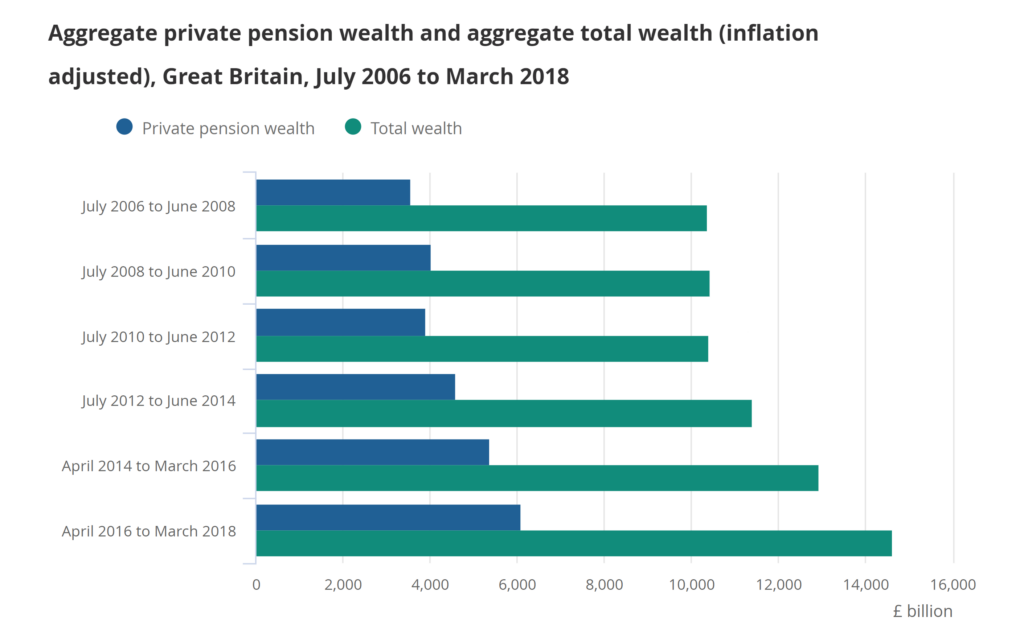

On the flip side of the coin, pension wealth has nearly doubled in real terms since 2008, but we know it is being accessed later.

If people could retire sooner and with less money a decade ago, why not now?

We suspect a big part of the reason why people work longer is a lack of financial education about investing, combined with a tough time to be a saver. There is no interest to be earned anymore on your savings.

If you plan to retire before state pension age, you need a good private pension, or you need decent savings to bridge the gap.

In the years before the 2008 crash, interest rates were high, and it was a simple thing for savers to retire and enjoy the high interest, or get generous annuities offering good income for life.

Now, wealth languishes in 0.1% savings accounts, losing real value each year, making a mockery of their life-savings. Today’s would-be-pensioners are fighting an uphill battle.

Retirement Age By Region

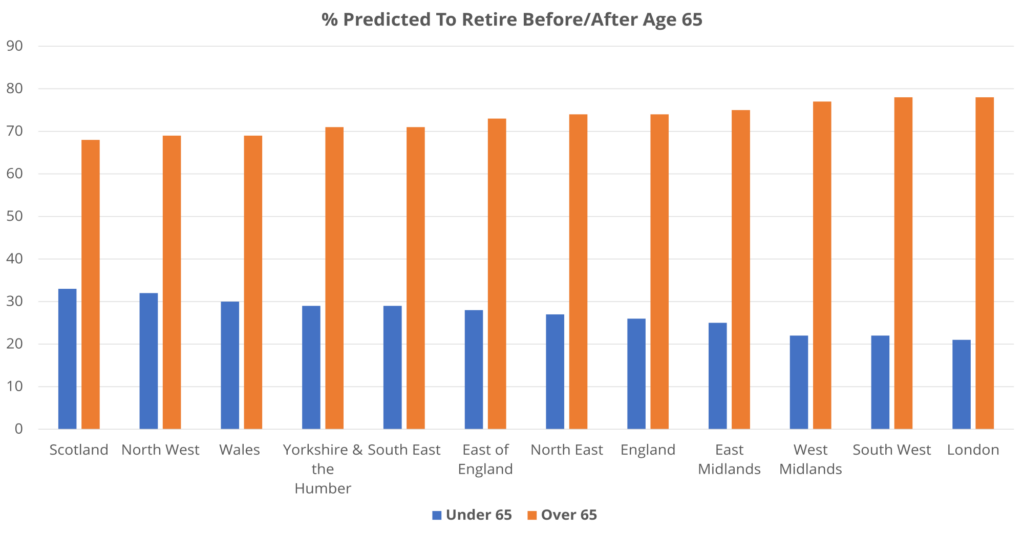

Where do you live? If we look at the UK on a regional basis, Scotland is the best place to live for early retirement, with 33% of Scots set to retire before age 65:

Surprisingly, despite the highest incomes, London is the worst place to retire early, with only 21% of Londoners predicted to be able to quit before age 65.

Maybe if they’re serious about retiring early, Cockneys may want to swap their jellied eels for haggis and neeps.

When Do People Want To Retire

A study by pensions advice specialist Portafina says that the nation’s dream retirement age is 57.

Presumably those people aren’t investors like the many subscribed to this channel, whose target retirement age could be a couple of decades before that!

But even age 57 is a lofty dream for most, because as we’ve seen, the real average retirement age is 64.

And it gets worse. 21% of Brits have no pension at all. Even 17% of the over-55s have nothing in their pension pot, according to an Opinium survey of 2,000 working adults from June 2020.

Figures from the ONS show that just 7% of people expect to retire before the age of 60. Most will retire at or just before the state pension age, out of necessity.

Ability To Retire Before The State Pension

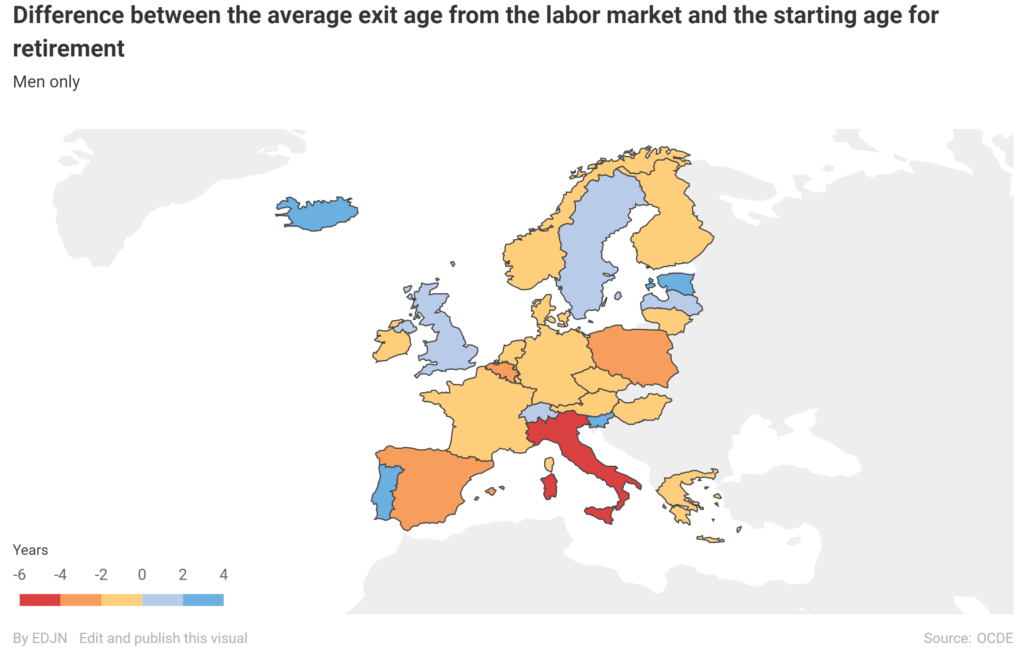

This next graphic shows, with data for men only, which countries in Europe are able to retire before their state pension age (those in yellow, orange and red). Those in shades of blue, like the UK, are retiring after the state pension date.

Women, not included in this graphic, actually help bring the totals down in the UK to just below the state pension age, as they retire earlier.

The Italians retire over 4 years before their state pension kicks in, and pretty much all of Europe bar a few pockets comfortably retire before the state tells them they can.

What we think we’ve shown so far is, you don’t want to be an average UK worker!

Years To Retirement By Savings-Per-Month (SPM)

What we really wanted to know, was at what age people are able to retire, based on the amounts they save each month from their income.

Try as we might, we couldn’t find any studies that have looked into this area, even though it’s got to be the one thing that everyone in the investing community really cares about!

What we’ve done instead is pull a chart together, based on these assumptions. In theory, it shows how many years you’d need to be investing into the stock market on average until you can retire on a basic income.

If you plan to retire earlier than age 58 – the age our generation can draw on their private workplace pensions and SIPPS from – you will need a big chunk of cash, or more likely, investment assets, to live on.

Here’s the chart, and it shows the estimated number of years to retirement based on the amount you are investing each month into the stock market, starting from scratch:

We’ve assumed zero tax because there are many ways to minimise it such as by using an ISA.

If you are investing £2,000 a month, it means you could retire 15 years from now.

Investing more than this each month has less and less effect on your retirement age if you’re aiming just for a £500,000 portfolio, as after a certain point the bulk of the work is being done by compounding returns, rather than new investments.

Investing £500 a month means you could retire about 33 years from now.

The main thing to do if you want to retire young is to increase the amount you can invest each month as much as possible.

The chart shows that the variance in years is massive at the smaller end of the monthly savings scale – an extra £100 a month could shave a decade off your career.

Our assumptions used the 4% rule to provide an income in retirement from the ISA of £20,000 tax-free.

We’ve shown here how the 4% safe withdrawal rate can be increased by trusting in the stock market, so maybe you could retire earlier than our cautious estimates.

People used to a £38,000 salary should be able to survive on a £20,000 after tax income in retirement, if we follow the 70% rule which says that people tend to need less money when they’re retired than during their working years.

This rule was made for old age retirement, but it could apply here too – but in reality, if you’re retiring young you may want to spend more on freedom activities.

But, consider that you won’t need to save for your retirement anymore, once you’re retired – and monthly savings would probably have been a big part of your budget if you’re retiring early.

Retirement Age And Career Choice

Finally, does your career affect the age you retire? Well, manual labourers tend to retire earlier than office staff, despite pay being typically lower.

This is more to do with being forced to retire early for health and productivity reasons than because they have saved more.

But maybe it shows that office staff could retire earlier than they do, if their blue-collar friends and neighbours are able to, and not be ruined by it.

Also, the pension age isn’t the same for all jobs.

The armed forces can draw a pension at age 60; police, firefighters and sports professionals from age 55.

So, maybe if you want to ensure your work boots are hung up for good by your mid-50s, and you’re good at rescuing cats from trees, maybe it’s time for a career change.

Don’t Be Average

The take-home lesson here is ‘Don’t Be Average’.

Average people retire in their mid-60s, at or close to the state pension age, and have little in the way of investments or private pension pots.

Make sure you subscribe to our YouTube channel below for regular videos aimed at UK investing and financial freedom, and check out the articles and features here on moneyunshackled.com, starting with this guide on matched betting for a way to increase your monthly income and savings rate by maybe £500 – maybe more!

What do you think is a good retirement age, and what’s your target? Join the conversation in the comments below!

Check out the MoneyUnshackled YouTube channel, with new videos released every Monday, Thursday and Saturday:

1 Comment

I suggest you check your facts about the age you can currently draw the state pension.

Comments are closed for this article!