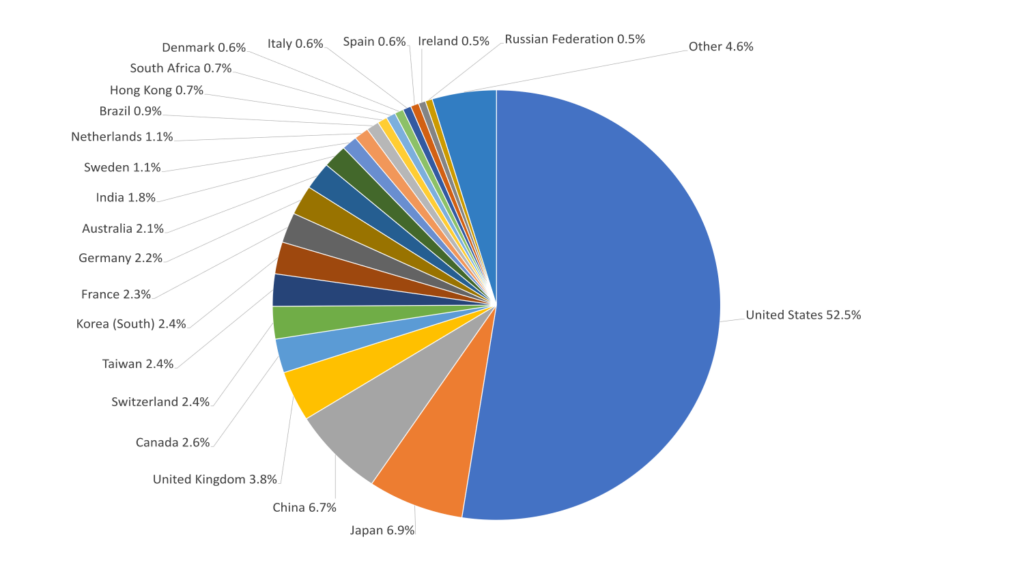

This by the way, is our actual portfolio equity split, more info on which can be found here.

If you’ve ignored us and built a portfolio solely of UK stocks, your small cap stocks may now perform better from a solely currency perspective, as they have less US exposure.

But as we’ve shown, large caps who make a lot of their earnings overseas in dollars are less likely to benefit.

Impact On Investments If The Dollar Returns To Strength

The most obvious way to restore confidence in the dollar and send it back to strength would be if the US central bank stopped their folly of printing money without limit.

But that is like asking a scorpion not to sting you – as much as it might try not to, at the end of the day, it’s all it knows how to do.

Obviously, central bankers think money printing is necessary, but other experts like Ray Dalio say they’re just kicking a problem down the road. It might be better to take the pain and get it over with.

If the dollar does return to strength, which it probably will eventually because America is such a powerful economy, then you may have wanted to use this time to buy US stocks while they were on sale – relatively speaking.

Should You Fear Currency Risk?

Your time horizon matters. Short-term exchange rate fluctuations can be violent – as we saw around Brexit.

But long-term investors may have much less to worry about – many economists believe that currencies reach equilibrium over time and therefore exchange rate fluctuations tend to balance out.

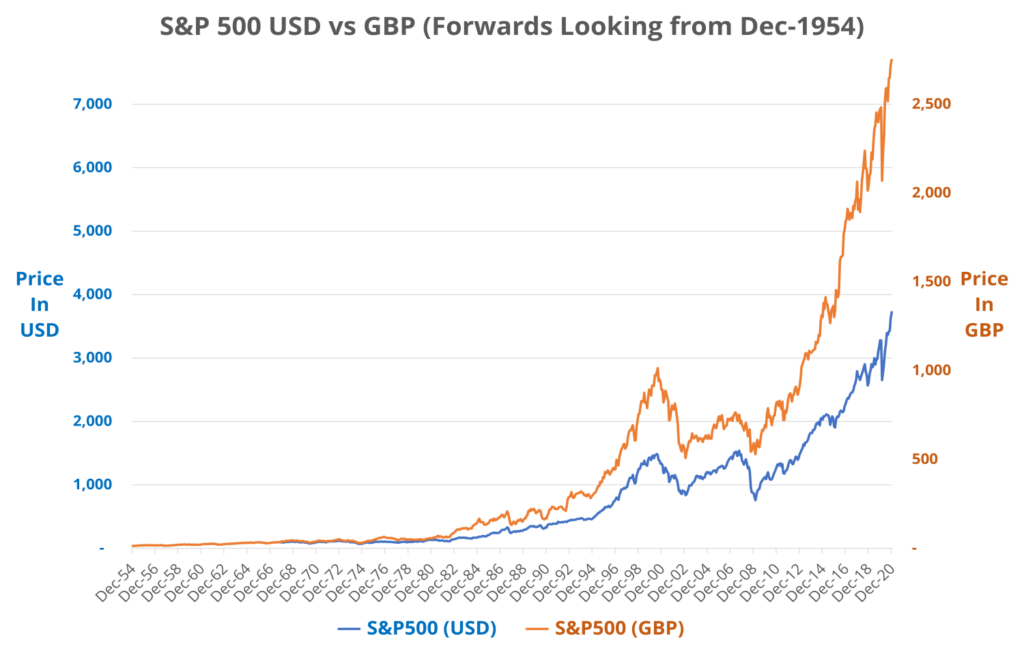

And we’ve shown how UK investors would have missed out on American growth if they’d worried too much about the increasing buy price.

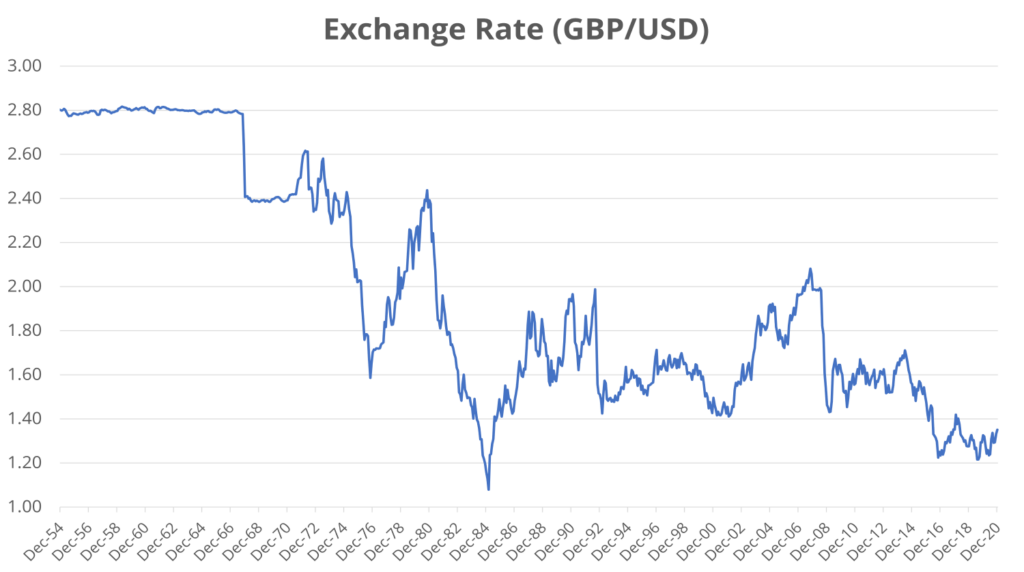

However, we know from looking at the last 70 years in Fig.1 that a directional trend can become engrained, so let’s now look at your options for reducing or eliminating currency risk.

#1 – Avoid

Just buy UK investments. Hopefully you see the pitfalls in limiting yourself to one market though, and this would not be our preferred way to run a portfolio.

And we’ve shown that avoiding currency risk in the UK market is almost impossible, dependant as it is on the Financial and Energy sectors, both hugely impacted by the US dollar.

#2 – Diversify

Instead of investing in one foreign country, invest in all of them. By owning assets in all currencies, global equities will naturally hedge each other as rising currencies are offset by falling ones.

This method gets our vote.

#3 – Currency-Hedged ETFs

This can be a very cheap and straightforward way to remove currency risk.

Currency-hedged ETFs offset the effects of exchange rates on returns, cancelling out any losses from falling overseas currencies.

Sadly, it also cancels out any win you might have taken from rising overseas currencies too.

As indeed would have happened if you’d chosen to hedge the S&P500 over the last 10 years, instead of accepting the risk and taking the much higher unhedged gains.

Currency Hedged ETFs will usually have the word “Hedged” in their title.

Future Outlook

So which way is the dollar going? The US has said it will keep injecting at least $120bn of credit per month until “substantial further progress has been made” in the recovery – by which it means both full employment, and inflation over 2%.

When this will be is anyone’s guess, and until then the dollar will presumably continue to weaken.

Economist Jim Rickards, bestselling author of The Death of Money, estimates this is 5 years away, which could mean $7trn more money printing still to come.

Wealth manager Iboss said: “We expect the dollar will continue to weaken … because the American government and central bank will continue pumping money into the market to help the economy.”

Another wealth manager Seven Investment Management said the dollar could weaken against the pound in the longer term, regardless of Brexit, and with the rollout of Covid vaccines, money might continue to flow out of safe haven currencies like the dollar.

So it looks like a weak dollar, and bargain prices in the US market, may be around for a while yet.

How do you manage currency risk in your portfolio? Let us know in the comments below.