Trading 212 is an incredible investing app – not just because it’s free but because it’s packed full of awesome features.

It’s a really exciting time in the UK investment app scene right now with lots of innovation and platform fees falling all the time – Trading 212 is at the forefront of this revolution.

We did a full review of Trading 212 back in 2019 and since then the app has gone from strength to strength. As a quick recap, Trading 212 offers zero fee investing in 3,000+ global stocks and ETFs, with no foreign exchange fees.

It also has zero fees for using an ISA and a feature we absolutely love is fractional investing. In his video, unless we say otherwise, we are only talking about the Invest and ISA Accounts.

Since our first review we’ve had hundreds of questions about Trading 212. So, today we are going to answer all of the most frequently asked questions such as:

Is Trading 212 a Scam? Do they pay dividends? If it’s free how do they make money? Should I go direct to Vanguard? And many others. All these and more coming up. Let’s check it out…

Editor’s note: We have lots of cashback offers worth hundreds of pounds on the Offers page – from time to time we have Trading 212 offers where they give you a free share, so it’s worth checking the offers page out. There are currently some great offers for competing apps including Freetrade and Stake, so maybe check these out as well!

YouTube Video > > >

Which Account Do I Use? CFD, Invest or ISA

When you download the app, you’ll have a choice of 3 different accounts or product types. We’re of the belief that most people should not go anywhere near CFDs. These are potentially dangerous financial instruments if you don’t know what you’re doing.

The CFD account is NOT free to use and 76% of retail investors (i.e. you and us) lose money when using this Trading 212 CFD account. We have an entire dedicated video about why to avoid CFD trading, which we’ll link to in the description below, so feel free to check that out later.

The Invest and ISA accounts are the same except the ISA is tax efficient. Although most beginners don’t have enough money invested to pay tax anyway. When you invest through the Invest and ISA account you own the underlying investment – you’re not just placing a bet!

Is Trading 212 a Scam?

We’re not sure why people are saying that Trading 212 is a scam. They are authorised and regulated by the FCA. You can check this out for yourself but here we have done this for.

We have also used the app ourselves and know many other people who have had no issues whatsoever.

As we just mentioned, a lot of people lose money on CFDs, so are likely to be extremely disappointed and which we suspect is the root cause of this “scam” myth, but despite this the app has an incredible rating on Trustpilot.

Almost all the negative feedback seems to come from those using the CFD account, which you should only use with caution anyway. We’re not suggesting that there are no genuine complaints, but it seems that this is the minority.

In any case, as a regulated platform they must comply with complaints according to FCA requirements.

Is It Really Free?

Incredibly, yes. At least from fees that they directly control. A lot of things these days claim to be free but have hidden fees that you have to navigate around like a ninja.

Usually there’s a big heading that’s say ‘FREE’ that gets you excited and then you go straight to the T&Cs or fee section only to discover that it was a load of nonsense. Well in this case it’s true – it is free!

We’ve scoured the entire site and have personally used the app ourselves and have not been victim of any hidden nasties.

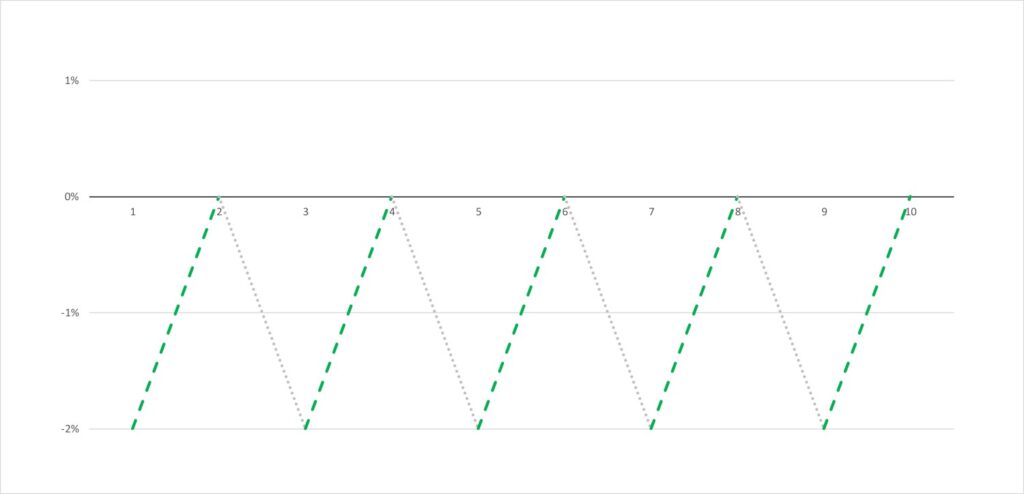

Of course, these is no such thing as completely free investing because you have to pay the bid/offer spread, which is a feature of the stock market.

All shares and ETFs have 2 prices – a buy and a sell price. The spread is what you would lose if you bought and immediately sold an investment.

You may also have to pay stamp duty or other taxes depending on what you’re buying.

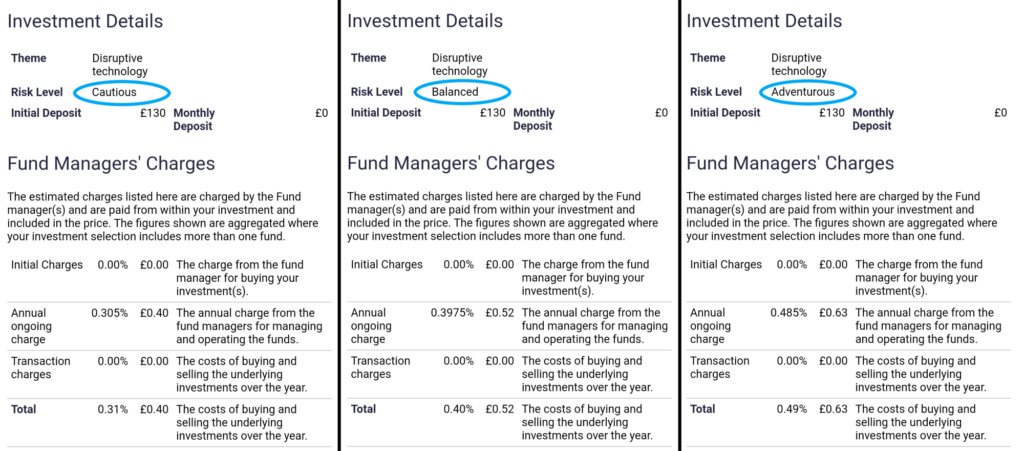

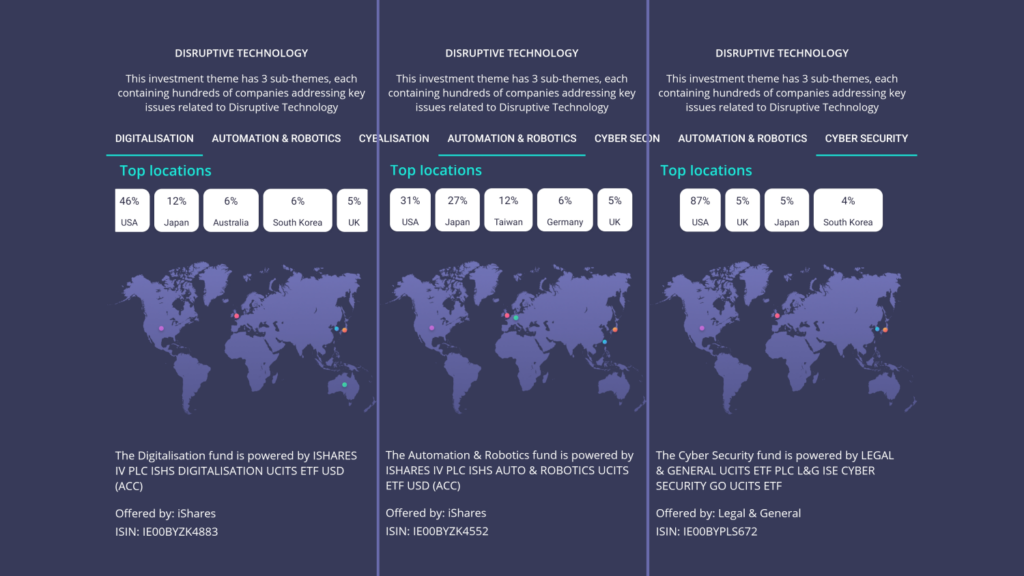

And when you buy ETFs, you will pay a fee called the OCF, which costs typically around 0.10 to 0.30% of your holdings depending on the ETF – again, this fee is to the ETF provider, not Trading 212, and is outside of their control.

If Trading 212 Invest/ISA Is Free How Do They Make Money?

According to the co-founder, actual trading costs that they as a business incur are less than £1, so waiving trading commission does not have a detrimental effect. Charging for other services should more than cover for these shortfalls.

The most obvious service that they make money from is their CFD service. So, we would suggest that they are using free investing to entice people to their platform and then hoping they also go on to use this paid product.

Also, as with many online businesses, we would expect them to be currently going through an explosive growth stage where it’s really important to grow as quickly as possible. With size comes economies of scale and strength. Profits can be made later.

Trading 212 adopts a classic ‘freemium’ model – like mobile games or probably your bank current account. Your bank account is free, but they’ll charge you for additional services like overdrafts, loans and so on.

We would expect them to start introducing paid for premium services at some point. They often give little teasers of upcoming features and from what we’ve seen we wouldn’t mind paying a small amount for these if they were to charge.

Should You Use Vanguard/X Platform Instead?

You would think that Vanguard’s own platform would be the cheapest place to buy its own funds, but this is not the case. Vanguard’s platform is incredibly cheap, but you cannot beat free.

However, price is not the only factor when choosing a platform. Investment choice along with additional services need to be considered.

Trading 212 doesn’t offer the extensive choice that you get with more premium platforms such as Interactive Investor. We both prefer to have more choice and are prepared to pay a little extra for this, but this doesn’t stop us from occasionally using Trading 212 and other free trading platforms.

Vanguard’s platform is amongst the cheapest place for the full range of Vanguard funds – Trading 212 for instance does not offer OEICs, so you cannot invest in the LifeStrategy range for example.

You can use multiple platforms, so you don’t have to commit to any 1, but you can only use 1 active Stocks and Shares ISA in any given tax year.

Do They Pay Dividends?

We’re not sure where this question comes from. We suspect it arises from the complexities of CFD Trading.

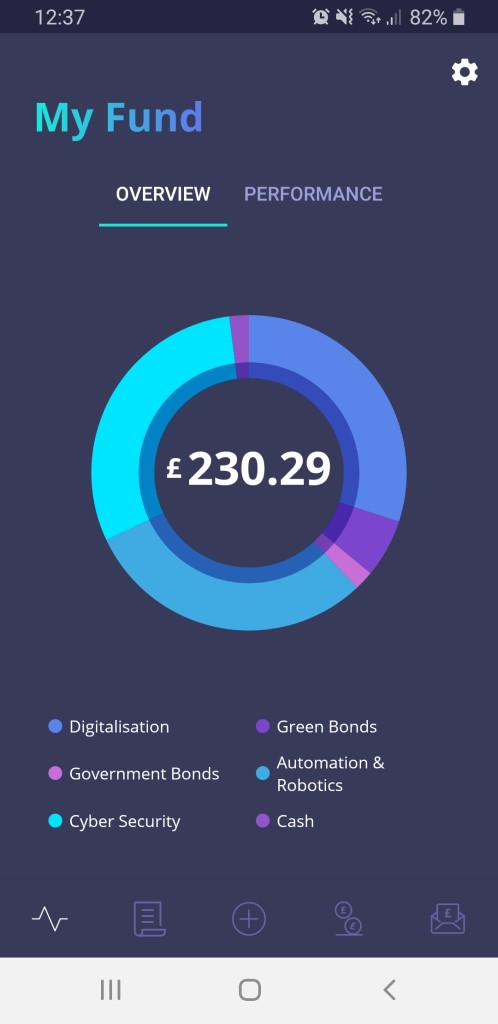

As you can see here, dividends for the Invest and ISA accounts are paid directly into your account balance. We can confirm this from our own experiences with the app.

Some ETFs are of the Accumulation variety, in which case dividends are not paid directly to you, rather they form part of the growth in the ETF price.

The ETFs that pay dividends to you directly are the Distributing variety. Check the ETF providers own site to find which type it is.