Assets, assets, assets. Buy them, hold them, get rich from them. This is the philosophy of Rich Dad Poor Dad author Robert Kiyosaki, distilled to few words, and yet he has a lot of detractors who like to call him a con man who doesn’t understand what an asset is.

A lot of the hate comes from the probably correct perception that his fortune was made from the books that described his fortune, rather than the assets which he writes about.

Take a step back from the man and look at the words in his books however and you are left with a treasure trove of sound advice – an investors’ Bible which both of us have used to plot the course of our lives over the last 5 years, culminating in massive increases to our portfolios as well as the creation of the Money Unshackled business.

It is no small exaggeration when we say that we owe our own successes in part to the teachings of the likely fictional Rich Dad in the books, whose words on the Cashflow Quadrant and the power of Assets we both took to heart.

Robert Kiyosaki – Legend or Con Artist, or both? Let’s check it out…

Editor’s note: People interested in investing in Peer to Peer Lending now have a new way to ease into it with our latest offer – open a new account with just £10 in the RateSetter platform and you will get a £20 cash bonus when you use the link on the Offers page!

YouTube Video > > >

Asset Theory – We Like

The core concept of the Rich Dad series is that Assets are things that create a positive passive cashflow without any further input from you, and that everyone should own a whole bunch of them.

We absolutely love this simplified view of investing, and it inspired each of us to new investing heights. Appraising an investment for its cashflow potential is how we pick investments to this day.

We took this concept and ran with it by buying assets such as rental property, dividend stocks and ETFs, and Peer-To-Peer Lending portfolios.

And now we can each draw good cash incomes from our assets every month. Winning advice from Robert there.

Fiction Sold as Truth? – We Find it a Little Dishonest

The “Rich Dad” story of Robert as a young boy and having 2 father figures who taught him everything he knows about money has widely been ridiculed as fiction, despite the author insisting it happened word for word as he said it did.

But as a parable it holds its own truths – all the advice given by the (likely fictional) Rich Dad is sound advice that we and many other investors live by.

And much of it was out of step with the thinking at the time that investing should be for long term growth rather than income creation.

We still find the majority of the investment media encourage a long-term growth strategy aiming at freedom in old age, rather than the “investing for passive income generation” method that we promote.

In this regard, the story of Rich Dad talks truth to power by going against the grain of common investing theory. But Robert should really stop pretending that the story is literally true.

Financial Freedom – Our Reason for Being

MoneyUnshackled.com is an investing site unlike most others because we promote Financial Freedom now, while we’re young, instead of the freedom in old age that most leading gurus including Tony Robbins and countless others around the investing world promote.

The story of Rich Dad Poor Dad is one of building up a portfolio of cash-flowing property assets and start-up businesses that Kiyosaki could then live off of, instead of employment.

By all means build a sweet global portfolio of shares to grow your wealth – we do this too. But alongside that have cash flowing assets like Peer-to-Peer Lending and Rental Property or REITs to pump out regular cash that you can start living off.

Then we say to use your freed-up time to start businesses that can be turned into passive income streams. This is also what Robert Kiyosaki says.

Courses – An Absolute Con

When I started out buying investment properties, it was to the Rich Dad University that I turned to get an introduction to the world of rental property.

I’d read the books and concluded that Robert Kiyosaki and his team must know their stuff. I paid to attend an online seminar, which cost me £120, and came out the other end more confused than when I went in.

And this course was a precursor for further courses, all of which would have cost a fortune. Many other players in the financial education market charge their loyal fans thousands for courses that are nowhere near worth it, so Kiyosaki is not alone in this regard. But it still strikes us as either a con or certainly not value for money.

We may one day create some paid-for courses, but these would be affordable, complete packages, with the aim to educate rather than to up-sell further courses.

The reason we give our tips away for free on YouTube is because we passionately want to change the country and get individuals to take care of their financial futures – because nobody else will do it for you.

Cashflow Quadrant as a Concept – Life Changing

The Cashflow Quadrant, Kiyosaki’s second book, opened our eyes to the truth, Matrix style. At school we are told there is one place to find income – a job.

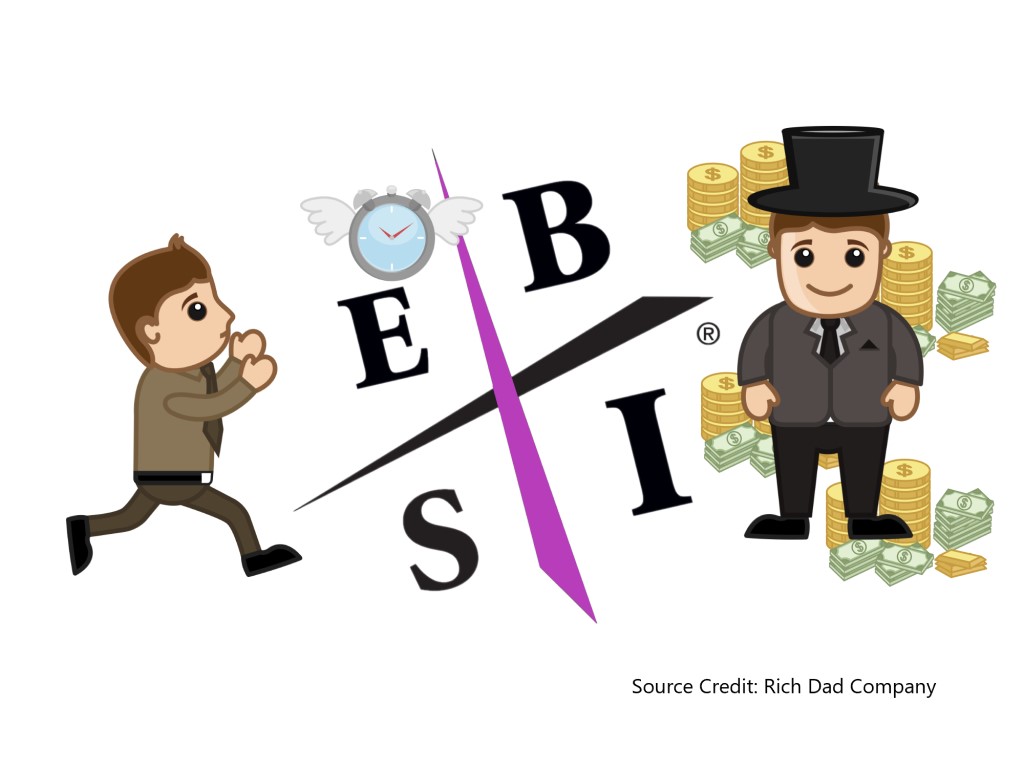

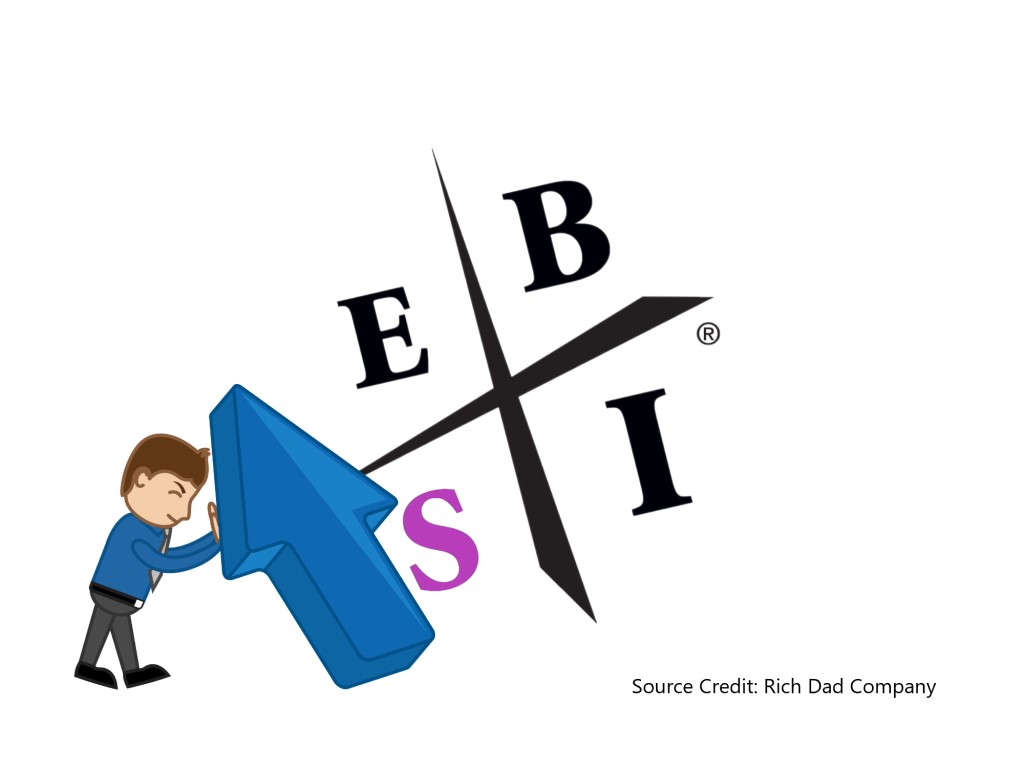

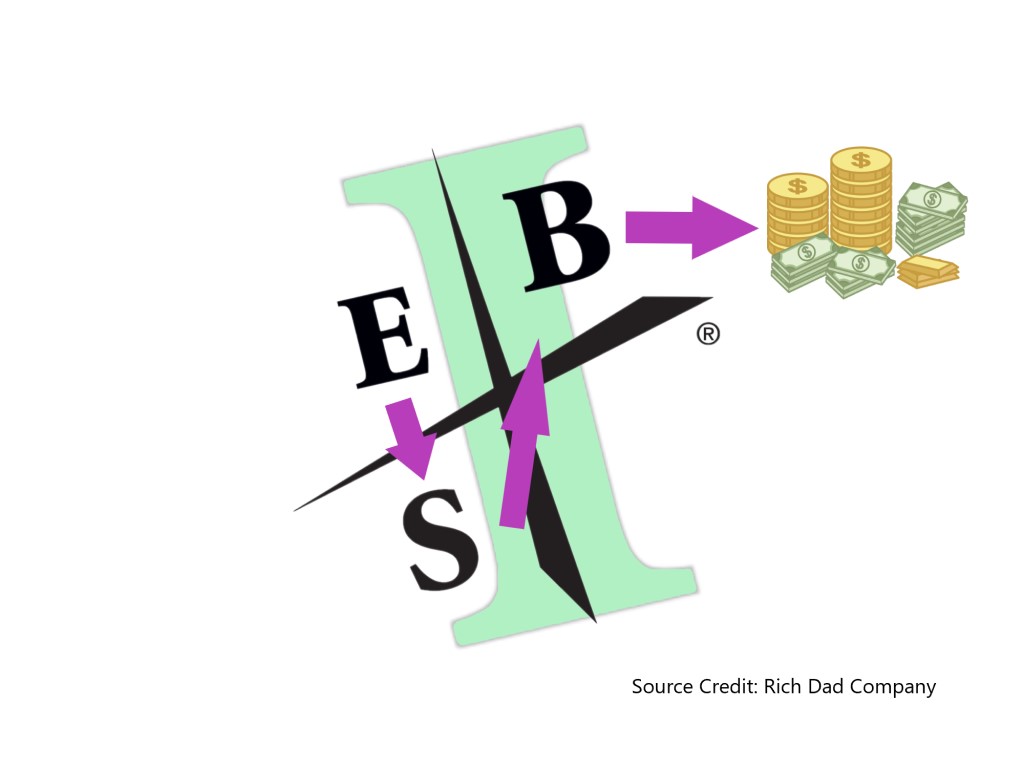

The Cashflow Quadrant shows that Employment is just 1 of 4 ways to make money, and the 4 ways are equally weighted as there is no reason why Employment should be any more important or worthy than the other 3:

The Quadrant is further split down the middle, with those who work a 9-5 on the left, and those who don’t have to work anymore on the right.

This concept is eye opening in so many ways that we can’t stress enough how much we love this book. It’s there on the MoneyUnshackled website in the Top Books section along with a load of others that we consider essential reading – check it out book lovers!

The Downplaying of Small Business Owners – A Bit Misguided

Kiyosaki is very critical of small business owners who work in their businesses day to day – in his words, all that they own is a job.

We see his point, but there is a world of difference between being told what to do every day by a line manager, and owning your own little empire.

Plus, Big Businesses do not appear overnight. They start as small businesses, whose owners have to be very hands on.

We find the Cashflow Quadrant makes more sense as a line than a grid – the most common route to fast Financial Freedom follows a route from Employment, to save money to start a Small Business, to develop through time and effort into a Big Business, that ends in a passive income stream being established.

The Investor quadrant is really more of an overlay, that sits behind or around the other 3. Investing compliments and enhances your wealth and income streams throughout your working life.

Your House is Not an Asset – Yes We Totally Agree With This One

Your house in itself does not produce income, in fact it costs a fortune in mortgage payments, council tax, bills, and regular maintenance.

When your boiler blows up, is your house an asset, or did it just cost you several grand?

Kiyosaki has taken more stick for this idea than any other over the years, in fact it’s what made him famous in the first place. His declaration that people’s precious homes were not assets upset millions of people; and intrigued many more.

People don’t want to be told that the thing they’ve spent years overpaying a mortgage on and adding new kitchens and new bathrooms to is not an asset; but is really a liability costing them a fortune.

Kiyosaki’s main point is that you can’t spend a house – because you’re living in it. Its value might go up, but you can’t retire on the value of your home.

Not unless you sell up and move to a poorer city or country where you can buy a far cheaper house and live on the difference for a bit.

But even that is likely to be unsustainable for retirement. The hard truth that your house is not an asset is one that people need to understand, and then start investing in real assets instead.

Your House is Not an Asset – oh, yes it is! – wait…

Although we totally agree, we also disagree completely 😉

I am far better off and further on my investing and financial freedom journey for having bought a house.

I had a lodger for nearly 2 years, paying by nearly £500 a month, and I have remortgaged my house twice, withdrawing equity to the sum of £50k to help finance 2 of my rental properties.

We’re not saying you should do this – it of course carries risk. A lodger may be dodgy, or an equity release could be invested in an asset that loses money.

But it goes to show that your home can be of financial use, and not always a total liability!

What have we missed? Is Kiyosaki wrong in any other regards, or is he just at the end of it all, a total legend? Let us know your thoughts in the comments below.

Written by Ben