We recently produced a popular video called How to Own the World with 6 ETFs, but we have since been asked how to construct a similar portfolio with one of the free investing apps such as Freetrade. One of downsides of the free apps is you obviously don’t get as wide a choice of ETFs as you do with the more expensive investment platforms. But this is not to say you cannot achieve a similar, if not the same result.

At the time of writing, Freetrade offered only 59 ETFs but they have clearly handpicked some of the best on the market, so we can still build a decent portfolio with what’s on offer. We suppose the real question is “does the zero-fee trading vindicate the limited ETF choice”. We think it’s a worthy sacrifice for many people especially those new to investing, who otherwise might be overwhelmed by the choice.

Why should you own the world? Hint- It’s all about diversification! Plus… owning the world is cool.

YouTube Video > > >

When constructing the last portfolio, we built it based on the premise that we wanted to limit the holdings to 6 ETFs. One of the main reasons to do this is reduce the amount of trades required – not only when buying the ETFs but also when rebalancing. As we all know, buying and selling investments was and often still is very expensive and so we had to keep it to a minimum. However, Freetrade removes this limitation allowing us to technically build a portfolio with as many holdings as we want.

We also don’t want to get carried away as it can still be an administrative burden managing a large portfolio, but at least we don’t need to worry about the cost anymore. In this article we’re going to build a core portfolio of ETFs within the Freetrade Investment App, in order to own the World. This should maximise investment returns, and minimise risk. Let’s check it out…

Editors note: If you like the look of Freetrade then sign up with the affiliate link on the Offers Page. By doing so you’ll get a free stock worth up to £200!

USA

Ideally, we would be able to invest in the entire Northern American continent but unfortunately this is where our choice is partially limited. Not to worry though as we still have plenty of S&P 500 ETFs to choose from.

The S&P 500 is the index that tracks the 500 largest US companies and, in our opinion, many of these stocks are an essential part of any investment portfolio. Think Apple, Google, Amazon and Microsoft. The main notable absence would be exposure to Canada, but this would have only made up a very small allocation of any North American ETF anyway. Mexico is also missing but we’ll get some exposure to Mexican stocks with another ETF in the portfolio, which we’ll get to shortly.

So, the ETF we will opt for is the Vanguard S&P 500 UCITS ETF (VUSA)

This beauty has an almost non-existent ongoing charge of just 0.07%. That would be a charge of 70p per £1,000 invested.

Mind. Blown. To think that you can invest £1,000 in 500 of the largest US stocks for less than the cost of a packet of crisps is extraordinary. Out of the few S&P 500 ETFs on the Freetrade platform, we chose this one because it distributes income quarterly and we always tend to opt for Vanguard whenever they are competitively priced, which they usually are.

Vanguard have earned our trust but there are some iShares equivalent ETFs on Freetrade, which will be just as good. FYI, the current market price at time of filming is about £45.32 and the dividend yield is 1.56%.

UK

In the previous ‘How To Own the World’ episode we opted for a FTSE All Share ETF but one of the key reasons for that is that we wanted to get as much exposure to the UK Stock market in as few ETFs as possible in order to limit the number of trades.

Freetrade do have a FTSE All share ETF on offer but as we don’t need to worry about trading costs with Freetrade we will instead opt for 2 ETFs instead:

1) iShares FTSE 100 ETF (ISF), which will track the FTSE 100 – the largest 100 stocks on the London Stock Exchange

2) Vanguard FTSE 250 ETF (VMID), which tracks the next largest 250 stocks aka. FTSE 250 index

We can even choose to invest more into the FTSE 250 than what we would naturally get in the FTSE All Share index. We might want to do this because we like the prospects of smaller companies and anticipate them to grow faster than larger stocks found in the FTSE 100.

Both these ETFs distribute income quarterly, which is what we prefer over the accumulation variety as we like to choose how we reinvest. The iShares FTSE 100 ETF comes in with an incredibly low fee of just 0.07% and the Vanguard FTSE 250 ETF at just 0.10%.

This FTSE 100 ETF has a whopping yield of 4.60% and is priced at £7.15. Whereas the FTSE 250 yield is 3.12% and is priced at £33.07. These are both superb cash returns, with the FTSE 100’s yield being explained by the fact that it contains many mature companies such as Shell, Glaxo, HSBC, etc, who return a lot of cash to their shareholders as they are past their rapid growth phases.

Europe

We want to invest in Europe and we already have UK exposure, so ideally, we would go with a European ETF that excludes the UK. Unfortunately, the limited ETF offering on Freetrade caused us a problem here as the closest ETF we could find is the:

Vanguard FTSE Developed Europe UCITS ETF (VEUR)

Don’t get us wrong – this is a great ETF. We didn’t want the additional UK exposure, but we can still opt for this one as long as we adjust the portfolio allocation accordingly, which we’ll get to shortly. As always, this Vanguard ETF comes in at a very low cost of 0.10%, distributes income quarterly and yields 3.41%. It contains 614 stocks and is priced at about £26.79.

Asia Pacific Ex Japan

To cover this region, we only have 1 choice on Freetrade, which is the:

iShares Core MSCI Pacific ex-Japan UCITS ETF (CPJ1)

This ETF is predominantly invested in Australia, Hong Kong, New Zealand, and Singapore. When you choose any fund you really ought to look under the bonnet to familiarise yourself with what you’re actually investing in.

We want to invest in South Korea as they have some great global companies such as Samsung. This ETF doesn’t do that but fortunately this is covered in another ETF we will be investing in. It’s a shame Freetrade don’t offer a wider choice for this region as there are cheaper ETF’s available that do the same thing. In this case the ETF costs 0.20% which is still cheap enough, but this is the accumulation variety.

It contains 145 stocks but is quite an expensive ETF at about £115.

Japan

Next on the list is Japan and we can invest using the:

Vanguard FTSE Japan UCITS ETF (VJPN)

Its price is £24.21 and costs just 0.15%. This is another distributing fund, yielding 1.76% and contains 505 stocks.

Emerging Markets

Freetrade offer a few emerging market ETFs and we will opt for the:

iShares Core MSCI EM IMI UCITS ETF (EMIM), which is priced at £21.59 and costs just 0.18%.

We have chosen this one over the Vanguard alternative as the Vanguard Emerging market ETF is a tad dearer and does not have any South Korean exposure, whereas the iShares ETF does.

This means that you’ll get a position in Samsung by investing in the iShares ETF. Also remember that earlier we said we were looking to get a small position in Mexico – we’ll get this with this ETF.

Investing in this ETF will give us 2,731 stocks across many geographies.

Other

If you follow this portfolio you are very likely in our opinion to beat the majority of investors. You could even use this as the core of your portfolio and use a small allocation to try and beat the market by picking more exciting ETFs that are on offer or even try your hands at stock picking.

Portfolio Weighting

If this was our portfolio we would allocate it something like this:

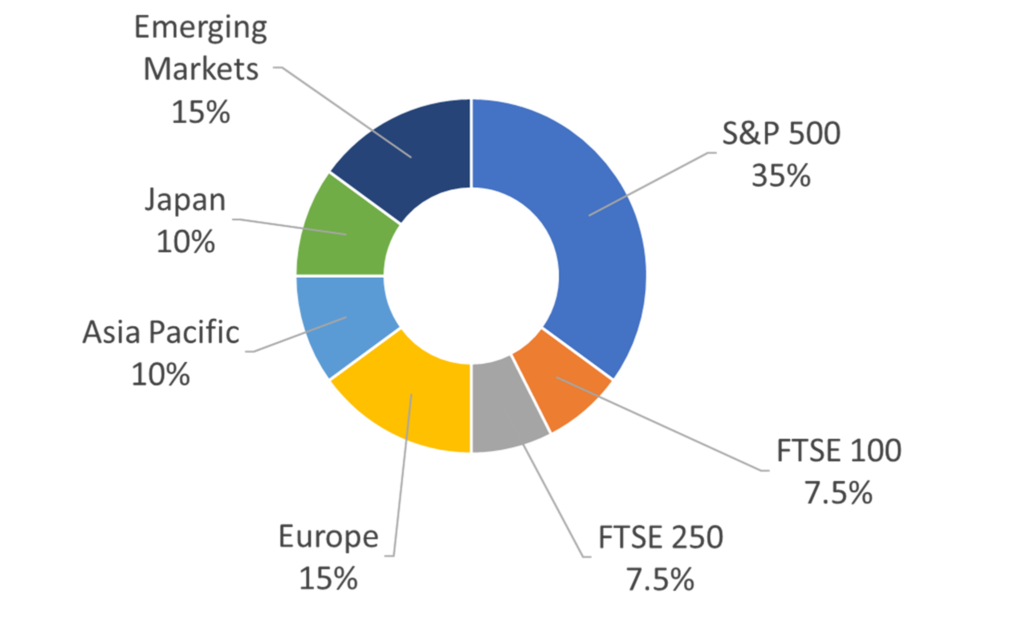

35% S&P 500, 7.5% in the FTSE 100 and 7.5% FTSE 250, 15% in Europe – remember this one contains some UK exposure as well – 10% in Asia Pacific, 10% in Japan, and the remaining 15% across the Emerging Markets.

You can easily adjust this allocation to reflect your own predictions and risk profile.

What other ETFs or even shares would you add to this portfolio from the Freetrade Universe and why? Let us know in the comments section.

4 Comments

Great choices and love your vids as they are very informative. I’m half tempted to use these selections as a basis for my portfolio and see how they grow over the years.

Thanks for watching! My (paper) portfolio is now almost entirely in Freetrade, using this strategy. Alongside my cash flowing Buy-To-Lets, I think it’s important to hold a diversified world portfolio of stocks for safety and growth. Ben

Hi Guys, have been watching your YouTube videos alongside others related to stocks and ETF’s.

As a UK expat living/working in Thailand, I am not sure FreeTrade will accept me as a new customer because I am not domiciled in UK. Any suggestions ?

Interactive Brokers will accept overseas customers but with trading fees associated.

My plan is to invest a proportion of my UK property BTL income in ETF’s and solid Dividend Stocks with proven long term history. I’ve already short-listed 40+ dividend stocks that are spread over 10 sectors. The time manage these is not a major concern for me as the strategy would be buy and hold permanently for next 10 years, simply re-investing the dividends in more funds/stocks.

I believe the £2000/year tax free dividend allowance is still applicable to me. However, I may have to consider UK dividend stocks only as I believe US ones are subject to 30% dividend tax.

Thoughts appreciated.

Andy.

Hi Guys, can we have a review on Interactive brokers? 99% of videos on youtube are from the uS, where IBKR has slightly different offerings. I am trying to understand the commission structure and fees compared for instance to Interactive Investors. At the moment I am on Trading212 and I’ll stay on it until I reach at least 20K in my portfolio. Thanks in advance.

Comments are closed for this article!