The announcement that Vanguard are finally going to offer a personal pension, otherwise known as a SIPP, in early 2020, is potentially game changing for those building a retirement pot.

SIPP’s have long been a great way to invest for old age with fees being moderately low for many years, but with the introduction of the Vanguard SIPP the industry will potentially be turned on its head with ground-breaking cuts to the cost of retirement investing.

You simply have no excuse anymore if you don’t retire wealthy.

In this article, we thought we’d take this opportunity to highlight what Vanguard will be offering with their SIPP and to talk about how we save for retirement with the goal of retiring wealthy. Let’s check it out…

Editors note: Don’t forget to check the Offers Page and grab free shares worth up to £200 plus £50/£75 cash backs when you open new investment accounts through the sign-up links there.

YouTube Video > > >

What is a Self-Invested Personal Pension (SIPP)?

In one way the Vanguard SIPP is not much different to any other SIPP. And by that we mean it will allow you to invest in a tax-efficient way for your retirement. A SIPP is not particularly exciting, but they do have a few cool features:

Firstly, they allow your money to grow without the greedy taxman taking a huge slice. Over the years this tax-free status will allow your pot to grow unhindered to hopefully unimaginable heights.

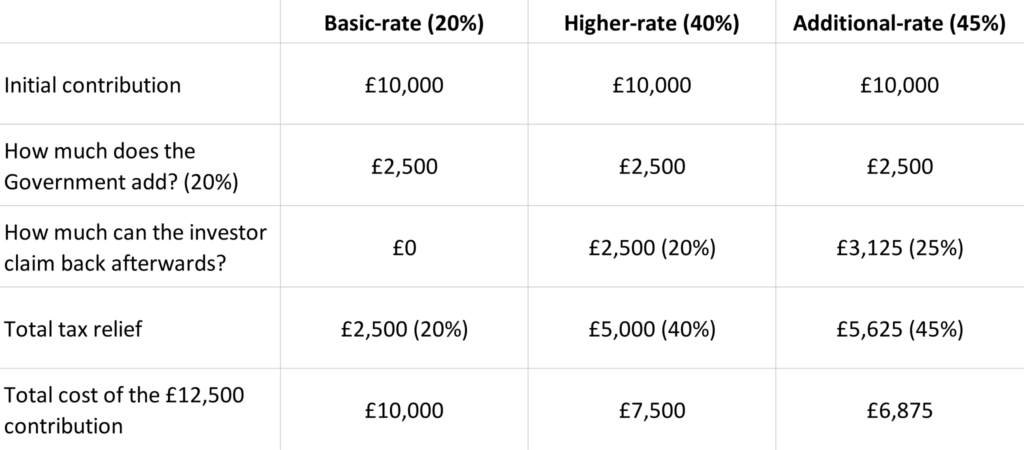

Secondly, you will also get tax relief on your pension contributions. In effect this means the government will pay into your pension if you do.

As an example, this table shows that basic rate taxpayers would receive an additional £2,500 if they contributed £10,000 themselves or even more for higher earners.

Sounds amazing- where do we sign up? But hang on! The main downside to any pension is that you cannot access the money until at least aged 55 and this will be increasing. Most probably into our 60’s for our generation.

The fact that your money is inaccessible until your older age is bad but meddling governments have and will continue to increase this age. We don’t trust governments.

The Western World including the UK is walking blindfolded into a financial catastrophe caused by excessive debt. It’s been heavily speculated that a future government will have no choice but to dip into this tempting pot.

What is the Vanguard Personal Pension (SIPP)?

The Vanguard SIPP has the same pros and potential downsides as what we just discussed but at least they do it all with rock bottom fees.

Their platform fee will be just 0.15%, which is much lower than all the existing investing platforms. That’s so low we feel it’s worth repeating. They will only charge 0.15%.

Moreover, it does not charge you to buy and sell funds or ETFs, meaning you won’t incur further trading costs as you do with the majority of other platforms.

You will be able to invest in any of the Vanguard Funds and ETFs, of which there are 76 at time of writing. And if you are a regular viewer of our YouTube channel you will know that Vanguard funds are some of the best available on the market.

You will of course incur the inbuilt fees from the funds, but these are also extremely low cost.

It’s worth pointing out that you will not be able to invest in non-Vanguard funds or invest directly in stocks. Perhaps check out the AJ Bell SIPP if you are keen to do that but it is more expensive.

Is a Personal Pension right for you?

When investing for retirement it is almost always a good idea to first use any matched contributions offered by your employer. This is because you will essentially get a 100% immediate return due to your employer paying in as well as you. Then of course you get the government tax-relief on top.

It’s great to see that Vanguard are even encouraging this and this is something we certainly support.

This then leads us onto whether you should be investing additional retirement savings into the Vanguard SIPP. This is only something you can decide. If your plan is to retire either at or after the minimum age from which you can draw your pension, then this would probably be an excellent choice, particularly if you’re a higher or additional rate taxpayer.

What Do We Do?

Whatever anyone else does, doesn’t necessarily make it right for you, but we want everyone to live a more fulfilling and enjoyable life starting today, so we’re always more than happy to share what we do in the hope that it might inspire others.

Neither of us add additional money to old age retirement savings over the matched amount that our employers will pay.

We feel that money in our hands today can be invested more wisely so that it can start generating us an income now or at least much sooner than the state dictated retirement age.

This benefits us in a number of ways:

- We get the 100% top-up from our respective employers

- We get the tax-relief

- This acts as a plan B should our plan A of achieving financial freedom today fail

- The money that we don’t put into a pension is put towards our business and investing ventures

But that doesn’t mean that we don’t use SIPPs. Andy invests in a SIPP because he has consolidated several pension pots accumulated over the years from changing jobs.

He doesn’t invest additional monies into it for the reasons just outlined but finds it a great way to manage his pot rather than having retirement money all over the place in old and more expensive workplace pensions.

With Vanguard entering the SIPP scene he’s seriously considering transferring his SIPP to them because he currently has about 75% of his SIPP invested in Vanguard funds. The question to ask is whether it’s worth paying more platform fees across the entirety of his portfolio in his current SIPP provider, for the sake of the small allocation that he has invested in non-Vanguard funds – probably better to use the Vanguard SIPP.

This is Ben’s plan when the Vanguard SIPP arrives – he has numerous pensions dotted around, and wants to bring them all together under a single low-fee umbrella.

If you have changed jobs and accumulated many different pension pots perhaps you could also consider consolidating it all with Vanguard. Before we finish let’s take a look at what’s on offer:

Vanguard Funds and ETFs

Vanguard offer a great range of funds and ETFs that cater for pretty much any experience level. For those that want to invest and forget they could look at the range of Lifestrategy Funds that cost just 0.22% or the family of Target Retirement Funds costing just 0.24%.

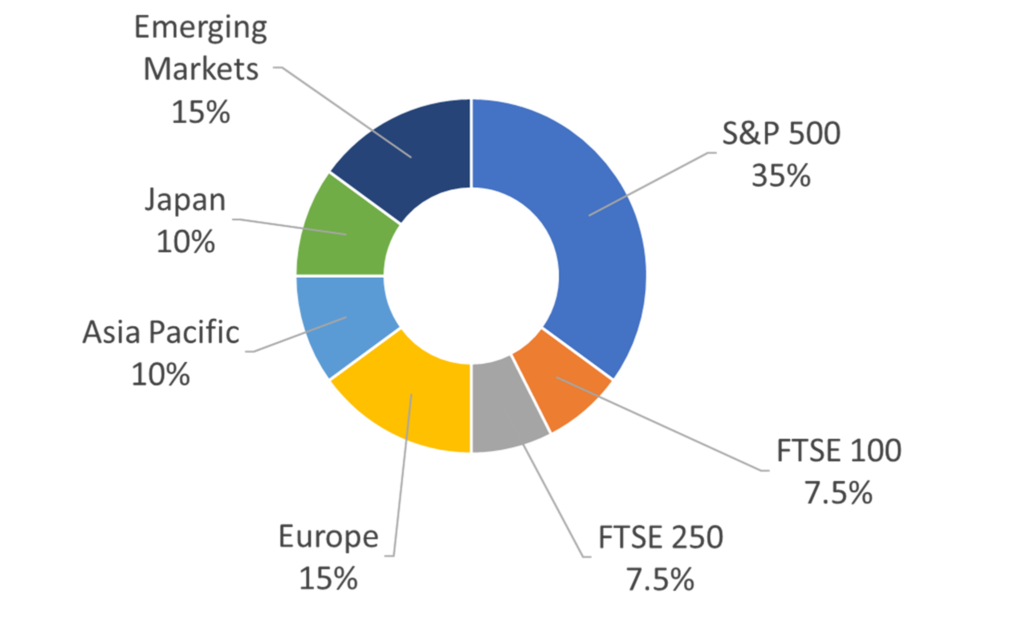

Alternatively, you could opt to be a bit more selective and construct your own portfolio. We like to build a World portfolio, which can easily be done using what Vanguard have on offer.

Do you think the Vanguard SIPP is a game changer for retirement saving and will you be moving your pension to Vanguard? Let us know in the comments section.