The Vanguard LifeStrategy Funds are amongst the most popular funds out there, being ultra-diversified, ultra-cheap, and managed by Vanguard – our favourite fund provider.

Vanguard products are great if you know a bit about investing and can make an informed decision about which one to go with. But even the LifeStrategy funds come in multiple forms; accumulating, distributing and at various equity levels – and a beginner and experienced investor alike might want a more tailored product without having to do the research.

That’s where robo-investing comes in. Nutmeg is the most popular robo-investing platform on the market and takes the hard decisions of investing out of your hands, while giving you the investment spread you wanted.

Both LifeStrategy and Nutmeg encourage regular monthly investing, to compound gains over time while avoiding the worst of the market’s dips, keeping costs low, and diversifying your money across a wide range of assets.

Vanguard LifeStrategy – the most popular fund out there – versus Nutmeg, the genius robo-investing all-in-one portfolio solution. Which wins? Let’s check it out!

Editors note: If you like the sound of Nutmeg, feel free to get your platform fees cancelled for the first 6 months when you open your account via our referral link on the Offers Page.

YouTube Video > > >

The Vanguard LifeStrategy Funds

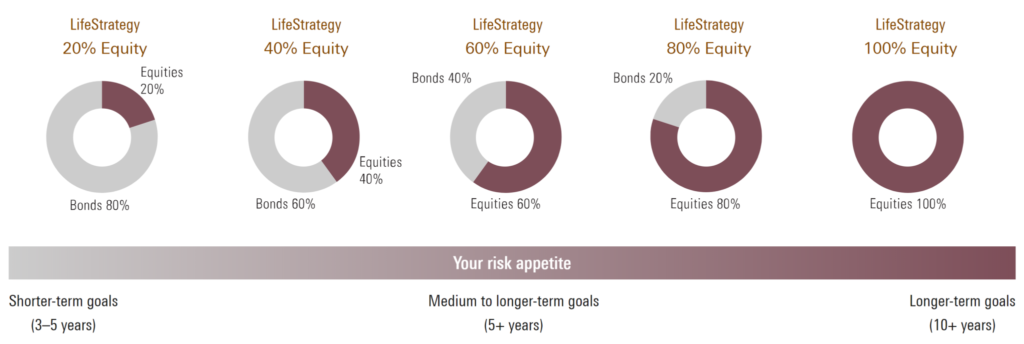

LifeStrategy is a fund of funds, a portfolio in its own right. There are 5 versions of the LifeStrategy fund in the UK. These are split down the lines of proportion of equities to bonds in the fund, with equities being considered higher risk but with greater upside for returns.

Bonds are about as close as you can get to cash savings whilst still being a risk-bearing investment. As the graph shows, shorter term goals are better served by fewer equities, which are more prone to swings in valuation in the short term.

We invest for the long term, so would and have chosen the 100% Equity LifeStrategy fund,

But deciding which is best for you is part of the problem of knowing what to invest in now to bring the results you want in the future.

It might be to your benefit to own some bonds – maybe you don’t know your needs as well as you think you do.

Robo-Investing

Nutmeg is one of the major robo-investing platforms, and the one we’d go to first due to it’s ease of use, range, past record and that you can save yourself the first 6 months of fees when you sign up through our referral link.

A robo-investing platform is a digital wealth manager that offers an extremely low-cost way to build an entire portfolio of stocks and bonds, along with access to basic investment advice from the inbuilt AI.

On signing up, you will be asked a small number of fact-finding questions with risk-profiling to help decide on a suitable investment portfolio.

Most investments require you to make all your own investment decisions and to take responsibility for your own portfolio. Nutmeg is a blessing for novice investors as it will make all those decisions for you based on your answers.

This is the digital equivalent of paying an expert financial advisor to interview you and construct a portfolio of shares and bonds on your behalf – except that rather than costing the earth, it’s ridiculously cheap, with fees being either initially free, or around than half of 1 percent of your pot per year.

Both Vanguard LifeStrategy and Nutmeg build their portfolios from a base of ETFs and index tracking funds, of both equities and bonds, so are both ultra-diversified and ultra-cheap.

We have built our own portfolios from ETFs in the past, and done a pretty good job too – but investing consistently into multiple ETFs can still be problematic on a traditional platform due to transaction fees.

The zero-fee trading platforms Freetrade and Trading212 are great to use to construct your own ETF portfolio without these pesky fees, but the range of choice is limited.

With one monthly investment of say £100 into LifeStrategy or Nutmeg, your money is instantly spread across many ETFs without incurring trading fees – true in the case of LifeStrategy if you purchase it directly through Vanguard’s own trading platform, that is.

Which is Simplest?

Nutmeg is simplest for 2 reasons: the whole package is in one place, i.e. Nutmeg creates and holds your portfolio; and it does all the research for you.

Vanguard LifeStrategy, while a portfolio of funds, is itself a fund that you can buy on a wide range of third-party platforms, meaning you need to work out the platform with the best fee structure for your circumstances, and then buy LifeStrategy through it. And you have to decide for yourself which one of the 5 fund types to invest in for your risk profile.

If you’re only interested in investing in LifeStrategy and perhaps other Vanguard funds, the cheapest and best place to do this is on Vanguard UK’s own online platform.

Which has the Cheapest Fees?

Vanguard LifeStrategy, assuming you buy on Vanguard’s own platform. The funds have an ongoing charges fee of 0.22%, and the platform is amongst the cheapest with an account fee of only 0.15%. This sums to 0.37% in total.

Nutmeg is an all in one package and has 2 standard fees, the main one being an ongoing charges fee of 0.45% for a Fixed Allocation. If you want to go Fully Managed the fee increases to 0.75%.

The Fixed Allocations with a lower fee are probably going to work out better in the longer term because fees usually do matter. There is also a 0.17% fund fee to factor in.

So LifeStrategy is slightly cheaper at 0.37% compared to Nutmeg’s 0.62% including the fund fee – but remember that Nutmeg fees are cancelled for the first 6 months if you use our link.

Which has the Best Returns?

These are stock market investments so we can’t say with certainty what their future returns will be. But we can look at past performance as a guide.

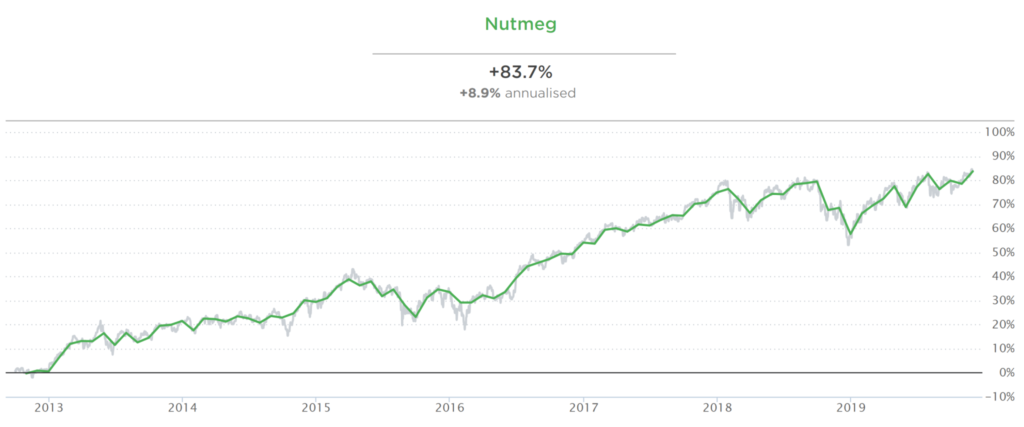

Comparing the highest risk options from each provider, Nutmeg 10 vs LifeStrategy 100% Equity, we see two excellent investment options.

Nutmeg comes in with a historical average annual return of 8.9% since 2013, smashing the stock market average which we might expect to be around 7%. We love to see a graph tick upwards!

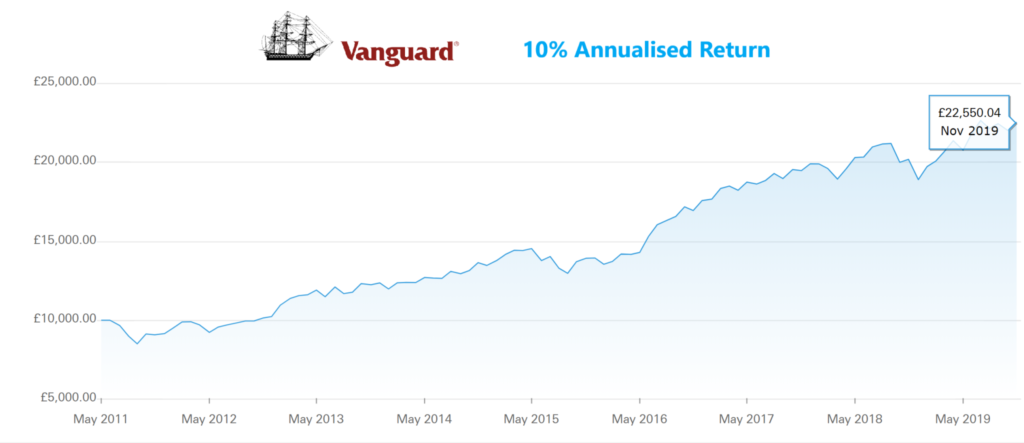

While Vanguard has done even better, with historical average annual returns of 10.0% since inception in 2011! If you’d invested £10,000 back then you’d have more than doubled your money by now.

Both funds average returns are since inception, so slightly different time periods, but Vanguard on the face of it wins the best historical returns test – but it’s so close as to not make much difference for future expected performance.

Your investment is looking like it’s in safe hands with either of these legendary providers.

Conclusion

Both options are excellent for diversification and returns. If you’re looking for simplicity as a new investor, choose Nutmeg.

If you are already set up on a premium stocks and funds trading platform, consider simply buying LifeStrategy through it and – boom! – you’re all set.

If your objective is to reduce fees, both are very cheap and therefore both are great choices, and Nutmeg has no fees whatsoever for the first 6 months when you use the link on the Offers Page.

1 Comment

What other platforms sell the vanguard life strategy range, but has low fees?

I would like access to other funds but as Vanguard has a limited selection l don’t want to be restricted by using their platform alone.

Comments are closed for this article!