It’s your fault you are poor – get over it. In the UK, unless you were born into genuine poverty, there is nothing to stop you from becoming financially comfortable or even rich.

But we’re not saying that you need to beg for handouts or pay rises from your boss – It’s our mission to make all of you financially free through good money management, investing in assets, and starting businesses.

If you’re feeling poor, don’t be disheartened by this message – here’s the 5 top reasons why you are poor, and more importantly, what you can do about it.

Get your investing journey off to a flying start with the links on our Offers page, and which has £hundreds of sign-up bonuses for new users of investment platforms, that we use and love. Enjoy!

YouTube Video > > >

Why It’s Your Fault You’re Poor

1. Your goal is financial security

Your goal is financial security when it should be financial freedom. You are playing it safe in a job for a fixed salary that barely covers your outgoings.

Those with financial security as their goal will only ever be underpaid by an employer relative to what they’re really worth – and financial security isn’t even that secure.

Remember – a job can be taken away from you at any time. Your stocks and property portfolios, carefully grown over many years, cannot be taken from you.

2. You don’t know how to use debt

If you’re genuinely poor, chances are you are heavily in bad debt on credit cards, overdrafts, or unsecured loans. This type of debt is like wildfire and you should make your number 1 priority in life to pay these off quickly.

But if you are poor in the sense of being stuck in a dead-end job for the next 50 years, then maybe you need to learn how to use good debt to rocket-power your finances.

For the financially savvy, good or low interest debt like mortgages and 0% money transfer credit cards can be used to alleviate cash flow issues and buy investments now, which earn an income to help pay off the cheap good debt later.

Debt is like fire – it can burn and destroy lives, but control it and it can warm and enrichen your life.

3. You don’t invest/You don’t pay yourself first

How old are you? How many years does that make it since you started earning money? Too many, if you’ve not been using that time to buy investments.

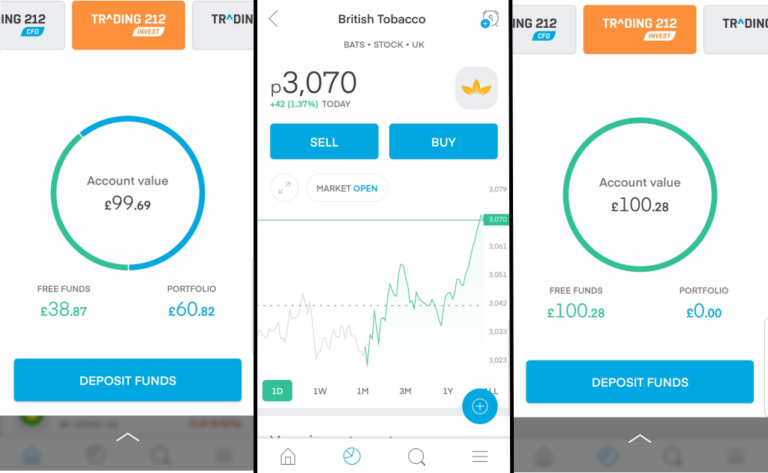

Anyone can afford to invest – new zero fee trading apps like Trading 212 and Freetrade mean you can invest pennies into the stock market whenever you want without being charged to do so.

Are you telling us you can’t spare £20 a month to buy stocks? Or £5? Pay yourself first, by investing small amounts immediately after receiving your pay-check, so you don’t run out of money to invest later.

Check out the Trading 212 Invest app – you are even given a free stock when you sign up using the link on our Offers page, worth up to £100.

We’d start by buying shares in ETFs, such as the Vanguard FTSE 100 ETF which simply tracks the UK’s biggest stock index. One of the safest and most reliable investments on there in our opinion.

4. You overspend

Come on – you know it’s true. We overspend – everyone overspends, but to different degrees.

Do you smoke? Cut back. Takeaways? Eat less. Or is your thing buying expensive clothes?

Maybe wait a bit until you’ve bought some investments first, whose dividends will help you to pay for them.

Though not our preference, cutting back is one way to expand your investable free cash. The other, is:

5. Side Hustles: You Don’t Have Any

A side hustle is a business that you set up on the side of working a job. You work on it in the evenings and on weekends, and over time it becomes a significant source of cash flow for you.

Anyone can start a side hustle – we don’t want to hear from you that you have no time.

You are choosing to priorities other things – you wish you had more money but are not prepared to pay the price.

The best type of side hustle business in our opinion is one which scales with time – i.e. it gets bigger and bigger without extra effort from you. After all, you’re busy at work, am I right?

A good example is starting a website that sells a product. Over time that website will grow, and you can potentially reach the whole world with your product.

An example of a side hustle that is not scalable is something like dog walking, or tutoring in the evenings.

This type of hustle is really a second job, but could be a good place to start if you need to save money fast. Scalable hustles can take a while to set up, and you could run at a loss initially.

Check out our popular video on side hustle ideas linked in the description below for ways to grow your monthly income outside of work, and to stop being poor, and start being rich instead.

Stop Begging and Self Promote

If you’re feeling underpaid and undervalued, don’t sit in your job for years working yourself into the ground to get noticed for a promotion.

Whenever we wanted a better wage, we simply changed employer, promoting ourselves to the next career level in the process.

The difference in career trajectory can be massive. Anecdotally, we know plenty of people who have patiently waited for promotions for years, while we just took what was ours. If you don’t ask, you don’t get.

Your employers’ job is to make money, they won’t give you a decent payrise just because you’re loyal.

Don’t just rely on your current employer to help you out when you’re feeling poor!

Take Responsibility

We don’t mean to be nasty when we say it’s your fault you’re poor. Most people in the country would class themselves as just-about-managing in their own words, and they all make the 5 mistakes that we’ve just discussed.

We do want you to equip you with the tools to fix the problem, though. And the most effective way to stop being poor is to take action yourself. You can’t rely on the government or on others to do it for you.

It’s Never Too Late to Start

Going back to personal responsibility, what are you waiting for?

Draw up that budget, research how to escape from or utilise credit card debt, invest £100 into the stock market, write down side hustle ideas! Remember: tomorrow never comes.

Are you thinking of setting up more income streams? Tell us your ideas in the comments below.