Do you want to add some safety to your portfolio without sacrificing returns? In this P2P review, we look at RateSetter, a Peer to Peer Lending UK platform that boasts a level of security similar to those of bonds, while offering returns more in line with the stock market.

RateSetter advertises returns of 4% on long term investments (which can even be tax free if you invest using their Innovative Finance ISA!), is regulated by the FCA, and is supported by a hefty Provision Fund that has protected investors’ money since 2010.

What’s more, if you sign up through our RateSetter referral link, you’ll get a £100 Peer to Peer sign up bonus if you invest just £1000 for a year.

Note: Article Updated 2nd April 2020, but the video is the original from April 2019, so read the article for all the updated content – new video out soon!

YouTube Video > > >

What is RateSetter?

RateSetter is a Peer to Peer Lending UK platform, which matches people and business who want to borrow money against investors who want to lend money. The platform acts as a middleman, doing all the donkey work behind the scenes.

Operating since 2010, it is FCA regulated and has 600,000 investors and borrowers and £3.0bn of investments on the books.

Is Peer to Peer Lending Safe?

As far as investments go, it is probably one of the safest, but offers fantastic returns at the same time. While any investment could lose money, this platform has been designed with safety in mind.

Consequently, it offers slightly lower headline returns than some other P2P platforms like Assetz Capital or Funding Circle, but investor losses due to loan defaults have been non-existent.

RateSetter’s Interest Rate

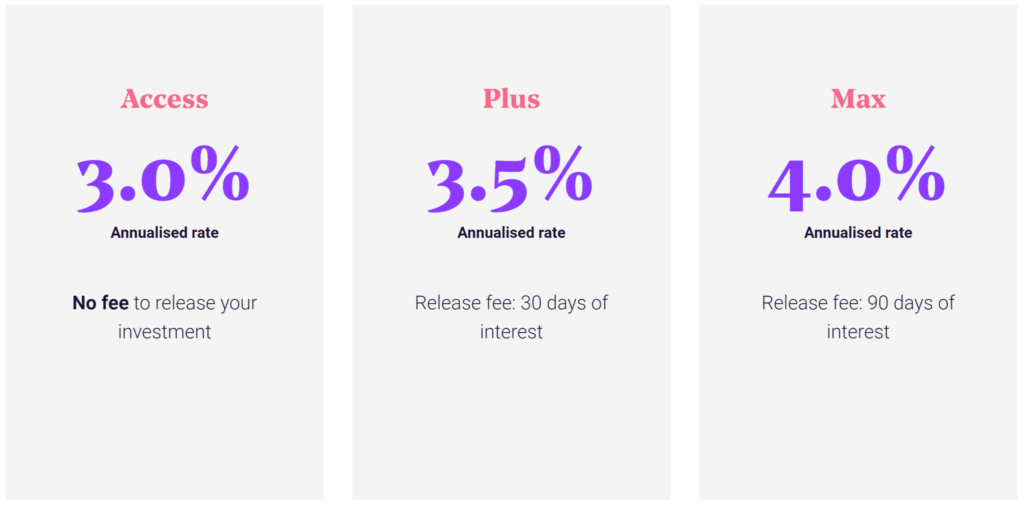

Ratesetter has 3 main products, the Access which was 3% at time of updating this article, the Plus which has 3.5% at time of updating this article, and the Max which had a 4% return.

Two things of interest to note – the Plus and the Max have early access fees, so choose wisely!

But the product WE would choose is the Max. 4% is more like the return we want from a P2P investment, and we would aim to keep our investment in for the longer term, justifying the release fee. After all, investing is a long-term game.

The RateSetter Provision Fund

Unlike many P2P platforms, RateSetter boasts a pot of money called the Provision Fund which will refund investors for any losses from debtor defaults.

In this way you are protected from bad debts and maintain the rate of return advertised.

But remember that the Provision Fund is not unlimited in size, and although it has been protecting investors from losses since 2010, past success is not a reliable indication of the future. But it IS a promising sign!

The provision fund is what you get in return for a slightly lower interest rate compared to other P2P platforms.

It makes RateSetter an ideal low risk element of a well-rounded and balanced portfolio, but shouldn’t be the only thing you invest in.

There are higher returns to be found elsewhere, but for greater risk.

Peer to Peer Friend Referral

RateSetter incredibly offer bonuses to new investors!

Ratesetter now give you a £100 bonus when you deposit just £1000 as a new customer – a great start to your investing journey. Use our link to get this offer.

What We Like

As well as the sweet bonuses, provision fund, and stable rate of return, RateSetter has so much more going for it:

1) You can see historic rates on the website – check out the FAQ section to see these, so you can compare the current rate to what’s been offered in the past

2) Innovative Finance ISA – RateSetter is compatible with the Innovative Finance ISA, making your returns tax free within the ISA – winning!

3) Trustpilot rating of 9.4/10 from over 5000 reviews – such a high score from users shows how highly rated this platform is. We think this is due to the ease of access and mix of low risk/moderate returns

4) Interest accrues daily – we want to know at any given moment what our assets are worth, and this platform does not disappoint

5) Invest as an individual or as a company – if you want to take advantage of the tax benefits that investing as a company brings, you can feel free to invest as a company – though for most people the ISA can provide adequate protection from tax

6) Borrowing – Peer to Peer goes both ways! We’ve reviewed the platform from the point of view of an investor – but who’s to say that a borrower can’t borrow to invest?

With a rate at time of filming of 3.9% on a one-year loan of £5000, it’s an easy and cheap way to access funds to invest in more lucrative ventures such as property.

However, we caution that this is very risky and that there are better ways to borrow small amounts, such as Money Transfer Credit Cards.

RateSetter uses a soft search to check your credit, so borrowers’ credit scores are not impacted. With Peer to Peer Lending bad credit needn’t hold you back, though we would strongly advise against investing if you could instead be paying down expensive short term debt.

What We Don’t Like

1) RateSetter lends to businesses and households–we are used to P2P platforms that lend to businesses with collateral, but RateSetter lends to anyone with a half decent credit rating, which in our view adds an extra risk of loan defaults – though our minds are put at ease somewhat by the mighty Provision Fund which is meant to offset the risk of defaults.

2) Lower rate of return than other sites – you could invest your money in other P2P platforms and get a better rate of return, this cannot be denied. What keeps us interested are the sweet sign up bonuses and the added security of that Provision Fund.

3) It’s not good enough to be your entire portfolio – if you invested all your money in RateSetter, your returns likely wouldn’t be good enough to become financially free. But it’s brilliant for partial liquidity and for being an entry level investment which you can build upon in the stock market. It’s easy to use – maybe too easy. By all means make some decent money on RateSetter, but also Learn by Doing by investing small amounts into some riskier asset classes.

Will you be signing up to decent returns for a low risk? Tell us what you think of RateSetter and Peer to Peer Lending returns in the comments section.