The FTSE 100 is an index of the top 100 companies listed on the London Stock Exchange by market capitalisation. It’s packed full of household names that you will be familiar with including HSBC, BP, Vodafone, Tesco and many more.

We think the FTSE 100 is a brilliant place to store your wealth – but do you know what risk you are taking on by investing in the FTSE 100?

As many of the companies listed on the London Stock Exchange are UK companies the FTSE 100 index is often seen as a barometer of the UK economy, but this isn’t really the case anymore. The FTSE 250 is a much better indicator of the UK.

This is because the companies that make up FTSE 100 actually generate 71% of their revenues outside of the UK. After all they are huge global companies.

In this video we’re going to look at some of the biggest risks that come from investing in the FTSE 100 index and some will surprise you!

Reminder: invest in the FTSE 100 without attracting any fees by using the Trading 212 app. If you use our link to sign up on our Offers page here, you get a free share for your portfolio. Enjoy!

YouTube Video > > >

Risk #1 – Little Stock Diversification

Many investors invest in indices like the FTSE 100 for quick diversification. But look closer and the FTSE isn’t very diversified at all – Just a few stocks dominate.

In fact, just 5 companies make up about 32% of the index- Shell, HSBC, BP, AstraZeneca and GlaxoSmithKline. And the top 10 make up about 48%

Some of you will be okay with this but for us, this definitely means that we want further diversification.

One way to achieve this but still invest in the FTSE 100 is to go for an equal weighted FTSE 100 ETF such as the Xtrackers FTSE 100 Equal Weight UCITS 1D ETF (XFEW).

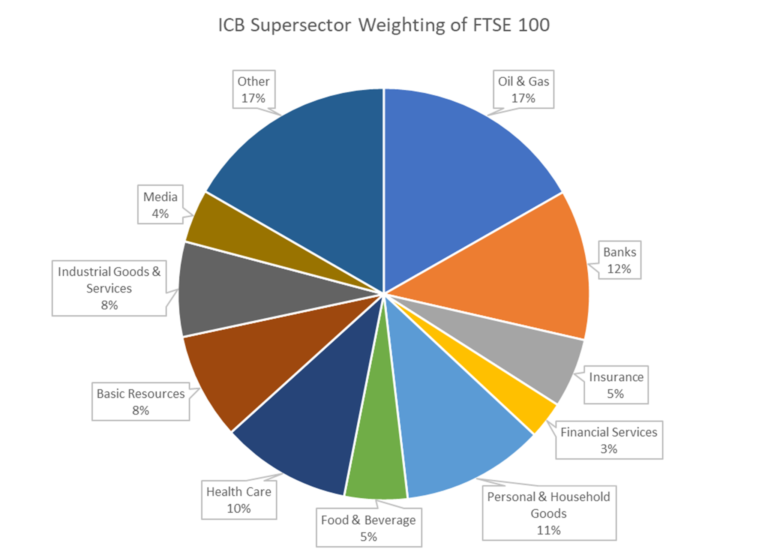

Risk #2 – Little Sector Diversification and No Technology

This is sort of an extension to what we just discussed. Unless we are targeting a specific sector for a specific reason, we investors don’t want to be overexposed to just a few sectors.

Unfortunately the FTSE 100 has some serious overexposure to a handful of sectors such as Oil, financial services such as Banking and insurance, and Personal Goods.

What’s worse is there is no tech. We don’t have any Googles, Apples or Microsofts.

Technology is the future of business. There’s a reason why tech stocks have what seems to be crazy valuations. They are expected to make huge future profits.

These tech companies are going to dominate our lives and the FSTE 100 has zero direct exposure. The risk here is that the FTSE 100 is left behind, unable to keep up with the tech heavy index S&P 500.

This means you cannot just invest in the FTSE 100. You need exposure to more industries that will create huge future profits. One techy area the UK does particularly well in is fintech but again this is just more exposure to the financial sector.

Risk #3 – Currency Fluctuations

If you watch the FTSE on a regular basis, you’ll have seen that since the Brexit vote, there has been an inverse relationship between sterling and UK Stocks.

Whenever the pound gets weaker, UK stocks and therefore the FTSE has usually gained in value but why is this?

The prevailing logic has been that a weaker pound boosts the overseas earnings of the UK Stocks. This makes perfect sense because if you remember, UK Stocks make the majority of their profits internationally.

Therefore, negative Brexit news has often had a very positive effect on UK Stocks, sending the value of the big blue chips skyrocketing.

Another positive for those that hold the FTSE 100 or its constituents is that the relative weakness in the pound makes the stocks increasingly tempting targets for foreign investors, particularly US companies who are sitting on a lot of cash after recent tax cuts. Takeover bids can also send valuations skyrocketing upwards.

Risk #4 – Brexit and a World Crash

Other than the currency fluctuations just discussed, there is in our opinion an irrational fear that Brexit will somehow destroy the UK economy.

But let’s say this does happen and Britain’s economy tanks. The FTSE will be affected but probably not significantly due to the FTSE 100 being more of an international stock market than a UK domestic one.

It’s little brother the FTSE 250, however, will almost certainly struggle as this has significantly more UK exposure. But then again if Europe and possibly the world are dragged into a recession caused by Brexit then this will have serious consequences on the FTSE 100 too.

But it’s always worth remembering that no matter what has happened to the stock market in the short term, it has always come back stronger.

Risk #5 – Dying Industries

The FTSE has many old industries, such as Banks, Oil and Tobacco companies. Some believe that they’ve had their day and their time is now over.

Banks were crippled during the financial crisis of 2008 and never fully recovered and face constant pressure from new technology such as Peer to Peer Lending, a ground-breaking new way to borrow and invest.

Oil is constantly being demonised and more renewable energy seems to only be a matter of time.

Alongside health concerns, tobacco is being taxed left right and centre causing the number of people who smoke to plummet, which is not good for tobacco profits. Good companies are able to adapt to new threats and respond to opportunities.

No matter what happens we know we’ll be looking for bargains. When the stock market falls, we’re buying!

Only a few times in a lifetime does the stock market have incredible deals on offer that are far too good to miss. Make sure you’re ready when the time comes – maybe after Brexit?

What other risks does the FTSE 100 face and what do you do to mitigate it? Let us know in the comments section.