We’re proud to bring to your attention a brand-new investment app which could be ideal for beginner investors in the UK. We know that one of the biggest barriers to investing is the perceived complexity, and perhaps the opinion from most people that it’s just not cool.

The Wombat Invest App plans to change all that by “empowering generations to manage, save and grow their money” in their words.

This app has some cool features that we think that many young people and beginners are going to love!

Editors note: Don’t forget to check the Offers Page and grab free shares worth up to £200, plus £50/£75 cash backs when you open new investment accounts through the affiliate links there!

YouTube Video > > >

In order to bring you this hot-off-the-press information and be amongst the first to review this app, Wombat gave us a small amount of credit to thoroughly test the app, on the condition that we had the freedom to provide an unbiased review.

We have remained impartial we will be covering the things we love and things we don’t love.

What Is Wombat Invest?

Wombat is a brand-new investment app available on Android and Apple devices that is making investing accessible to the masses. One of most commonly discussed problems with investing is the cost but it can also be very complex.

Even if you spend enough time learning the basics of investing it can still be needlessly complicated.

For instance, let’s take this ETF as example:

Ishares Dow Jones Global Sustainability Screened UCITS ETF

Most people will have no idea what that means, making it very difficult for beginners to even start.

It might as well be written in a foreign language.

Wombat will simplify all this for you as they have packaged investments into themes. Each theme invests in an ETF and we think the snappy names and description are far easier to understand for the average person than the complicated investment product names found elsewhere.

That ETF we just looked at by the way is actually the underlying fund that ‘The Goodies’ Theme invests in. We think you’ll agree that ‘The Goodies’ is far easier way to say that that the fund invests in socially responsible businesses.

A great thing about Wombat is it makes it simple for the novice but gives you enough detail for those that desire to know more. On the app you can easily view the fund fact sheet, KIID and prospectus.

It’s worth noting that Wombat does not currently offer investments in individual stocks.

What Are the Fees?

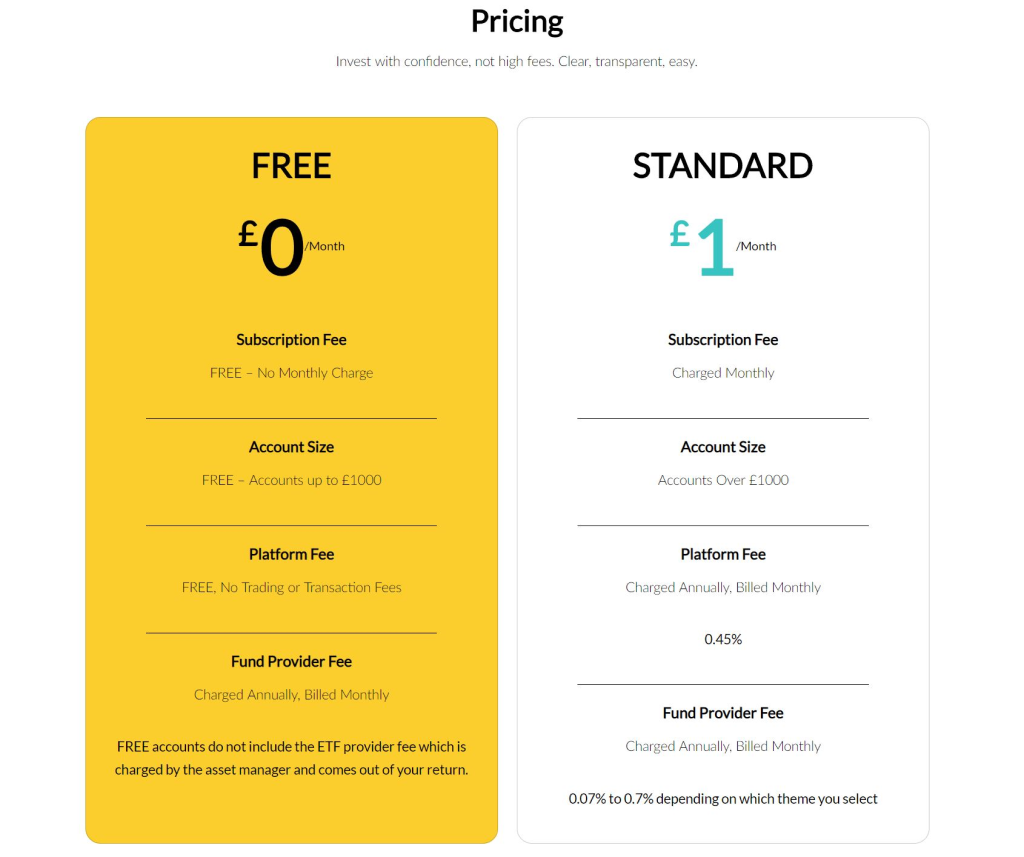

For those with small pots, fees can often decimate returns and we think that Wombat have been fairly competitive.

Usually the worst time for fees with many platforms is when you have a small pot. Wombat have amazingly [to find axe image maybe] taken an axe to all their fees when your investment pot is below £1,000.

We can’t stress enough what great news this is for those just starting out!

For those with pot sizes over £1,000 the prices are roughly in line with other platforms; but you need to be careful.

They’ve gone for a fixed monthly fee of £1 and a platform fee of 0.45%.

The 0.45% is perhaps a little high and they may struggle to attract investors with large pot sizes.

Having said this, this fee includes the use of an ISA, which you often must pay extra for on other apps, such as what Freetrade intend to do.

Unlike other platforms however you don’t need to pay extra for additional features.

As for the £1 monthly fee, this is practically nothing for those with a larger pot but if you have a small pot it can be on the rather steep side as a percentage of your pot – but of course it’s waived below £1000.

You’ll want to grow your pot quickly to minimise the impact of this fixed fee.

In fairness though, if people start investing because of this app we feel that it’s a price worth paying. You will almost certainly be better off financially by investing than never investing at all.

Round Ups

Here at Money Unshackled we have longed encouraged the behaviour of paying yourself first, which means you either save or invest money as soon as you get paid.

Although this is best practice most people don’t or won’t always do this. So, a nice little feature Wombat offer is called ‘Round Ups’.

What this does is round up your purchases and every 2 weeks it will pay the accumulated ‘Round Ups’ into your Wombat Account.

Hopefully you’ll build up a nice little investment pot without really noticing.

Obviously for this feature to work they will need access to your banking details, so they can securely access your transaction history, so they can calculate the required ‘Round ups’.

We expect this is no problem for the tech-savvy youth of today.

The App

The app is slick and easy to use. You can buy into a fund with just a few taps and set up auto invest. They have some nice charts, enabling you to track your portfolio size and see projections way into the future.

The app even has a Learning Hub where you can find interesting and very helpful articles that should hopefully improve your investing knowledge, so we encourage you to check that out.

Fractional Investing

Sometimes you want to buy into an investment, but the ETF price is way too high, which may mean you can’t buy it at all, or you can’t get your desired allocation percentage.

This isn’t a problem with Wombat as they offer a very cool feature known as Fractional Investing.

Instead of having to wait until you have enough money for 1 fund you can invest in a fraction, meaning you can invest no matter how little money you have.

This again is unusual for an investing platform, and welcome. Some funds can be priced at hundreds of pounds just for 1 share.

On another platform this might be too much for you and may prevent you from diversifying properly – not the case on Wombat thanks to fractional investing.

Cool Stuff in The Pipeline

As we’ve been in touch with Wombat, we’re very pleased to share with you some of the great features on the horizon, which we think will really enhance the app.

This includes individual stocks, so people will be further able to customise and tailor their experience. We always think new investors need to tread carefully around stocks, but there’s no doubt that they’re in demand by most new investors.

They’re also working on a “Wombat Junior” App, which will allow those under 18 to invest and “Wombat Gift”, which will allow people to offer investments as a gift.

They mentioned a lot more, which we’re not at liberty to say just yet for confidentiality reasons but it must be really exciting times at Wombat HQ.

A Great App for Beginner Investors?

To summarise, you can find cheaper ways to invest but we feel that its prices are competitive enough and combined with its great app and simple themes-based approach the Wombat Invest App will prove very popular.

Of particular interest to us were the Round-Up feature and the Fractional Investing feature.

We’re disappointed that we can’t buy individual stocks, but we’re told will be possible soon. If you want to invest in diversified funds this is a top-notch app. When the word gets out, we can see this being very popular amongst new investors.

What do you think of the Wombat App and will you be checking it out? Let us know in the comments section.