Trading 212 is one of the new zero fee free trading apps in the UK revolutionising how investors buy stocks and shares.

It has certainly changed our investing strategy with regard to how we buy shares – fees meant buying small amounts of a stock were far too costly before – now that’s simply not the case.

The cost of buying and selling shares has fallen over time, but remains sizeable on popular platforms Interactive Investor charging £8, AJ Bell £10 and Hargreaves Lansdown charging £12 per trade.

Also, we have a sweet Trading 212 bonus offer where you’ll be gifted a free stock to the value of £100 that you can snap up if you sign up through our link on the offers page here.

YouTube Video > > >

Trading 212 – Where to Start

Ben has been using the app for the last several weeks and loves it – he’s set up an ISA account for his baby daughter, and uses the Invest account to invest small amounts into ETFs.

This is a review of the Trading 212 Invest account – the other account types available to you are Trading 212 ISA and Trading 212 CFD.

The CFD area is not covered in this review – we do not invest in CFDs due to the huge risk involved – we see it akin to gambling. After all, almost 80% of retail investor’s lose money with CFDs

Briefly, one use of CFD’s is to use leverage to make money on short selling, but beware – leveraged gains mean there’s a chance of leveraged, or magnified, losses.

You are also charged for overnight positions, so they’re no good for long term investing. We say stay away! Now, back to the review…

Trading 212 Invest – Is It Really Free?

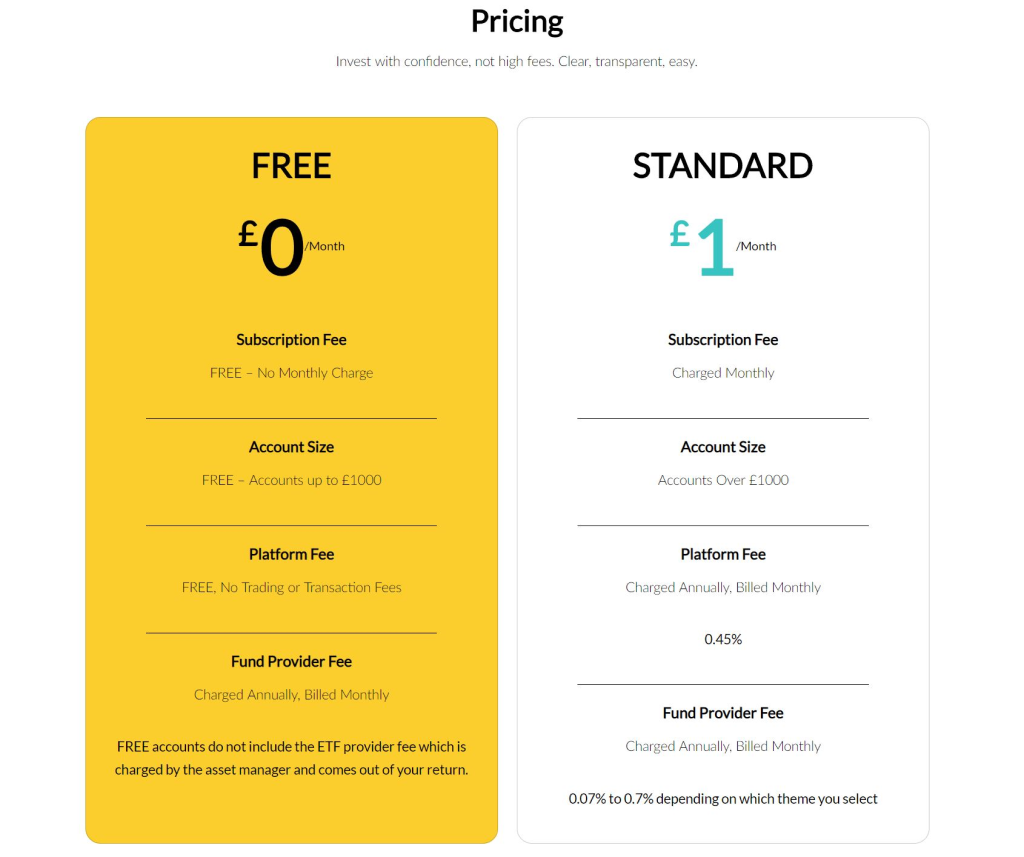

Yes! Well, nearly. There are certainly no trading or platform fees, but surely there must be some hidden fees? How else do they make their money?

This is the first question we ask when confronted with a free offer – what’s the other side getting out of it?

Well, Trading 212 are indeed offering a free service on their Invest platform, with the hope that you will use the CFD area of the site as well, and other future products such as robo investing, for which they intend to charge.

It’s a classic freemium model – the parts that most people will want to use (the stocks and ETF markets) are offered for free, with their profits coming from more niche developments.

Sort of how banking works in the UK. Most people get a free current account, paid for by those that use the banks debt facilities such as overdrafts. Basically, someone else overpaying so that YOU get a free service.

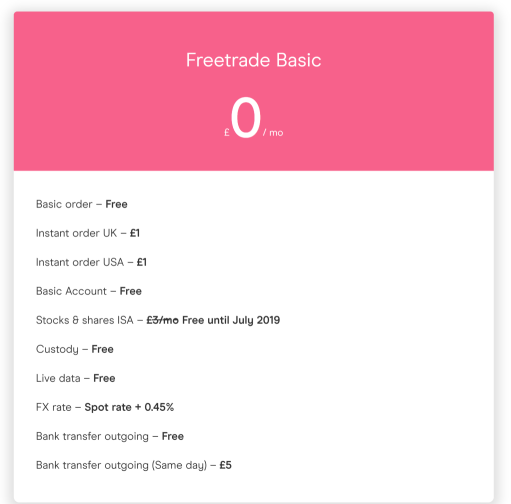

It’s worth noting that even the ISA is fee free – Freetrade, another free stock trading platform that we reviewed recently, plans to charge £3 per month to use their ISA, but Trading 212 does not charge for this – a win for Trading 212 against the competition.

Hidden Costs?

So come on, what are the hidden costs. There are always hidden costs with investing and Trading 212 is no exception – though these are not the fault of the platform, and it seems Trading 212 really have done their best to be cost free.

1) Stamp Duty

You will pay stamp duty taxes on the purchase of UK shares, but nothing for funds. UK Stamp duty is 0.5%, which is an immediate hit to your portfolio when you buy a share. But in all fairness, this is a tax and not a fee for Trading 212.

The share price would have to move up by this amount just to break even. And that is before considering:

2) The Bid Offer Spread

Trading 212 is a stock trading floor like any other in that shares and ETFs have 2 prices: a buy price, and a sell price.

The difference is called the spread, and this is the amount of money you would lose if you bought a share and immediately sold it.

A typical spread on a share in Tesco is around 0.04% on the platform.

It’s the kind of cost you should be aware of if you trade frequently, but most long term investors will not notice such small amounts.

3) Foreign Exchange Spot Price

Not a concern on Trading 212 Invest – When buying foreign shares, of which there are 1,093 at time of filming, you would usually be charged a foreign exchange fee on most platforms – Trading 212 doesn’t and translates at the spot rate.

It’s worth noting that competitor platforms do charge a fee – for example, Freetrade adds a 0.45% charge on top of the spot rate; but Trading 212 does not.

Another reason why Trading 212 is currently the superior platform in terms of price in our opinion.

Example Purchase – British Tobacco

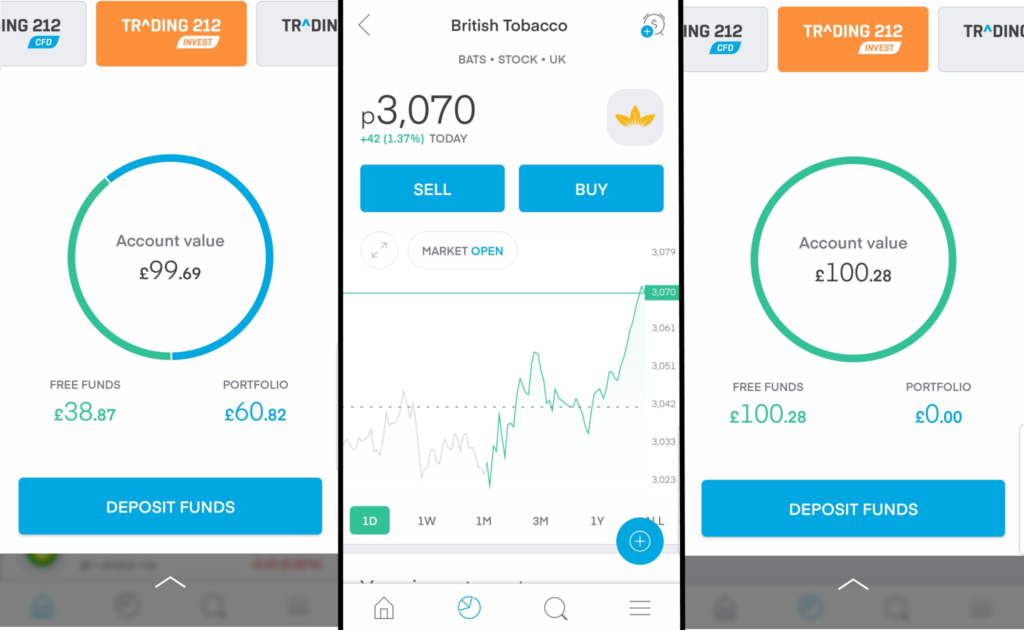

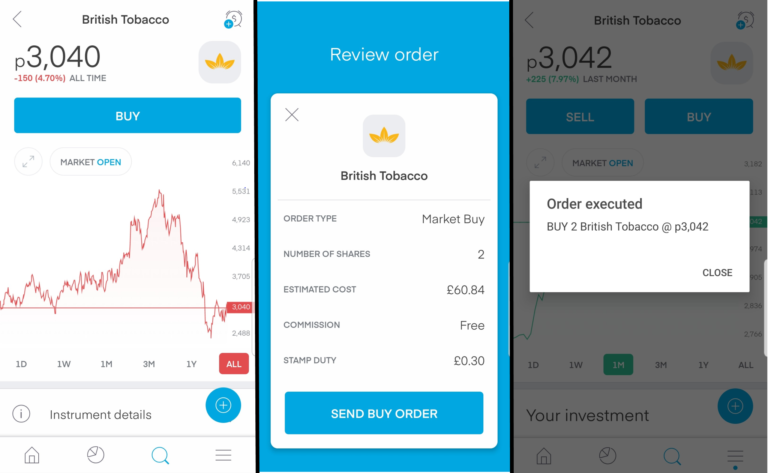

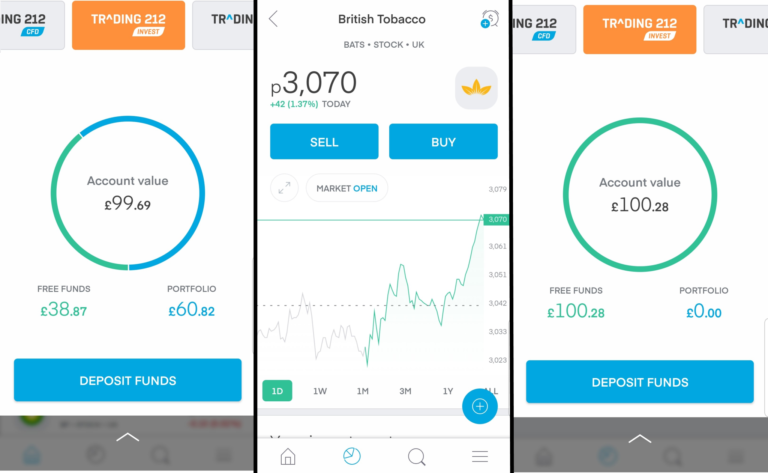

Ben used the app to buy shares in British Tobacco. Again, Trading 212 was superior to the Freetrade app as the trade was carried out instantly without paying extra. See how the price was 3,040 just before he clicked the Buy button.

The competitor platform Freetrade batches trades together and executes at 4pm, so prices can move during the day but Trading 212 traded at such a current price that it had moved to 3,042 in the fraction of a second it took to load the next screen. Note that the minimum number of shares you are allowed to buy in a stock is 2 shares. Also note that stamp duty is already hitting this portfolio by 30 pence.

Ben locked in the price and executed the purchase at 3,042. What started as £100 went down to £99.69. Why? Two things happened in the intervening seconds. One was he’d been taxed stamp duty of 30 pence, and the other is the market had moved down by a penny. These price updates are lightning fast!

Later that week, he took advantage of a rise in the share price to sell the shares and test how well the app handles sales. He sold the 2 shares in British Tobacco at a price of 3,070, just by clicking sell, and confirming the sale.

Seconds later, the portfolio value was confirmed as £100.28 in Free Funds, a.k.a cash; therefore the sale had been instantaneous. He’d made a profit of 58 pence, after the 30p stamp duty, in a week.

Interesting sidenote: If we could replicate that return every week, that would £30 a year return on £100, or 30% rate of return. There’s definitely value to be found by having this app in your pocket, though we encourage long term investing over trading.

What Funds and Shares Does Trading 212 Invest Offer?

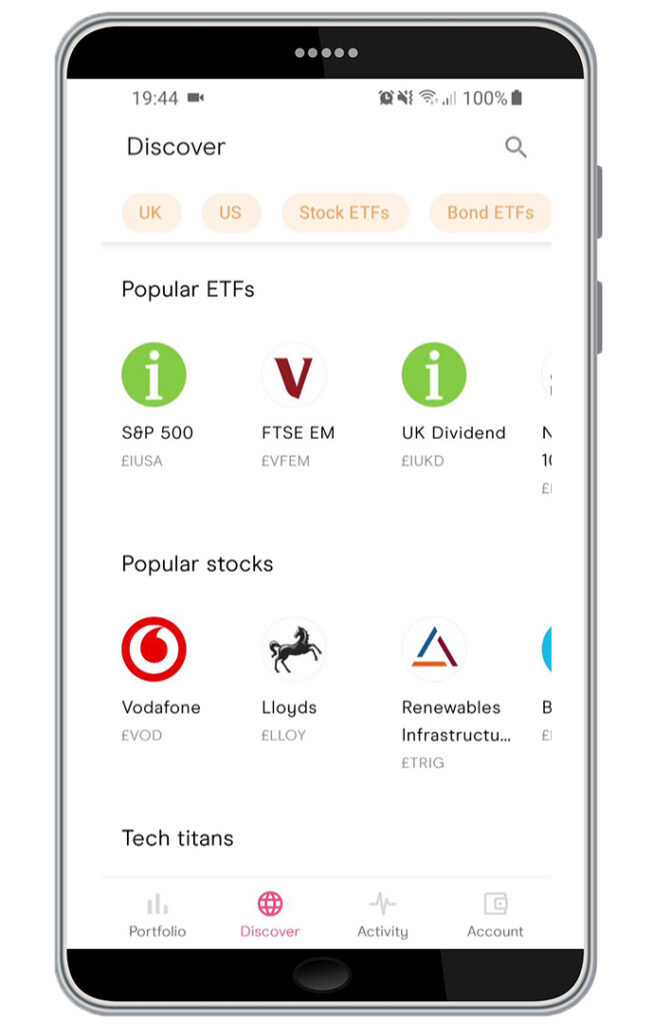

At time of filming there are over 1,500 stocks (of which 450 are UK stocks) and 223 ETFs on the app to choose from.

This is quite a decent range in our opinion for a free app.

It doesn’t offer nearly the wide range that a big platform like AJ Bell or Interactive Investor offers, but it offers enough for you to dabble in many interesting markets.

Want to invest in cannabis, healthcare, automotive, tech, finance, America, Europe? You’re covered.

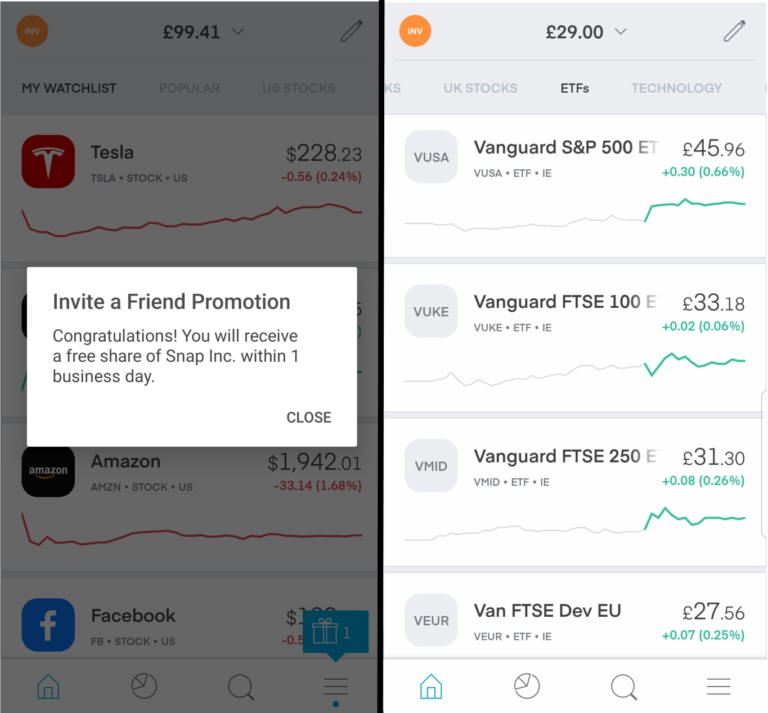

What we love more than anything else is that Trading 212 has some of the main ETFs from the Vanguard family, including the FTSE 100, FTSE 250 and S&P 500 ETFs. These funds are perfect for beginners and pros alike, and would be what we would be investing in first.

Do you Want Some Free Stuff?

It’s bonus time! Sign up to Trading 212 Invest through our offers page here and you will be given a randomly selected free share by the app, which could be worth up to £100.

You just need to open an account, deposit £30 and you’ll get your free share within days.

(Probably best to deposit a little more than the minimum as the stock market can move down as well as up, and you don’t want to miss out on your bonus on a technicality!)

So – do you think Trading 212 is the future of stock market trading? Are you happy with the trade-off of less choice for lower fees? Let us know in the comments below.