The impact of platform fees, trading fees and management fees on an investment portfolio can be disastrous to long term success – add in taxes, and the impact can be catastrophic.

Below we’ll work through several examples of how a person might invest their money in the stock market – what we think the best method is – and show how fees and taxes can wipe almost half off of your portfolio’s value.

YouTube Video > > >

Our Investor

In these worked examples we assume that an investor is regularly saving £250 a month into an investment platform, achieving a return on investment of 6% after inflation. All long term forecasts have inflation factored in, so show the real money returns.

Unless you are an expert, you might expect to get similar returns from investing in shares as you could investing in Funds or ETFs, at least this is the assumption we have used.

Section 1: Fees – a hidden parasite

If you are investing in the stock market, you are going to have to navigate a whole ecosystem of fees.

Fees for making trades, fees for using a platform, fees to pay a Fund Manager’s salary, and a whole bunch of hidden admin fees that investment platforms and funds are less-than-transparent about revealing.

At Money Unshackled, we have long promoted low fee stock market vehicles such as ETFs, exchange traded funds, over more Fee-heavy vehicles of Managed Funds and even buying individual stocks directly, and now we’re going to show you why.

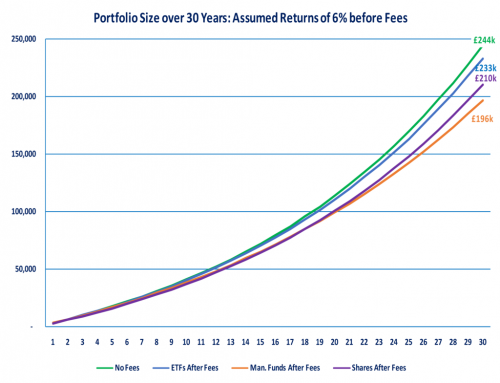

In green is our baseline – it’s how big our investor’s pot would be if left to grow over a 30 year term, adding £250 a month and compounding at 6% net return from growth and reinvested dividends. £244,000! Not a bad little pot to retire on.

30 years of industrious saving and investing giving you a result you deserve. But let’s now consider Fees.

Exchange Traded Funds

ETFs generally have the lowest fees. We’ve used as our example the Vanguard FTSE 100 ETF on the Vanguard platform, which has total fees of 0.26% – cheap as chips! Incidentally, their FTSE 250 ETF does have high transaction costs built in, making the total fee 0.4%.

For our example, we’ll use 0.26% as our example total ETF fee… and ask you to think twice about hidden transaction fees when you choose your ETFs!

If we’d invested in ETFs (the blue line in the chart above), our after-fees total pot size barely moves – we’re able to walk away with £233,000 with fees barely making a dent on our retirement.

Managed Funds

Managed Funds on the other hand are notorious for having high hidden fees. A popular UK fund we use an example is the Investec UK Alpha Fund J GBP Acc:

- Ongoing charges fee: 0.72% (includes Management Fee)

- Transaction Fee: 0.22%

- Platform Account fees of 0.25%

- Trading Fee on many popular platforms of £1 a time as a regular investment; £12 a year.

Total Fees on an example Fund: around 1.2% plus £12 a year

Investing in this fund will cost you 1.2% total fees. 1.2% doesn’t sound much, but consider that 1.2% knocked off your assumed 6% return gives you only a 4.8% return after fees. As we’ll see, the effect of this can be huge.

If we’d invested in Managed Funds (the orange line in the chart above), we’ve paid Fund Manager’s salaries and other costs of tens of thousands of pounds over the years, leaving us with only £196,000 to spend on ourselves.

Stocks and Shares

And finally, by buying shares individually you will incur lots of different fees, including but not limited to ongoing platform fees, stamp duty on trades, and regular platform trading fees.

You will need to regularly rebalance a portfolio of shares to keep your portfolio performing – we estimate this costs £200 a year on a 20 stock portfolio: 20 trades a year at around £10 a pop.

Other fees are stamp duty on rebalancing: which might be 0.125% a year on our portfolio [0.5% stamp * ¼ of our portfolio each year] if we assume we annually rebase a quarter of the value of our portfolio, platform account fees of, let’s say, 0.25%, and another £45 a year for trading and stamp duty on new deposits.

Total fees an example individual stocks portfolio = 0.375% plus £245 a year.

If the investor thought that they knew best and invested directly into shares, returning the same as a Fund manager could achieve, they’d have performed a little better after fees, keeping £210k to play with in retirement – the purple line in the chart above.

Of course, this assumes you know what you’re doing and are able to get the return before fees as a Fund Manager! And that you don’t have an itchy trigger finger and trade even more frequently!

The effect of fees is truly scary – the moral is, unless you think you can beat the market, tracking the market with an ETF will generally pay off better. It’s all in the Fees.

Section 2: The Greedy Tax-Man

Don’t forget that as an investor, the government feels it is entitled to take chunks of your invested savings for itself, despite you doing the “right thing” and planning for your future.

By investing, you will be less of a burden on the state as you will be able to sustain yourself through retirement rather than rely on the government for handouts, but this point is lost on the Treasury.

In any case, if you invest without shielding yourself from tax, you will be stung, and stung hard.

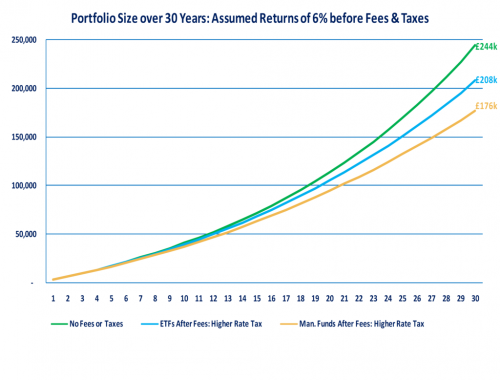

Tax is largely dependent on your circumstance, so let’s show a high level assumption of what out investor’s pot would look like as a higher rate taxpayer if he invested in ETFs vs Managed Funds, after fees.

A higher rate taxpayer will be taxed a crippling 32.5% dividend tax! We’ve assumed half of your return comes from dividends, and have factored in the £2k dividend tax threshold.

Starting again at our baseline (the green line), lets now look at what a higher rate taxpayer would expect to keep investing in ETFs and Funds. A higher rate taxpayer might keep only £208k investing in ETFs (blue), while a higher rate taxpayer investing in Managed Funds (orange) might only keep £176,000 of their potential pot size – on the way to half your pot being lost to Fees and Taxes!

Stocks and Shares ISA

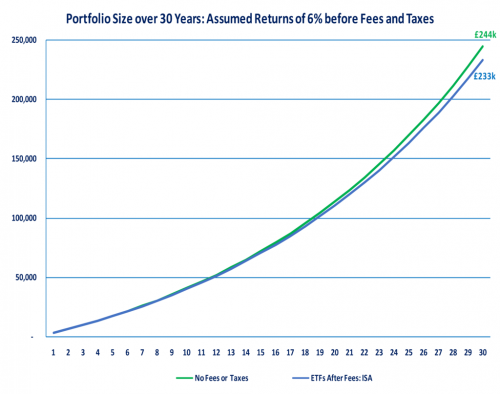

There is of course a way to protect yourself from Taxes. Just like ETFs have been created to avoid Fees, ISAs have been invented to avoid taxes – and legally.

A Stocks and Shares ISA works much like a regular Cash ISA, in that the returns within are shielded from taxes.

There are some exceptions that can’t be avoided, such as US Foreign Withholding Taxes of 0.15%, but for a UK investor investing solely in UK stocks this shouldn’t be an issue for you.

Conclusion

The ultimate Fee and Tax busting combo is therefore an ETF based portfolio, built up through an ISA, as below:

Of course there is still reason to buy stocks and shares directly alongside ETFs, and we do this ourselves – if you know what you are doing, and have seen an opportunity for market beating value, it is of course possible to do better than the scenarios detailed here.

But for most of us, following a strategy of Fee and Tax minimisation is the key to a successful long term investment plan.

Have you put much thought into Fees? And are you making use of your ISA allowances? Let us know in the comments below.